Bitcoin

Can BTC Hit $145K After October ETF Surge?

Credit : coinpedia.org

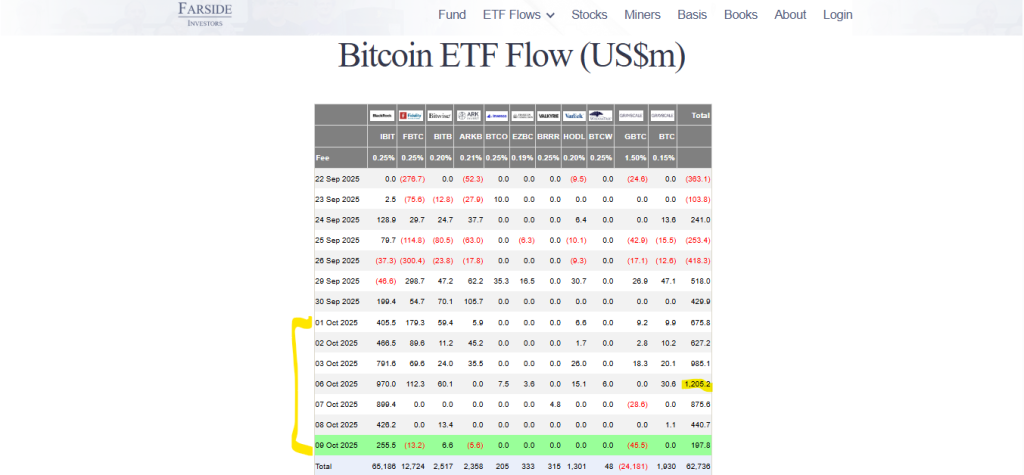

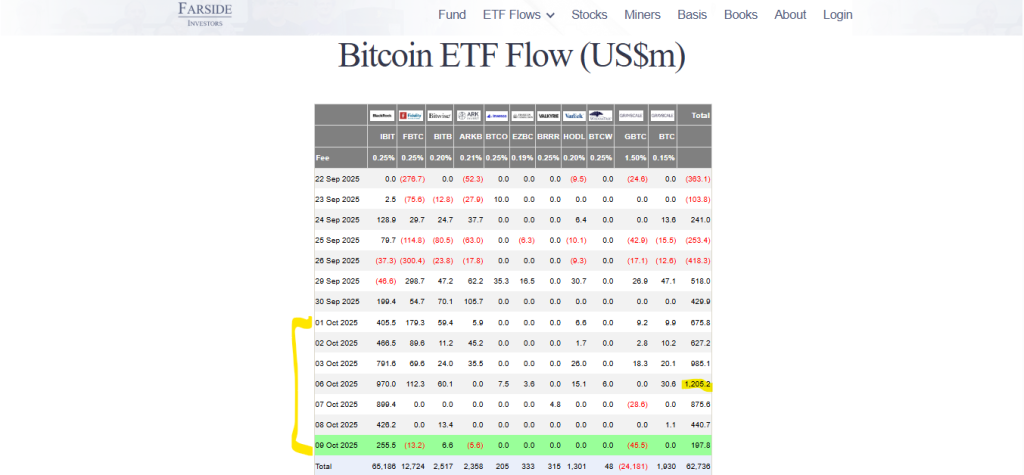

The Bitcoin value has proven outstanding power firstly of the fourth quarter, buying and selling round $121,302 with a market cap of $2.42 trillion. After a large $1.2 billion influx into ETFs on October 6, the identical day BTC hit a brand new all-time excessive (ATH) of $126,296, investor optimism continues to develop. Nevertheless, persons are nonetheless curious whether or not it might attain $145,000 or not.

After the ultimate month of the third quarter, September noticed important ETF outflows, and October’s turnaround was nothing wanting spectacular.

All buying and selling periods thus far have recorded optimistic internet inflows, led by the biggest single-day improve of $1.205 billion into spot Bitcoin ETFs. This shift marks a robust transition to internet accumulation, signaling a broader restoration in investor curiosity.

BlackRock leads accumulation and stabilizes BTC value

Nevertheless, this inflow shouldn’t be evenly distributed. Information reveals that solely one of many eleven ETF suppliers is at the moment absorbing a lot of the market’s promoting strain, and that is BlackRock.

It successfully stabilizes the Bitcoin value chart and helps the bullish construction. Such accumulation habits has preceded main breakouts, and the latest ATH on October 6 was proof of that, whereas different gamers are taking part in cautiously, however what in the event that they be a part of BlackRock quickly? Will BTC nonetheless stay sluggish? No, not an opportunity; it’s going to explode, and plenty of specialists are betting that it’ll. Even Michael Saylor’s rising orange dots present loads of optimism for the market.

Bitcoin Technical Evaluation: Upward Channel Signifies $145,000 Potential

Presently, the Bitcoin value is holding regular round $120,000, consolidating after the early October rally. Technical patterns present that BTC continues to commerce inside an upward channel that has remained intact for the previous two years.

Traditionally, each bounce from the decrease restrict of the channel has led to an eventual take a look at of the higher restrict. Now such a transfer, if repeated, may result in the anticipated BTC value prediction of $145K.

Nevertheless, earlier than the market can obtain that purpose, it should first overcome the psychological barrier of $130,000. Continued accumulation and robust on-chain traits recommend {that a} breakout above this degree may spark renewed momentum, probably resulting in new all-time highs earlier than the tip of the fourth quarter.

- Additionally learn:

- Ethereum (ETH) Value Stays Sturdy at $4,300 as ETF Outflows Take a look at Investor Confidence

- ,

Decrease international change reserves point out a bullish long-term outlook

Along with the technical alignment, BTC’s quantity profile additionally helps an optimistic outlook. The FRVP POC-based help that proved essential within the third quarter has once more emerged as a key space for the fourth quarter. BTC is at the moment testing this help degree, which if held, may set the stage for the following leg greater in the direction of $145K.

In the meantime, Bitcoin price-USD dynamics profit from the continued decline in international change reserves. For the reason that third quarter, reserves have fallen considerably, indicating that traders are withdrawing cash from the exchanges, a transparent signal of intentions to carry cash for the long run.

With fewer cash on the market, provide stays tight, additional strengthening the case for a bullish BTC value prediction story.

Present market circumstances additionally recommend that it is just a matter of time earlier than the bear strain disappears, after which the bulls will shine even brighter.

Regularly requested questions

In response to Coinpedia’s BTC value forecast, Bitcoin value may peak at $168,000 this yr if bullish sentiment continues.

With better adoption, Bitcoin’s value may attain a excessive of $901,383.47 by 2030.

In response to our newest BTC value evaluation, Bitcoin may attain a most value of $13,532,059.98

By 2050, a single BTC value may attain $377,949,106.84

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict editorial pointers primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluation coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We try to offer well timed updates on the whole lot crypto and blockchain, from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared characterize the writer’s personal views on present market circumstances. Please do your individual analysis earlier than making any funding choices. Neither the author nor the publication accepts duty in your monetary decisions.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks might seem on our web site. Adverts are clearly marked and our editorial content material stays fully unbiased from our promoting companions.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024