Ethereum

Can Ethereum ETFs overtake Bitcoin ETFs by 2025?

Credit : ambcrypto.com

- Regardless of lagging Bitcoin ETFs, which ended 2024 with a powerful $35 billion inflows, Ethereum ETFs have proven constant progress.

- ETH ETFs noticed a big enhance in buying and selling quantity, with December figures exceeding $13 billion.

Ethereum [ETH] ETFs gained exceptional momentum in December, accumulating web inflows of $2.6 billion. This enhance highlighted the rising institutional curiosity in Ethereum as a viable funding automobile.

Furthermore, ETH ETFs have proven constant progress even when Bitcoins [BTC] ETFs lagged behind, ending 2024 with a powerful $35 billion inflows. This pattern displays confidence in Ethereum’s long-term potential, fueled by its strong ecosystem and rising use instances.

Can Ethereum ETFs Outperform Bitcoin ETFs in 2025?

Latest market information signifies that Ethereum ETFs may surpass Bitcoin ETFs by 2025 if sure situations are met. Analysts attribute this potential to Ethereum’s distinctive betting capabilities, which offer buyers with extra alternatives to generate returns.

Favorable regulatory developments additional place ETFs to draw a broader institutional viewers.

In November and December 2024, ETH confirmed robust market momentum with eight consecutive weeks of inflows. This era included report inflows of $2.2 billion within the week ending November 26, demonstrating elevated investor confidence.

Whereas BTC ETFs stay dominant, ETH ETFs are regularly closing the hole, indicating a shift in institutional preferences.

Buying and selling view

If Ethereum continues its value trajectory, pushed by elevated community exercise and technological developments, its ETFs may emerge because the best-performing belongings by 2025.

Moreover, exterior components such because the rising adoption of synthetic intelligence in Ethereum’s ecosystem have elevated its enchantment.

Key Challenges to Ethereum’s Market Rise

If ETH ETFs need to problem the dominance of BTC ETFs, Ethereum should deal with key obstacles, together with market dominance and competitors from rival networks.

Bitcoin’s intensive model recognition and first-mover benefit proceed to draw vital inflows, leaving Ethereum with the duty of constructing comparable belief amongst institutional buyers.

Ethereum’s present market dominance of 18.7%, based on current information, lags behind Bitcoin’s 47.1%, reflecting the disparity in investor confidence.

Nevertheless, analysts emphasize that ETH’s market share may develop as stake rewards turn into extra enticing and regulatory readability improves. Sustaining a constant upward trajectory in ETF inflows might be crucial to closing this hole.

One other impediment lies in Ethereum’s historic volatility, which has often deterred risk-averse buyers. To beat this, these ETFs should display stability and resilience, particularly in response to broader market shifts.

With exterior components resembling macroeconomic situations and world regulatory modifications, the Ethereum ecosystem should display its capacity to adapt and thrive in a aggressive panorama.

