Altcoin

Celestia’s Next Move: Are the Odds Favorable for a Soon Breakout?

Credit : ambcrypto.com

- TIA is attempting to interrupt out of its consolidation vary, with the technicals displaying bullish potential.

- The buildup of whales and rising curiosity point out rising market confidence, however warning is suggested.

Celestia [TIA] is gaining vital momentum because it continues its efforts to interrupt away from a protracted consolidation part that has restricted its value actions for months.

The token was buying and selling at $5.95 on the time of writing, with a acquire of 6.85% up to now 24 hours, displaying bullish potential. Will TIA keep its upside momentum and transfer increased, or will resistance ranges sluggish the rally? Let’s discover out.

TIA Consolidation Scope Overview: Will It Break Free?

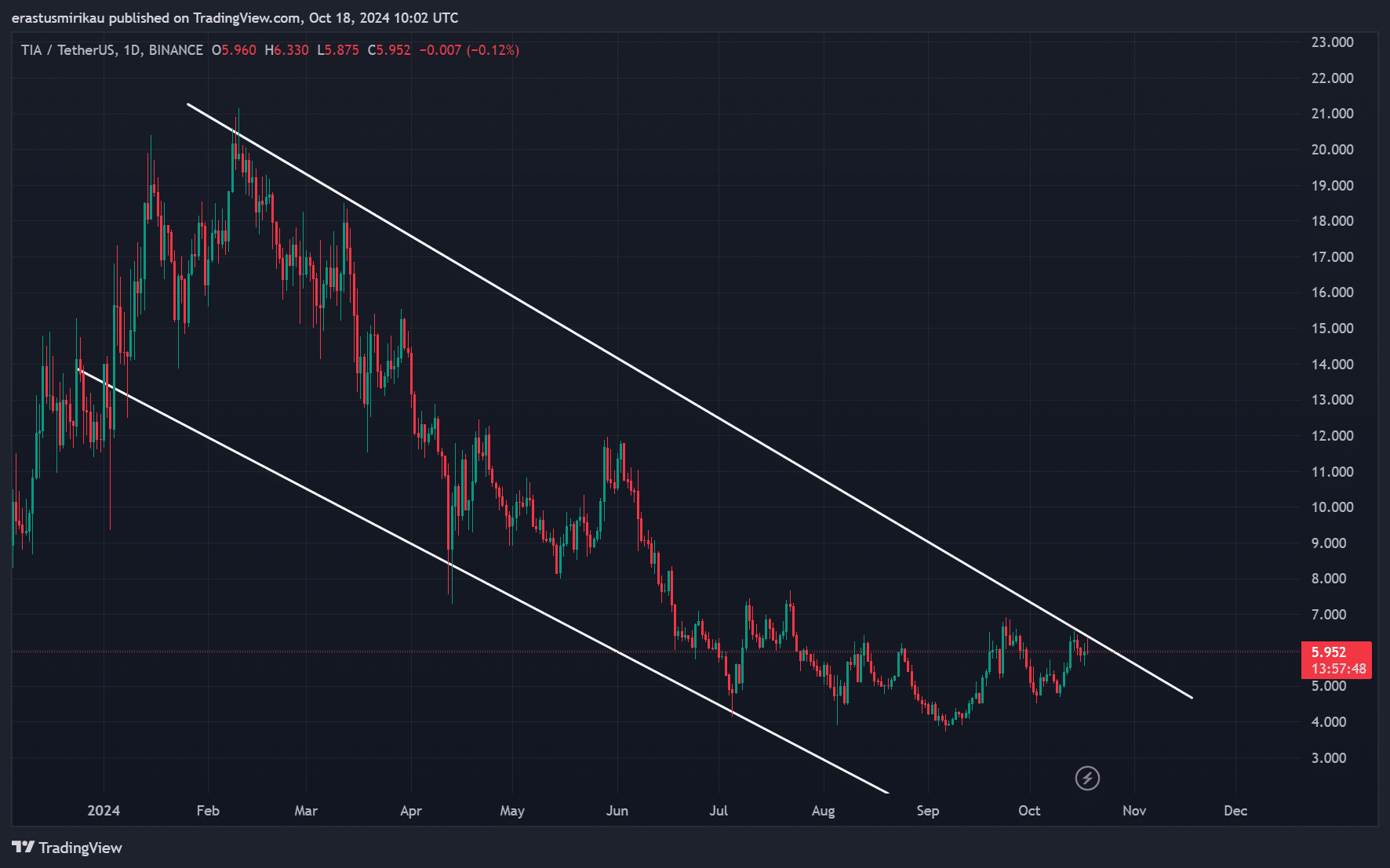

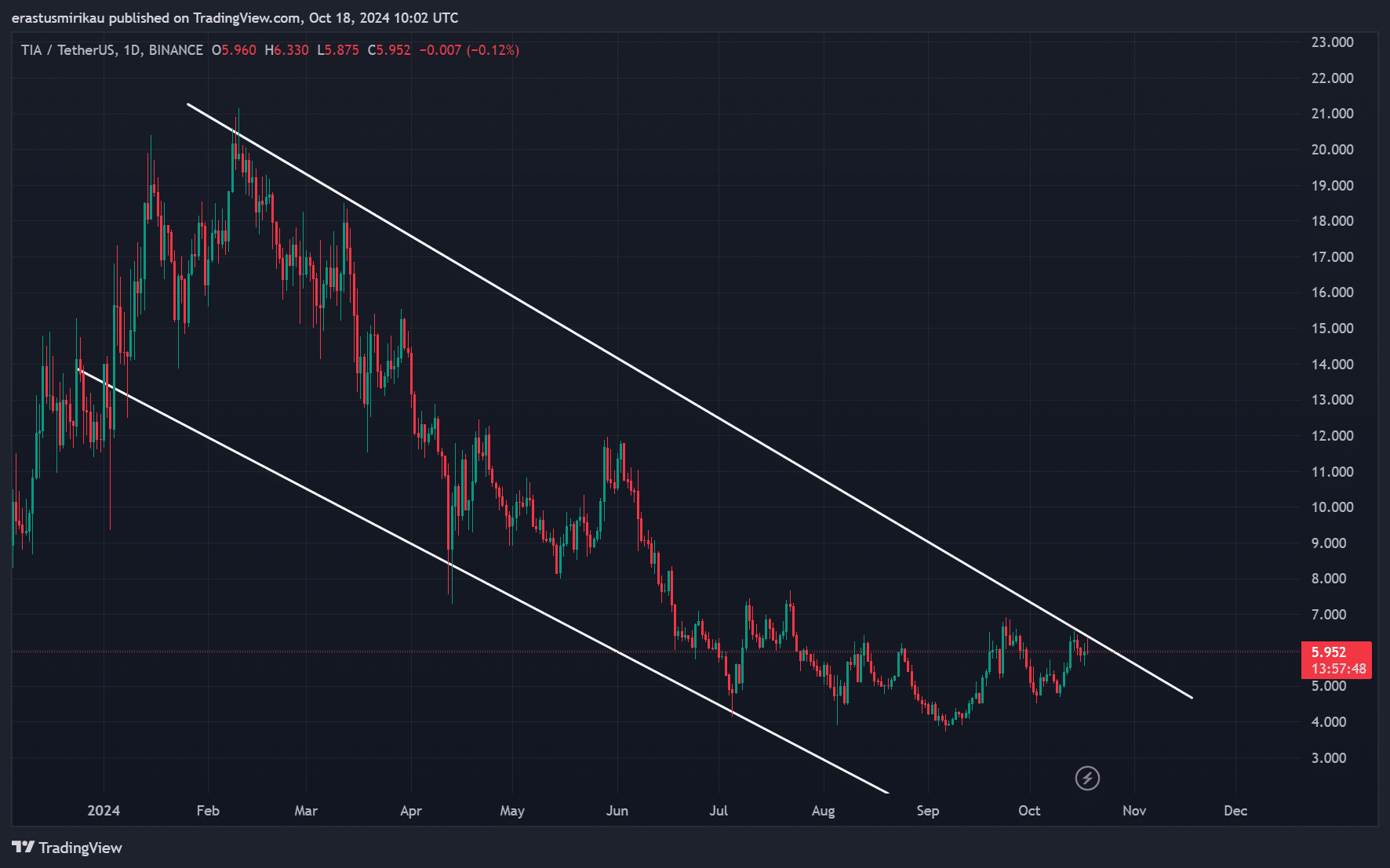

TIA is caught in a long-term downward pattern, as evidenced by the declining value channel. For months, the token has struggled to interrupt above essential resistance ranges and keep inside this channel.

Nevertheless, the latest try to succeed in the higher restrict might imply a doable breakout. If TIA efficiently clears this key resistance, it might pave the best way for additional bullish momentum.

Supply: TradingView

TIA technical evaluation: what do the symptoms present?

