Analysis

Bullish market momentum fails to sway global fund managers toward crypto, survey shows

Credit : cryptoslate.com

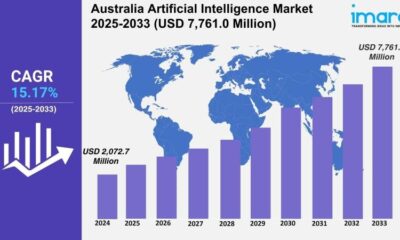

A current examine by the Financial institution of America exhibits that the majority world fund managers nonetheless hesitate to spend money on crypto, regardless of the current bullish momentum that’s noticed within the sector.

The studyTogether with 211 fund managers who supervise $ 504 billion in property, found that about three-quarters of the respondents don’t have any crypto firms in any respect.

Within the meantime, crypto assignments are small for managers who’ve these monetary devices. On common, these portfolios solely dedicate 3.2% to digital property.

6% of managers have splitting, have about 2% publicity, 2% have 4% and just one% stories allocations above 8%. When it’s on common over the whole group, Crypto represents solely 0.3% of the Below Underweering Belongings.

Touch upon this findingsBloomberg ETF analyst Eric Balchunas recommended that the low publicity can mirror by missteps of those funds. He famous that some managers who had beforehand made dangerous calls on broader markets might train further warning on the quick -growing business.

In keeping with him:

“Are these not the identical” world managers “who mentioned they offered America within the first quarter? Perhaps they need to begin investigating individuals with a greater return.”

Within the meantime, different business gamers famous that the low participation price might point out unused potential within the cryptomarkt.

Frank Chechelo, the pinnacle of the content material at GSR, stated:

“Wall Avenue has barely come zero and Bitcoin remains to be $ 120,000. We’re going to be absurdly larger.”

Traditionally, digital property have provided sturdy returns, however they’ve appreciable volatility. This threat issue appears to be why many institutional buyers have restricted their crypto firms.

Regardless of this cautious method, institutional curiosity in cryptocurrencies is rising. Previously yr, buyers have more and more been uncovered by shares of crypto firms and crypto-oriented listed funds (ETFs).

Furthermore, there has additionally been the arrival of Bitcoin-oriented treasury firms which have added a substantial a part of the most effective crypto to their steadiness.

On the identical time, the American regulatory atmosphere additionally encourages a broader acceptance of the rising business.

For context, President Donald Trump lately signed an government order with which digital property might be included in 401 (Okay) pension plans. Industrial gamers imagine that this step may lead fund managers to rethink their positions and enhance crypto assignments.

State on this article

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024