Altcoin

Can Ethereum’s HODLers prevent ETH from falling to $3,169?

Credit : ambcrypto.com

- Ethereum is down 12% this week, reflecting the broader wrestle as altcoins undergo double-digit losses.

- The restoration now relies upon greater than ever on a broader market restoration.

Ethereum[ETH] has misplaced greater than half of its post-election beneficial properties and is now locked in a high-stakes tug-of-war.

With Bitcoin consolidation holding again any main breakout, traders are enjoying it protected. Given the present panorama, is it time to err on the aspect of warning or seize the chance?

The scales are tipped in favor of…

Conventional Bitcoin[BTC] stagnation heralded the beginning of an altcoin season – however not this time. Altcoins are struggling to realize traction, with 70% of the highest 10 excessive caps (excluding stablecoins) struggling double-digit losses in only a week.

Ethereum hasn’t escaped the downturn both, with a weekly decline of 12%, partly on account of sturdy US financial information. The ETH/BTC pair is hitting day by day lows, making ETH’s rebound seem tied to a broader market restoration.

However the strain would not cease there. Whales are feeling the warmth and dumping 10,070 ETH at $3,280, making a lack of $1 million. Consequently, ETH fell 1.15% and stood at $3,227 on the time of writing. Nonetheless, the stakes are increased than ever.

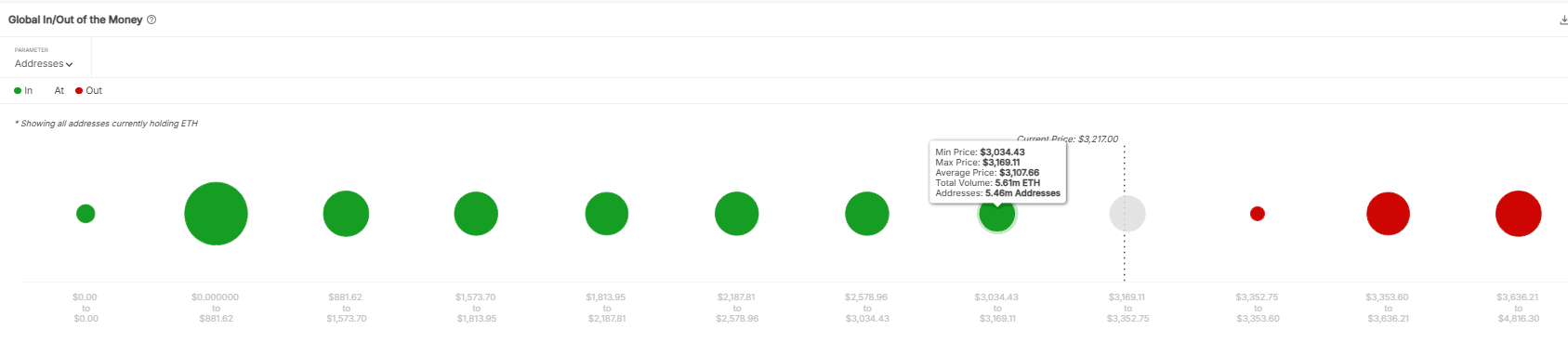

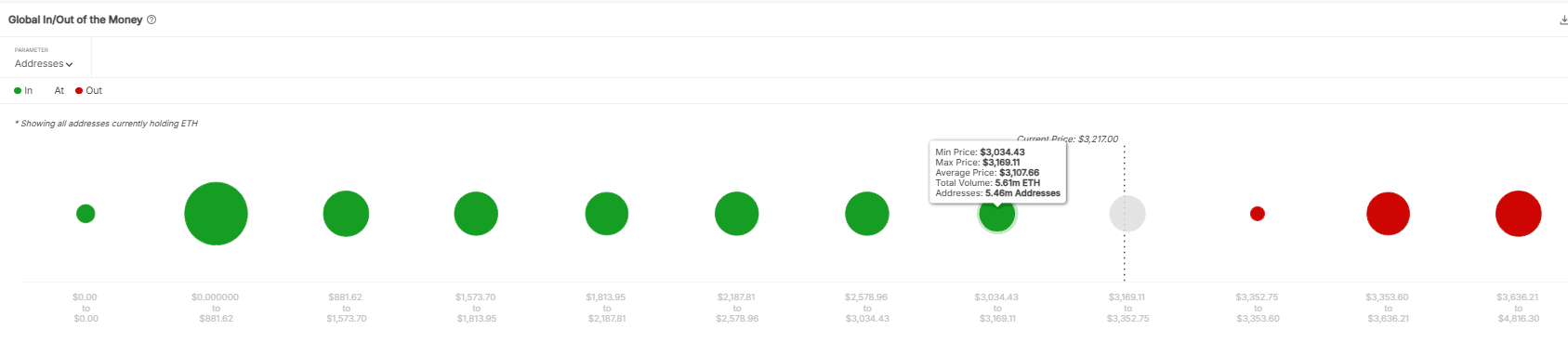

If capitulation continues, ETH might drop to $3,169. At this degree, 5.46 million addresses have been bought with 5.61 million ETH at that value.

