Ethereum

Can BSC’s Maxwell upgrade challenge Ethereum’s DeFi dominance?

Credit : ambcrypto.com

- BSC now leads in a tough block exit and clocks 115,200 blocks/day, 8x greater than the projected quantity of Ethereum

- Does this efficiency hole additionally replicate a deeper traction on the chain?

As blockchain-use instances shortly develop to common financing, tighter low-1 chains sharpen their protocols to make use of their declare as the subsequent web3 energy patters.

In truth, BNB chain [BSC] Do not wait. Whereas Ethereum [ETH] DEVS Debate Block Time Reductions, the Maxwell -Improve has already decreased the block time of BSC from 1.5 seconds to 0.75s.

This step is meant to extend velocity, consumer expertise and transit within the community. However does this daring step BNB chain give an actual lead over Ethereum?

BNB chain doubles at velocity with Maxwell Improve

As ambcrypto marked, Ethereum deliberates a block time discount of 12 seconds to six seconds as a part of the upcoming Glamsterdam -upgrade, anticipated in 2026.

Within the meantime, BNB chain has already taken motion. Are Maxwell upgrade has decreased the block time of 1.5 seconds to 0.75 seconds.

Statistically, the decrease block time interprets into a better block frequency. With Maxwell in place, BSC now produces round 4,800 blocks per hour, or 115,200 per day.

Even when Ethereum implements the ultimate time of 6 seconds, this might solely generate 14,400 blocks per day. That implies that BSC is on a tempo to supply virtually 8x extra blocks day-after-day, giving it a substantial lead in transaction provide and settlement velocity.

Solely velocity alone doesn’t assure the dominance of the community. So, this architectural divergence interprets into measurable earnings into the actions on chains, Defi-Liquidity flows and value momentum?

Can efficiency station the affect of the BSC -Winsten ecosystem?

On the time of writing, chain numbers appeared to counsel that the velocity enhance of BSC might bear fruit. It sees 2.04 million energetic addresses, virtually 5 instances greater than the 411,000 of Ethereum – a transparent signal of broader consumer exercise.

The DEX quantity has additionally supported it – $ 7.38 billion on BSC in simply 24 hours, in comparison with $ 1.44 billion on Ethereum. That sort of liquidity circulation implies that the sooner block instances of BSC assist to burn the actual use in Defi.

