Bitcoin

BTC supply shock incoming? Exchange reserves hit multi-year lows!

Credit : ambcrypto.com

- The alternate reserves of Bitcoin are at multi -year lows, which expresses concern a few attainable provide shock.

- With much less BTC obtainable for commerce, analysts predict a possible value dump if the demand stays robust.

Bitcoin [BTC] Reserves on spot gala’s have fallen in recent times, in line with their lowest ranges, in line with Cryptoquant -Data. Alternate reserves grew between 2020 and 2022, however have since been in a steep lower.

Buyers proceed to take BTC from inventory markets and transfer to chilly storage, which strengthens an extended -term holding development.

A shrinking alternate provide reduces the variety of obtainable Bitcoins for commerce, which might trigger an upward stress on the worth if the demand stays robust.

With Bitcoin who exhibits an upward development in 2024 and 2025, this shift suggests a tightening of the delivery-based stability.

Supply: Cryptuquant

The continual decline of the reserve has elevated hypothesis on a attainable provide shock, as a result of much less BTC can result in value will increase which can be similar to earlier cycles.

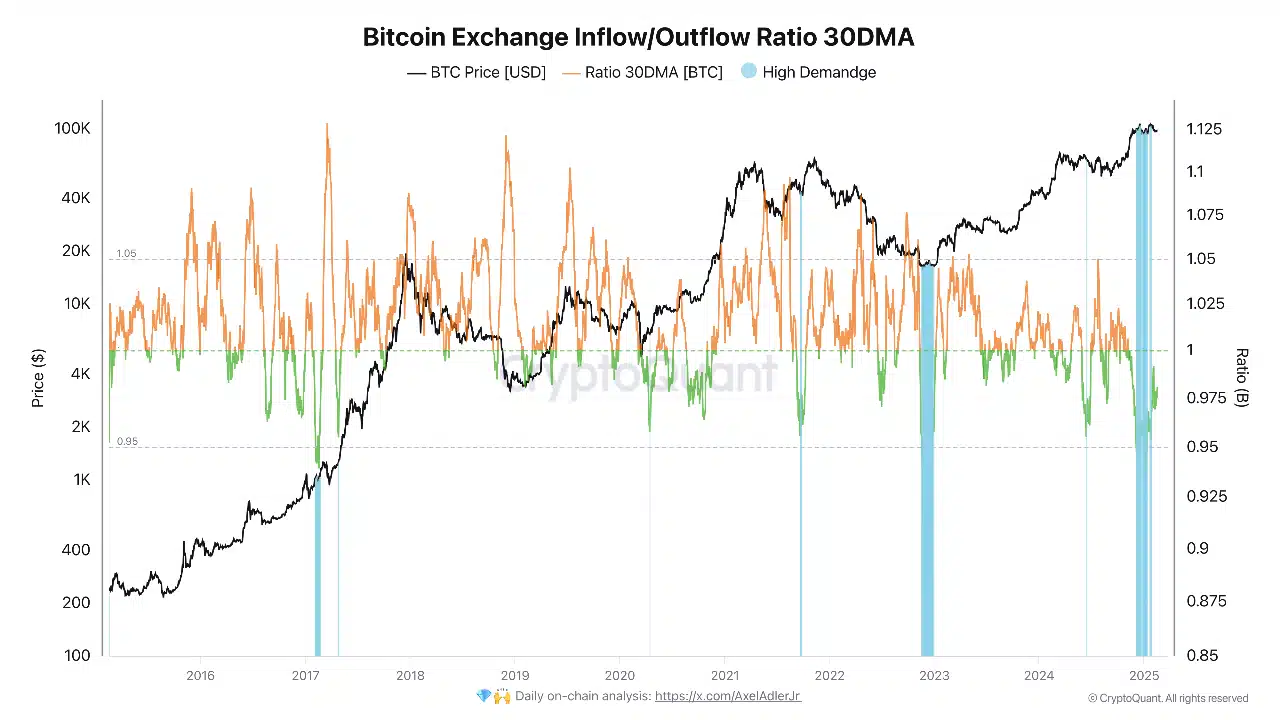

Knowledge on chains recommend a powerful bitcoin accumulation

Bitcoin has hit between $ 90,000 and $ 105,000, and Give information to Steady accumulation. The 30-day advancing common (30DMA) of the alternate of alternate/outflow ratio has remained below 1, indicating that extra BTC is leaving inventory exchanges than arriving.

Analysts typically think about this a bullish sign, as a result of it means that buyers as an alternative of promoting as an alternative of promoting.

When this ratio drops below 1, this implies that the influx of dominates, a situation that {many professional} buyers regard as a bullish sign.

If historic patterns are in drive, Bitcoin may see a value for the quick time period as quickly because the gross sales stress weakens.

Supply: Cryptuquant

Nevertheless, a few of these retailers could be linked to routine activations by centralized exchanges to storage portfolios, resembling ETFs, institutional accounts or OTC businesses.

Bitcoin -Market traits and value motion

From the second of the press, Bitcoin was traded at $ 96,071reflection of a lower in -1.23% within the final 24 hours and a lower of -1.43% within the final seven days.

