Analysis

Can the Symmetrical Triangle Spark Another 900% Rally?

Credit : coinpedia.org

The 12 months is about to finish over the following two months, which has piqued market individuals’ curiosity a couple of much-missed altcoin rally. As a purpose, the SUI value forecast story for 2025 is in pattern. The SUI is among the many high cash which have beforehand proven big good points and have the potential to attain comparable or increased good points once more.

Wanting particularly at SUI, its value motion is coming into a decisive part because the asset consolidates inside a large symmetrical triangle following a historic rally in late 2024. With ecosystem metrics exploding and on-chain exercise reaching document highs, the approaching months might decide whether or not SUI crypto will regain its earlier all-time highs.

SUI Value Motion: From 950% Rally to Tight Consolidation

The second half of 2024 was nothing in need of extraordinary for the SUI value because it skyrocketed over 950% from $0.49 to an all-time excessive of $5.32. Nonetheless, 2025 offered a unique story. After the euphoric rally, the SUI The value chart confirmed actions inside a multi-month symmetrical triangle, indicating growing accumulation.

Because the buying and selling house shrinks, this displays rising optimism and strengthened community fundamentals. Such consolidation phases usually precede essential steps.

Presently, the $2 help stage is performing as the principle focal point. A collapse beneath this threshold might open doorways for a deeper correction in the direction of $0.49, whereas holding this zone retains bullish hopes alive.

