Analysis

Can Chainlink ACE & DAO Buyback Save AAVE From a $150 Dip?

Credit : coinpedia.org

AAVE value forecast for 2025 is changing into more and more optimistic because the protocol continues to strengthen its fundamentals by way of new integrations and powerful monetary efficiency. The newest partnership with Chainlink and a $50 million DAO buyback spotlight how Aave is transferring from market corrections to a extra sustainable, institution-ready DeFi ecosystem.

Aave Horizon integrates Chainlink ACE for institutional compliance

Aave’s institutional lending arm, Aave Horizon, has introduced a significant step ahead in compliance and on-chain governance by integrating Chainlink’s Automated Compliance Engine (ACE). The brand new integration permits Aave to validate id and coverage information on the transaction degree, permitting tokenized asset markets to function inside issuer and regulatory frameworks.

By Chainlink ACE, Aave can present safe, compliance-oriented lending environments for institutional contributors. This represents a pivotal second within the DeFi sector, the place decentralized protocols are more and more bridging the hole between crypto and conventional finance (TradFi).

This transfer additionally displays Aave’s proactive stance in advancing DeFi innovation, making certain the corporate stays on the forefront of blockchain adoption. This integration strengthens the place of each AAVE crypto and Chainlink as key gamers powering regulated and scalable on-chain markets.

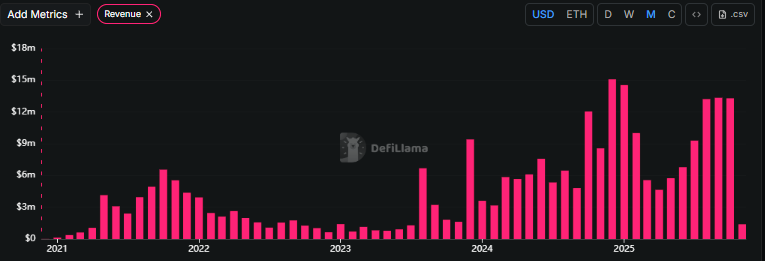

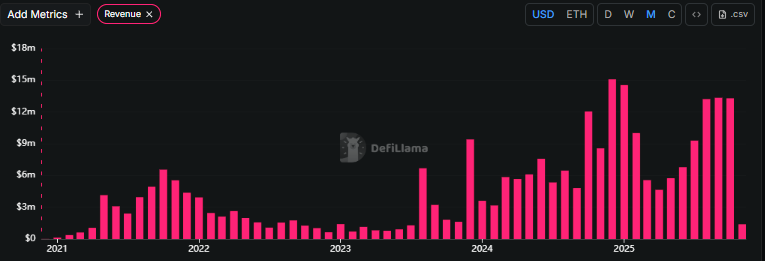

DAO buybacks and strong fundamentals strengthen market confidence

Based on information from DefiLlama Aave DAO recently launched a $50 million annual buyback program, a choice made potential by the platform’s sturdy income base. Final month, Aave generated $98.3 million in charges and $12.6 million in protocol income, whereas sustaining a complete worth (TVL) of $35 billion.

Such constant development demonstrates Aave’s long-term stability, setting Aave aside from speculative tasks. The buyback program, funded by protocol income, goals to strengthen the ecosystem whereas rewarding token holders.

These indicators assist a bullish AAVE value forecast for 2025, which displays a maturing DeFi protocol based mostly on sound monetary mechanisms fairly than hype.

The technical setup factors to assist at $150-$160 earlier than a potential reversal

Regardless of sturdy foundations, the AAVE Right now’s value has confronted notable stress amid the broader crypto market volatility. On the AAVE value chart, the token has undergone a collection of corrections, however analysts counsel this transfer displays a wholesome retracement fairly than weak spot.

The principle assist is within the $150-$160 vary, in keeping with a long-standing uptrend line that has held since 2023. If this degree holds, a reversal might push AAVE value USD to $240, with potential upside to $341 within the close to time period. A decisive break above $341 might open the door for a rally in direction of $446-$538 by 12 months finish.

This setup, mixed with institutional integration through Chainlink ACE and DAO-driven sustainability measures, makes the 2025 AAVE value forecast notably engaging to buyers wanting past short-term volatility.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our skilled panel of analysts and journalists, following strict editorial pointers based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluation coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We attempt to supply well timed updates on all the pieces crypto and blockchain, from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared symbolize the creator’s personal views on present market circumstances. Please do your individual analysis earlier than making any funding choices. Neither the author nor the publication accepts accountability on your monetary selections.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks might seem on our website. Adverts are clearly marked and our editorial content material stays utterly unbiased from our promoting companions.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now