Bitcoin

BTC has declined by 10% yet it’s in declining bullish consolidation

Credit : ambcrypto.com

- BTC is down 10% within the final 30 days, however nonetheless discovered itself in a declining bullish consolidation.

- An analyst checked out a brand new ATH primarily based on earlier consolidation cycles.

Bitcoin [BTC]the biggest cryptocurrency, has suffered a pointy decline in current weeks. On the time of writing, the king coin was buying and selling as excessive as $57736, having dropped 9.58% previously week.

Within the month of August, the crypto skilled a particularly risky market. Throughout this era, the crypto fell to a neighborhood low of $49,000 earlier than staging a average restoration.

Regardless of the current decline, BTC continues to be 16.6% above the current native low, consolidating in a down but bullish development. Likewise, it was 59.94% above the yearly low of $38,505 recorded earlier this 12 months.

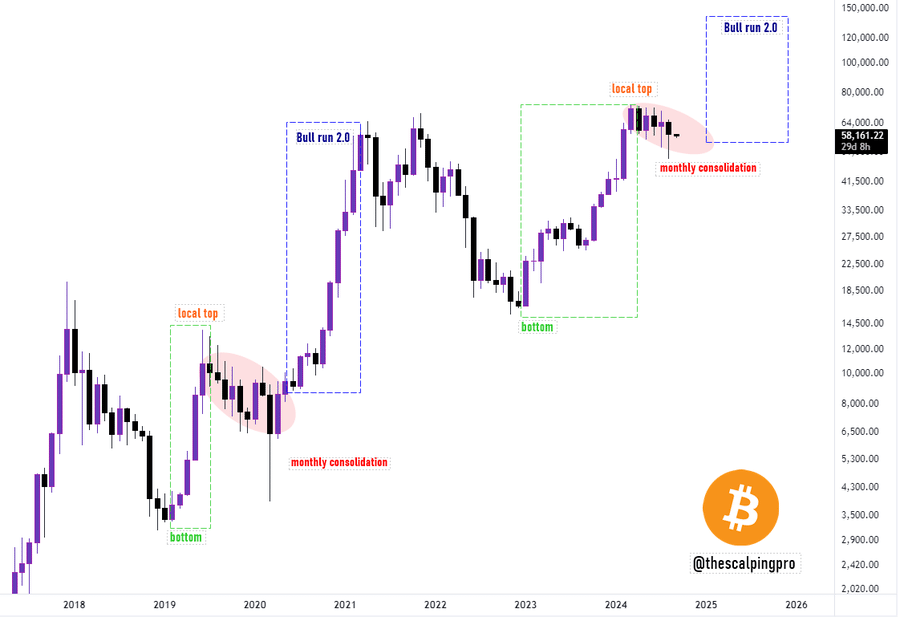

These indicators and market conduct have led analysts to foretell a repeat of a bull run 2.0 to a brand new all-time excessive. For instance, in style crypto analysts Mags sees a brand new all-time excessive, citing historic cycles.

Market sentiment

In his evaluation states Stockroom tightened the earlier two cycles with month-to-month consolidation, leading to a brand new bull run.

Primarily based on the cycle analogy, after BTC reaches a backside after which a neighborhood high, a interval of consolidation follows, which is later preceded by a powerful bull run.

He shared his evaluation by way of X (previously Twitter) and famous that:

“Bitcoin – Bull run 2.0 incoming. The present month-to-month consolidation for BTC appears to be like loads just like the earlier cycle, when the worth rose all the way in which to its all-time excessive.”

Supply:

This argument factors to the earlier bull run, which was the results of months of consolidation.

Specifically, consolidation performs an important position in stabilizing markets. This era permits the market to soak up the current value motion, stopping excessive volatility.

It additionally helps scale back speculative strain as short-term merchants have a tendency to shut their positions.

With the appearance of long-term merchants, buyers start to build up, regularly rising demand, leading to better shopping for exercise.

What Bitcoin’s Charts Counsel

Mags believed {that a} new bull run was imminent for the king coin. The query is: what do different indicators present?

