Altcoin

Cardano: Can $1.12 Boost ADA’s Recovery After a Seven-Day Dip?

Credit : ambcrypto.com

- ADA is down 9% over the previous seven days.

- Regardless of the decline, massive whales have gathered.

Cardano [ADA] has had a turbulent week, dropping greater than 9% of its worth amid a broader bearish market and an absence of serious catalysts. Regardless of this decline, an intriguing improvement has emerged: whale accumulation is rising.

This raises a vital query: may huge buyers lay the groundwork for a worth rebound?

Value efficiency and technical evaluation

Cardano’s worth efficiency has confronted important challenges over the previous week. After a number of failed makes an attempt to interrupt the $1.12 resistance degree, the token is now buying and selling at $1.10, reflecting a transparent decline.

Supply: TradingView

Technical indicators present a extra nuanced image. The Relative Power Index (RSI) is at 58.66, indicating a impartial place indicating potential momentum as shopping for strain will increase.

Furthermore, the ADA stays above the 200-day transferring common, round $0.77. Traditionally, this degree has acted as a vital backside for bullish momentum.

ADA not too long ago shaped a golden cross, with the 50-day transferring common rising above the 200-day transferring common. Nevertheless, the lack to interrupt the resistance at $1.12 raises questions on whether or not the token can maintain an upward transfer within the brief time period.

Accumulation of Cardano whales: a potential contrarian sign?

