Altcoin

Canary’s Stuted TRX ETF Pitch meets Cold Market: Why Tron Bulls don’t buy

Credit : ambcrypto.com

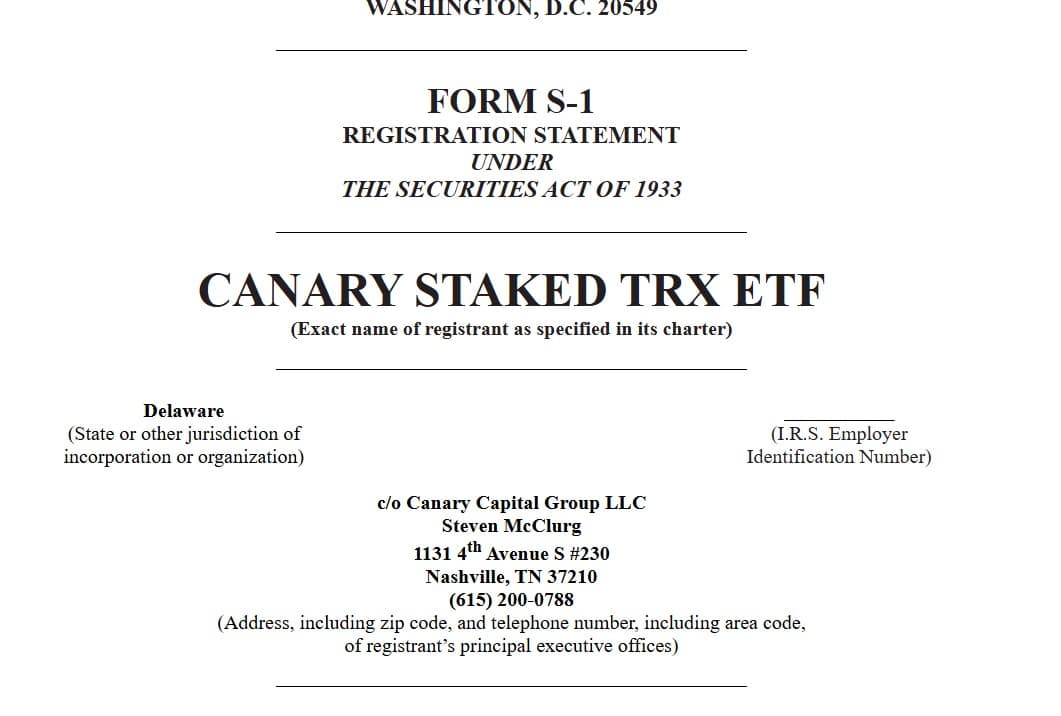

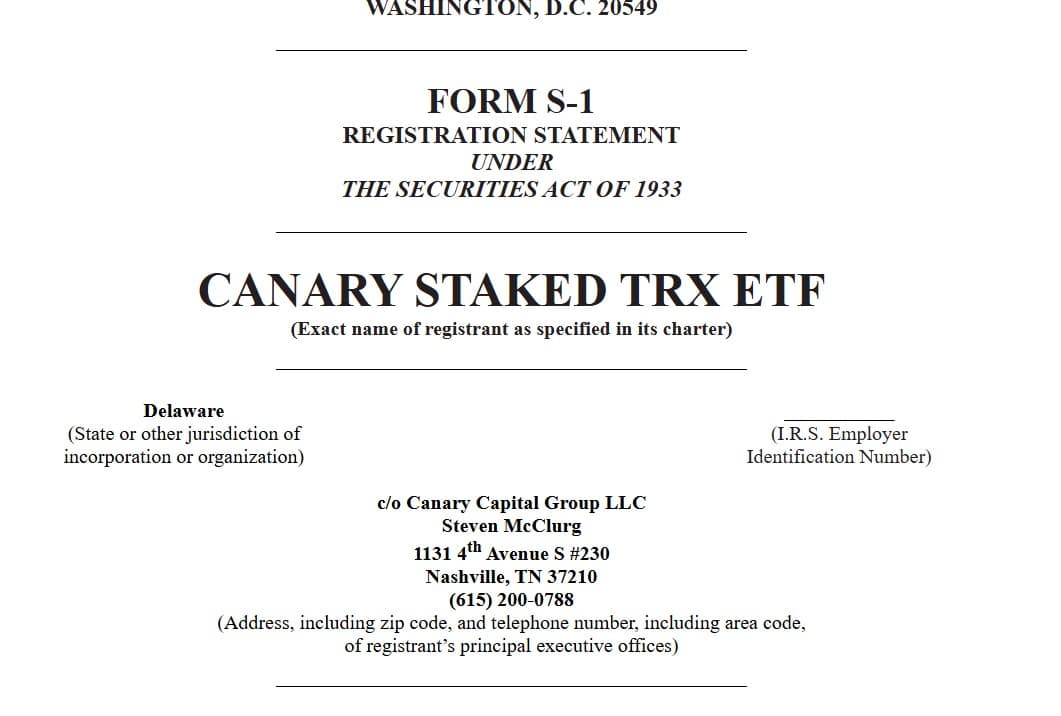

- Canary Capital has utilized for a trx ETF used with the sec.

