Analysis

BTC Nears $110K Amid ETF Momentum and Fed Rate Cut

Credit : coinpedia.org

Because the Bitcoin White Paper celebrates its seventeenth anniversary, the world is reflecting on how a easy e mail from Satoshi Nakamoto remodeled world finance. Seventeen years later, BTC crypto is now leaving adolescence and coming into maturity. From its humble beginnings of $0.00076 to as we speak’s Bitcoin worth of over $109,980, Bitcoin’s story exhibits the world’s best rise of a decentralized monetary revolution.

How the Bitcoin White Paper Sparked the Digital Forex Revolution

On October 31, 2008, Satoshi Nakamoto launched the Bitcoin white paper to a mailing checklist of cryptography fans beneath the topic line ‘Bitcoin P2P e-cash paper’.

The e-mail was fairly quick and described a peer-to-peer digital foreign money system. This laid the inspiration for what BTC has develop into as we speak, because the world’s first decentralized financial community.

Simply over a couple of months later, in early 2009, the primary Bitcoin block, often called the Genesis Block, was mined. That began as a small experiment, which later grew right into a monetary revolution.

In its early days, Bitcoin crypto was traded for only a fraction of a cent on platforms like New Liberty Normal in 2009, in response to a Reddit discussion postthe place a single BTC was valued at simply $0.0007639.

Quick ahead to 2025, and the Bitcoin worth chart tells a totally breathtaking and bone-breaking story. The present Bitcoin worth in USD is nearly $109,890, which represents an astronomical achieve of 14.6 million % since its inception. It is a feat unparalleled within the historical past of recent finance and has surpassed each shiny metallic in existence when it comes to the quickest earnings.

Seventeen years of change: from skepticism to world integration

“Seventeen Years After the Bitcoin Whitepaper! This is not simply an anniversary; it is the second all the crypto house transitioned from thought to actuality.

It nonetheless holds the crown, accounting for greater than half of the market capitalization, and each innovation we see will be traced again to that one doc. The legacy is easy: the way forward for finance is constructed on transparency, expertise and the collective perception in an open system.”-Edul Patel, CEO of Mudrex.

Over the previous 17 years, perceptions surrounding Bitcoin have undergone a whole transformation. What was as soon as rejected by establishments and governments is now acknowledged as a strategic asset of significance.

