Bitcoin

BTC surges as RSI confirms a bullish trend

Credit : ambcrypto.com

- BTC is up 4.16% over the previous week, with fundamentals pointing to constructive sentiments.

- Regardless of the lows, the RSI confirms a bullish development with a bullish RSI divergence.

Bitcoin [BTC] has seen sturdy upward momentum all month. Traditionally, September is related to a bearish development. Nonetheless, a dramatic shift has occurred this month, with BTC reaching increased lows.

On the time of writing, Bitcoin was buying and selling as excessive as $65,530. This marked a rise of 10.52% on the month-to-month charts, extending the uptrend over the previous week with a rise of 4.16%.

Nonetheless, over the previous 24 hours we now have seen a small correction with Bitcoin falling 0.46%.

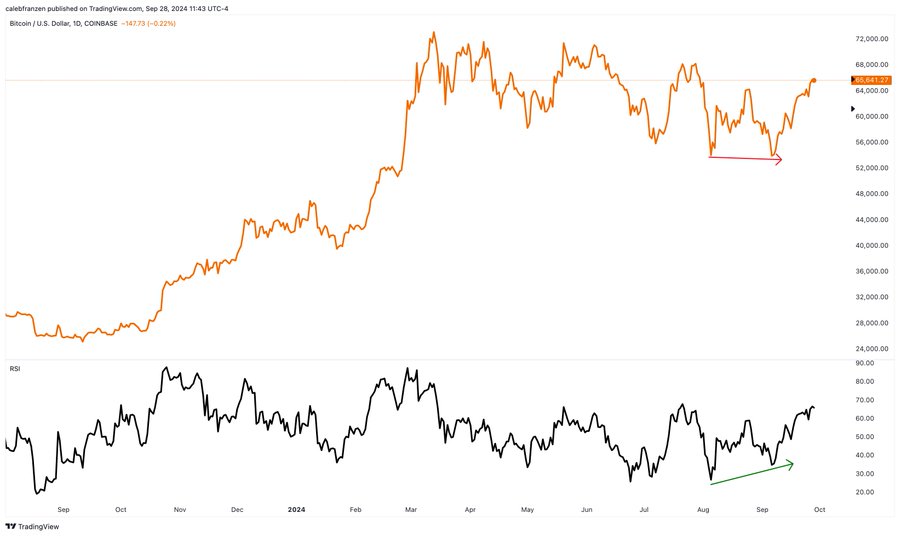

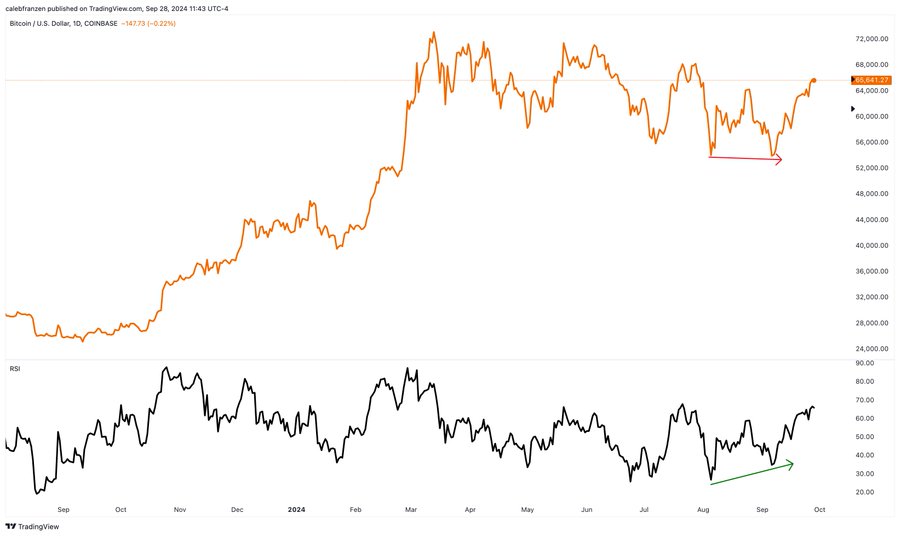

Subsequently, present market situations have analysts speaking about Bitcoin’s trajectory. One in all them is the favored crypto analyst Caleb Franzen which instructed {that a} bullish development will proceed, citing bullish RSI divergence.