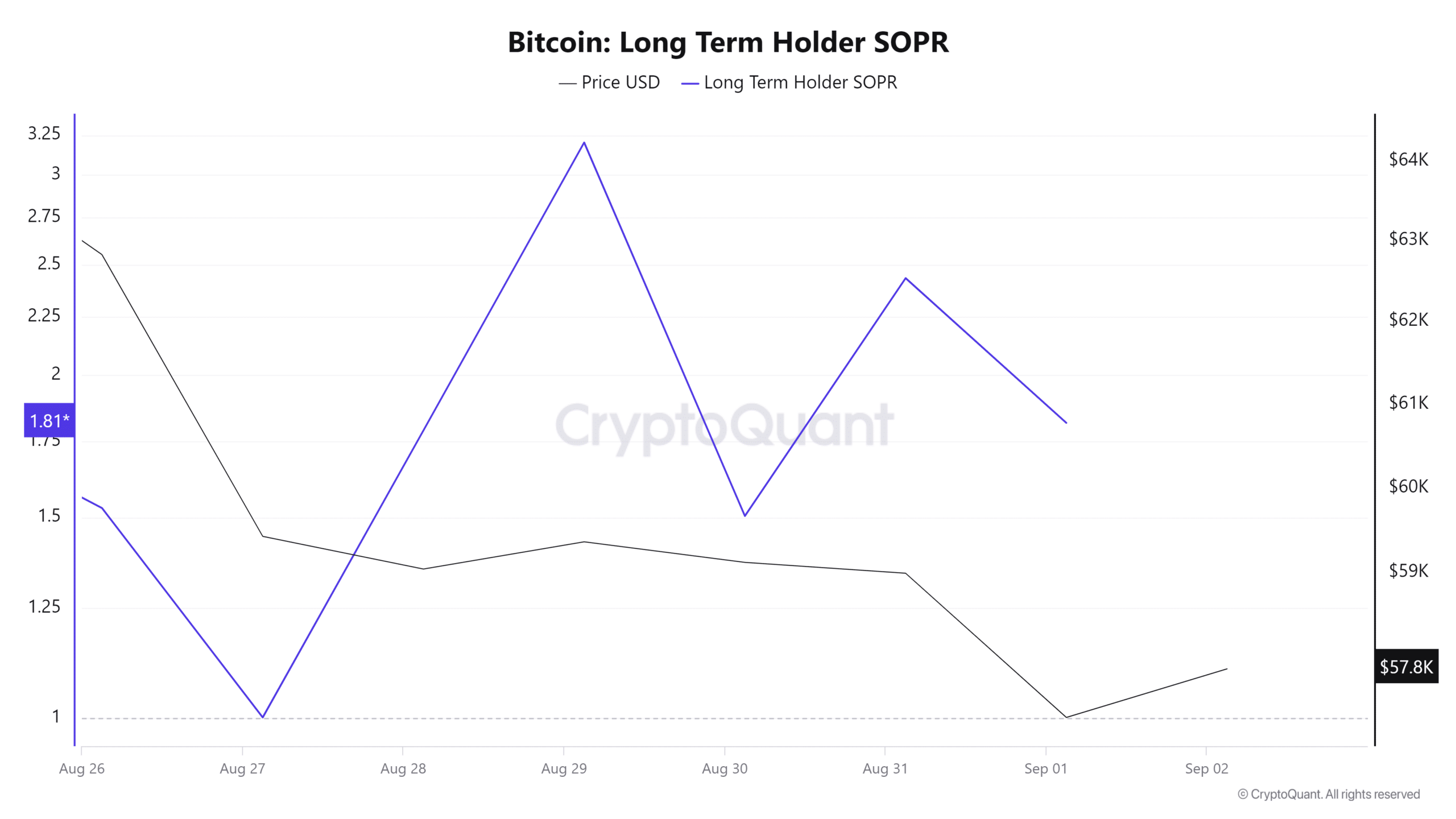

Supply: CryptoQuant

For starters, Bitcoin’s long-term holder SOPR has averaged round one over the previous seven days. When the revenue price for long-term holders stays round one, it means that crypto is being bought at price.

This means market consolidation, with long-term holders experiencing neither revenue nor loss. Such a state of affairs leaves long-term homeowners ready for worthwhile gross sales sooner or later.