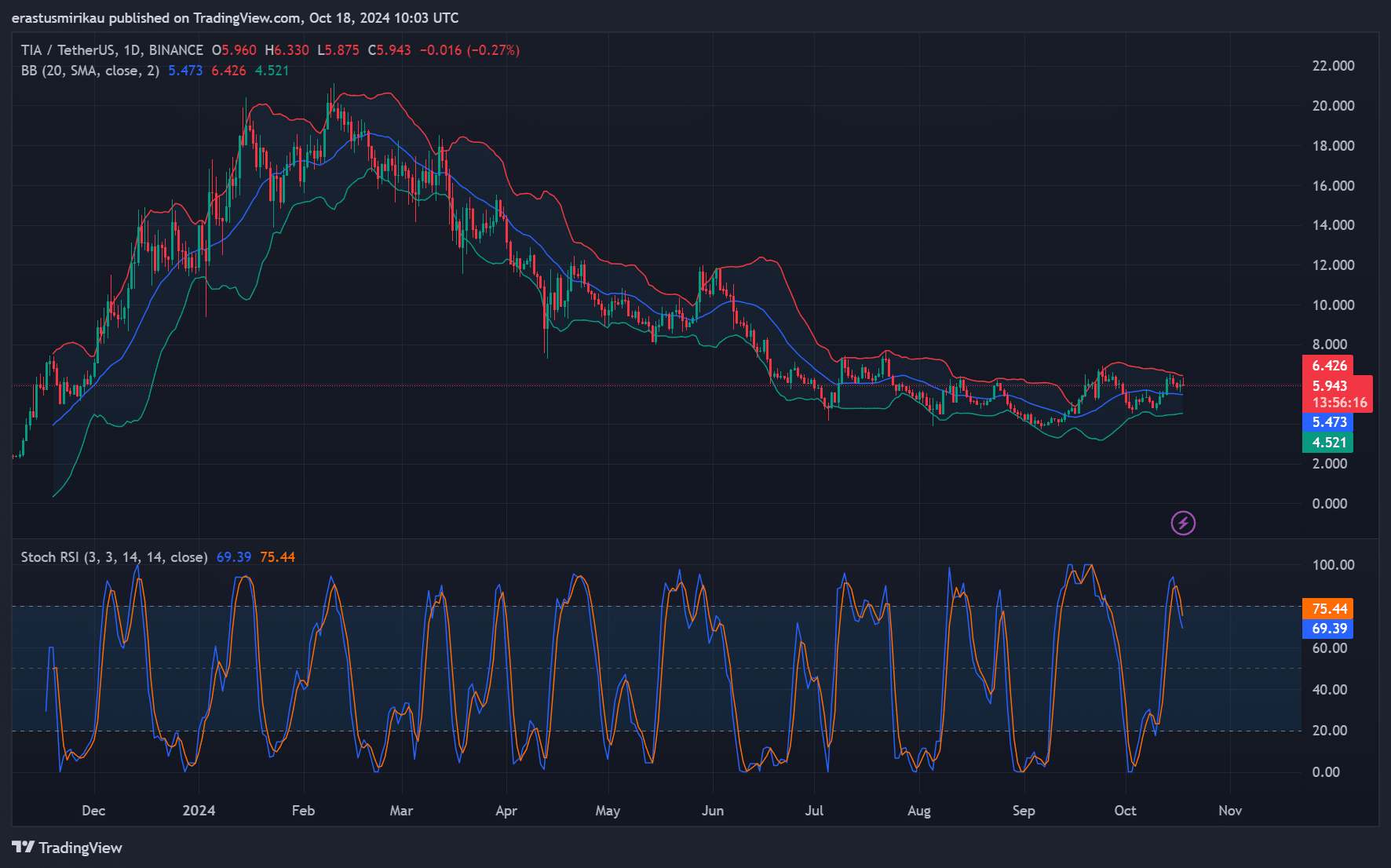

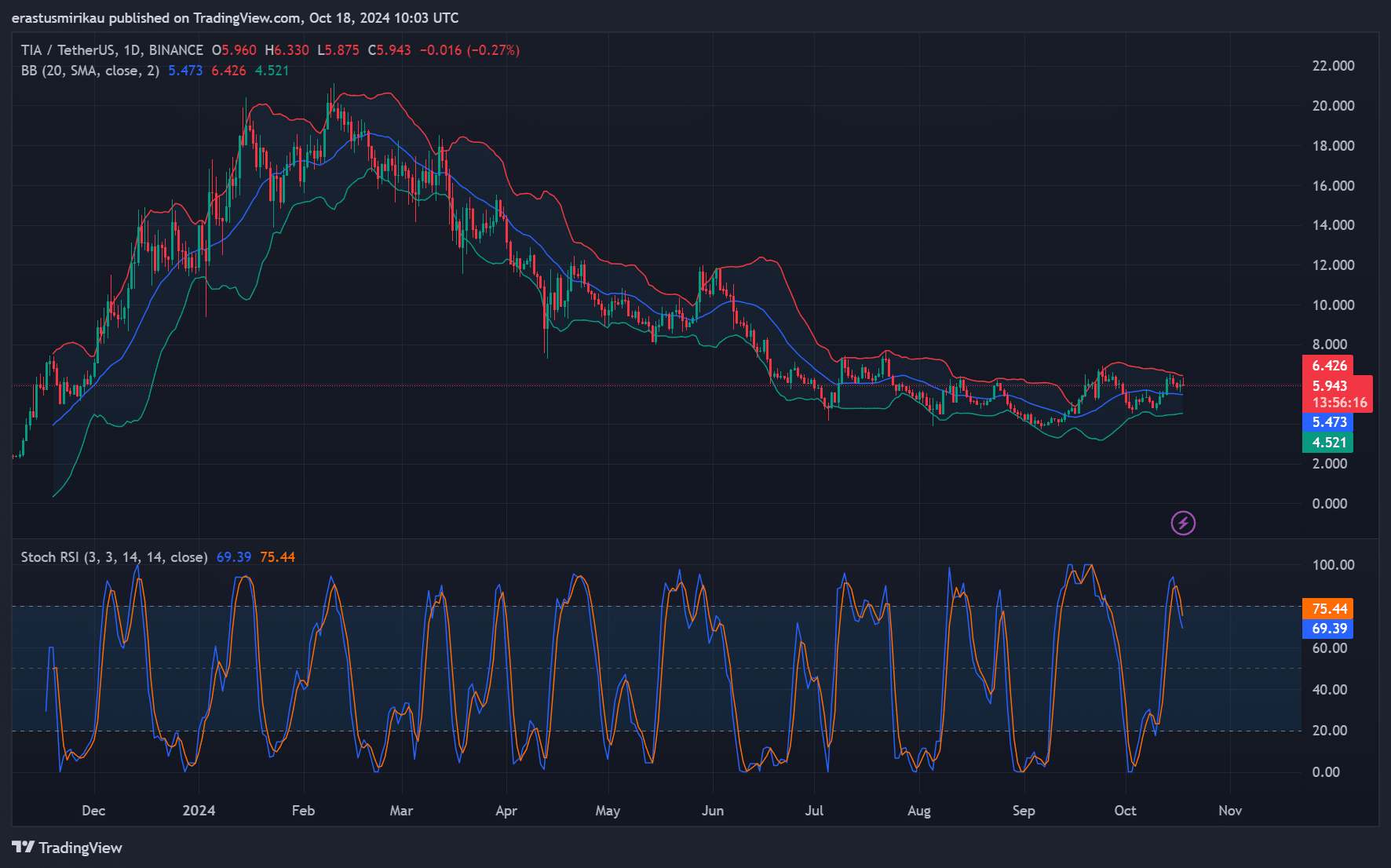

The technical indicators supply a combined outlook. The Bollinger Bands (BB) on the each day chart present TIA testing the higher band, indicating elevated volatility.

Furthermore, the Stochastic RSI is close to the overbought space, with values of 75.44. Though consumers at the moment dominate the market, there’s a danger of a short-term pullback.

Nevertheless, the general pattern means that if TIA manages to beat quick resistance, it might spark a powerful rally. Subsequently, merchants ought to take note of the important thing ranges earlier than making any choices.