What market sentiment says

In his evaluation, Franzen cited the bullish RSI divergence to argue that the bulls are dominating the market.

Supply:

In line with the analyst, the RSI has not shaped a bearish RSI divergence on the day by day charts. Nonetheless, the RSI continues to substantiate the bullish development from the lows. Subsequently, it confirms the bullish RSI divergence.

In context, the truth that there isn’t any bearish divergence implies that the worth improve is supported by momentum and that there isn’t any important signal of a reversal at this level.

When a bearish RSI divergence happens, it alerts weakening upside momentum and will point out {that a} value correction is imminent.

So whereas BTC could have been making decrease lows currently, the RSI is making increased lows, indicating momentum is rising regardless of decrease costs.

Usually, a bullish RSI divergence signifies that promoting strain is weakening and shopping for curiosity is rising, resulting in additional upside potential.

What BTC Charts Say

As Frazen famous, Bitcoin is having fun with favorable market situations. Subsequently, these market situations might trigger BTC to make much more beneficial properties on the worth charts.

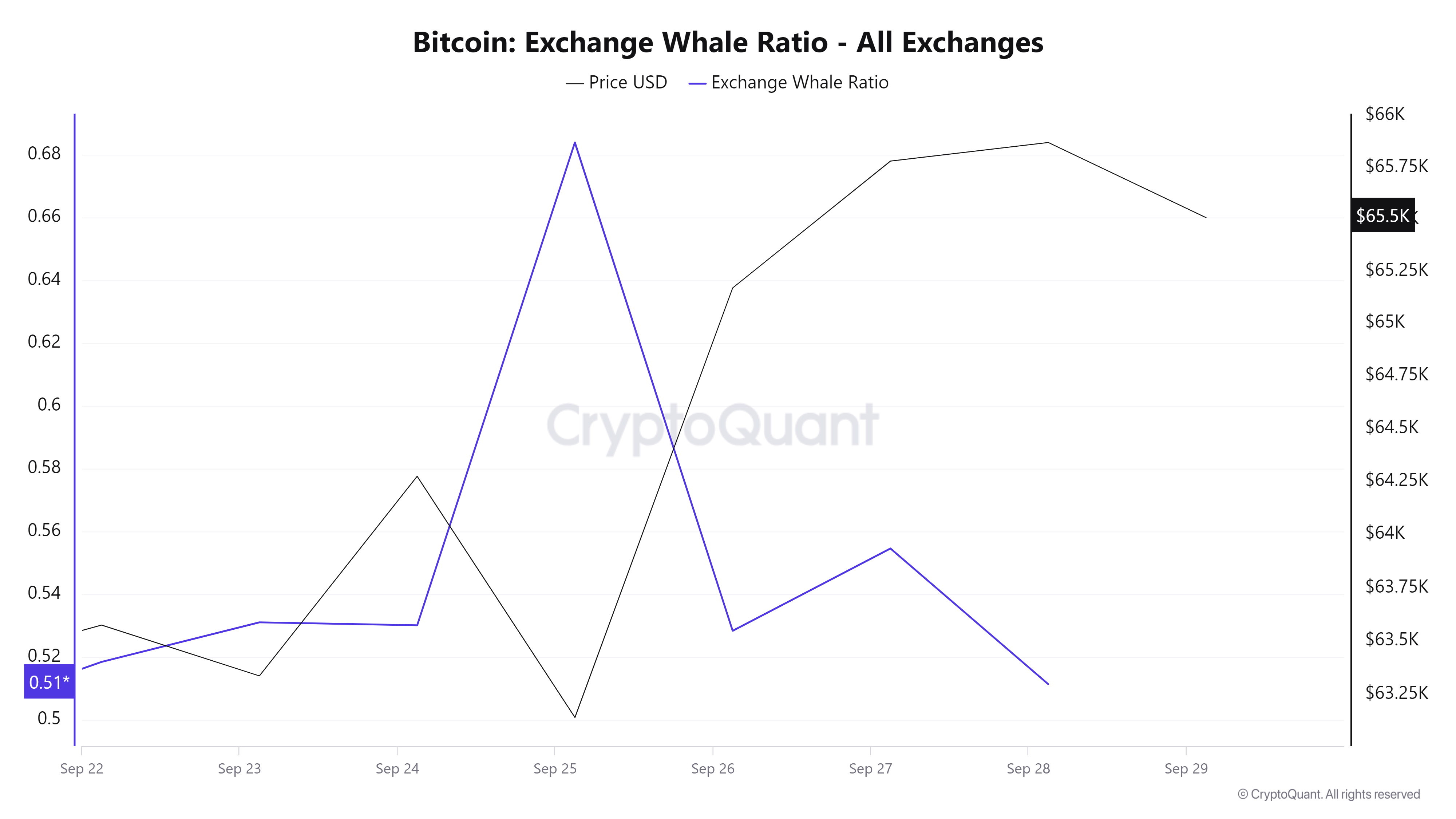

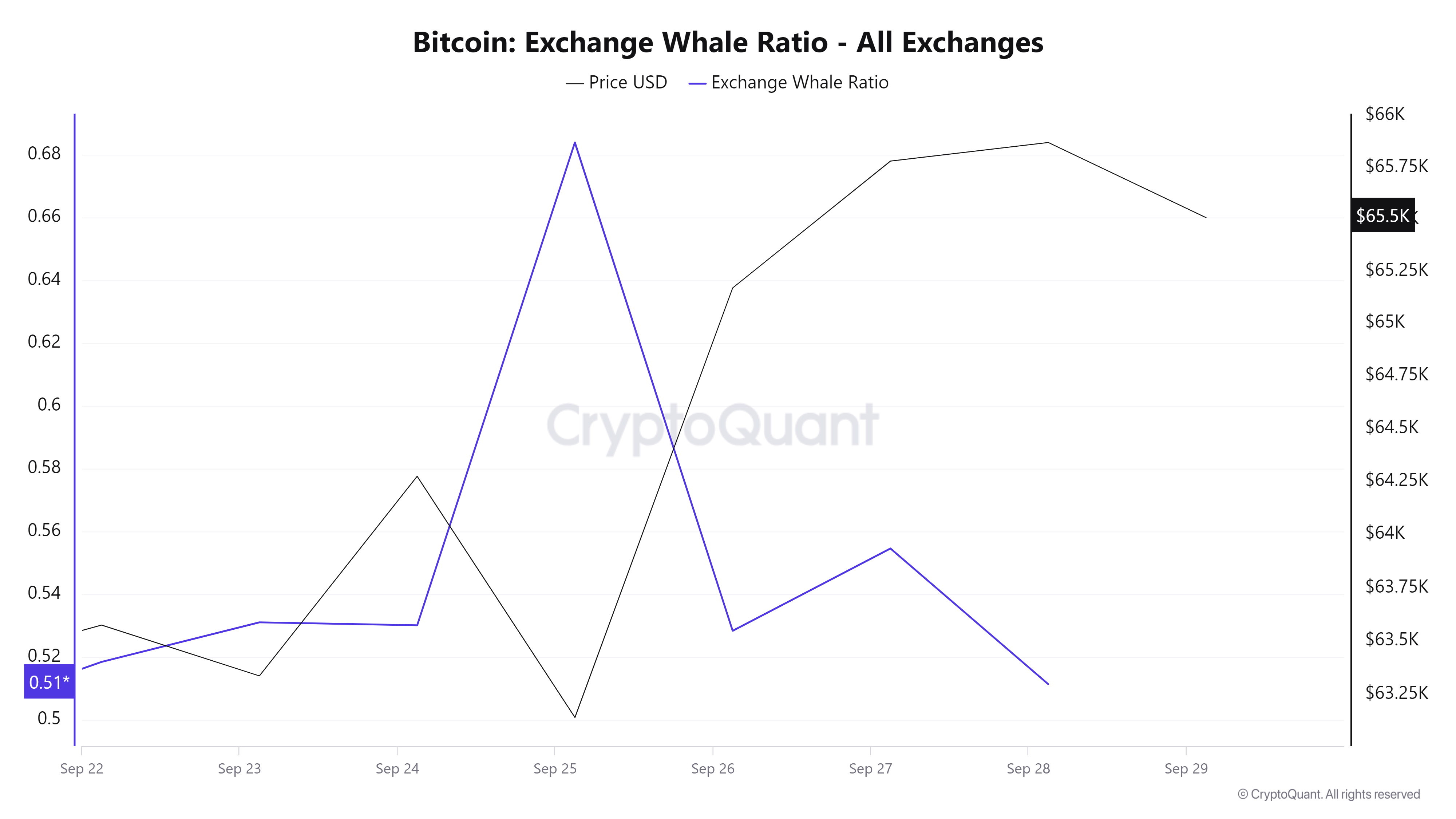

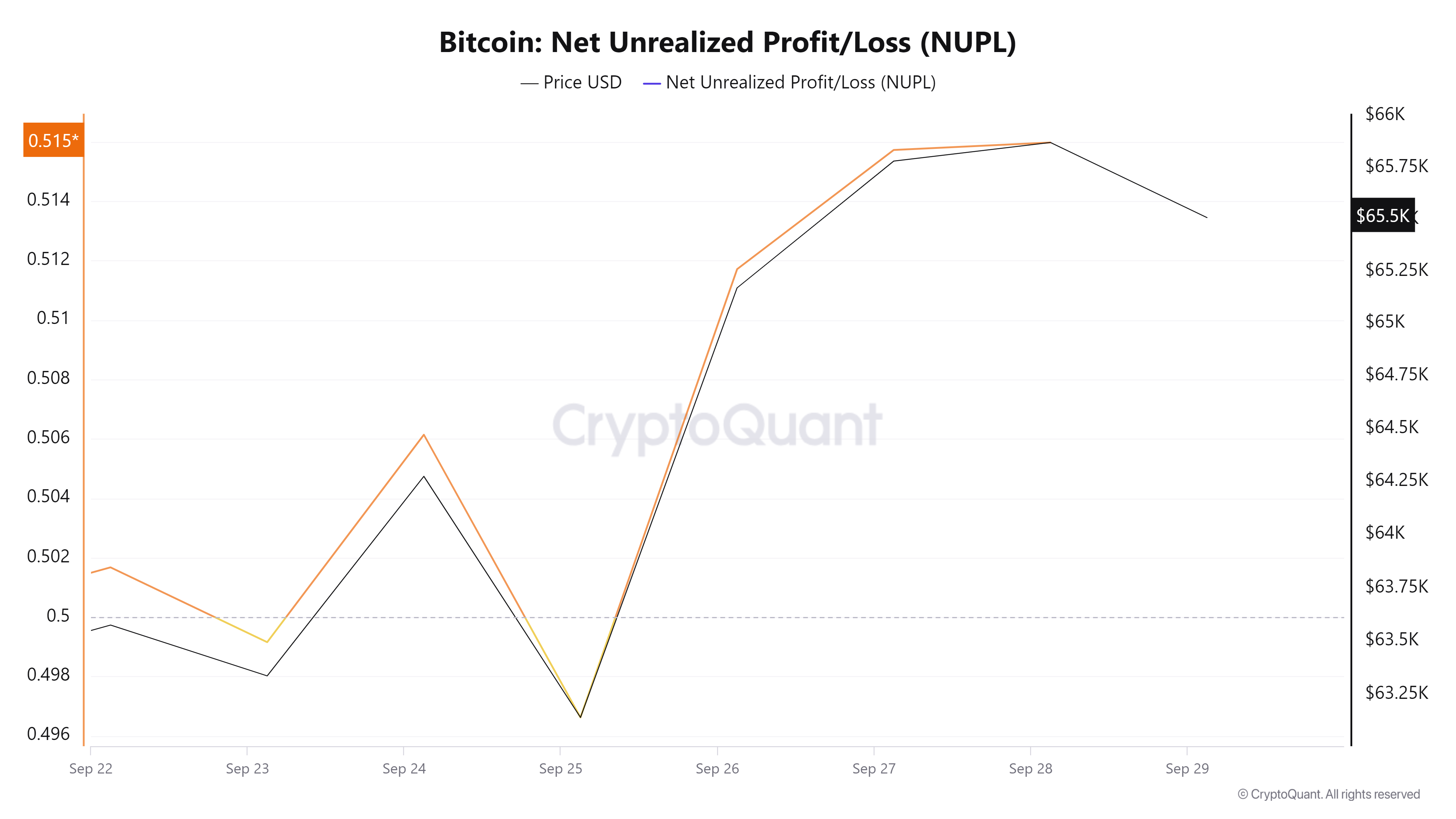

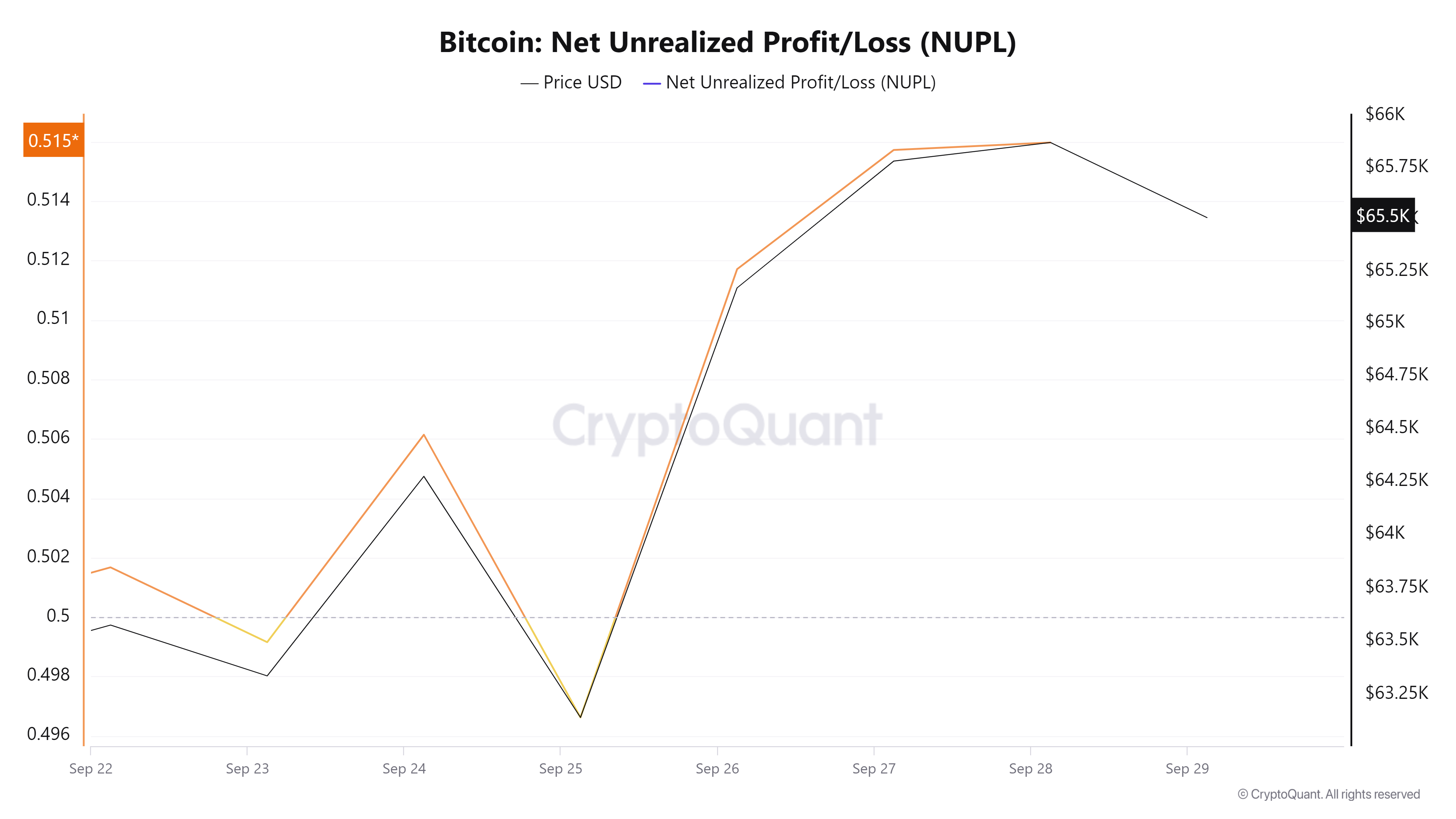

Supply: Cryptoquant

For instance, the Trade Whale value has fallen from a excessive of 0.68 to 0.511 on the time of writing. This decline signifies that whales are transferring their BT from the exchanges to non-public wallets.

Such market habits is a bullish sign indicating that giant traders don’t have any plans to promote within the close to time period.

Supply: Cryptoquant

Moreover, Bitcoin’s web unrealized achieve/loss (NUPL) has risen from a low of 0.4 to 0.51 over the previous week. Because the NUPL rises, it signifies that traders are seeing earnings.

This often occurs throughout the bullish part of the market, when costs rise above the acquisition value. Subsequently, this leads to larger optimism as contributors have extra confidence sooner or later potential of the market and anticipate additional value will increase.

