Ethereum

Can Ethereum Hit $20,000 This Cycle? Analyst Maps The Path

Credit : www.newsbtc.com

Motive to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by consultants from the trade and thoroughly assessed

The best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

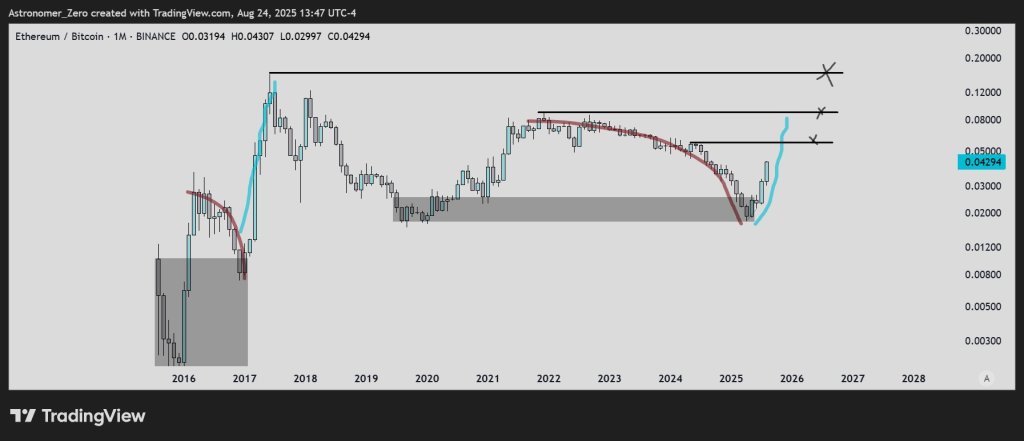

Crypto analyst Astronomer (@Stronomer_Zero) says that his long-standing soil thesis on the ETH/BTC purple has performed and specific cycle targets on the cross anchored and revealed. In a graph that’s shared on X, he repeated that “Eth Backside Name” is inside and the route map is totally framed through ETH/BTC ranges as a substitute of ETH/USD, with the argument that ether’s outperformance normally follows the impulse of Bitcoin and that “all main liquidity is from BTC.”

How excessive can Ethereum go this cycle?

Astronomer’s submit concentrates on a a number of months ‘zone’ on ETH/BTC that he had marked upfront as a possible cyclical bending. He writes that the decision regarded “delusions” when it was first signed – “a” ridiculously lengthy “prediction line (straight up from the soil) of what” might be inconceivable on the time the ETHBTC base ” – however says that the bend is in accordance along with his personal sentiment work.

“The sentiment about ETH was the worst that my sentiment metric ever adopted,” with tales starting from “ETH is a nasty funding” to “Eth Basis sells” to “Sol is the brand new ETH”, till “Utility cash are useless.” In his phrases: “That type of sentiment enabled us to substantiate the soil on ETHBTC in coordination with our outdated plan, the second it hit our zone.”

Associated lecture

With that background, the graph and the commentary have been three ETH/BTC targets for the remainder of the cycle. The primary is 0.058 BTC per ETH, of which he notes that “35% above was above” on the time of posts and, instantly translated utilizing Spot Bitcoin, “set ETH to round $ 6,500 if BTC stays for this worth.”

The second is 0.091, “Virtually a double from right here”, equivalent to “$ ETH to $ 10,000+, 5 digits”, a stage the place he says he “could have bought greater than half of my recognizing luggage.”

The ultimate and highest objective is 0.16, “barely lower than a 4x from right here, in order that ETH is dropped at $ 20,000 or larger.” He’s specific that the 0.16 level is formidable as a substitute of fundamental case: “That’s definitely my highest goal, and I don’t count on that that is assured to be achieved. However I believe it’s nice in case it occurs.”

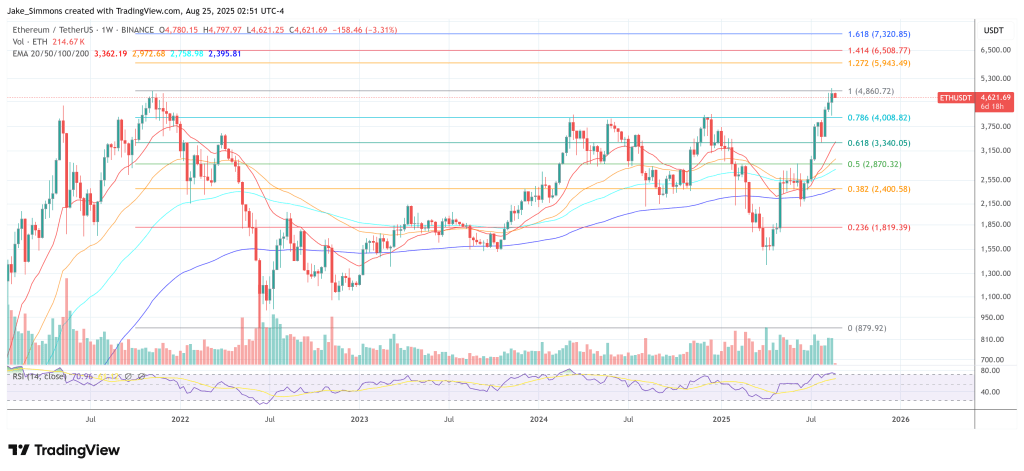

The technical logic he presents is intentionally pushed collectively. By mapping the cycle with ETH/BTC, he tries to seize the relative energy as a substitute of absolute worth and bypassing the transferring base of the greenback worth of BTC. The implicit ETH/USD ranges in his submit are easy translations of ratio × BTC worth; He provides that these USD conversions “will in actual fact be underestimated if I additionally see BTC rising additional.” In different phrases, the horizontal ranges of the graph are ETH/BTC at 0.058, 0.091 and 0.16; The USD numbers are contingent and can float with Bitcoin.

Associated lecture

The analyst additionally rejects the calendar heuristics. “The explanation I by no means discuss seasonal influences or ‘Pink September’ or ‘Promote in Could, Stroll Away’ … is as a result of I don’t need to promote to place your arduous -earned capital on weak knowledge … Neither of them has.” He provides that “seasons do not work in markets, solely cycles” and indicators with a shot at De Meme: “For Pink September, pleasant, go to your native forest …”

It can be crucial that the trail that he describes is conditional on the identical relative rotation dynamics which have organized past cycles: Bitcoin-Leads, ether stays behind till the liquidity rotates than the ETH/BTC by pre-defined planks. In that context, the evaluation doesn’t depend upon a single ETH/USD quantity; It relies on ETH/BTC recovering and retaining the cited tires.

Astronomer can also be frank about positioning psychology. He argues that though “it appears as if many are actually all bull submit Eth and maintain massive luggage”, orderlow suggests: “Most of these individuals who haven’t purchased Down Low are quite frozen or are pressured to purchase larger with the next leverage.” Based on his opinion, that construction continues to be advantageous within the route of the posted ETH/BTC aims: “So long as it stays that approach, I’ll proceed to count on these targets.”

On the time of the press, ETH traded at $ 4,621.

Featured picture made with dall.e, graph of tradingview.com

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International