Analysis

Can Polygon Rise 500%? A Look at Polygon Price Prediction 2025

Credit : coinpedia.org

After months of spending time in a spread, with weak worth motion, bullish expectations have now intensified. Consequently, the Polygon worth forecast for 2025 is gaining momentum as each on-chain and real-world developments point out that the community could also be gearing up for a powerful upward transfer.

Regardless of the modest worth motion, its growing adoption, authorities partnerships, and favorable supply-demand dynamics level to a promising future. This implies that the long-term trajectory for the Polygon crypto worth might be bullish if issues proceed to enhance.

The adoption momentum strengthens the community foundations

Polygon adoption has accelerated and exhibits clear indicators of sturdy community utilization. The undertaking CPO recently noticed this October ended with report development throughout a number of cost classes.

He talked about that switch quantity elevated by 20% to a report excessive, on/offramp quantity elevated by 35%, ticket quantity elevated by 30% and infrastructure undertaking exercise elevated by 19%.

This constant improve displays the rising use of Polygon crypto in the actual world outdoors of the DeFi ecosystem.

Furthermore, its growing acceptance seems to be instantly associated to ties with the federal government. If Polygon’s integration into public infrastructure with local government has marked an essential milestone.

In accordance with Polygon’s official The town tokenizes land titles, possession paperwork, tax information and certificates, making a clear and immutable registration system.

This adoption underlines Polygon’s growing relevance in real-world purposes, growing belief and effectivity in governance.