The overall circulating provide is 20 million BTC, which supplies Bitcoin a market capitalization of $ 1.9 trillion.

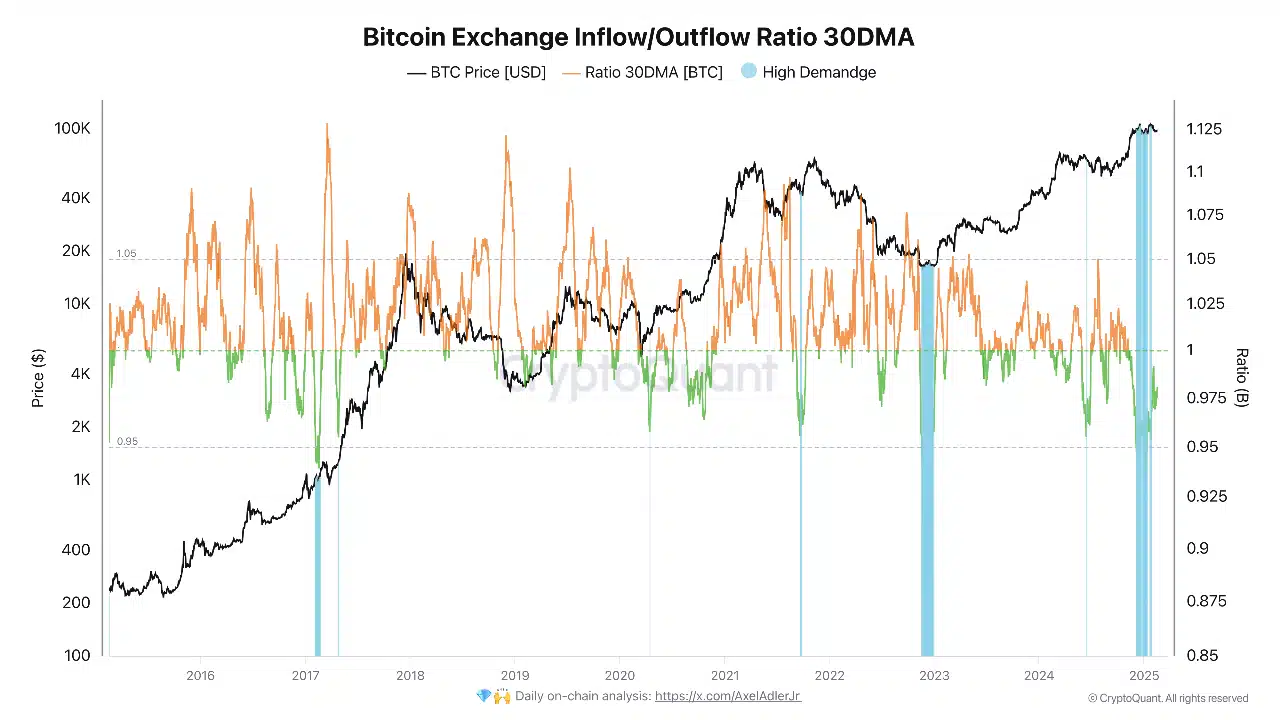

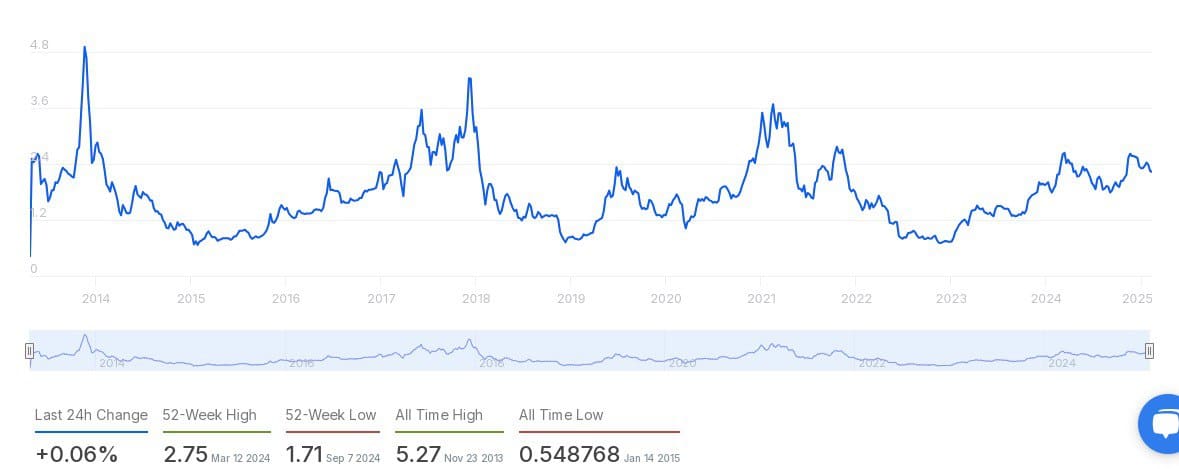

The market worth and realized worth (MVRV) ratio, which measures the market score on the value at which BTC was final moved, stays inside a reasonable vary.

