Analysis

Can On-Chain Strength Set Up a Major Recovery?

Credit : coinpedia.org

Arbitrum’s robust fundamentals proceed to face out throughout the business and supply an essential basis for the broader dialogue surrounding Arbitrum’s 2025 value forecast. Regardless of value uncertainty, continued development in contracts deployed, buying and selling exercise, stablecoin demand, and consumer engagement point out a wholesome growth of the ecosystem that might affect future tendencies.

Primary ideas of the chain to help the arbitrary value forecast for 2025

Arbitrum constantly ranks among the many most lively blockchain ecosystems year-round, sustaining excessive developer and consumer exercise throughout a number of classes.

In accordance with Token Terminal information, practically 3.9 million sensible contracts have been deployed on Arbitrum One previously three hundred and sixty five days, putting it within the prime tier of chains with long-term, sustainable improvement. This metric highlights actual infrastructure and utility development, which is a vital foundation for evaluating any Arbitrum value prediction.

Furthermore, the chain registered a powerful ecosystem of $240.8 billion DEX trading volume throughout the identical interval. This determine displays a powerful presence of liquidity and steady interplay between decentralized purposes. Such constant buying and selling exercise signifies the chain’s relevance inside the broader DeFi panorama and helps the structural power behind Arbitrum crypto.

Ecosystem income and consumer exercise strengthen the arbitrage value chart outlook

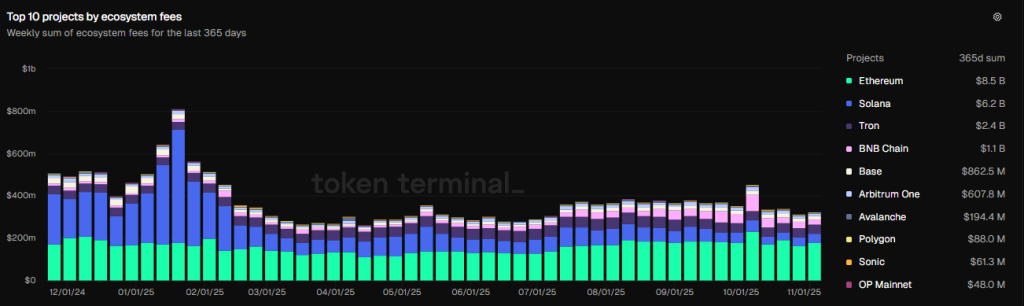

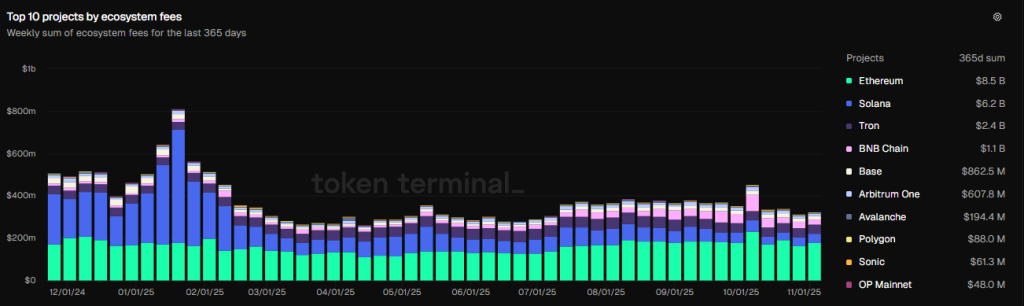

Along with buying and selling quantity, weekly ecosystem prices over the previous three hundred and sixty five days reached $607.8 million, demonstrating excessive financial worth generated by purposes working on the community. This stage of compensation production strengthens Arbitrum’s position as probably the most lively and economically related chains.

Person participation additional helps this pattern. Arbitrum has averaged 2.4 million lively addresses per thirty days over the previous three hundred and sixty five days, which is among the strongest consumer exercise metrics amongst L2 networks.

Furthermore, the chain maintenance 867,000 customers monetized month-to-month, displaying that a lot of the neighborhood is engaged in revenue-generating transactions quite than passive interactions. Collectively, these numbers point out sturdy long-term demand that might contribute to the longer term stability and development of the US greenback.

Stablecoin demand and TVL tendencies help the 2025 arbitrage value forecast

Along with consumer exercise, demand for stablecoins is one other essential power. Arbitrum has $6.6 billion in stablecoin holdings and ranks fourth globally behind Ethereum, Tron and Solana.

This stage of on-chain liquidity underlines the robust demand from retail and institutional customers, which regularly contributes positively to market construction and future valuation situations.

Additional supporting curiosity: Arbitrum’s TVL is $2.88 billion, in accordance with this report DefiLlama. Whereas the decline is beneath October’s peak of $4.108 billion, the decline seems wholesome quite than alarming, particularly when contrasted with the present consolidation of the Arbitrum value charts.

- Additionally learn:

- Ethereum Value Evaluation: Can ETH Stay Above $3000 Regardless of BTC Value Crash

- ,

Technical construction consistent with arbitrary value forecast situations for 2025

Technically the Arbitrum price shows signs of stabilization after liquidity was eliminated on October 10. The present value motion is close to a key horizontal help zone related to the April and June swing lows. If a reversal had been to type at this stage, it might mark a traditional third response level doubtlessly aligning with a restoration construction.

If such a transfer happens, analysts anticipate a possible restoration in the direction of $0.62, the August excessive, by the top of the 12 months. This technical setup, mixed with Arbitrum’s robust on-chain basis, helps set affordable expectations for any medium-term Arbitrum value prediction. These parts collectively type the broader story surrounding Arbitrum’s 2025 value forecast because the mission continues to develop.

Regularly requested questions

Arbitrum’s development comes from the growing deployment of sensible contracts, lively customers, robust buying and selling quantity and excessive ecosystem prices that help long-term stability.

Sure. Arbitrum’s TVL stays strong and the current dip seems regular throughout consolidation, displaying that the ecosystem remains to be seeing robust capital inflows.

Main help from the lows of April and June is essential. A rebound might push Arbitrum in the direction of $0.62, consistent with the development in technical and on-chain power.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our skilled panel of analysts and journalists, following strict editorial pointers primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our assessment coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We purpose to offer well timed updates on every thing crypto and blockchain, from startups to business majors.

Funding Disclaimer:

All opinions and insights shared characterize the writer’s personal views on present market circumstances. Please do your individual analysis earlier than making any funding selections. Neither the author nor the publication accepts duty to your monetary decisions.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks could seem on our website. Adverts are clearly marked and our editorial content material stays fully unbiased from our promoting companions.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now