Analysis

Can the Rally Sustain After Breaking Its Rising Channel?

Credit : coinpedia.org

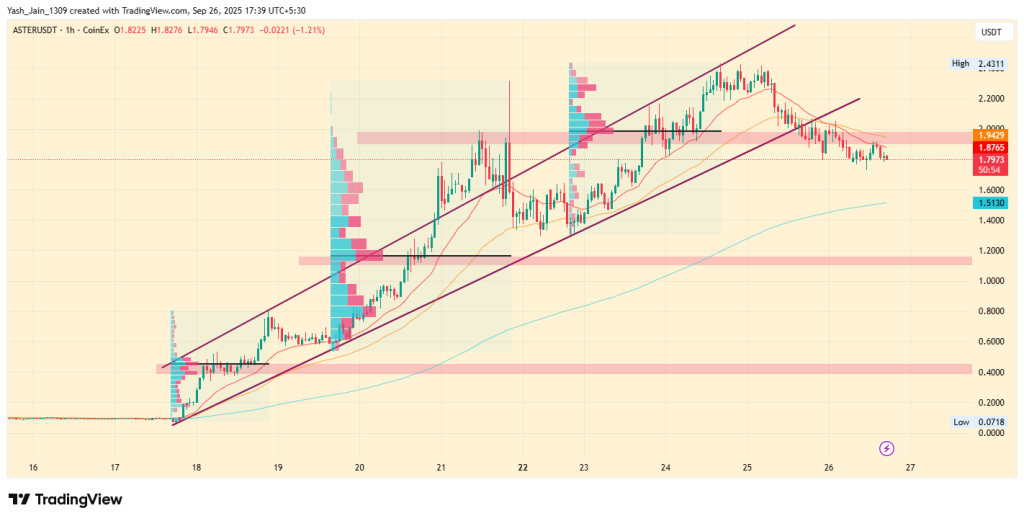

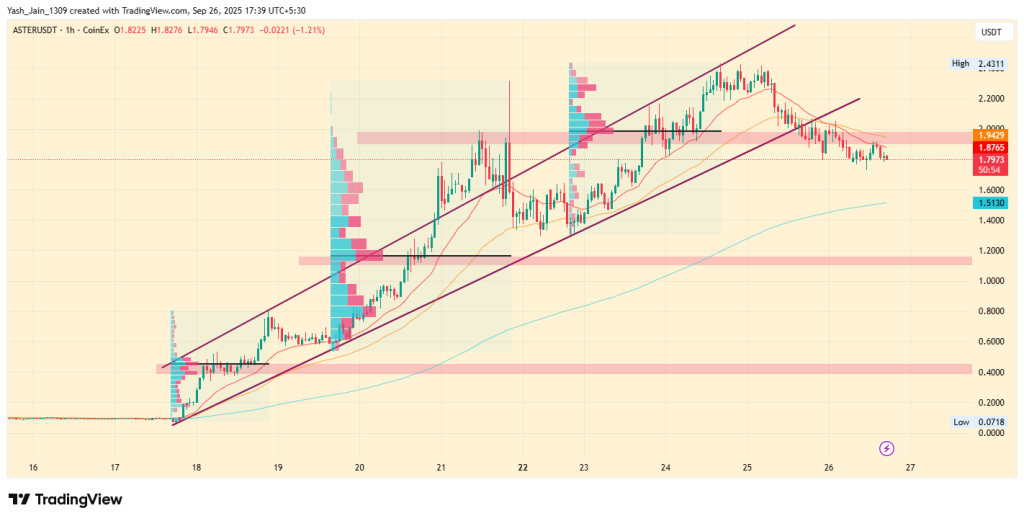

The current rally in Aster worth has attracted appreciable consideration after rising from simply $ 0.0718 to $ 2.43 inside every week. After this parabolic motion, nonetheless, token is damaged beneath its rising channel, which arouses questions on its sustainability. With $ 1.95 as an vital resistance, merchants preserve a detailed eye on the next directional shift.

Asterperprijsgrafiek exhibits development exhausting

Trying on the Aster-price diagram, the token initially shaped a steep rising channel in mid-September, with a peak at $ 2.43 earlier than he receding himself to $ 1.82- $ 1.83, whereas writing. The break beneath the channel help on 24 September meant early indicators of exhaustion and opened the door for deeper corrections.

A powerful resistance cluster is now between $ 1.85 and $ 1.95, an space the place heavy commerce quantity has been accrued. If the Aster worth doesn’t stay again this zone right now, the gross sales strain is predicted to accentuate additional.

The speedy help is $ 1.50, in accordance with the 200 EMA on the 1-hour graph. A decisive break beneath can result in a sharper decline within the course of the $ 1.20 demand zone, which additionally matches an earlier FRVP POC degree. Moreover, excessive help stays within the vary of $ 0.40- $ 0.50, with Aster Crypto attracting a robust institutional exercise for the primary time.

Momentum -indicators affirm this weak spot. RSI exhibits cooling of overheated ranges, which means that consolidation or perhaps a totally different withdrawal is required earlier than a sustainable benefit. For a bullish reversal, the asterper worth should reclaim $ 1.95- $ 2.00. A clear outbreak above $ 2.00 can deal with $ 2.25- $ 2.43, with earlier highlights being examined once more.

- Additionally learn:

- In the present day’s most vital US Financial occasion might shake crypto -branches

- “

Adoption and growthogers behind Aster Crypto

Whereas the graph exhibits a pullback, the Fundamentals emphasize quick acceptance. Aster positions itself as a subsequent era of everlasting Dex, supported by YZI Labs, who helps tasks resembling Ater by investing in corporations with sturdy web3, AI and biotech bases.

On his official X account, essentially the most not too long ago, the Aster reported greater than $ 46 billion in commerce quantity inside 24 hours on its perpetual merchandise, which exhibits a determine that underlines the usage of accelerating.

As well as, new entries on Aster Professional assist with a most of 50x leverage and partnerships with trusted portfolios, resembling Belief Pockets, in constructing credibility.

These progress griders can proceed to help the optimistic sentiment within the Aster prize prediction, even when short-term corrections happen.

FAQs

The worth of Aster rose on account of a speedy acceptance of its perpetual DEX platform, which not too long ago reported greater than $ 46 billion in 24-hour commerce quantity and new lists with excessive leverage.

Funding entails a excessive danger. Whereas the adoption is rising, token is at present in a correction. Its sustainability relies on sustaining crucial help ranges and sustaining the expansion of customers.

Aster’s prospects are blended. It should win $ 1.95- $ 2.00 for a bullish reversal. If it breaks beneath the help of $ 1.50, a drop to $ 1.20 or decrease is feasible.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024