The all-time excessive of 5.27 on November 2013, mirrored extraordinarily optimism, whereas the low level of 0.548768 advised a deep undervaluation on January 2015.

Supply: Intotheblock

Up to now yr, the MVRV ratio reached a peak of two.75 on March 2024 and a low level of 1.71 on September 2024. With solely a +0.06% change within the final 24 hours, the market sentiment appears secure.

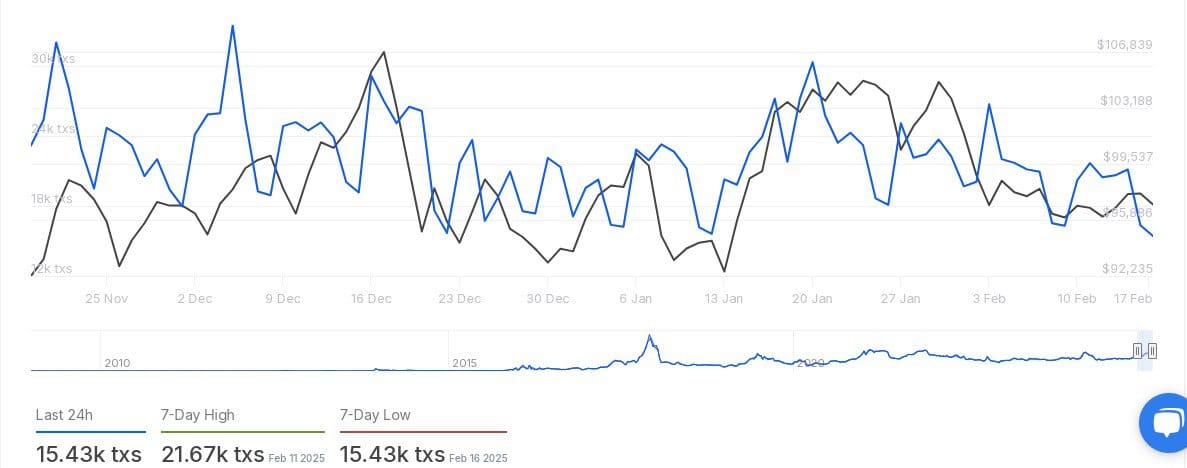

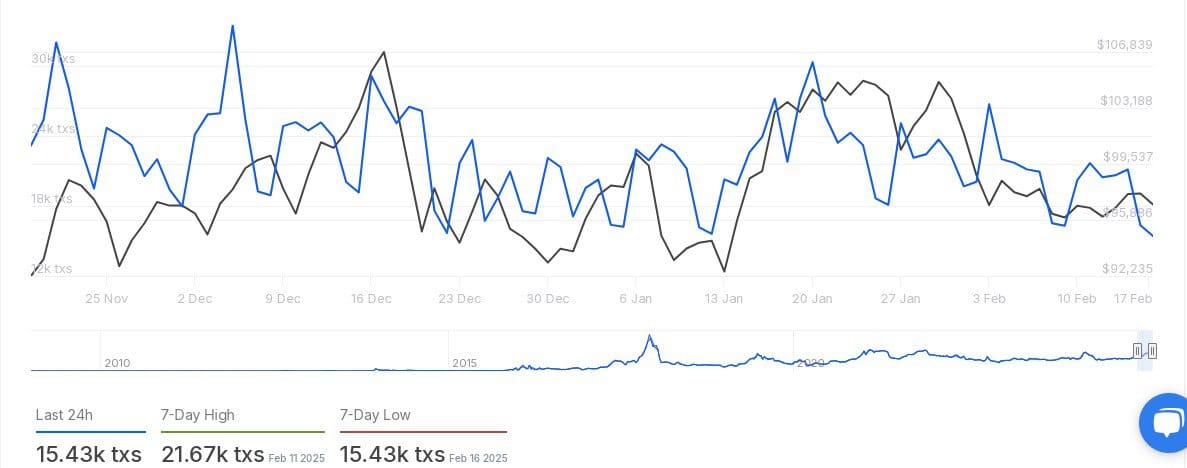

Institutional transactions stay energetic

The variety of Bitcoin transactions value $ 100,000 or extra exhibits fluctuations in large-scale actions. The final 24-hour transaction depend is 15.43k, which additionally marks the 7-day low level that was registered on February 16, 2025.

Supply: Intotheblock

On February 11, 2025, Transactions peaked at 21.67K, which signifies a excessive institutional exercise. Though the transaction quantity has decreased from the tip of January, it stays inside a historic energetic attain.

This means steady curiosity of institutional buyers and Hoognet-worthy folks.

What’s the subsequent step for Bitcoin?

With BTC reserves when shrinking gala’s, the opportunity of a provide shock stays an necessary focus. If the query stays or will increase, Bitcoin may expertise an upward value stress.

Whereas the market appears on the subsequent main motion, many assess whether or not this development can point out the beginning of the following Bull Run.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now