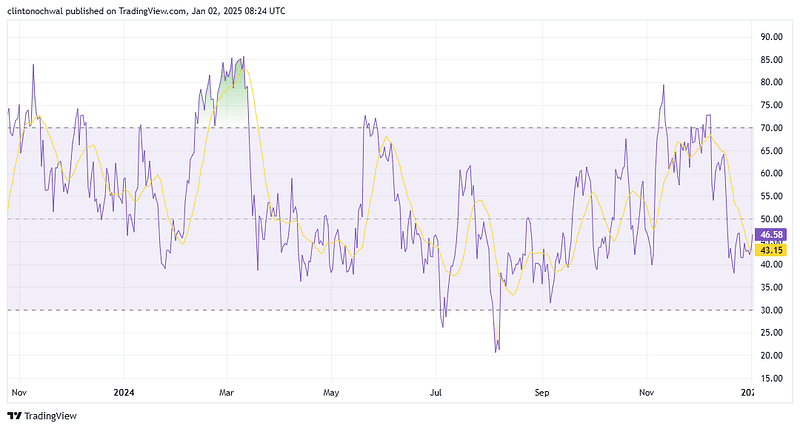

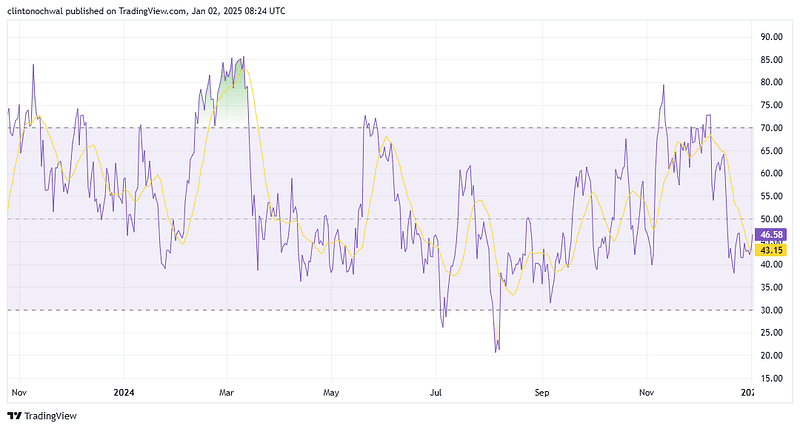

Ethereum’s RSI tendencies point out bullish momentum

Ethereum’s Relative Power Index (RSI), an necessary technical indicator, supplies priceless insights into present efficiency.

On the finish of December, ETH’s RSI stood at 68, approaching the overbought threshold of 70. This means robust bullish momentum, however raises considerations about potential short-term corrections.

Supply: TradingView

Traditionally, the coin’s RSI strikes close to the overbought zone have preceded momentary pullbacks earlier than resuming an uptrend. Moreover, ETH’s current ETF inflows have fueled optimism amongst buyers, with many anticipating additional RSI beneficial properties.

If Ethereum breaks the important thing resistance ranges, the RSI could stabilize inside the bullish vary, reinforcing confidence in its long-term prospects.

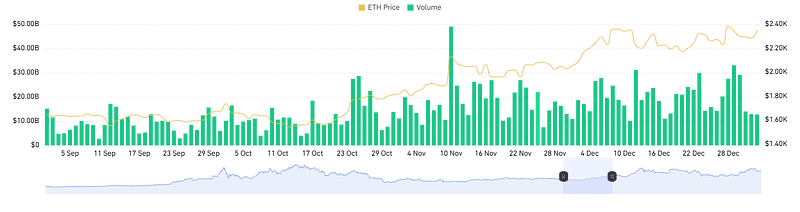

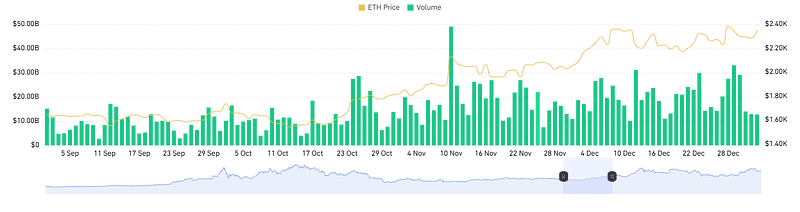

Highlights of the rising buying and selling quantity…

Ethereum ETFs noticed a big enhance in buying and selling quantity, with numbers surpassing $13 billion in December.

Supply: Coinglass

This progress underlines the rising curiosity amongst buyers, pushed by constant inflows and optimistic market sentiment.

This quantity enhance signifies strong liquidity, a vital issue for institutional buyers in search of steady and scalable choices. Analysts view the elevated buying and selling exercise as a harbinger of stronger ETF efficiency because it underlines elevated confidence in Ethereum’s future.

Learn Ethereum’s [ETH] Worth forecast 2025–2026

Trying forward, Ethereum ETFs could proceed to see rising volumes, particularly if ETH value tendencies stay bullish and community exercise will increase.

Mixed with optimistic momentum in price hikes and assist from regulators, this quantity progress may place ETH ETFs as dominant market gamers by 2025.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024