Bitcoin

BTC small retail traders dominate the market hitting 7 months high

Credit : ambcrypto.com

- Bitcoin’s small BTC retail holders dominated the market on the time of writing.

- Analysts recommend three circumstances for Bitcoin to soar to new highs.

Bitcoin [BTC]the most important cryptocurrency by market capitalization, has been on a downward trajectory over the previous month. On the value charts, BTC is down 1.01% on the day by day charts to commerce at $56657.

The value has additionally fallen 2.80% within the final 30 days, indicating elevated volatility.

Since reaching an ATH of $73737 in March 2024, the crypto has struggled to take care of upward momentum, even hitting a neighborhood low of $49,000.

The elevated market volatility has raised questions in regards to the future prospects based mostly on the habits of holders. To this extent, Santiment analysts have advised three circumstances for BTC to achieve new highs.

What prevailing market sentiments recommend

In response to Santiment, Though market sentiment amongst retail merchants has turned optimistic, this isn’t sufficient to offer BTC momentum for a rally.

The evaluation exhibits that wallets with <1 BTC have now elevated their holdings to the best stage in seven months. Because of this small retailers management nearly all of the BTC provide.

Supply: Santiment

Nonetheless, based on this analogy, elevated possession by retail merchants just isn’t adequate for a rally. Primarily based on this evaluation, the primary situation for BTC’s restoration is that small holders cut back their holdings.

When small farmers dominate the market, this ideally signifies elevated hypothesis or a weak market, as small farmers are emotional sellers.

Fewer small farmers are subsequently much less preferable for a sustained rally, as they’re delicate to panic promoting.

Second, medium-sized buyers with 1-100 BTC have to develop their holdings steadily. Continued progress amongst mid-market buyers signifies that extra refined buyers and establishments are coming into the market.

The entry of such buyers is mostly optimistic, because it exhibits confidence within the long-term prospects.

The third and closing situation for a rally is aggressive accumulation by greater than 100 holders. Aggressive accumulation by giant holders means that establishments and whales are optimistic about future prospects.

Due to this fact, whales are accumulating BTC, suggesting they’re assured of a longer-term worth enhance by decreasing liquidity on exchanges, which usually helps worth appreciation.

Bitcoin Holder Evaluation

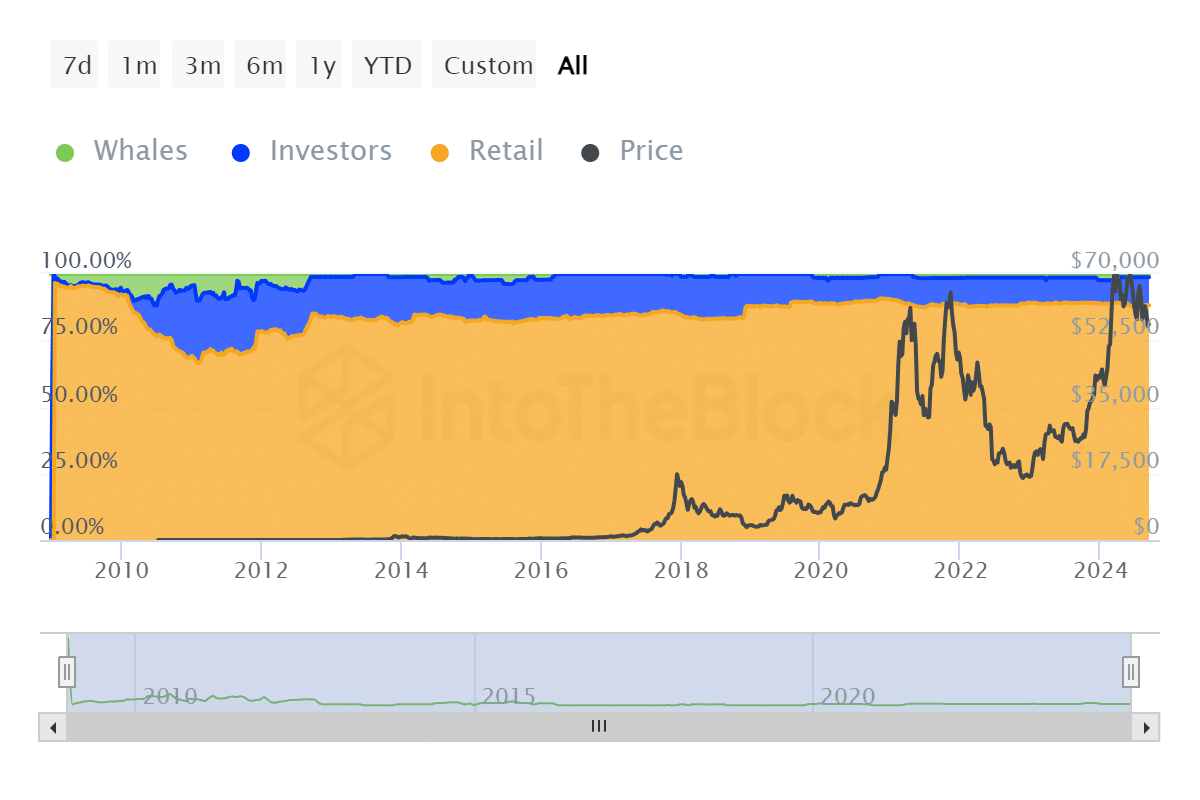

As famous by Santiment, small retailers have continued to dominate the market within the current previous.