- Regardless of the ETF utility, Tron stands for a robust bearish sentiment.

In keeping with reviews, Canary Capital, an asset supervisor of the USA, has submitted to say an ETF instruments for native token TRX. In keeping with the corporate, the proposed product canary is known as Stusted TRX ETF.

In keeping with the submitThe funds talked about are meant to maintain Spot TRX and use to generate additional yield. Buyers have regulated entry to the strike of rewards and market bbloting through the ETF.

If authorized, Canary Capital will handle the ETF actions and supervise the overall efficiency.

Supply: Sec.gov

Previously 4 months, in an try to make the most of a pro-Crypto SEC in the USA, there was an outpouring of submissions geared toward mentioning ETFs.

For the reason that begin of the Trump administration, American supervisors have obtained a number of archives.

Canary has submitted within the midst of this ETF racing for numerous Altcoin ETFs, together with Litecoin [LTC]XRP, Hedera [HBAR]Sky [SUI]and pudgy penguins [PENGU].

Is an ETF the enhance that TRX wants for restoration?

Though it’s anticipated that so excellent news has a optimistic impact on the value motion, this nonetheless must be mirrored. So far as Tron stays in a robust downward development.

On the time of writing, Tron even acted at $ 0.24. This meant a lower of 1.28% on every day graphs. The Altcoin has fallen by 2.8percenton weekly playing cards.

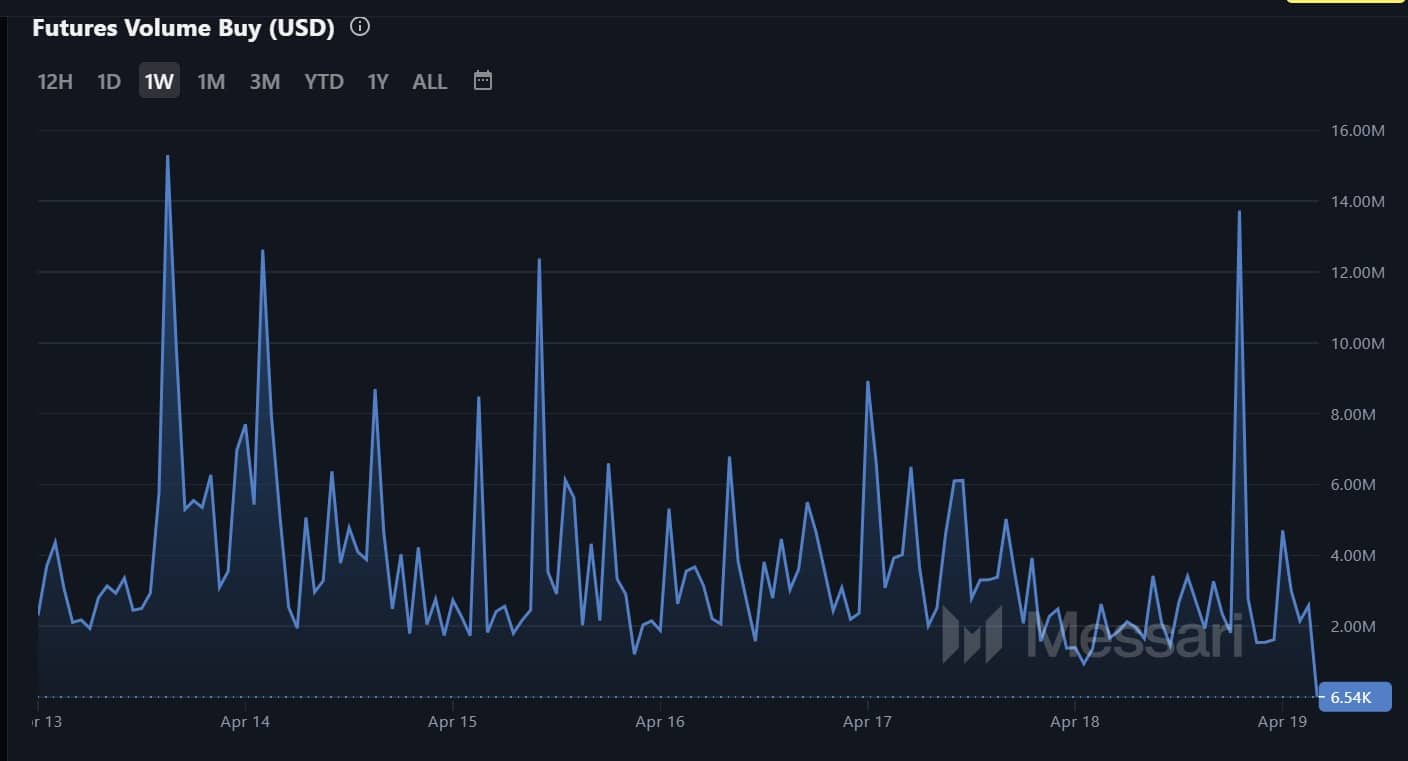

Within the midst of those losses, the query and the meeting of bearish sentiments slows down. To start with, Tron patrons have virtually disappeared from the market. Futures Purchase Quantity has additionally fallen to a weekly low of $ 6.5K.

