Ethereum

Can Ethereum surge to $16K in two years? Assessing…

Credit : ambcrypto.com

- Ethereum has proven unbelievable resilience, defying bearish expectations to get near the $4K goal.

- Regardless of its sturdy foundations, it now wants a ‘Secret Santa’ to take the following leap.

The crypto market has had a tough 24 hours, with most cash retreating after testing key psychological ranges.

Ethereum [ETH] has not been spared and noticed a pointy correction after briefly breaching the $4,000 mark. Weak arms look like cashing out and holding positive factors as bearish sentiment takes over.

Nevertheless, this dip might solely be a short-term detour. Because the market shifts into “New Yr’s” mode, Ethereum’s historical past of restoration factors to a possible restoration – particularly with Bitcoin’s worth at $200,000. speculation gaining steam.

So trying to the longer term, might Ethereum actually rise to $16,000 within the subsequent two years? Is that this primarily based on Ethereum’s confirmed resilience, or simply one other speculative guess?

Ethereum’s monitor file of defying odds

Mathematically, to achieve $16,000, Ethereum would want a rise of 312% from its present worth.

Nevertheless, its efficiency over the previous 30 days, Ethereum has lagged behind the competitors, a lot of which have posted triple-digit positive factors.

That mentioned, if there’s one factor the crypto market is thought for, it is defying mainstream expectations – and Ethereum has a confirmed monitor file of doing simply that.

Numerous “Ethereum Killers” have come and gone over time, however none have come near Ethereum’s market cap of over $450 billion, a testomony to its resilience.

But when Ethereum actually needs to interrupt via, sturdy fundamentals are essential. Altcoins like Ethereum want extra than simply hype to remain related – they want lasting worth.

Since its launch in late July, the Ethereum ETF initially struggled to draw the institutional curiosity that many anticipated. Nevertheless, a shift occurred in November, with institutional consideration starting to construct.

Simply 4 days in the past, complete ETF inflow rose and reached the half-billion greenback mark for the primary time.

This surge in institutional curiosity could possibly be a game-changer for Ethereum. Whereas short-term downturns are inevitable, the true catalyst for long-term development lies with the massive gamers – those that keep on with the long run.

So so long as institutional help stays sturdy, predicting an Ethereum worth of $16,000 would not appear that far-fetched.

Nonetheless, as a way to rise, Ethereum wants the help of Bitcoin

Because the coin with the most important market share, Bitcoin leads the cost in setting the course for the market. Over time, nevertheless, Ethereum has labored arduous to determine its personal id as a definite asset class.

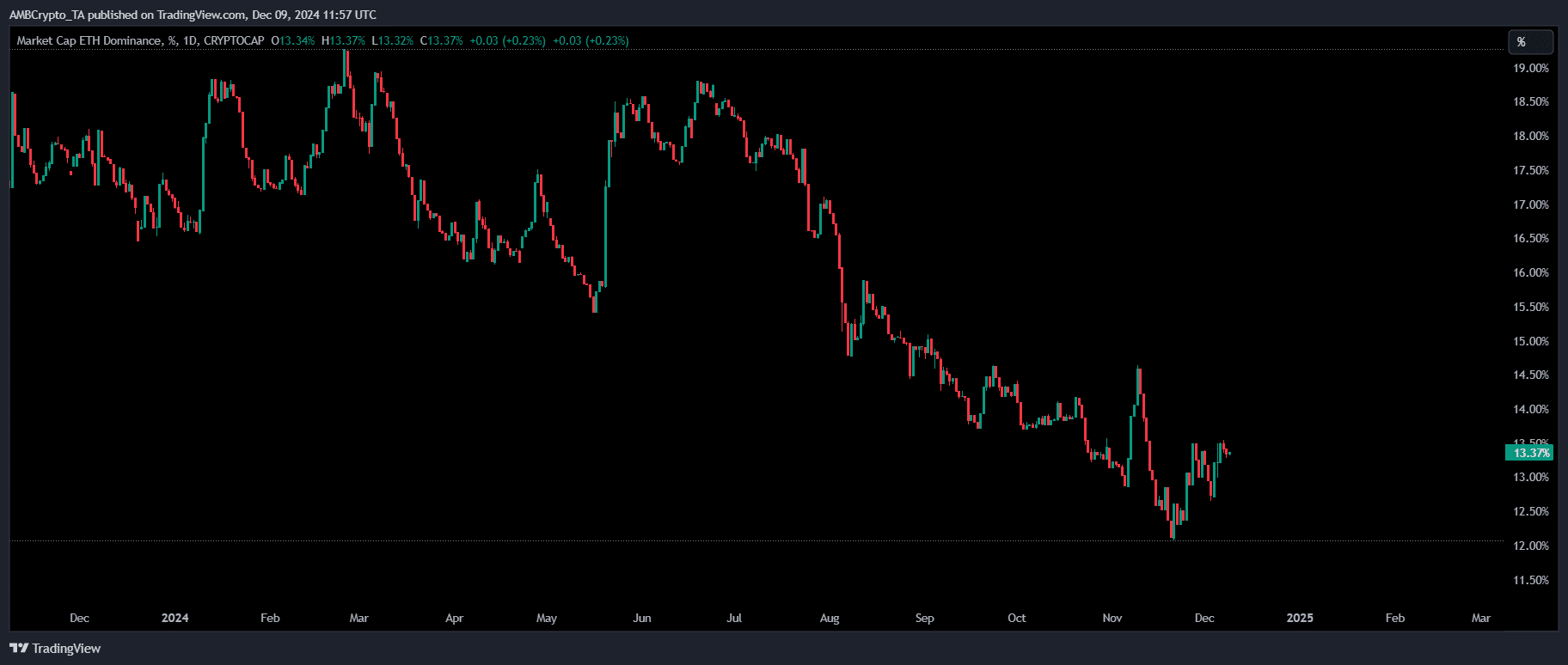

Regardless of these efforts, Ethereum’s dominance not too long ago hit a two-year low, making it extra susceptible to market fluctuations when Bitcoin strikes, both up or down.

Supply: TradingView

With market makers worrying about Bitcoin’s subsequent large goal, its dominance is certain to peak, making Ethereum’s probability at $16,000 extra carefully tied to Bitcoin’s efficiency.

This is why: When Bitcoin performs nicely, large buyers typically pile into altcoins like ETH, driving up the worth.

With out this, Ethereum’s positive factors could possibly be restricted to speculative curiosity as buyers search for safer choices throughout Bitcoin’s peak buying and selling instances.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

Briefly, for Ethereum to essentially rise, Bitcoin should take the lead.

Even with sturdy fundamentals and help from main gamers, Ethereum can’t break this essential milestone alone; it wants Bitcoin to maintain the momentum going, whatever the prices.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024