Supply: IntoTheBlock

For starters, Bitcoin possession by historic focus indicated that retail dealer holders owned 88.24%, amounting to 17.44 million Bitcoins, whereas buyers owned 10.5% and whales owned 1.26%.

This exhibits that retailers have a big voice out there, leading to speculative gross sales, ensuing within the volatility and fluctuations noticed not too long ago.

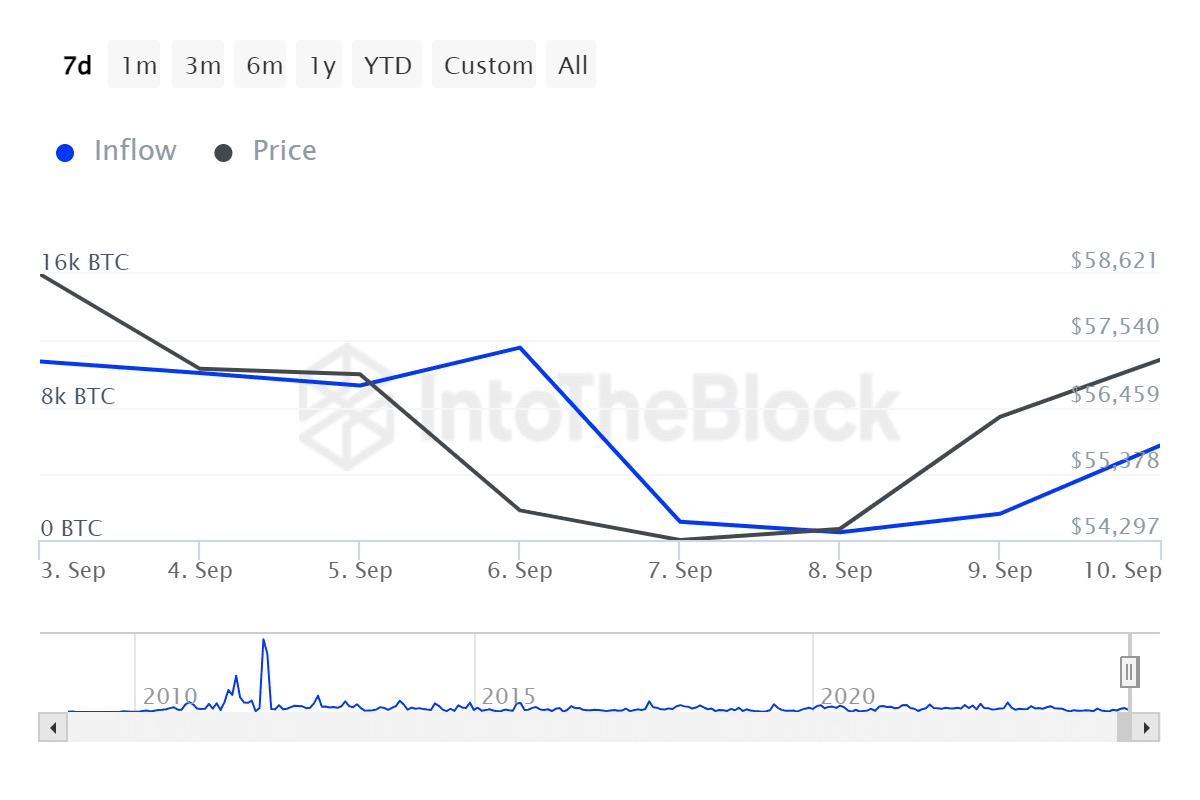

Supply: IntoTheBlock

Furthermore, giant investor inflows have fallen from 11.57k to a low of 1.58k over the previous seven days.

This means lowered demand from whales as they closed their positions through the market downturn. A discount in whaling exhibits confidence sooner or later prospects.

Due to this fact, the rise in small retailer possession displays present market fluctuations.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

Throughout recessions, retail merchants have a tendency to shut their positions as a result of they’re speculative sellers, which drives costs down additional.

A rise within the variety of giant and medium-sized holders would subsequently stabilize the market and enhance costs. So if the retail merchants proceed to dominate the markets, BTC will fall to $54587.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now