Supply: TradingView

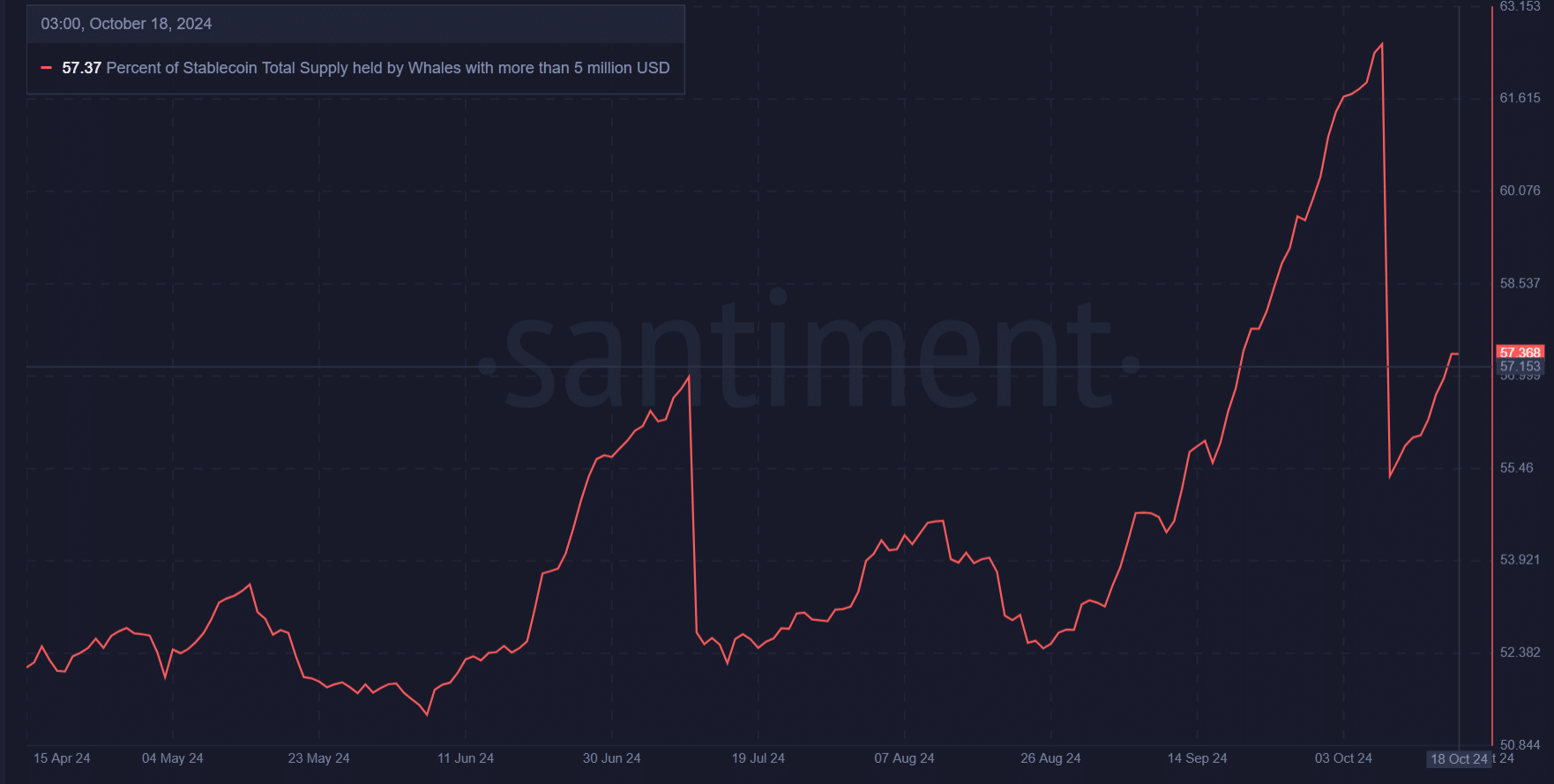

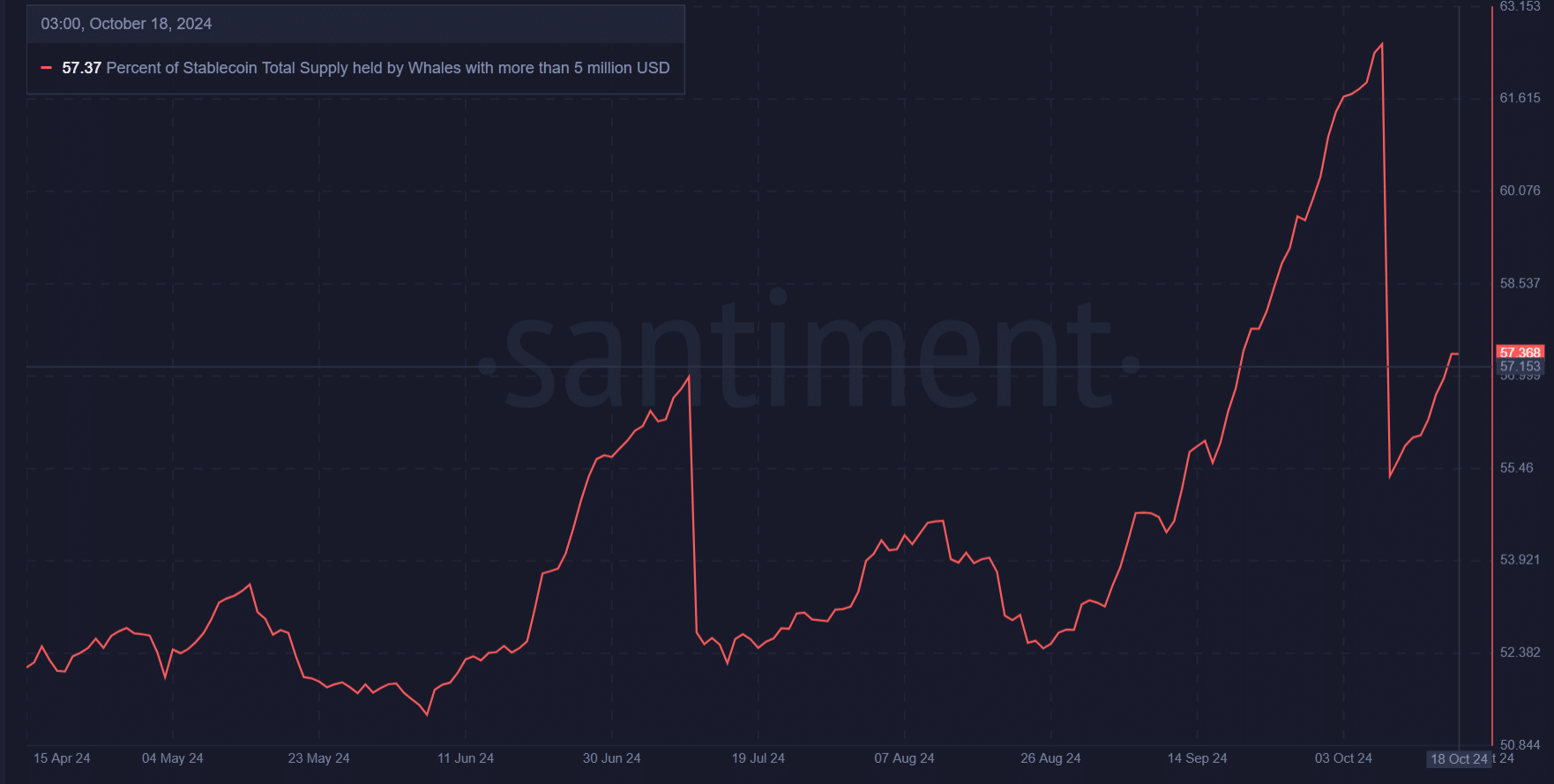

Prime Holder Evaluation: Do Whales Accumulate?

Analyzing the highest holders supplies invaluable insights into market sentiment. Presently, 57.37% of the stablecoin provide is owned by whales, who personal giant property of over $5 million. This degree of accumulation signifies vital confidence within the asset’s potential for future development.

Nevertheless, latest fluctuations in whale exercise point out that enormous holders could also be in a distribution part. Subsequently, shut