Blockchain

BTC.b Technical Transition to Lombard’s Architecture

Credit : cryptonews.net

BTC.b, the established BTC asset, is transitioning to Lombard’s structure and product suite, enabling cross-chain enlargement and deeper DeFi integrations. Your tokens, balances and integrations stay unchanged. No motion required from holders, and non-compulsory actions for protocols.

Overview

BTC.b has been a cornerstone of Avalanche DeFi since 2022, with ~$550 million in circulation and deep integrations between Aave, GMX, BENQI, and LFJ. Lombard has acquired BTC.b’s infrastructure and associated property, and Lombard Protocol will assume accountability for BTC.b’s bridge operations and safety structure, whereas sustaining full continuity for present customers and integrations. BTC.b will first transition to the identical trusted structure as LBTC, earlier than Lombard coordinates its distribution and integration throughout choose chains and main DeFi protocols.

BTC.b will function solely on Lombard’s clear, verifiable protocol structure and will likely be a next-generation Bitcoin asset constructed for the decentralized financial system – permissionless, custodial and safe. BTC.b will present institutional-grade safety to the on-chain Bitcoin with out the institutional gatekeepers.

This transition achieves three targets:

-

Enhanced safety: Multi-layer structure with decentralized validation by a consortium of main establishments

-

Multi-chain enlargement: Native implementation to Ethereum, Katana, MegaETH and Solana within the early phases

-

Improved entry: Permissionless mining instantly from native BTC through the Lombard app, the place will probably be accessible alongside LBTC

Which stays the identical

For customers and protocols, the quick actuality is straightforward: BTC.b stays the identical token and balances, addresses and integrations stay unchanged. What modifications are BTC.b’s development alternatives: new chains, deeper liquidity, expanded DeFi integrations and capabilities, and a cleaner path for builders to combine native BTC into Apps through Lombard’s SDK.

For customers:

-

The identical signal: Contract handle, image and identify stay similar

-

Identical assist: 1:1 native BTC reserves with out remortgaging or staking

-

Identical balances: All holdings, addresses and pockets integrations are unchanged

-

Identical integrations: Aave, GMX, BENQI, LFJ and all DeFi protocols will proceed to function usually

For protocols:

-

Contract addresses stay unchanged

-

Protocols are not allowed to name the ‘unwrap’ perform on the BTC.b sensible contract to roll again to native Bitcoin. Because the BTC.b contract is immutable, a brand new Lombard contract should be used for this.

-

The earlier ‘unpack’ perform anticipated BTC to be withdrawn to a particular handle generated by Core Pockets from the identical seed because the Avalanche handle.

-

Lombard requires you to explicitly specify the recipient within the ‘redeemForBTC’ perform for a newly deployed ‘AssetRouter’ sensible contract.

-

-

Commonplace value feeds will proceed to perform

-

Proof of backup feeds should be up to date to Lombard-based feeds, if accessible via Chainlink

-

Current liquidity swimming pools and credit score markets stay unaffected

The BTC.b you personal in the present day is the BTC.b you’ll personal as soon as the transition is full within the fourth quarter. That is an infrastructure improve, not a token migration.

What’s new

Multi-chain enlargement

Within the preliminary part, BTC.b will increase past Avalanche to Ethereum mainnet, Katana, MegaETH and Solana.

Hit instantly

Anybody can mine BTC.b instantly from the native Bitcoin through the Lombard App – no middlemen, no KYC, no geo-restrictions (aside from sanctioned jurisdictions).

SDK integration

BTC.b joins Lombard’s SDK, permitting builders to supply customers:

-

Native BTC deposits and one-click Bitcoin entry present entry inside accomplice purposes

-

Native pockets integrations (already reside at Binance and Bybit)

-

Streamlined deployment by builders

-

Uniform vault merchandise for BTC.b and LBTC

Enhanced safety structure

The transition implements a trust-minimized, multi-layered safety mannequin described within the subsequent part.

