Bitcoin

BTC YTD Performance 2nd to Gold but 308,709x Higher Total Return Since 2011

Credit : www.coindesk.com

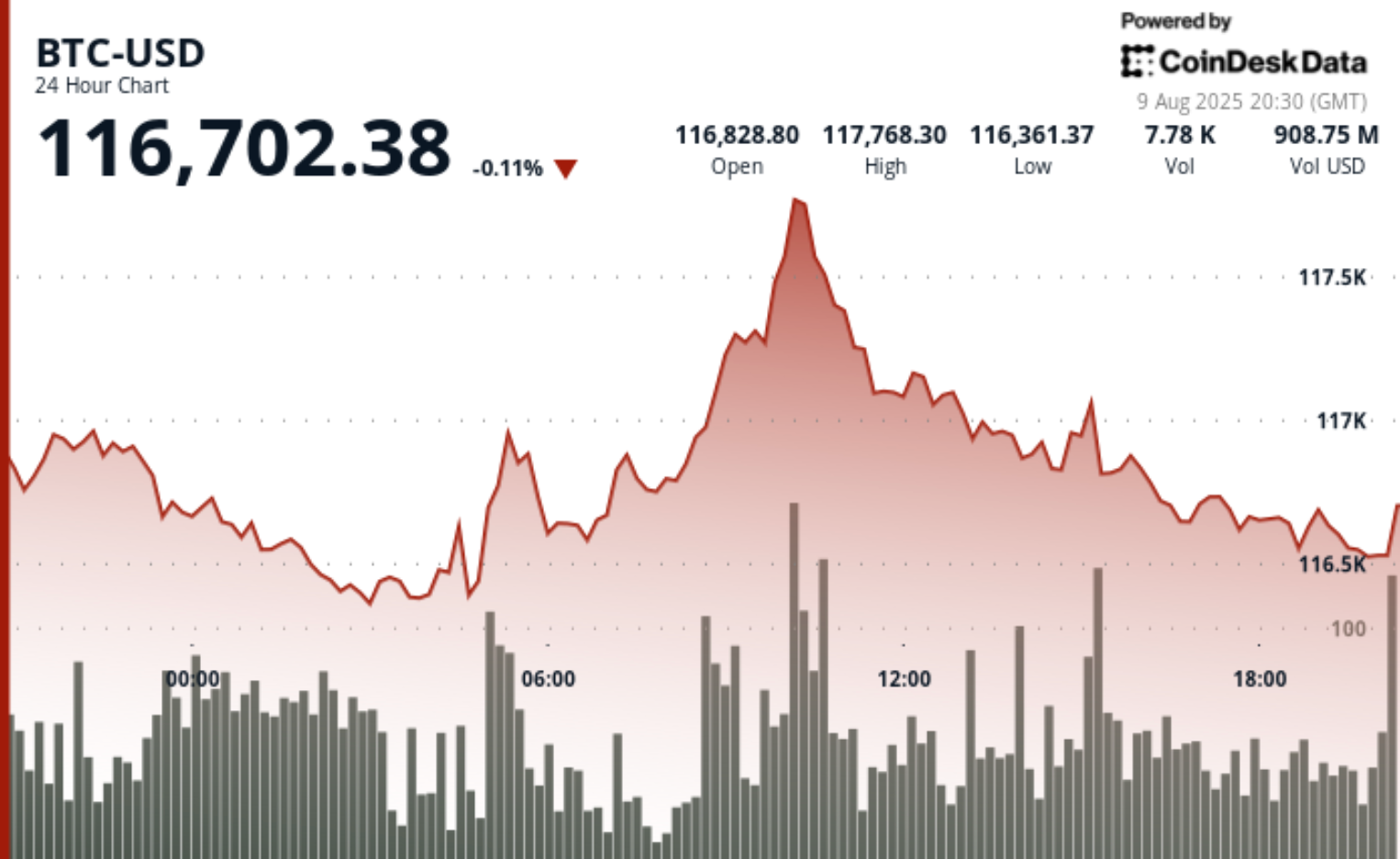

Bitcoin has fallen 0.11% to $ 116,702 within the final 24 hours, based on Coindesk information, however has so removed from 25% years, the second after the win of 29% of the Gold below massive activa lessons, based on information shared By monetary strategist Charlie Bilello on X.