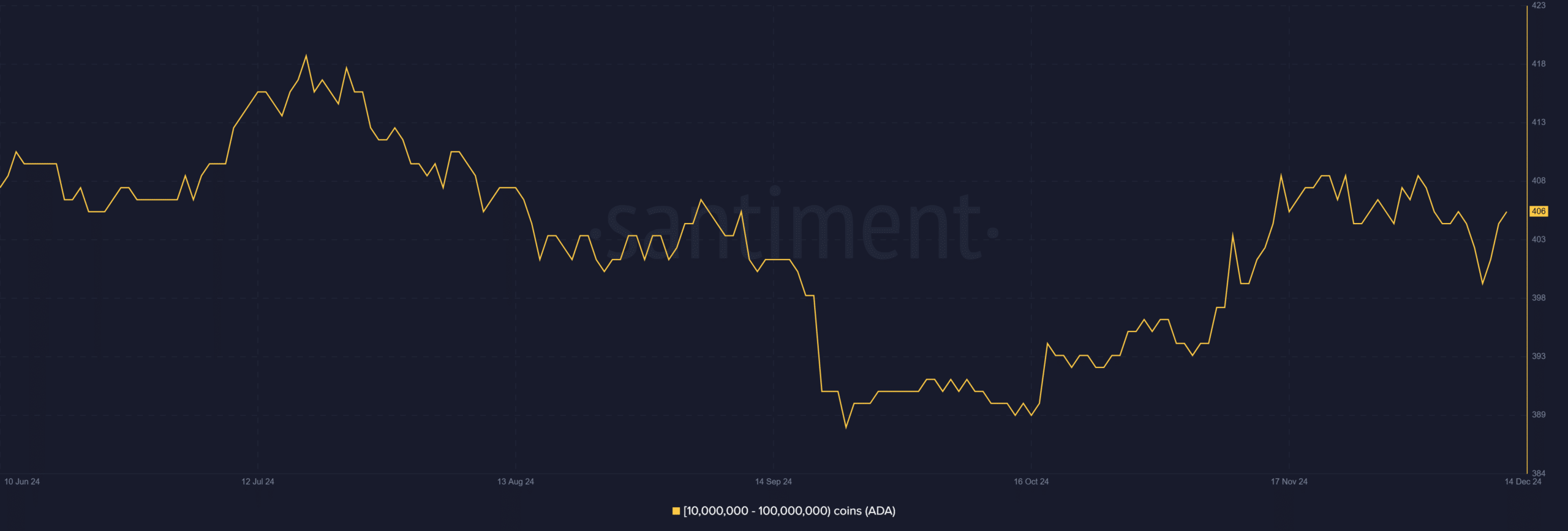

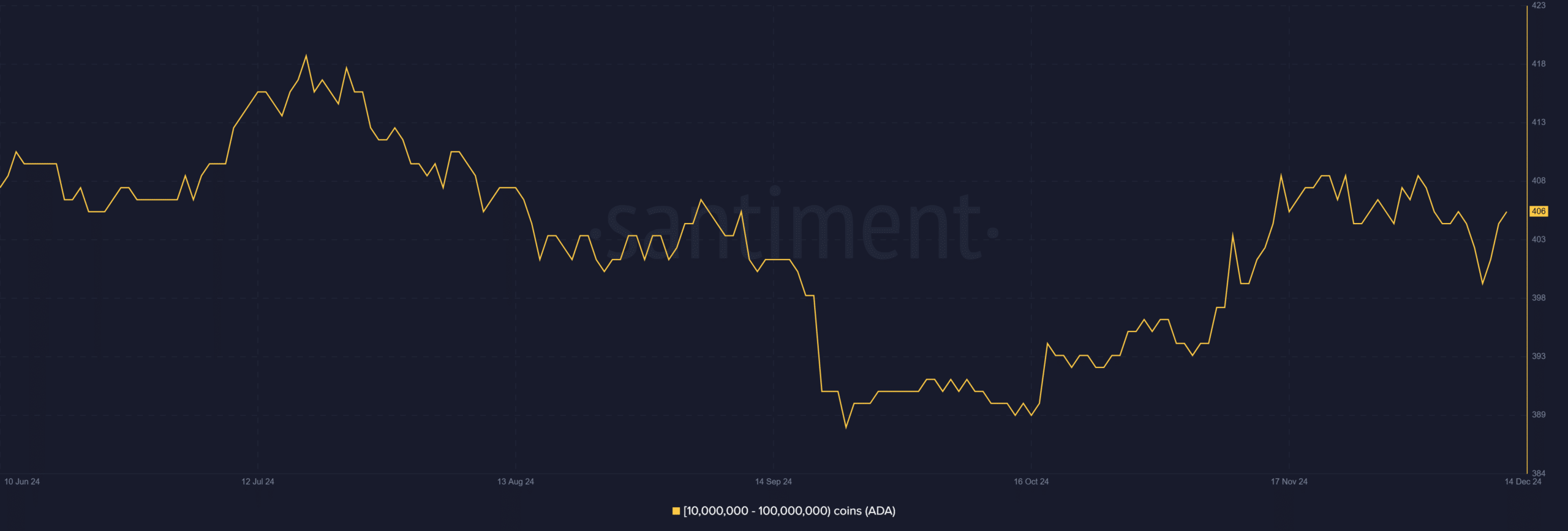

Though worth developments are disappointing, knowledge in regards to the chain reveals a special story. Whale accumulation has elevated dramatically not too long ago, with wallets holding between 10 million and 100 million Cardano considerably rising their balances.

Supply: Santiment

Based on SantimentThese massive holders at the moment are accountable for one of many highest accumulation ranges in current months.

Such conduct is commonly interpreted as a bullish sign, as whales usually accumulate throughout perceived market lows in anticipation of future worth will increase. Their actions point out confidence in ADA’s long-term potential, whilst short-term worth dynamics stay bearish.

