Bitcoin

Buy Signal For Bitcoin? BlackRock Adds 4,323 BTC

Credit : coinpedia.org

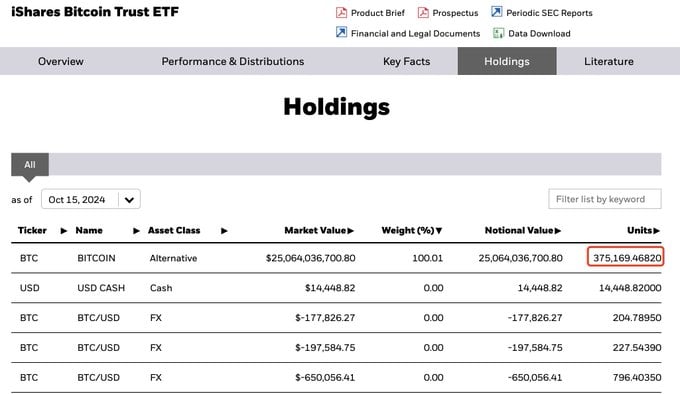

The world’s largest asset administration firm BlackRock has taken one other main step into the cryptocurrency business. On October 16, 2024, blockchain-based transaction tracker Lookonchain posted a message on

BlackRock $293 Million BTC Buy

This large buy follows the corporate’s sale of 182 BTC, price $11.34 million, on October 11, 2024, as reported by CoinPedia. Nonetheless, BlackRock’s newest BTC buy has sparked bullish sentiment amongst buyers and merchants because the asset approaches a robust resistance stage the place it beforehand confronted important promoting strain and a worth drop of greater than 20%.

Bitcoin technical evaluation and upcoming ranges

In response to professional technical evaluation, BTC seems bullish however is going through sturdy resistance on the higher restrict of the descending channel sample. Since March 2024, BTC has reached this stage nearly six instances, every time with a worth drop.

This time, nevertheless, the sentiment has modified. If BTC breaks the resistance stage and closes a each day candle above the $68,800 stage, there’s a excessive probability that the asset will attain its all-time excessive and probably attain a brand new stage.

Bullish statistics within the chain

Bitcoin’s optimistic outlook is additional supported by on-chain metrics. In response to the on-chain analytics firm MintGlassBTC’s Lengthy/Brief ratio presently stands at 1.03, indicating bullish sentiment amongst merchants. Moreover, future open curiosity has elevated by 4.9% over the previous 24 hours, indicating rising curiosity from merchants and potential place constructing in comparison with the day earlier than.

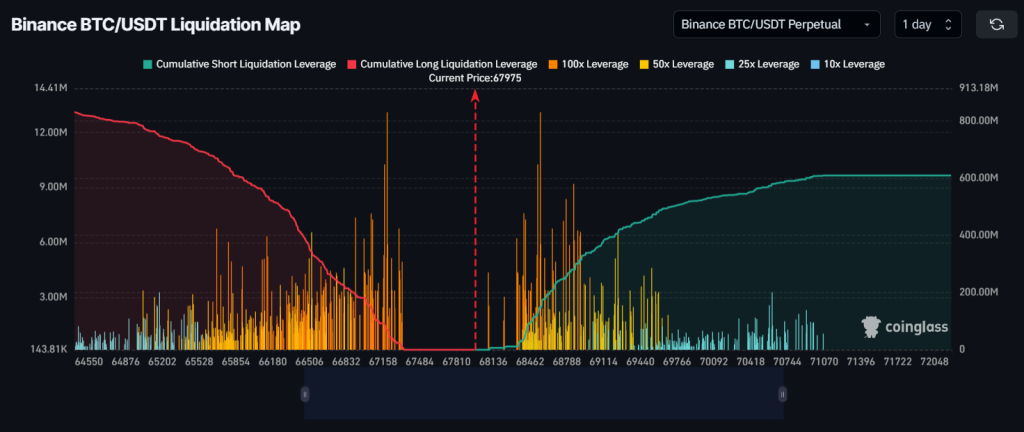

Main liquidation ranges

Presently, the important thing liquidation ranges are at $67,300 on the draw back and $68,600 on the upside, with merchants at these ranges being over-leveraged, based on on-chain analytics agency CoinGlass.

If sentiment stays unchanged and BTC reaches the $68,600 stage, nearly $568,400 price of quick positions will likely be liquidated. Conversely, if sentiment adjustments and the worth falls to $67,300, roughly $6.7 million in lengthy positions will likely be liquidated.

Analyzing this liquidation information, it seems that bulls’ bets on lengthy positions are considerably greater than bears’ bets on quick positions.

Present worth momentum

On the time of writing, BTC is buying and selling close to the $68,010 stage and has skilled a worth improve of over 1.7% over the previous 24 hours. Throughout the identical interval, buying and selling quantity elevated by 12%, indicating better participation from merchants and buyers in comparison with the day earlier than.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024