Altcoin

Can LINK buyers handle the incoming selling pressure after a 52% gain in November?

Credit : ambcrypto.com

- Chainlink’s alternate supply ratio regularly rose to a one-month excessive as portfolio profitability rose

- Open curiosity additionally rose to the best degree since April

November delivered vital good points for many altcoins, together with Chain hyperlink (LINK)with the crypto buying and selling at $18.63 on the time of writing. After posting good points of round 5% within the final 24 hours alone, LINK’s month-to-month good points at the moment are over 52% on the charts.

These good points seem to have fueled profit-taking exercise, with the identical highlighted by the rising alternate price provide ratio. Information from CryptoQuant revealed a gradual improve on this metric to a month-to-month excessive of 0.161.

(Supply: CryptoQuant)

When this ratio rises, it signifies a rise within the variety of LINK tokens being despatched to exchanges – an indication of accelerating stress on the promote aspect. This may very well be a bearish signal, particularly if there isn’t any improve in shopping for exercise to soak up the cash offered.

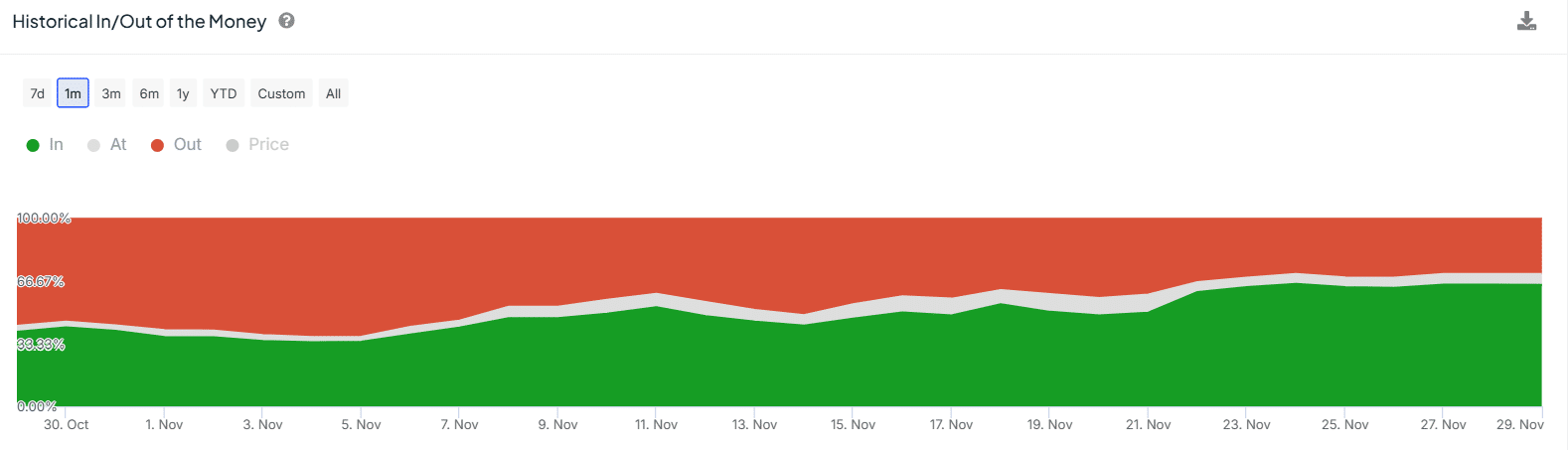

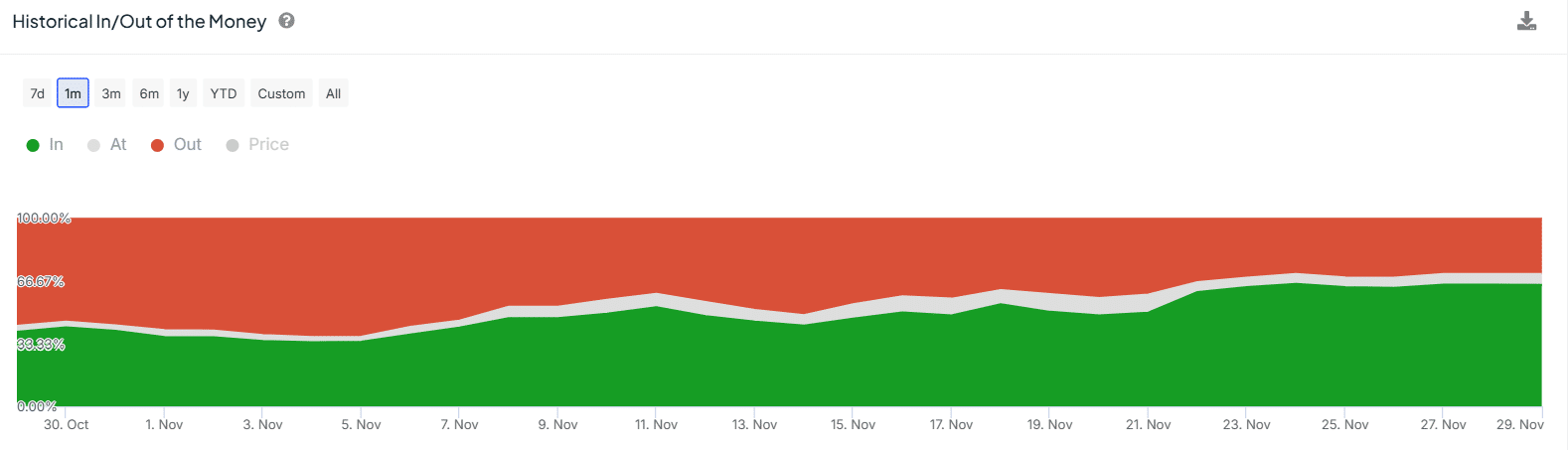

Right here it’s value mentioning that the rise within the alternate supply ratio coincided with the rising profitability of the pockets. In keeping with IntoTheBlock, 64% of LINK holders at the moment are making income – a big bounce from 36% to early November.

On the similar time, portfolios with losses fell from 59% to 29%.

(Supply: IntoTheBlock)

Rising pockets profitability will also be good for the value as it may possibly result in constructive market sentiment.

Nevertheless, for LINK to proceed its upward pattern, it wants a robust improve in shopping for exercise.

Chainlink Value Evaluation – Are Patrons Energetic?