monitoring of those key gamers might be essential in assessing TIA’s future value motion.

Supply: Santiment

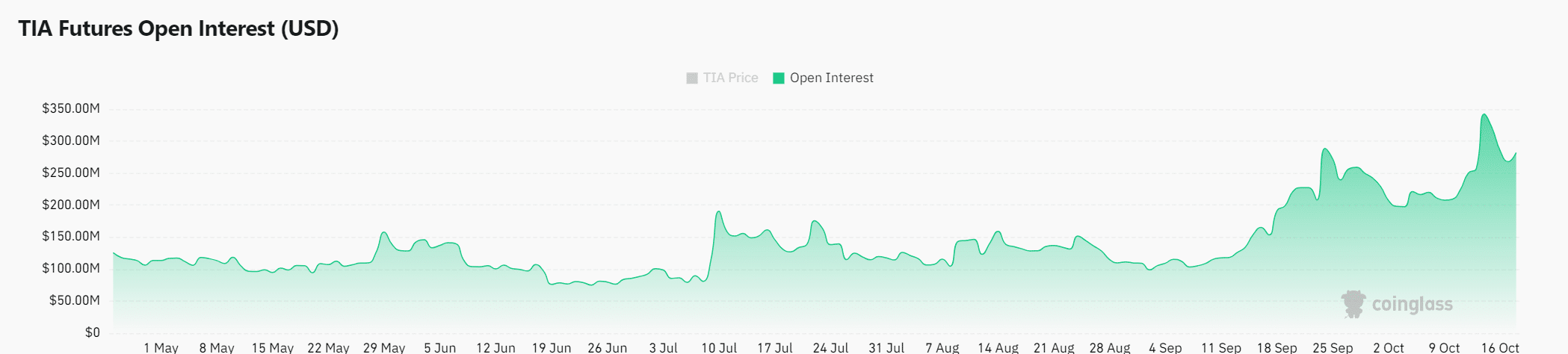

Rise in open curiosity: is bullish sentiment rising?

Open curiosity, which elevated 11.02%, now stands at $294.21 million. This enhance indicators elevated investor curiosity, indicating merchants are positioning themselves for vital value motion. Consequently, rising open curiosity usually indicators larger volatility, and for TIA, this might rapidly translate right into a breakout.

Supply: Coinglass

Is your portfolio inexperienced? View the TIA revenue calculator

In brief, Celestia (TIA) is displaying promising indicators of breaking by its consolidation margin. With robust assist for whales and rising open curiosity, market sentiment is leaning in direction of bullish. Nevertheless, technical indicators recommend warning as overbought circumstances might set off a pullback.

If TIA can clear its resistance ranges, a powerful upside rally might comply with. Nevertheless, traders ought to stay cautious as a result of potential for short-term corrections.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024