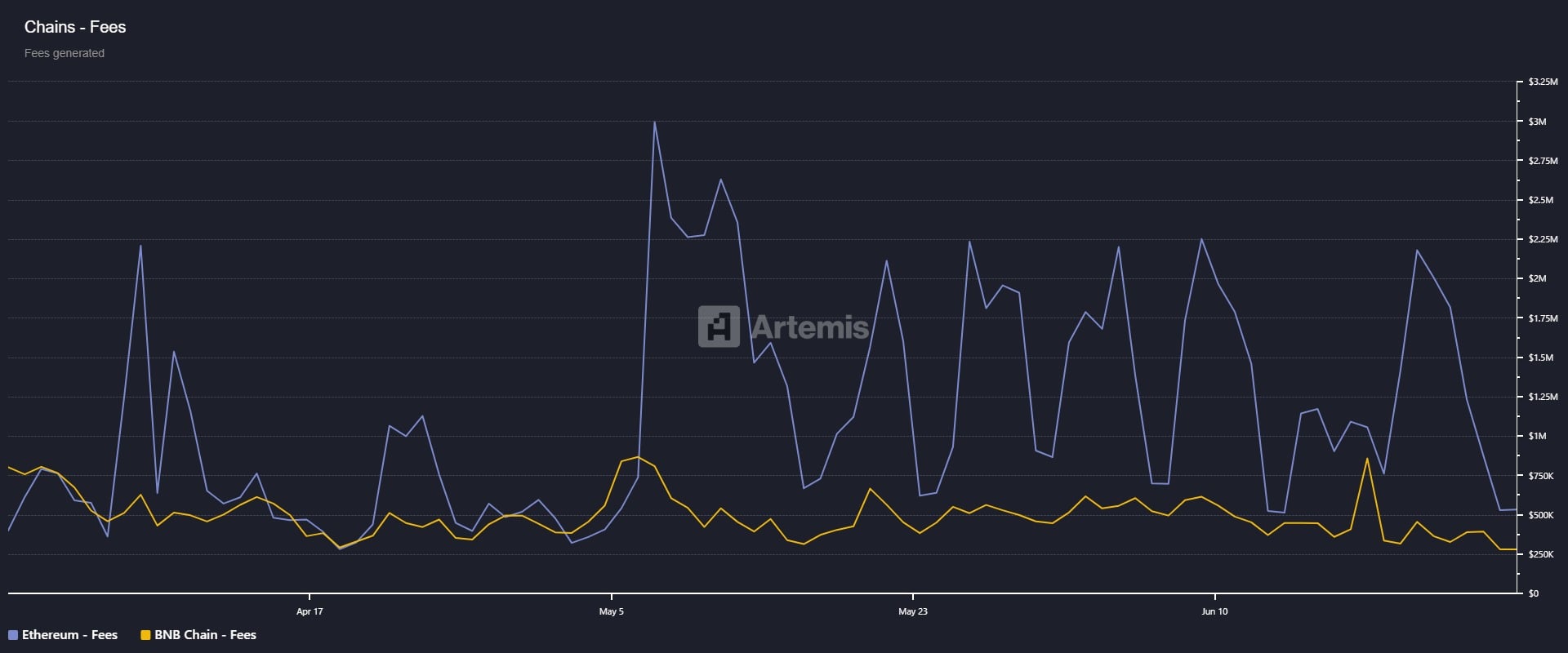

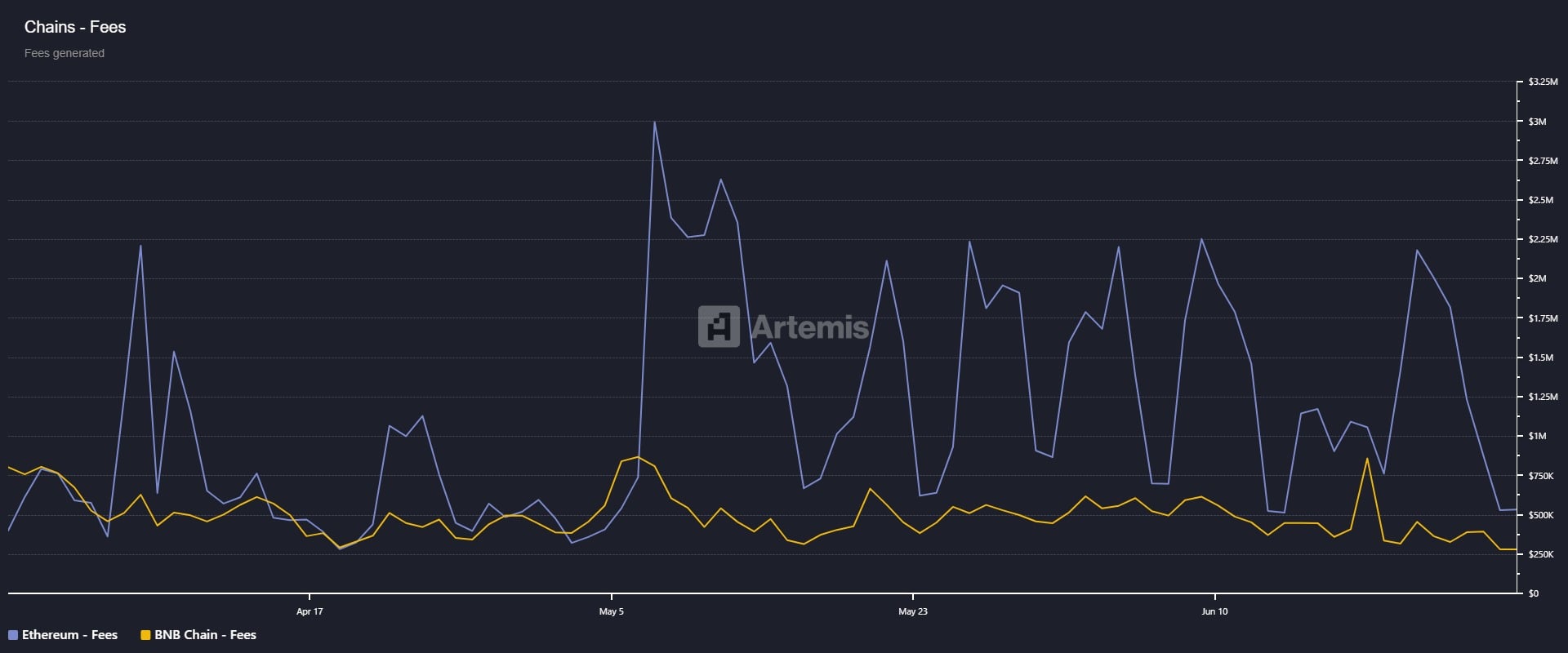

And but BSC remains to be left behind at Ethereum in whole worth (TVL) and protocol earnings. Which means that though BSC excels in consumer exercise, Ethereum continues to draw deeper capital and better Defi interactions.

Supply: Artemis Terminal

The divergence additionally refers to a structural Distinction-BSC has been optimized for scale and velocity, whereas Ethereum stays the first location for capital-intensive, income protocols.

In essence, one chain strikes sooner, whereas the opposite nonetheless has extra worth. That implies that though the Maxwell -upgrade can stimulate a better involvement, it nonetheless works far below the dominance of Ethereum in TVL and Payment Seize.

If the Glamsterdam -upgrade of Ethereum efficiently improves block instances with out endangering decentralization, this might neutralize the velocity advantage of BSC. In flip, sharpening the race for Defi -relevance.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024