Such a lower means that traders are at present lacking the motivation to consider in a possible upward development. As such there’s a weak bullish conviction available in the market.

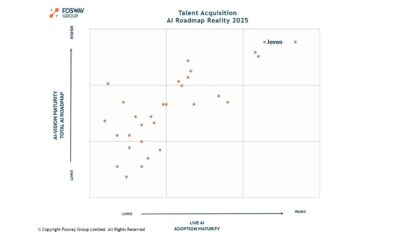

Supply: Messari

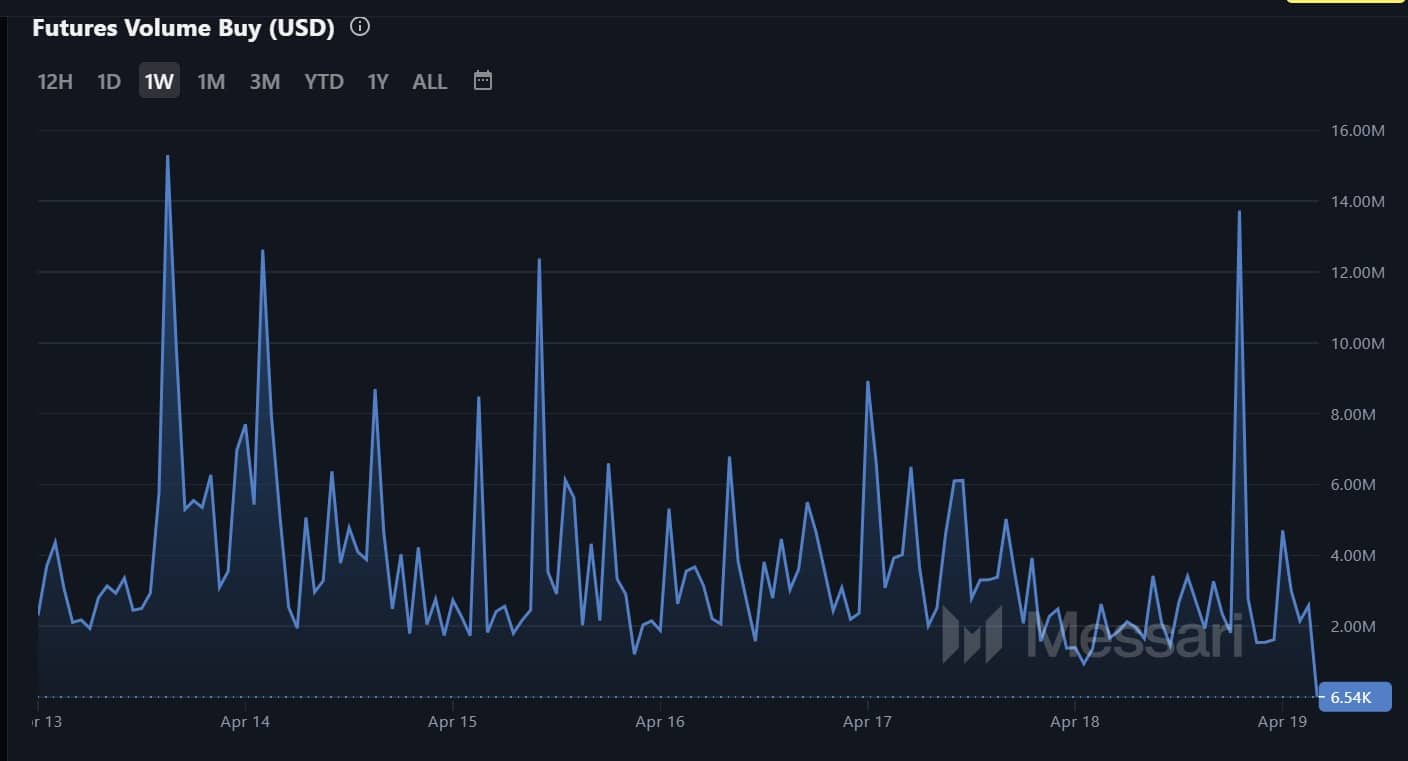

In keeping with the financing velocity (quantity weighed), there’s a lower within the demand for lengthy positions, whereby the financing share is saved at a month-to-month low inside damaging territory.

When the metric is about up on this means, this implies that traders are failing aggressive Tron as a result of they anticipate costs to fall.

Supply: Messari

That’s the reason an ETF could be a recreation change for Tron and his native token. An ETF will create area for extra adoption as institutional traders enter the market, which ends up in the next demand.

Any more, the appliance has not positively influenced the Trx worth motion. If the event in the marketplace is felt, we may see TRX $ 0.259 reclaim.

Nonetheless, if the prevailing market sentiment applies, a lower to $ 0.23 is inevitable.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024