Analysis

Can HYPE Price Hold the $30 Level Amid Market-Wide Selling Pressure?

Credit : coinpedia.org

This week’s HYPE value replace highlights a pointy shift in sentiment because the broader crypto market recession places strain on Hyperliquid’s native token. Regardless of sturdy income fundamentals and daring long-term projections, near-term weak spot and declining open curiosity elevate essential questions for the HYPE value forecast outlook.

One of many largest consideration grabbers surrounding HYPE crypto stems from the corporate’s extraordinary monetary profile. Hyperliquid generates an estimated $1.15 billion in annual recurring income with a group of simply 11 staff, making it some of the worthwhile and lean operations within the business, in accordance with David Schamis, CEO of Hyperliquid Methods.

This degree of effectivity and scale has prompted David to ambitiously challenge HYPE’s valuation development trajectory considerably larger than as we speak. He mentioned in a video clip that he expects the token to realize 20x growth from present market cap ranges, offered the ecosystem continues to develop revenues with out counting on exterior capital.

Whereas this story helps a powerful long-term HYPE value forecast, the quick problem lies out there surroundings, the place macro weak spot is dominating fundamentals.

The short-term outlook will depend on the important thing help ranges

Whereas long-term optimism persists, the short-term construction of the HYPE value chart reveals decisive strain. Technical discussions inside the neighborhood emphasize that the $30-$31 vary is a important help zone. If this degree fails, the HYPE value in USD might fall sharply in direction of the $20 area, reflecting a broader capitulation to high-beta altcoins.

Conversely, if the token manages to carry this help and regain upside momentum, analysts notice {that a} significant turnaround might emerge in 2026, particularly as soon as the broader crypto market stabilizes. This makes the present vary some of the essential areas for merchants following the subsequent step.

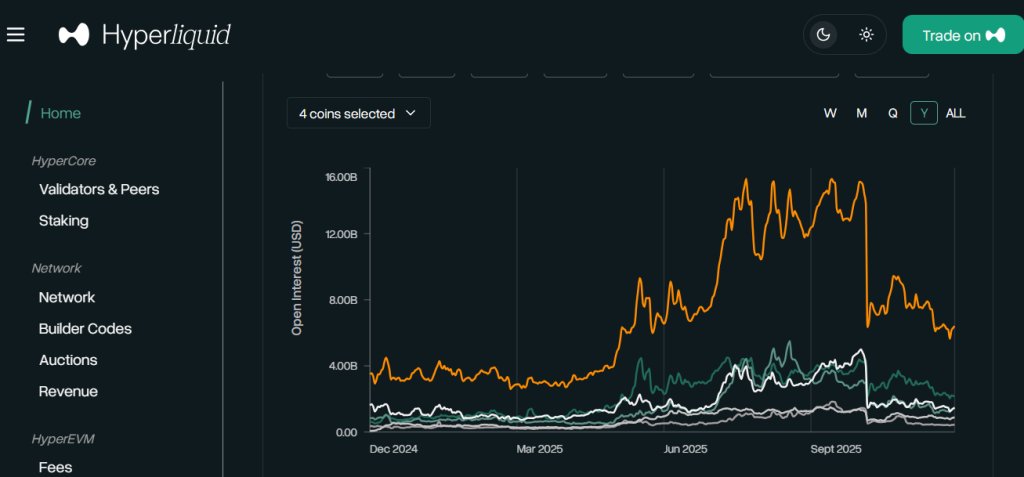

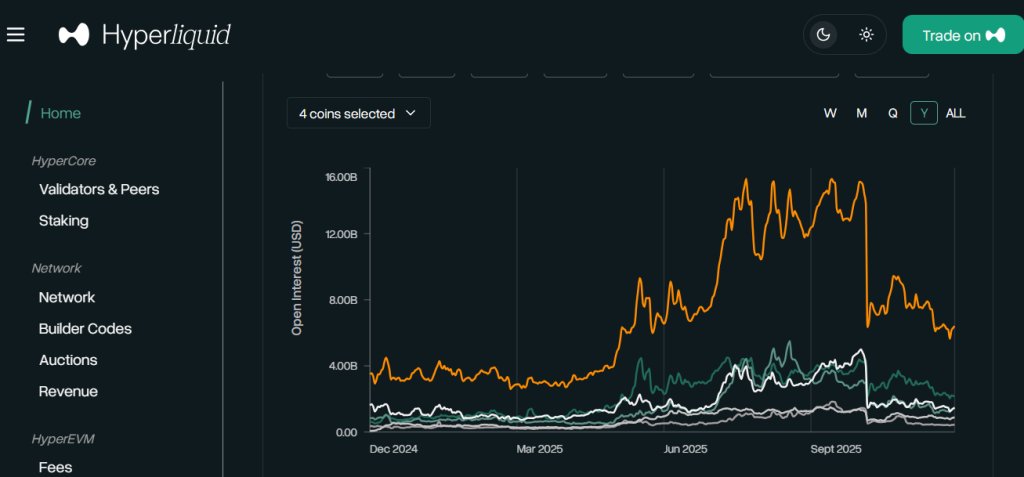

A lower in open curiosity signifies a decrease threat urge for food

One other issue driving market expectations is the dramatic decline in buying and selling exercise. Throughout Bitcoin’s all-time excessive earlier in October, Hyperliquid recorded open curiosity (OI) of practically $16 billion, supported by heavy buying and selling between BTC and ETH. Nevertheless, by early December, OI has fallen to round $6 billion, representing a major contraction.

This decline alerts that merchants are taking fewer positions, lowering leverage publicity and buying and selling with larger warning amid ongoing market declines. On the identical time, the sample additionally implies that after main belongings resembling Bitcoin and Ethereum regain energy, derivatives exercise on Hyperliquid and presumably the HYPE the value itself might see a powerful rebound.

Taken collectively, diminished risk-taking, weakening technical construction, and distinctive income fundamentals all come collectively to outline this week’s evolving story round Hyperliquid.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict editorial tips based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluate coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We goal to offer well timed updates on all the pieces crypto and blockchain, from startups to business majors.

Funding Disclaimer:

All opinions and insights shared signify the writer’s personal views on present market circumstances. Please do your personal analysis earlier than making any funding selections. Neither the author nor the publication accepts accountability in your monetary decisions.

Sponsored and Advertisements:

Sponsored content material and affiliate hyperlinks might seem on our website. Advertisements are clearly marked and our editorial content material stays fully unbiased from our promoting companions.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now