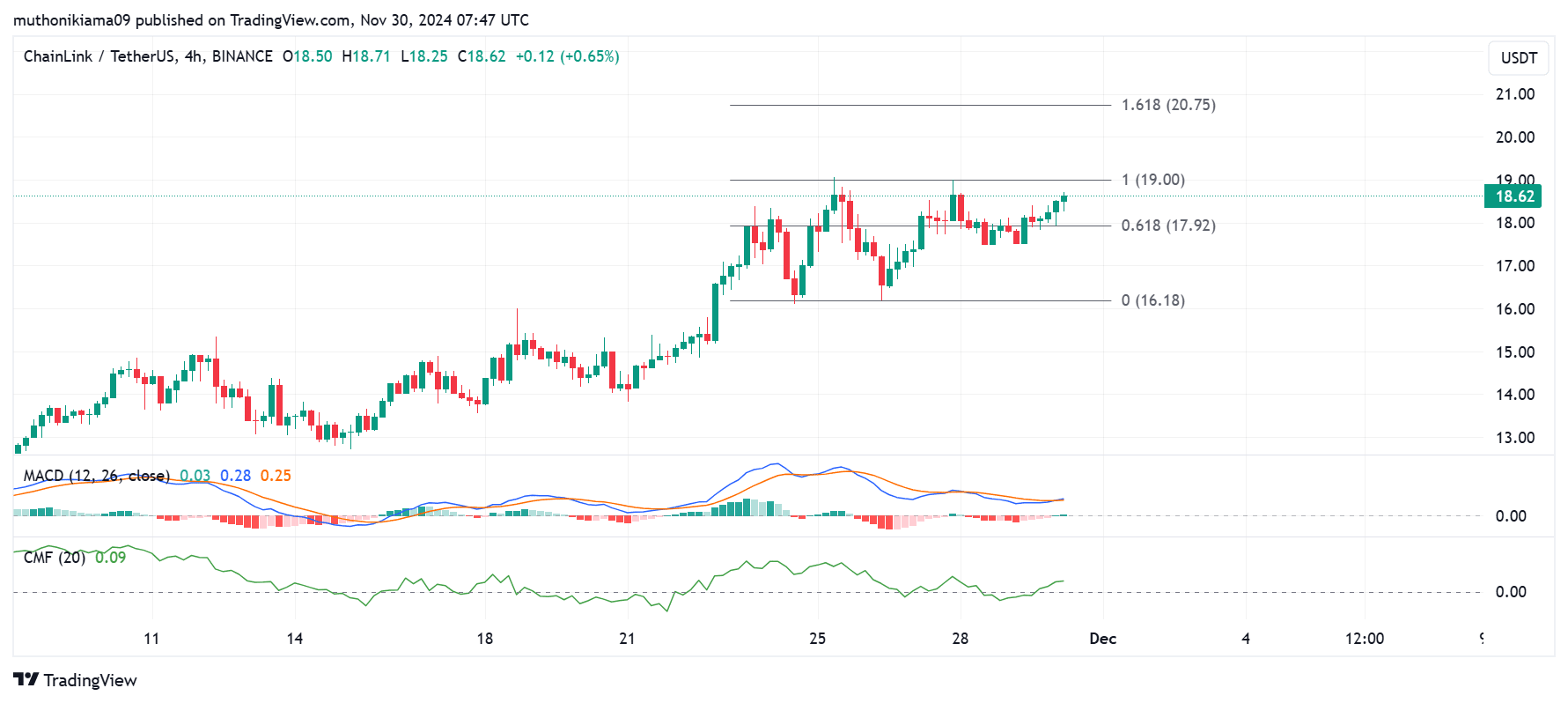

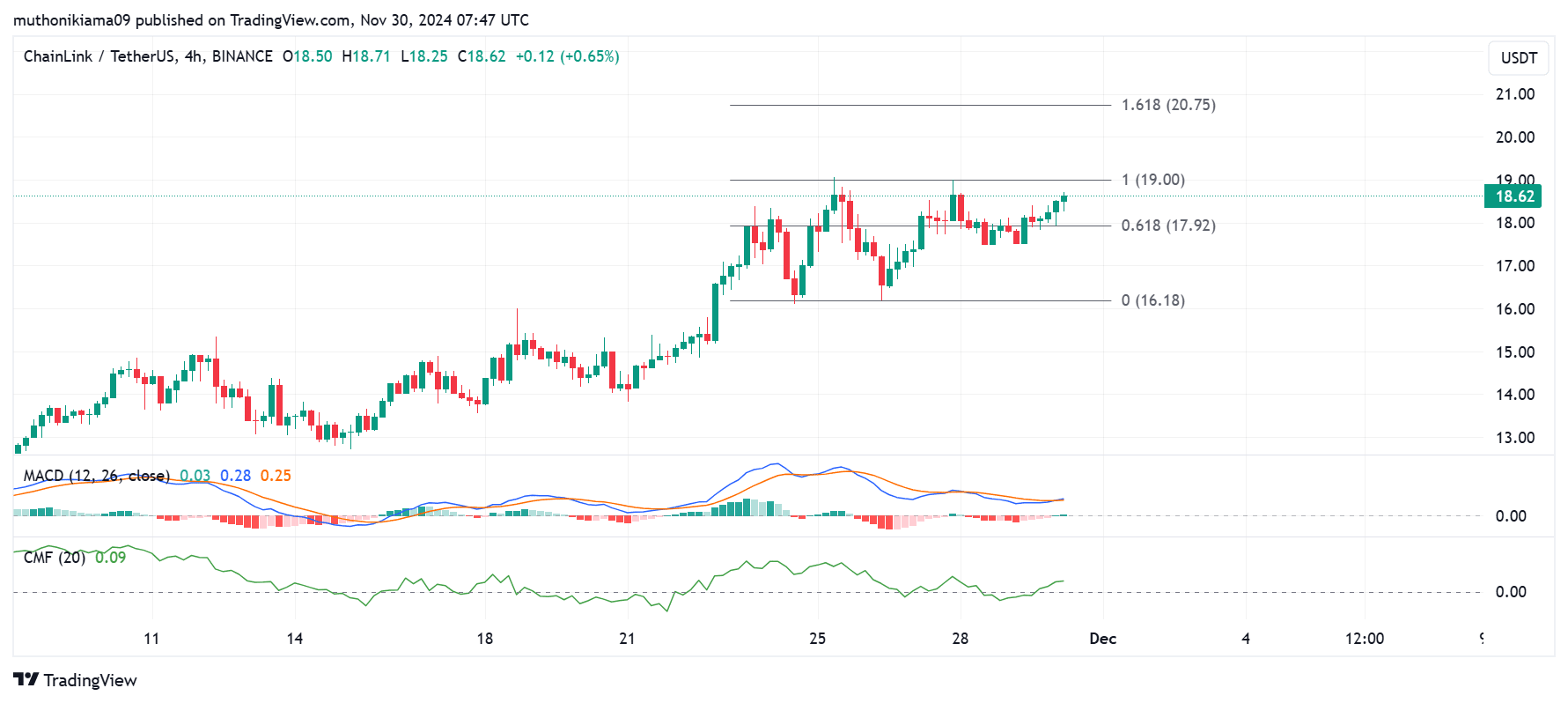

Chainlink’s four-hour chart exhibits that purchasing stress has been better than promoting stress. This was evident from the Chaikin Cash Movement (CMF) indicator, which had a constructive worth of 0.02. The CMF additionally tilted north, indicating that extra patrons have entered the market lately.

The Transferring Common Convergence Divergence (MACD) line additionally created a purchase sign after crossing above the sign line. If the MACD line continues to rise above the sign line, it may strengthen the altcoin’s bullish pattern.

(Supply: Handelsview)

If patrons handle to push LINK previous the USD 19 resistance degree, the token may purpose for USD 20.75. Nevertheless, Chainlink has been rejected at this assist degree a number of occasions as greater shopping for volumes have been wanted to assist a breakout.

On the time of writing, the variety of energetic addresses steered that buying volumes have been low. In keeping with InTheBlokthese addresses fell by nearly 50% in a single week from 7,420 to 4,210. The variety of new addresses additionally fell from 2,650 to 1,530.