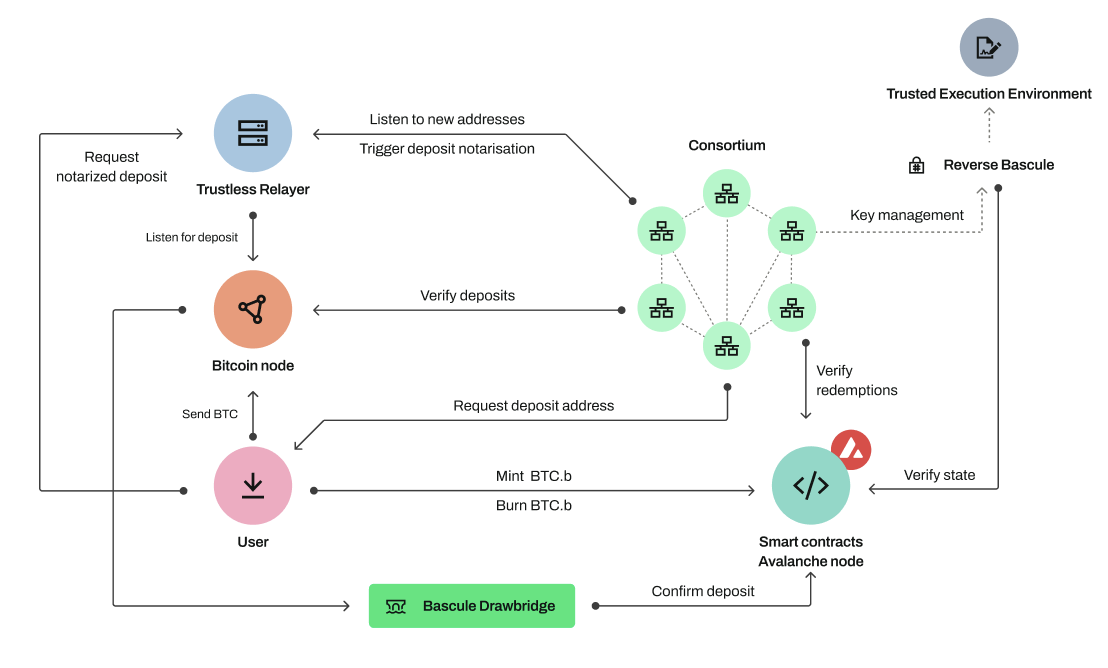

Technical structure: what’s altering

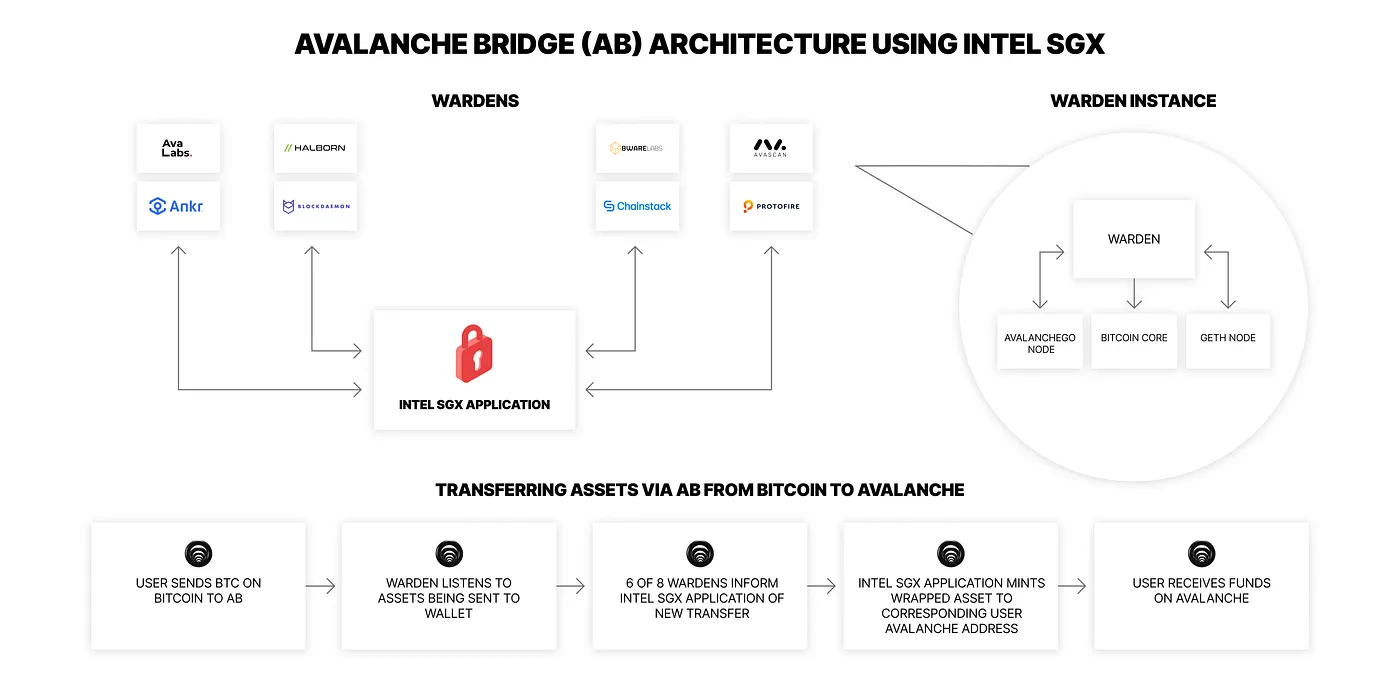

The present Avalanche bridge makes use of Intel SGX enclaves with a Warden community to index Bitcoin and coordinate transactions. The brand new structure implements a number of impartial layers of safety with decentralized validation and is designed to scale BTC.b throughout a number of chains whereas sustaining verifiability and operational self-discipline.