Ecosystem development strengthens SUI value forecast

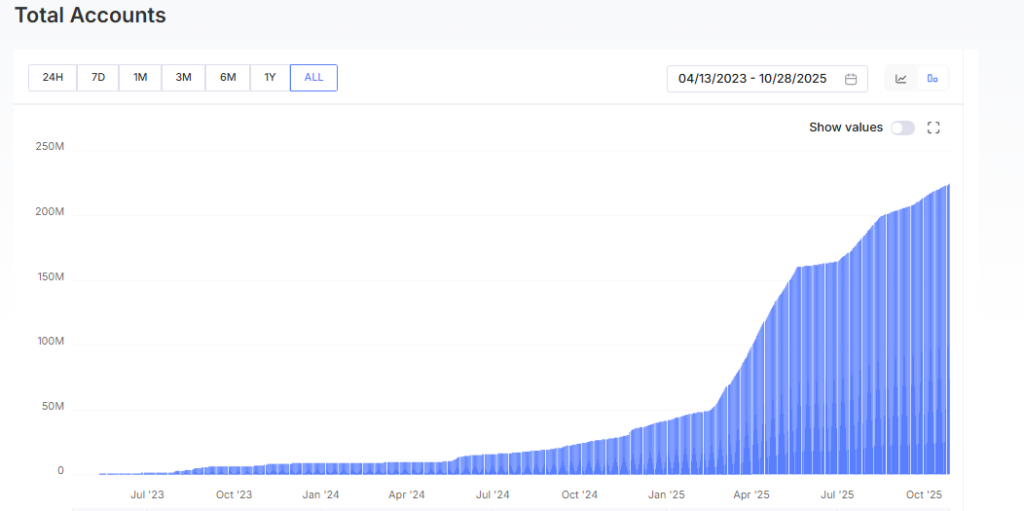

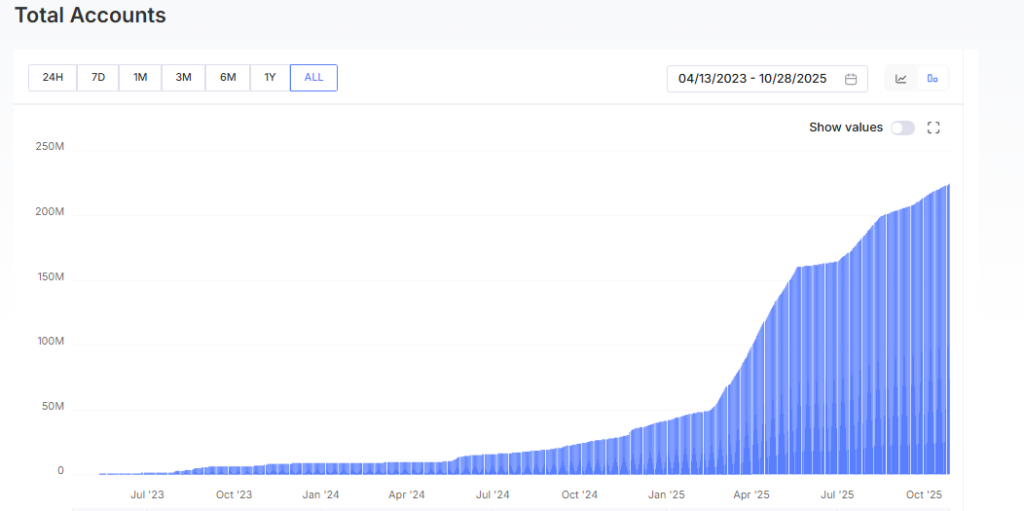

Regardless of the uneven motion within the USD SUI value, the mission’s fundamentals stay remarkably sturdy. Information within the chain shows the SUI crypto ecosystem continues to thrive. The community lately reached an all-time excessive of 225 million accounts, a transparent signal of accelerating engagement and person participation.

Much more spectacular, on October 28, 923,966 new accounts have been created in at some point, demonstrating speedy adoption momentum. This constant growth of community exercise underlines investor confidence and strengthens the long-term viability of SUI’s ecosystem.

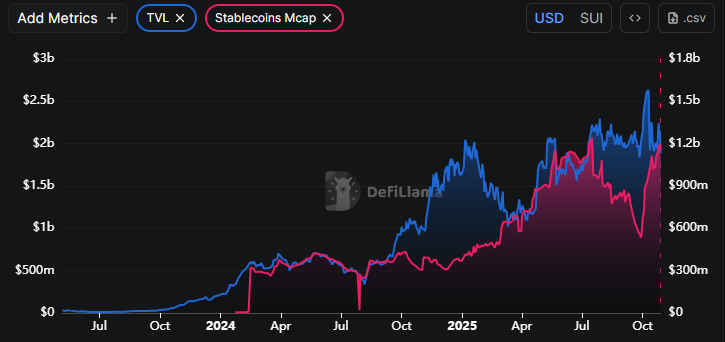

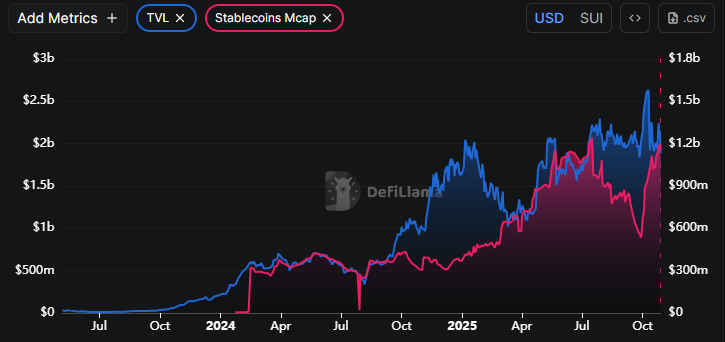

Moreover, SUI’s Complete Worth Locked (TVL) stays regular at roughly $1.89 billion, after reaching an ATH of $2.62 billion earlier in October.

Stablecoin’s market capitalization development fuels optimism

One other essential facet of the present SUI value evaluation is the notable improve in stablecoin inflows in October. The market capitalization of stablecoins rose from a dip round $560 million to $1.15 billion on the time of writing. This displays the growing liquidity and utility of the ecosystem.

Rising stablecoin exercise usually indicators deeper adoption as customers turn into extra involved with decentralized functions, yield protocols, and staking capabilities.

This gradual however stable rise in stablecoin dominance displays investor confidence within the community’s resilience, suggesting that the muse for the following bullish part could already be underway.

SUI Value Prediction 2025: A Essential Preparation Earlier than the Outbreak

The SUI value forecast framework for 2025 factors to a decisive few months forward. If there may be aggressive shopping for, a breakout from the symmetrical triangle might ship costs again in the direction of $5.32 earlier than the top of the 12 months, probably forming sturdy Marubozu candles on the SUI value chart.

Nonetheless, a extra gradual build-up might gradual the explosive transfer into the primary half of 2026, permitting belongings to consolidate throughout the triangle boundaries. Regardless, the tightening sample and robust on-chain fundamentals make SUI crypto some of the intriguing belongings to look at within the DeFi panorama.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial pointers primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our overview coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We attempt to supply well timed updates on every part crypto and blockchain, from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared characterize the creator’s personal views on present market circumstances. Please do your personal analysis earlier than making any funding choices. Neither the author nor the publication accepts duty in your monetary decisions.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks could seem on our web site. Adverts are clearly marked and our editorial content material stays fully impartial from our promoting companions.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now