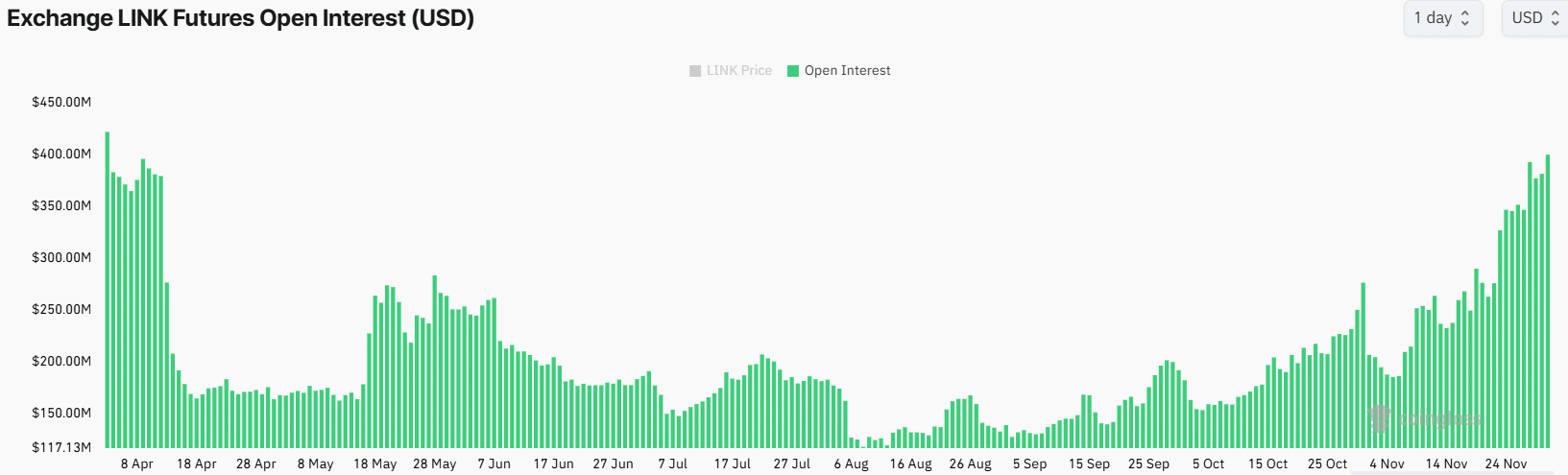

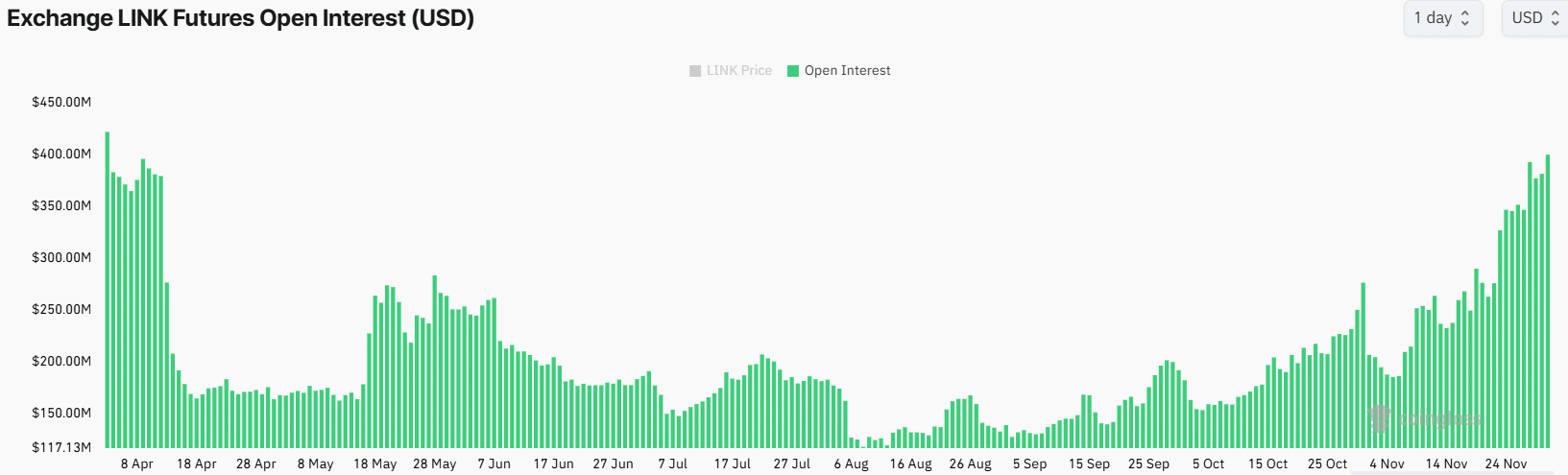

Open curiosity is approaching an eight-month excessive

Chainlink has additionally seen a robust improve in exercise within the derivatives market. In. In actual fact, Open Curiosity (OI) rose to the best degree in additional than seven months.

(Supply: Mint Glass)

LINK’s OI stood at $396 million on the time of writing – a sign that derivatives merchants are opening new positions on the altcoin.

Chainlink’s funding charges additionally rose sharply, highlighting that many of the newly opened positions got here from lengthy merchants betting on extra income.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now