Energetic tackle developments and retail sentiment

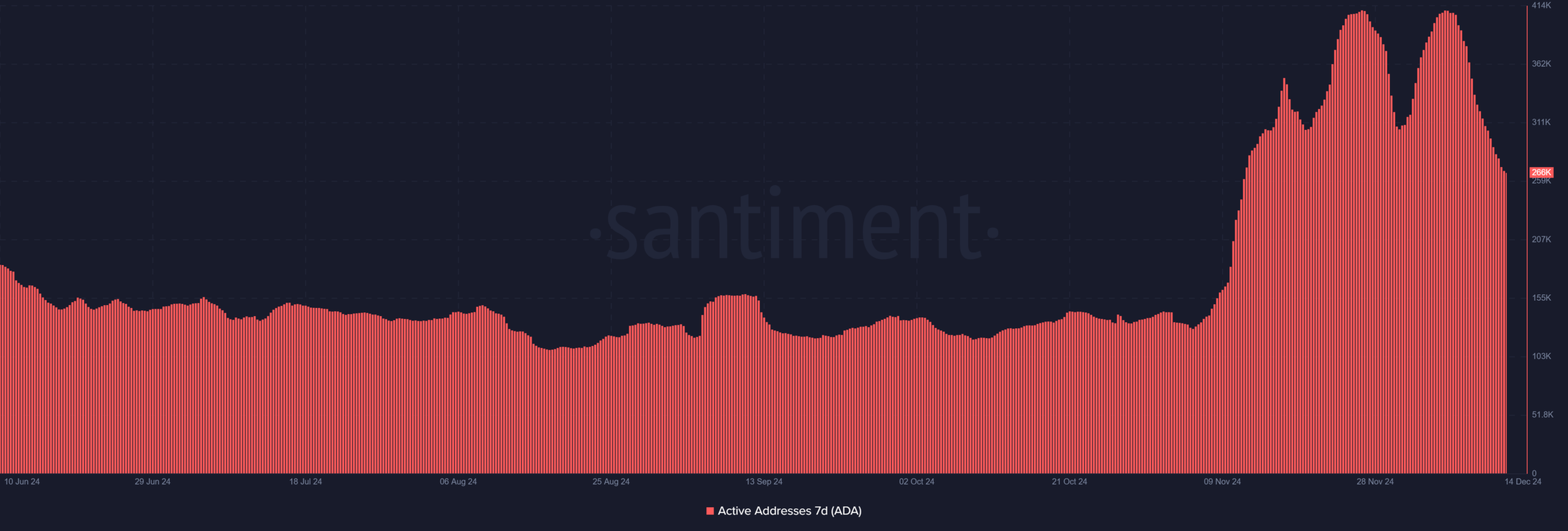

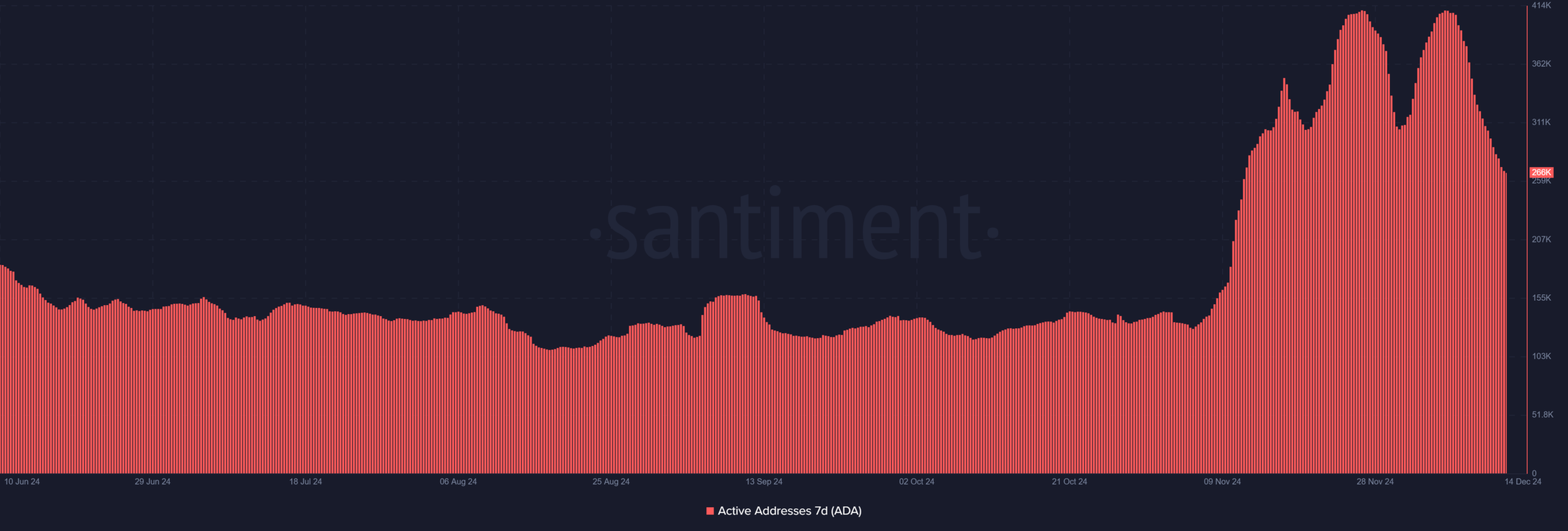

In distinction to whale exercise, retail involvement is declining. The variety of seven-day energetic addresses rose considerably in late November and has since fallen to round 266,000.

This decline indicators lowered exercise from smaller buyers, who’ve traditionally performed a vital function in ADA worth will increase.

Supply: Santiment

The distinction between rising whale accumulation and declining retail participation highlights an vital shift in market dynamics. Whales could also be positioning themselves for a possible restoration, whereas retail buyers stay cautious amid broader market uncertainty.

What’s subsequent for ADA?

Cardano’s present scenario is a fragile steadiness between conflicting indicators. On the one hand, the continued accumulation of whales may finally result in a worth rebound, particularly if retail curiosity picks up once more.

On this case, ADA may break the $1.12 resistance degree and probably goal $1.20 or increased.

Alternatively, the continued lack of retail involvement and additional rejections at key resistance ranges may result in larger losses. If bearish strain continues, ADA may check the subsequent main assist degree round $0.90, a traditionally vital zone.

– Real looking or not, right here is the market cap of ADA when it comes to BTC

ADA’s efficiency over the previous week displays a market at a crossroads. Whereas the token’s decline underlines the challenges of broader bearish circumstances, the regular improve in whale possession affords a glimmer of hope for a potential reversal.

Whether or not ADA is getting ready to a restoration or faces additional corrections is determined by how these components play out within the coming days.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now