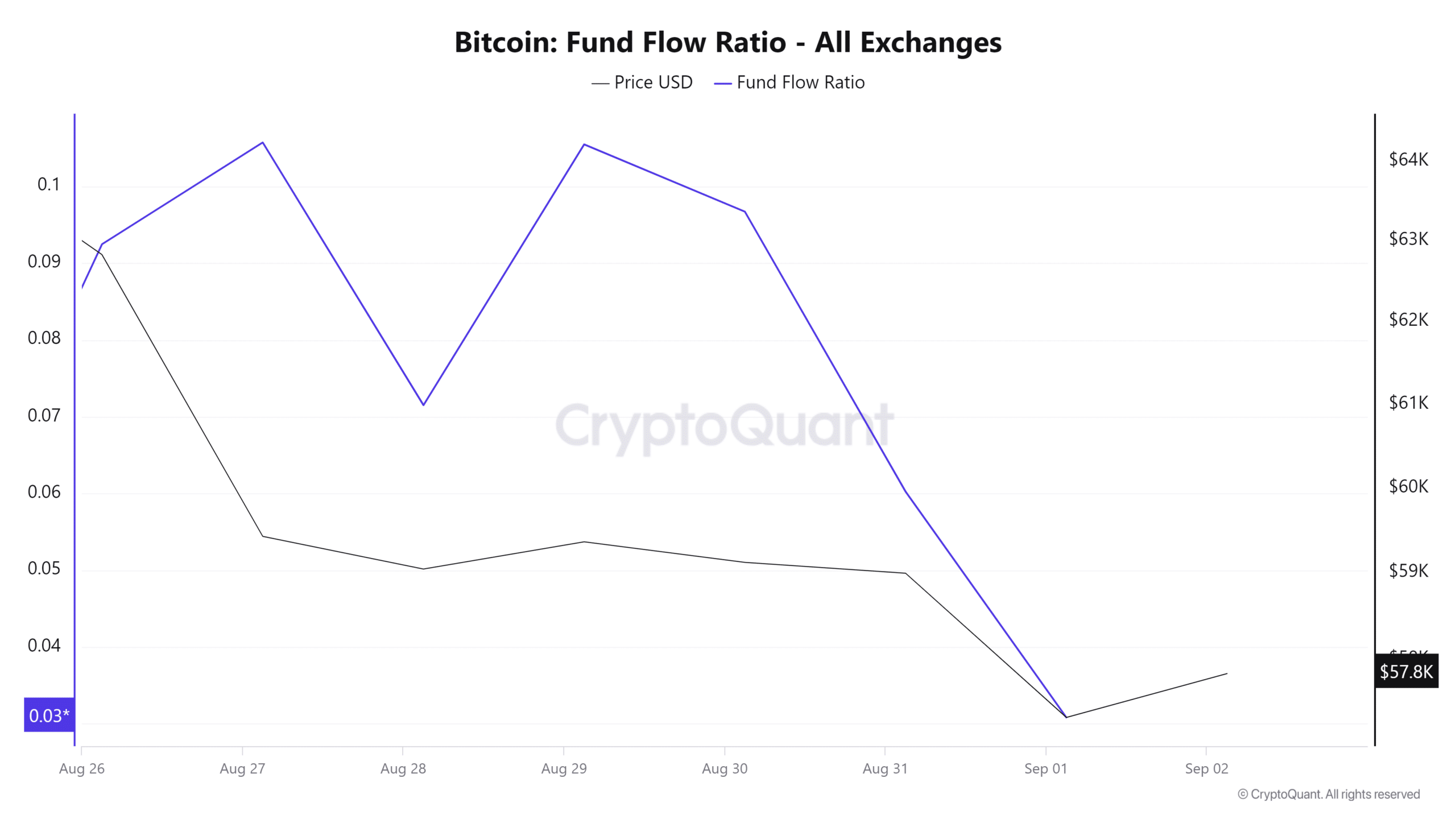

Supply: CryptoQuant

Moreover, the fund move ratio has been persistently under 1 for the previous seven days. Which means extra BTC has been withdrawn from the exchanges, moderately than being deposited.

This can be a bullish sign, indicating that buyers are withdrawing their crypto from exchanges for long-term holdings, decreasing the provision obtainable for quick sale.