Onchain information highlights bullish supply-demand dynamics

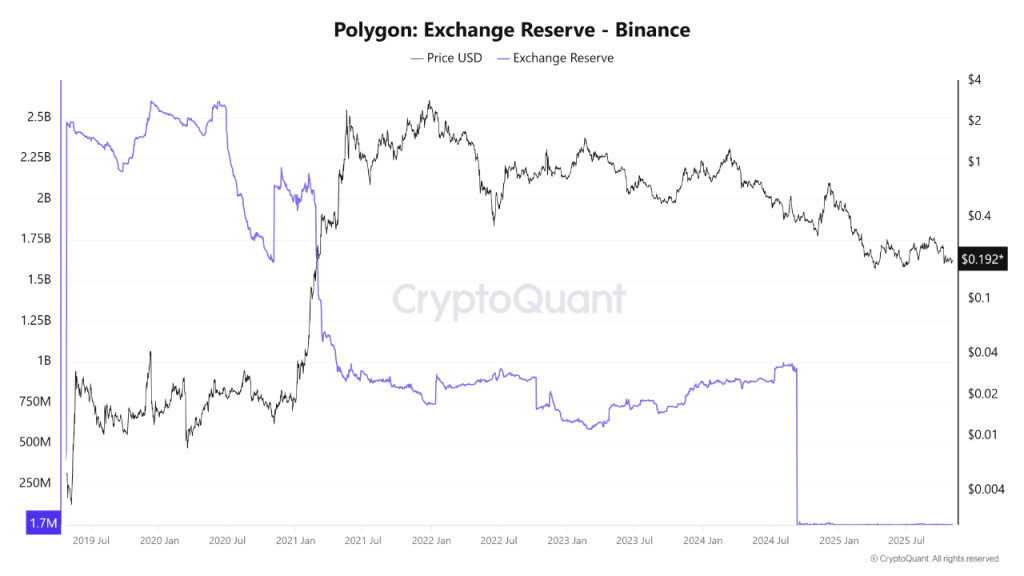

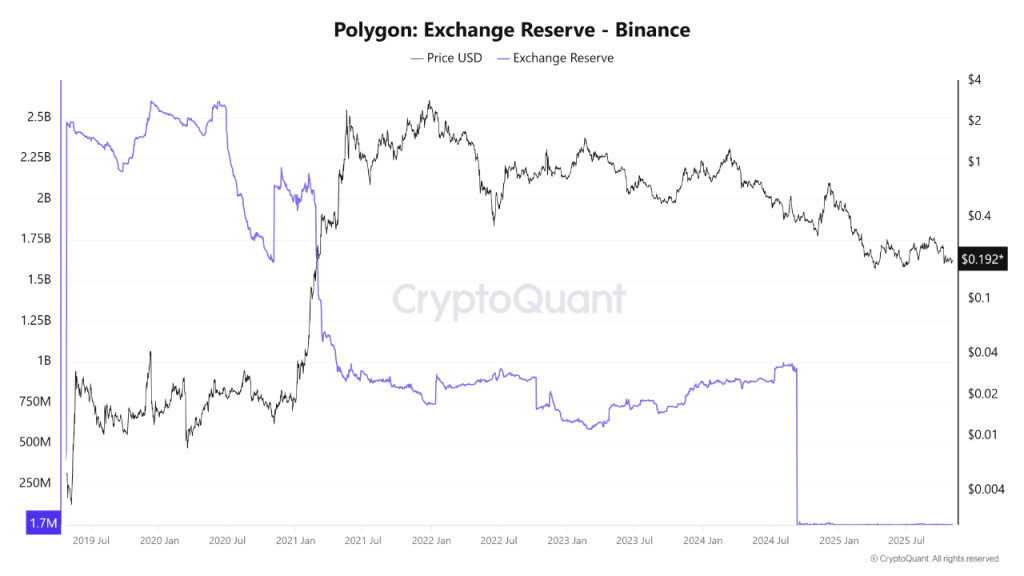

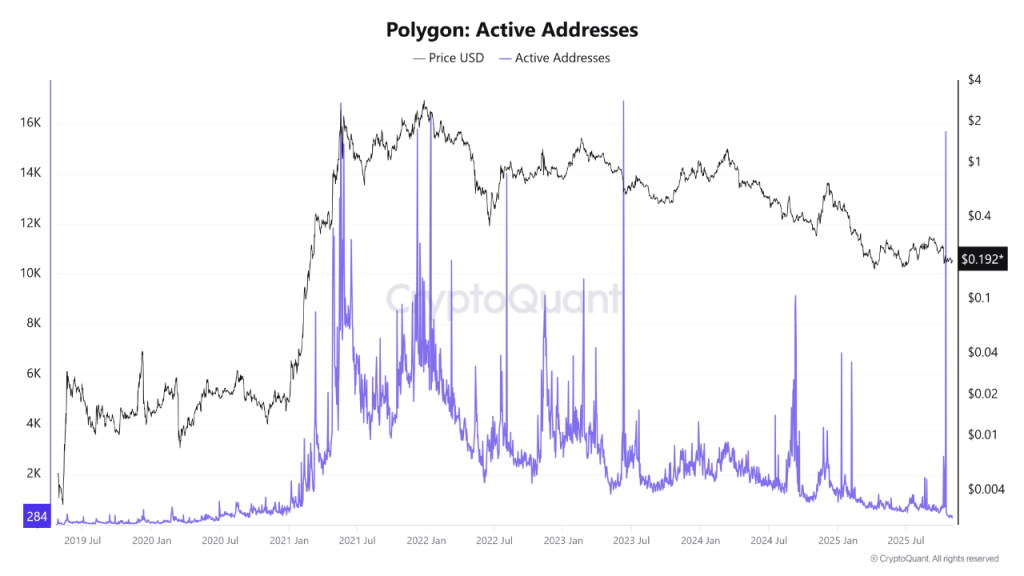

In accordance with Polygon’s on-chain chart insights shared by CryptoQuant, the metrics replicate favorable market habits. The change reserves of POL tokens on Binance have decreased considerably, implying diminished promoting strain and tightening circulating provide.

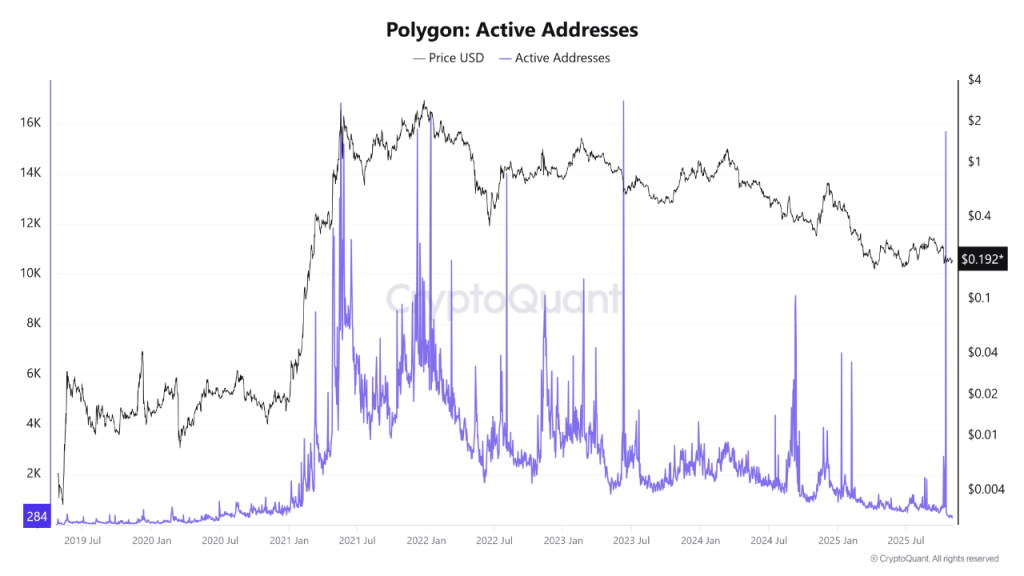

In the meantime, lively addresses on the Polygon community have elevated, indicating elevated engagement and consumer participation. This mix of decrease overseas change reserves (indicating a contraction in provide) and better lively addresses (indicating an growth in demand) supplies a bullish backdrop.

If this development continues, it may help renewed momentum within the Polygon worth USD, permitting the asset to exit the consolidation part for good.

Nonetheless, the CryptoQuant insights Information additionally exhibits that sharp will increase within the variety of lively addresses can typically coincide with native worth spikes, indicating overheated sentiment within the brief time period.

Subsequently, continued development accompanied by a gradual improve in consumer exercise may structurally help the subsequent rally.

Technical association signifies a possible escape zone

From a Polygon worth prediction perspective, technical indicators at the moment present the token consolidating on the low finish of its buying and selling vary, close to $0.15. This part may symbolize accumulation as the worth strikes inside a good band. Usually, the longer such consolidation continues, the stronger the following breakout tends to be.

If Polygon Beginning at this time, the inventory will begin to construct its worth motion, after which it may rise from the present degree earlier than the tip of the month. The chances additionally counsel that November is a key month, the place the index may transfer out of the consolidation vary if the worth have been to shut above $0.40 earlier than the tip of the month.

There may be additionally an excellent probability that the worth may even get near $0.76. A decisive transfer above this degree may open the door to the $1 zone, marking a possible begin of a brand new bullish cycle, delivering virtually 500% good points.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our skilled panel of analysts and journalists, following strict editorial tips primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluation coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We try to supply well timed updates on every little thing crypto and blockchain, from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared symbolize the writer’s personal views on present market circumstances. Please do your personal analysis earlier than making any funding choices. Neither the author nor the publication accepts accountability on your monetary decisions.

Sponsored and Advertisements:

Sponsored content material and affiliate hyperlinks might seem on our website. Advertisements are clearly marked and our editorial content material stays fully unbiased from our promoting companions.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now