Altcoin

Cardano (ADA) Rally -cooling, market sentiment or what?

Credit : coinpedia.org

Ada, the native token of the Cardano Blockchain, attracted a whole lot of consideration from crypto fanatics after the step of an asset supervisor to submit a Cardano Alternate-Traded Fund (ETF) in america. This improvement has aroused a outstanding curiosity amongst merchants and buyers, leading to a formidable upward momentum.

Cardano (ADA) loses his revenue

Whereas the market rise is pushing ADA close to a vital resistance stage, it has actively began with experiencing large sale, which implies that his worth is falling one different disappointment for merchants and buyers at the moment.

Regardless of the latest lower within the ADA topping worth, it has actively recovered its upward pattern, whereas above the 200 exponential advancing common (EMA) is shifting on the each day interval. Furthermore, at the moment’s outstanding gross sales strain has not had any vital affect on the sentiment of buyers, as a result of lengthy -term holders appear to gather token.

Present worth momentum

ADA presently acts virtually $ 0.77 and has skilled a worth improve of greater than 11% within the final 24 hours. Nevertheless, it actively reached an intraday excessive of $ 0.815 with a win of 16%, however the market misplaced a substantial a part of that revenue, most likely because of steady revenue reserving and the present market sentiment.

Nonetheless, the participation of merchants and buyers to the subsequent stage has risen, by greater than 120% in the identical interval.

ADA -Value promotion

In line with the technical evaluation of specialists, ADA has a vital resistance stage of $ 0.85, the place it was these days confronted with resistance.

Based mostly on the latest worth promotion, if ADA continues to gather and breaks the extent of $ 0.85, so {that a} each day candle is closed above it, there’s a robust chance that it may rise by 32% to the $ 1.13 stage may be reached sooner or later.

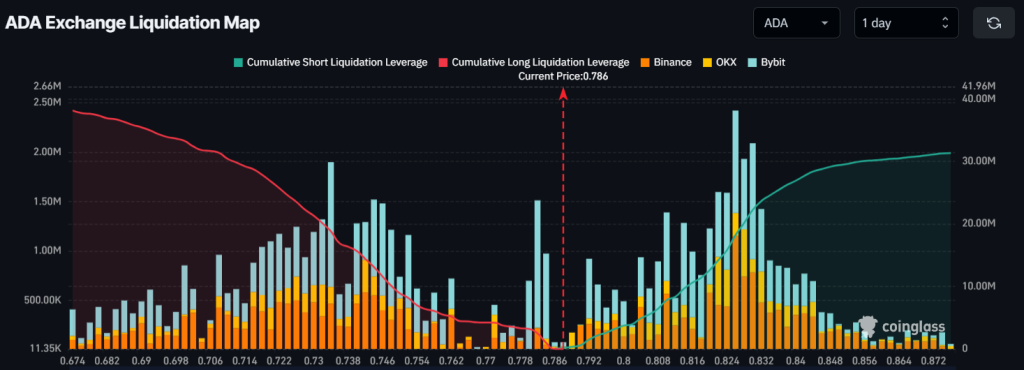

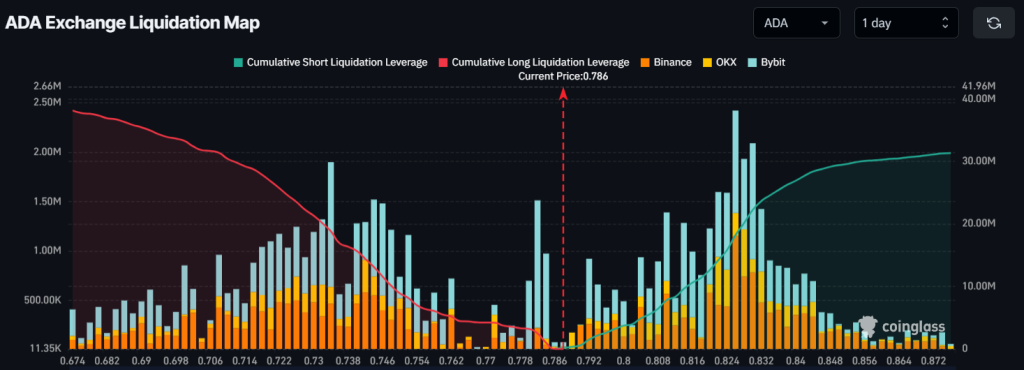

A very powerful liquidation areas of ADA

Merchants are presently following a combined method. At the moment, the main liquidation areas are virtually $ 0.734, the place merchants with lengthy positions are used an excessive amount of, with $ 18.80 million in lengthy positions. Conversely, $ 0.826 is one other liquidation stage, wherein merchants with brief positions are used an excessive amount of, with $ 18.20 million briefly positions.

When combining these on-chain statistics with technical evaluation, plainly holders accumulate tokens in the long run, whereas intraday merchants profit from the present market sentiment.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024