Ethereum

Bulls Must Hold $2,500, Spot ETF To Catalyze Demand

Credit : www.newsbtc.com

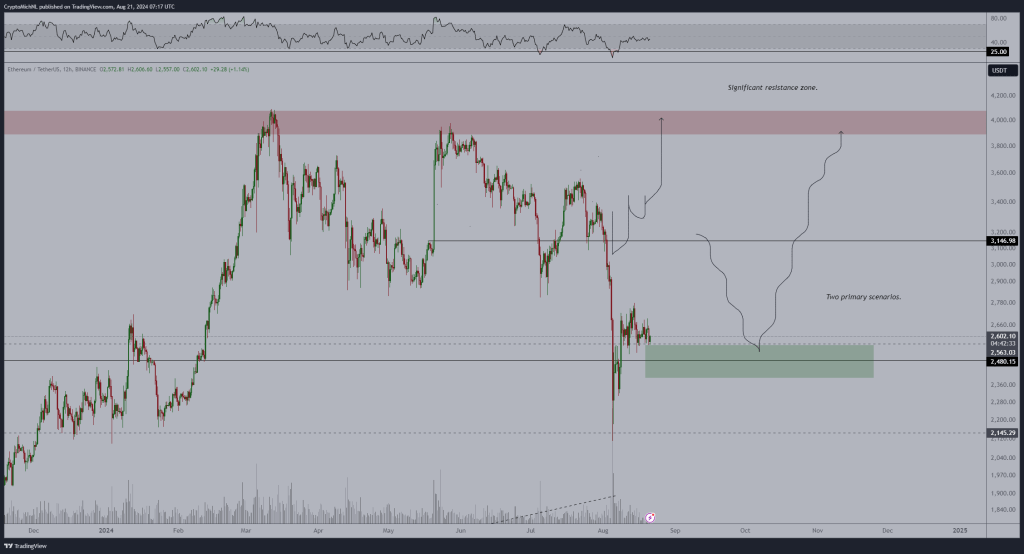

Ethereum, like most altcoins, is below important promoting strain and is struggling to shake off the weak spot seen in early August. Despite the fact that there have been moments in impact after the August 5 sale, costs are nonetheless below $2,800.

The one constructive for now, a minimum of trying on the day by day chart, is the resilience of the spectacular bulls. Regardless of the wave of decrease lows, consumers have been immersed within the flood of promoting strain, maintaining costs above $2,500.

The bearish formation nonetheless stays, however one analyst thinks the rejection of decrease costs beneath $2,500 is essential.

Ethereum Bulls Have to Maintain Costs Above $2,500

In a publish on X, the analyst said that bulls must preserve Ethereum above $2,500 for the uptrend to proceed. The spherical quantity, trying on the value evolution within the day by day chart, marks the bottom of the bull flag.

Associated studying

Over the previous few buying and selling days since its peak on August 8, Ethereum has discovered itself beneath the $2,700 and $2,800 resistance zones. On the similar time, help stays clear at $2,500. As the worth motion consolidates, a bull flag has fashioned, signaling energy.

In keeping with the analyst, if consumers preserve $2,500 as an anchor, Ethereum will take off and attain $3,150 within the subsequent session. The restoration is welcomed because the August 1-5 sell-off was a bearish breakout formation. This sell-off broke by means of the crucial help zones from April to July 2024.

Influence of spot ETFs and ecosystem progress

The rise, the analyst added, would seemingly be pushed by inflows into spot Ethereum ETFs. Since spot ETFs have been accepted in July, establishments have been keen to seek out publicity.

Take X, an ETF analyst notes these inflows now exceed $2 billion, not together with outflows from Grayscale’s ETHE. Throughout this era, BlackRock’s iShares Ethereum ETF has pushed demand.

Along with the inflows of spot Ethereum ETFs, Vitalik Buterin thinks constructive progress has been made that would help costs. Certainly one of these is the lower in fuel prices within the mainnet and by way of layer 2 options comparable to Base.

Associated studying

Moreover, the co-founder famous that Arbitrum and Optimism’s decentralization efforts are big. Arbitrum and Optimism just lately introduced their error resistance. Nonetheless, optimism returned to a centralized error-proof system after an audit report, permitting errors to be corrected.

Characteristic picture of DALLE, chart from TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September