2025 Efficiency up to now

From 8 August, Bitcoin’s 25% year-to-date return was behind Gold’s 29.3% progress. Different massive asset lessons have made extra modest revenue, with sharing market shares (VWO) a rise of 15.6%, the Nasdaq 100 (QQQ) a rise of 12.7% and our large caps (SPY) rising 9.4%. In the meantime, American mid -caps (MDY) and small caps (IWM) 0.2% solely gained 0.8%. This marks the primary time that Gold and Bitcoin have held the highest two positions in Bilello’s annual rankings of Asset Class for the reason that information began.

2011–2025 Cumulative return

In the long term, Bitcoin has yielded a rare 38,897,420% return since 2011 – a determine that each one different activa lessons within the dwarf -set dwarfed. Gold’s 126% cumulative return in the identical interval it locations it in the course of the peloton, with a inventory -benchmarks such because the Nasdaq 100 (1101%) and our large caps (559%)in addition to mid -caps (316%)Small caps (244%) and rising market shares (57%). Primarily based on Bilello’s figures, Bitcoin’s complete return has exceeded greater than 308,000 instances within the final 14 years.

2011–2025 Annual returns

When it’s measured on an annual foundation, Bitcoin’s dominance is equally clear. The Cryptocurrency flagship has achieved a mean annual revenue of 141.7% since 2011, in comparison with 5.7% for gold, 18.6% for the Nasdaq 100, 13.8% for American massive caps and 4.4% to 16.4% for different massive fairness indexes. Gold’s lengthy -term stability has made it a precious cowl in sure market cycles, however the tempo of appreciation has been a lot slower than Bitcoin’s exponential climb.

Gold vs. Bitcoin, based on Peter Brandt

Famend dealer Peter Brandt weighed On August 8, contrasting Gold’s Deserves akin to a Worth Winkel with Bitcoin’s potential to exceed all Fiat alternate options. “Some suppose that gold is a good worth of worth and that’s it. However the final worth of worth will become Bitcoin,” he stated on X, and shares a long-term chart of the buying energy of the US greenback. His feedback mirror the rising story that makes the shortage and decentralization of Bitcoin uniquely positioned to surpass conventional hedges over time.

Technical evaluation highlights

- In response to the technical evaluation mannequin of Coindesk Analysis, between August 8 at 21:00 UTC and August 9 at 20:00 UTC, Bitcoin traded inside a spread of $ 1,534.42 (1.31%) From $ 116,352.52 to $ 117,886.44.

- Value was opened nearly $ 116,900 and moved sideways earlier than he rose in the course of the Asian hours and climbed from $ 116,440 to $ 117,886 between 05:00 UTC and 10:00 UTC on 9 August, with 24-hour commerce quantity of greater than 9,000 BTC throughout these intervals.

- Robust shopping for arose practically $ 116,420 at 05:00 UTC, whereas the gross sales stress is rising round $ 117,886 excessive.

- Bitcoin closed the session to $ 116,517, a lower of 0.32% in comparison with the open, with outlined help at $ 116,400 – $ 116,500 and resistance to $ 117,400 – $ 117,900

- Within the final hour of the evaluation interval (9 August 19: 06–20: 05 UTC)Bitcoin remained below downward stress inside a tire of $ 195.11, sliding from $ 116,629.40 to $ 116,519.29 (-0.09%).

- The most important peak of the final hour quantity happened at 19:27 UTC, when 296.43 BTC modified proprietor when the value supported $ 116,547.

- Restoration makes an attempt have been repeatedly taught within the neighborhood of $ 116,600 – $ 116,713, according to earlier Intraday resistance.

Safeguard: Elements of this text have been generated with the assistance of AI instruments and assessed by our editorial group to ensure the accuracy and compliance with Our requirements. For extra info, see The total AI coverage of Coindesk.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now