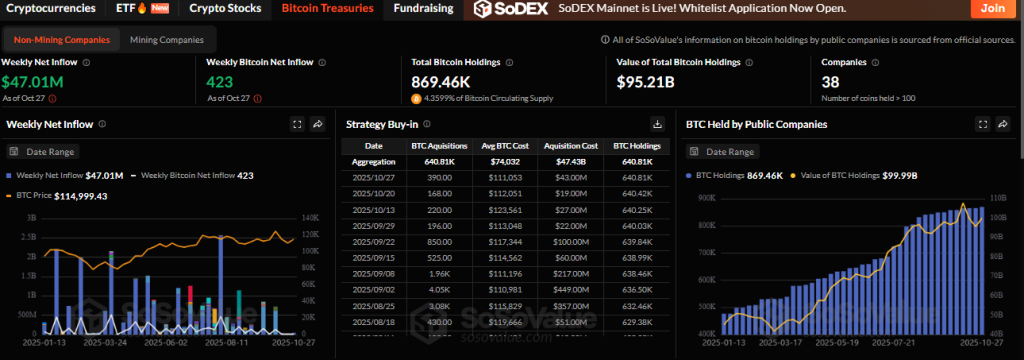

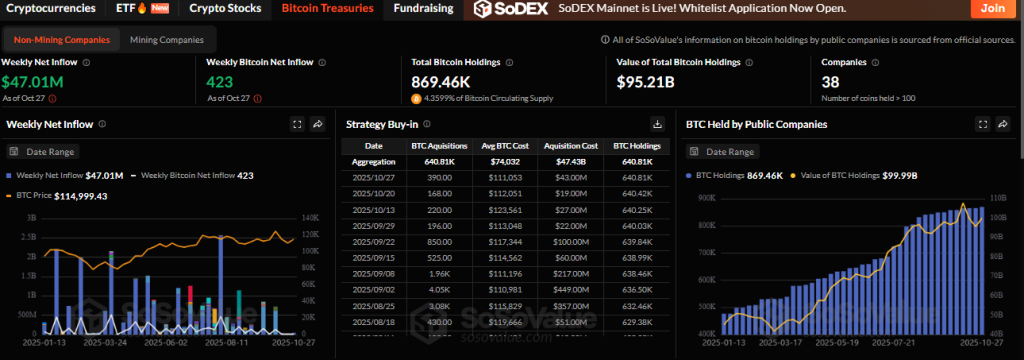

Because of demand, the worth has elevated considerably, which is obvious proof of this. Main companies now maintain Bitcoin of their treasuries, whereas nations just like the US, China, El Salvador and others have integrated it into their official reserves.

The launch of spot Bitcoin ETFs within the first quarter of 2024 marked one other main shift, giving institutional buyers protected, regulated publicity to BTC. The BTC ETF total net assets have reached $143.94 billion throughout 12 ETF issuers.

This transfer strengthened Bitcoin’s legitimacy and deepened its integration into world monetary programs. The seventeenth anniversary of the Bitcoin white paper comes at a time when Bitcoin has a market cap of $2.18 trillion and dominates 59.4% of all the crypto market.

Its shortage is much more engaging than gold. With a tough restrict of 21 million cash, its worth proposition as ‘digital gold’ has solely develop into stronger. This remained Bitcoin’s defining attribute, and the speedy development on the Bitcoin worth chart is obvious proof.

Mixed with rising institutional frameworks and an inflation hedge narrative, Bitcoin continues to draw new waves of capital amid world financial uncertainty.

- Additionally learn:

- Is it too late to purchase Bitcoin and Crypto in 2025?

- ,

Macro tailwinds and year-end worth outlook

Regardless of the current volatility, Bitcoin worth stays resilient as we speak, holding regular round $109,980 at the same time as world markets confronted dangers as a result of US authorities shutdown. The Federal Reserve’s current 25 foundation level rate of interest lower, coupled with its determination to finish quantitative tightening (QT) on December 1, 2025, may show essential to Bitcoin’s subsequent transfer.

If these financial shifts inject new liquidity into the markets, Bitcoin worth prediction fashions level to a doable near-term retest of $120,000 or perhaps a retest of the ATH degree.

Nevertheless, BTC’s long-term story stays strongly bullish, turning round $126,296 would make $135K the primary goal amongst many greater.

As 2025 approaches its last months, the legacy of the Bitcoin White Paper is a testomony to resilience, innovation and unstoppable world adoption.

Steadily requested questions

The Bitcoin White Paper, revealed by Satoshi Nakamoto in 2008, launched the idea of peer-to-peer digital cash, sparking the present crypto revolution.

When Bitcoin launched in 2009, it traded at simply $0.00076. At the moment it’s value greater than $109,000 – one of many largest monetary will increase in historical past.

Bitcoin has grown from a distinct segment expertise thought to a worldwide asset, embraced by establishments, governments and ETFs, shaping the way forward for digital finance.

Analysts count on Bitcoin may retest $120,000 or greater by the top of the yr as easing of US financial coverage and rising adoption will gasoline optimism available in the market.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict editorial pointers based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluation coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We intention to supply well timed updates on every thing crypto and blockchain, from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared signify the writer’s personal views on present market situations. Please do your individual analysis earlier than making any funding selections. Neither the author nor the publication accepts accountability in your monetary decisions.

Sponsored and Advertisements:

Sponsored content material and affiliate hyperlinks might seem on our web site. Advertisements are clearly marked and our editorial content material stays utterly impartial from our promoting companions.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now