What these HODLers do subsequent shall be essential to ETH’s subsequent step. It is a high-stakes gamble: HODL and look ahead to a market restoration, or money out earlier than one other crash occurs.

Supply: IntoTheBlock

Will Ethereum whales take the chance?

The choice entails a mixture of psychology and information. Statistically, ETH remains to be 33% above post-election ranges, a value that has served as sturdy help prior to now.

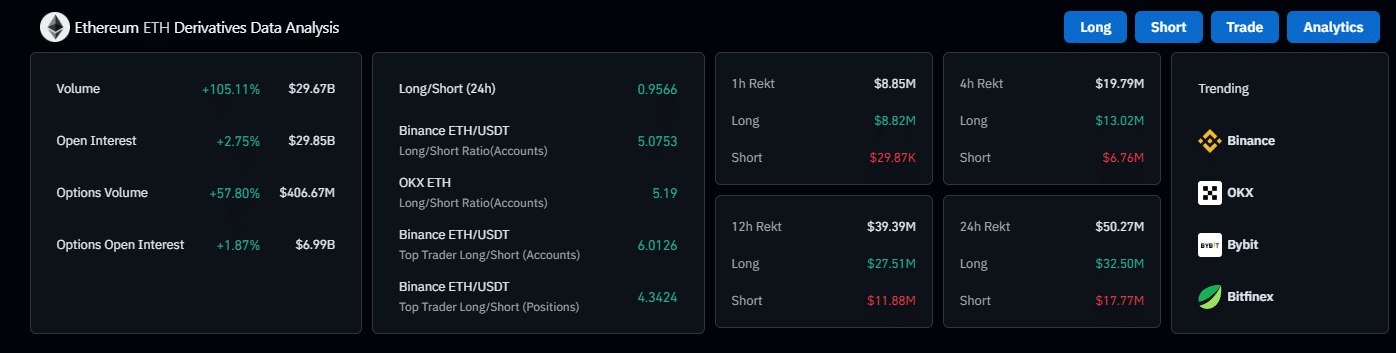

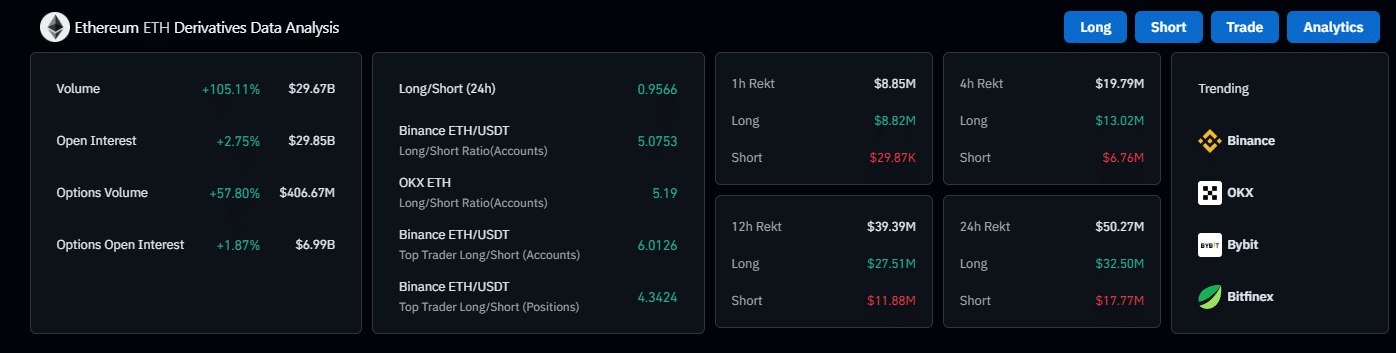

Moreover, the futures markets are buzzing, with derivatives quantity rising 105% and Open Curiosity (OI) rising 2%.

Supply: Coinglass

However there’s extra at play: Traders are relying on a repeat of the This fall cycle, hoping for a brand new ‘Trump pump’. The psychological momentum is undoubtedly there, however will or not it’s sufficient? In line with AMBCrypto, a transparent ‘Sure’ remains to be far-off.

Learn Ethereum’s [ETH] Worth forecast 2025–2026

Why the uncertainty? Main gamers are shedding confidence, which might deplete FOMO, fueling present market optimism. Retail and institutional Capital has but to movement again and concern is excessive.

Not like the final Trump rally, which despatched Ethereum hovering to $4,000, an identical response feels more and more unlikely this time round. Even with the Trump pump, it might not be sufficient to spark a robust restoration for Ethereum.

In brief, warning is essential proper now. Ethereum’s restoration is intently tied to the broader market restoration. The optimism surrounding the potential for a Trump pump is tempting, but it surely’s essential to not get carried away by the “hype.”

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024