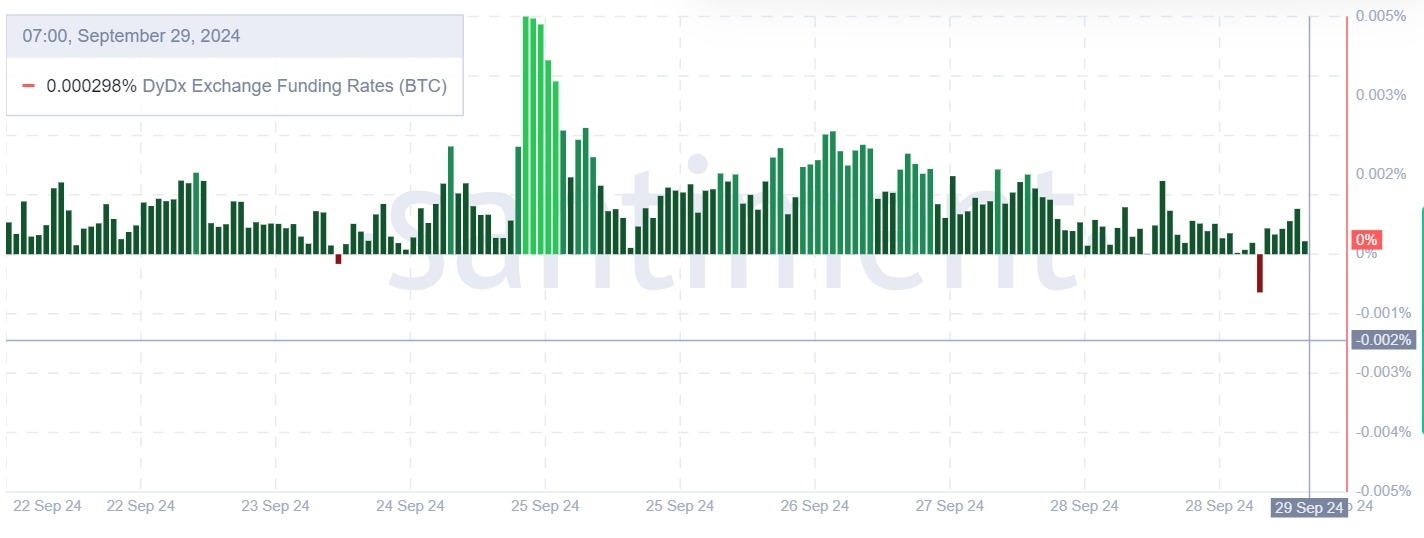

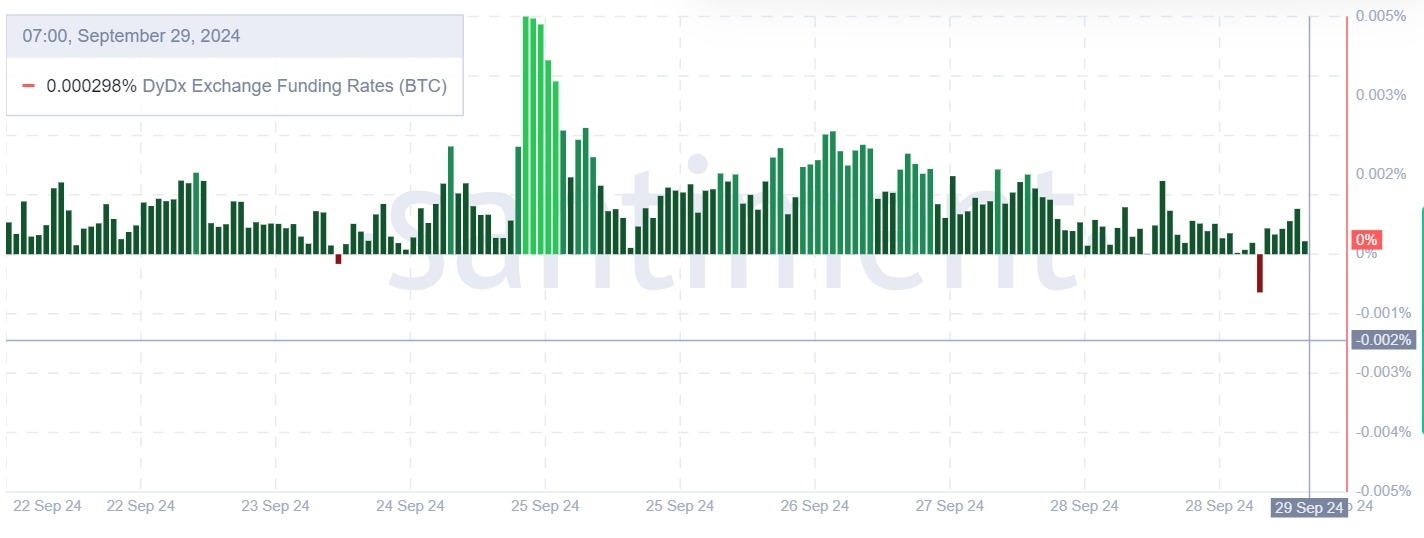

Supply: Santiment

Lastly, Bitcoin’s DyDx trade funding charge has remained constructive over the previous week. A constructive DyDx trade funding charge means that holders of lengthy positions pay those that take shorts to take care of their place.

Is your portfolio inexperienced? Try the BTC revenue calculator

In such a market state of affairs, traders are extra inclined to take lengthy positions in anticipation of value will increase.

Merely put, Bitcoin is experiencing sturdy upward momentum with bulls dominating the market. Subsequently, below these situations, BTC will make additional beneficial properties on the worth charts by regaining the $66,500 resistance degree within the brief time period.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024