Structure comparability

Present mannequin (avalanche bridge):

-

SGX enclave primarily based key isolation

-

Warden community for multi-party approval

-

Centralized bridge operations

New mannequin (Lombard protocol):

-

{Hardware} Safety Module (HSM) helps key administration

-

Safety consortium with 15 members and BFT consensus

-

Double-layer verification through Cubist Bascule and Lombard Consortium

-

Byzantine fault-tolerant Lombard Ledger for traceability and transparency

Present state

New situation

Why this structure issues

The brand new safety mannequin presents:

-

No level of failure: Requires majority consensus amongst 15 impartial validators

-

Protection in depth: 4 impartial layers of safety that each one have to validate operations

-

Clear verification: Actual-time proof of reservation through Chainlink feeds

-

{Hardware}-based safety: Key safety is rooted in Cubist’s vHSM (FIPS 140 HSM + Nitro Enclave)

-

Integrity between chains: Impartial verification of collateral in every chain

-

Impartial third celebration audits: Safety structure and sensible contracts managed by OpenZeppelin, Veridise and Halborn. All audits are publicly accessible.

Deep Dive safety mannequin

Layer 1: Decentralized validation

The Safety Consortium replaces the Warden community with 15 impartial digital asset establishments, together with OKX, Galaxy, DCG, Wintermute, Figment, Kiln, Antpool, F2Pool and Kraken. This Proof-of-Authority community manages the Lombard Ledger, a Byzantine fault-tolerant consensus layer that transparently information all protocol operations on-chain.

Every transaction requires majority consensus among the many validators, eliminating particular person factors of failure.

Layer 2: HSM-supported key administration

Within the new safety mannequin, Safety Consortium members use Cubist’s CubeSigner platform to handle keys and signal transactions. Not like the earlier mannequin, the place SGX enclaves had been used to reconstruct keys and coordinate Warden approvals, Consortium members signal transactions however by no means have entry to secret key materials. As an alternative, the keys stay in Cubist’s safe {hardware}, which mixes FIPS 140 HSMs and Nitro Enclaves to supply enhanced safety. As well as, these keys are additional locked by a number of safety insurance policies, which restrict Consortium members to signing solely particular forms of transactions (for instance, cash backed by deposits) which have been authorized by a majority of the events.

Layer 3: Administration coverage

There are a number of safety insurance policies that govern key utilization:

-

Time slots: Pressured delays for delicate operations

-

Multi-party approval (MPA): A number of consortium members should approve each transaction and coverage change

-

Transaction restrictions: Keys can solely signal particular pre-approved transaction varieties

Layer 4: Impartial Bridge Authentication

Two impartial techniques confirm all actions:

-

Cubist bascule drawbridge: Checks collateral consistency between Bitcoin and vacation spot chains (Avalanche C-Chain, Ethereum, and so forth.)

-

Chainlink CCIP: Verifies collateral throughout chains the place BTC.b is bridged, offering safe cross-chain messaging and real-time Proof of Reserve verification

This double-verification method ensures 1:1 assist via impartial audit layers.

Deposit circulation

-

Authenticated deposits: Customers deposit BTC to deterministic addresses that encode the EVM vacation spot handle on the Avalanche C-Chain. This allows handle verification and gives safety towards phishing.

-

Consensus Validation: Safety Consortium validates and notarizes the deposit transaction through BFT consensus on Lombard Ledger.

-

Double verification: Each Bascule and CCIP independently affirm collateral assist.

-

Cash: BTC.b tokens are minted on the user-provided handle in spite of everything validations have handed.

Recordings (burns) observe the identical multi-layer validation course of in reverse.

For builders: integration updates

Avalanche Builders

Whereas the contract addresses stay the identical, the BTC redemption circulation has modified. The earlier ‘unwrap’ function is now deprecated and builders should use the brand new Lombard adapter for redemptions.

Elective updates:

Core Pockets customers

The Lombard SDK will likely be natively embedded into Core Pockets on day 1, permitting customers to get BTC.b on Core Pockets.

New integrations

The Lombard SDK gives straightforward integration for protocols, wallets and platforms:

Timeline

Present standing: Migration is underway and testing and safety audits are underway

Anticipated launch: This autumn 2024

Transition course of:

-

Completion of ultimate safety audits

-

Mainnet deployment and verification interval

-

Seamless transition with minimal downtime for the person

-

Submit-launch monitoring and assist

Each the Lombard and Avalanche groups will present common updates via official channels as soon as milestones are reached. Subscribe to official channels for detailed progress updates.

BTC.b will proceed to function Avalanche’s essential Bitcoin bridge because it grows into a real multi-chain Bitcoin asset, with institutional-level safety and permissionless entry.

Incessantly requested questions

Do I have to do something with my BTC.b? No. Your tokens stay unchanged and require no motion.

Will there be downtime? The transition is designed for a seamless transition with minimal disruption to transfers or integrations. It’s anticipated that creating and redeeming BTC.b will solely be unavailable for a most of two hours. Within the occasion {that a} transaction is shipped throughout the switch, customers will expertise a small delay and won’t have to fret about dropping any funds.

What ought to I do if I’ve BTC.b in a lending protocol? Your positions will proceed as regular. Protocol integrations usually are not affected.

The place can I get technical assist? Speak to Lombard representatives through Discord or the intercom perform on the web site.

You probably have any questions on this transition, please contact Lombard through Discord or the intercom perform on the web site. For questions on collaboration, go to lombard.finance.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now