Such strikes scale back promoting strain and enhance demand, which in flip helps in a development reversal.

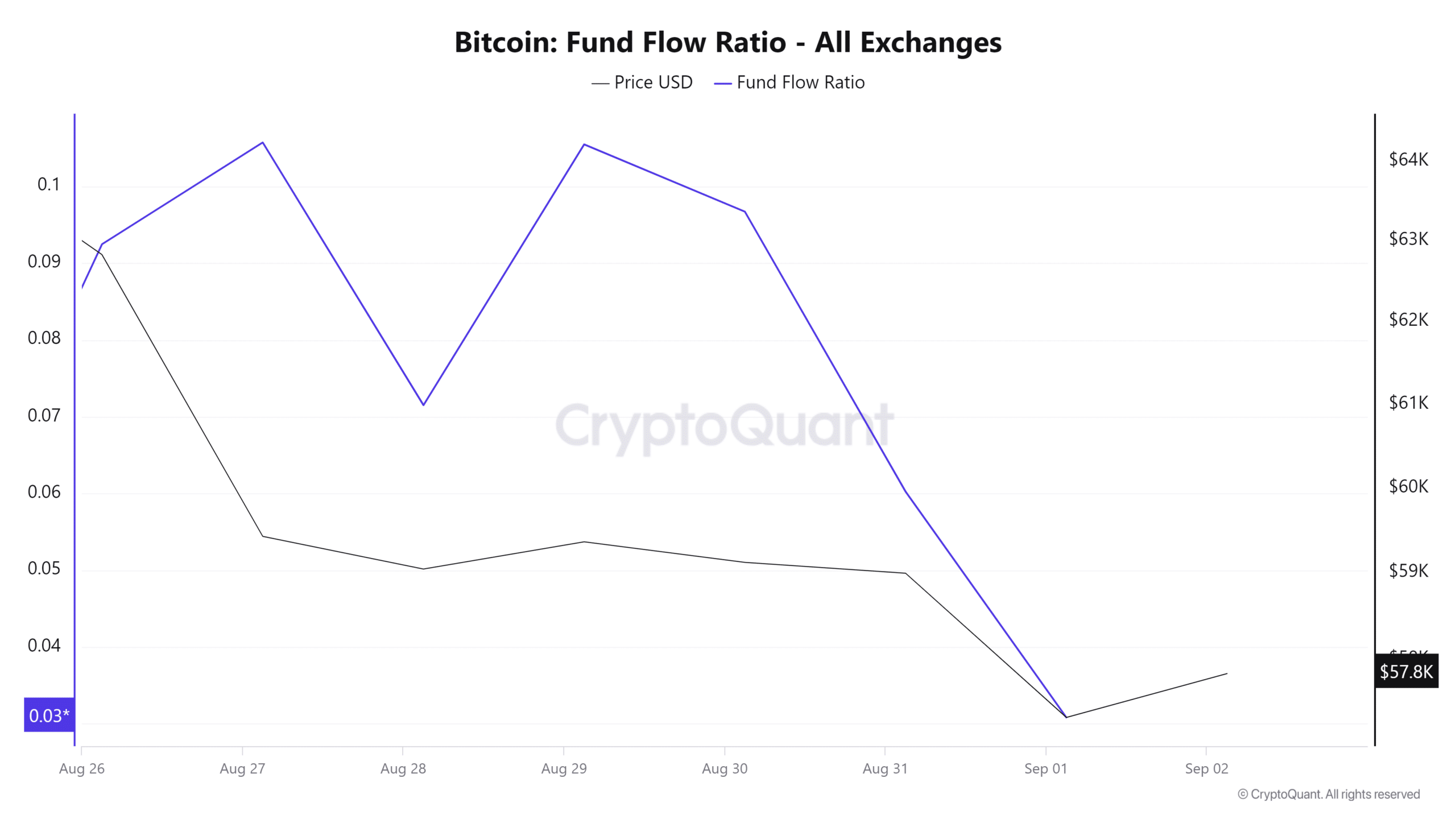

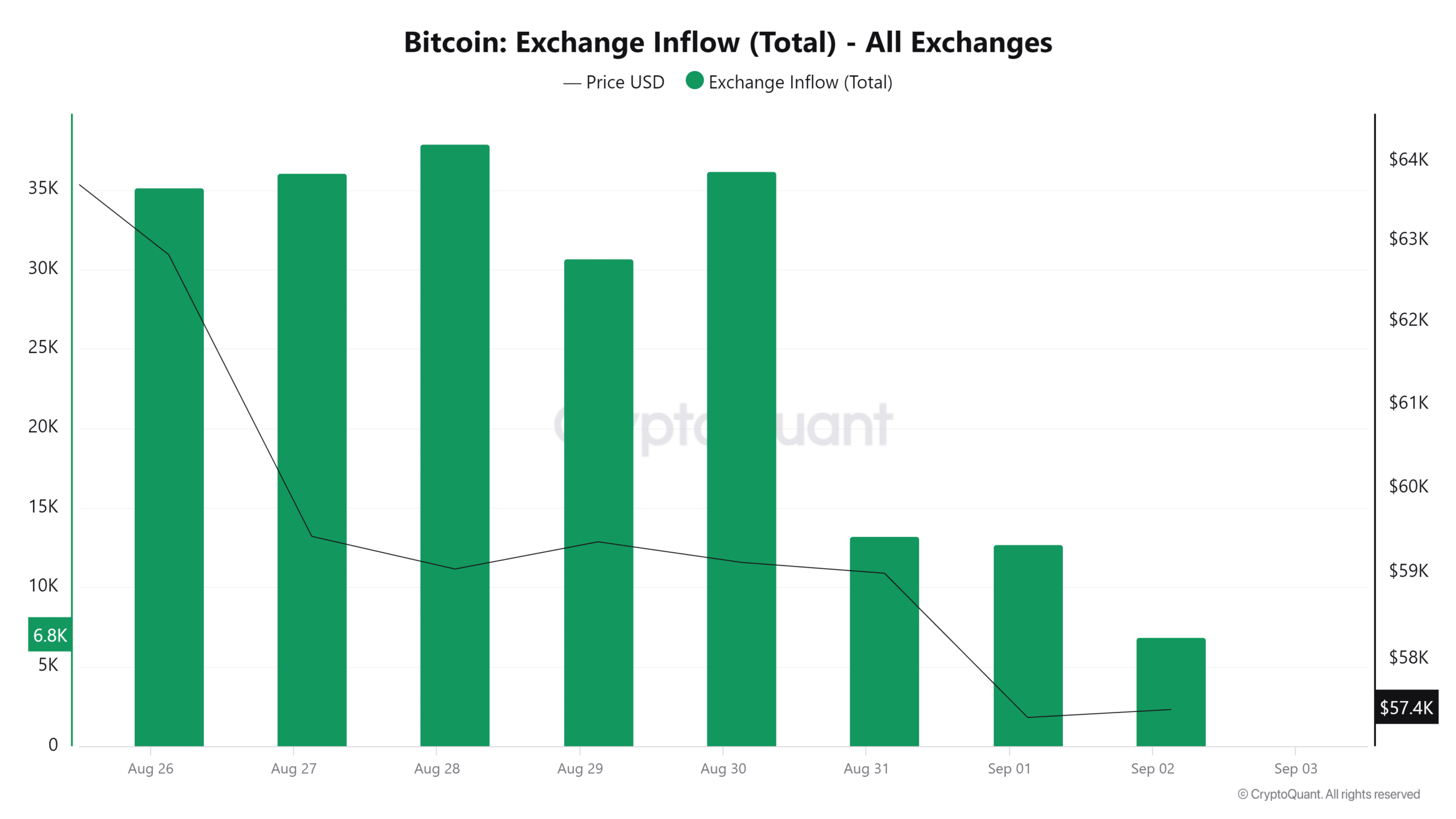

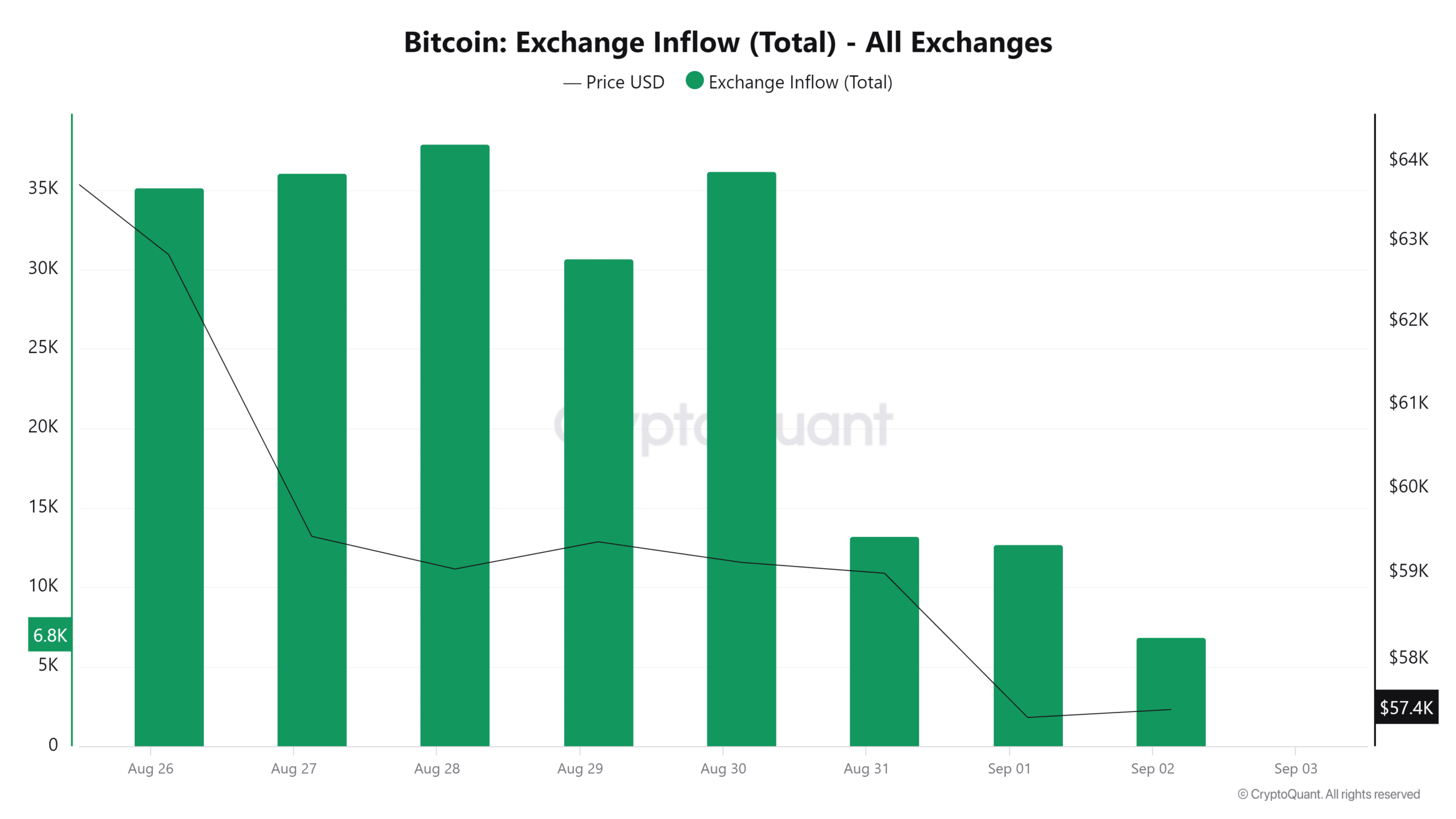

Supply: Cryptoquant

Lastly, inflows on the BTC exchanges have declined over the previous three days, from a weekly excessive of 37899.7 to a low of 6869. Such a decline in inflows on the exchanges signifies holding conduct as buyers anticipate larger costs.

This market sentiment reduces promoting exercise, which is bullish as there are fewer cash available for buying and selling.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

Though BTC has fallen over the previous 30 days, it’s on the decline, however a bullish consolidation. As market indecisiveness will increase, buyers select to carry, decreasing provide.

Such accumulation conduct results in diminished provide and a rise in demand, permitting bulls to retake the markets. This can result in BTC breaking above the $61,159 resistance stage, presumably heading in direction of $70,000.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024