Altcoin

Chain link [LINK] Price forecast – Watch out for a defense of this key level!

Credit : ambcrypto.com

- Hyperlink has recovered its each day trendline when Bulls defended $ 12.25 within the midst of Delicate Voorwaartum

- Exercise on the chain fell sharply, however the primary ideas and reserves hinted to restoration potential

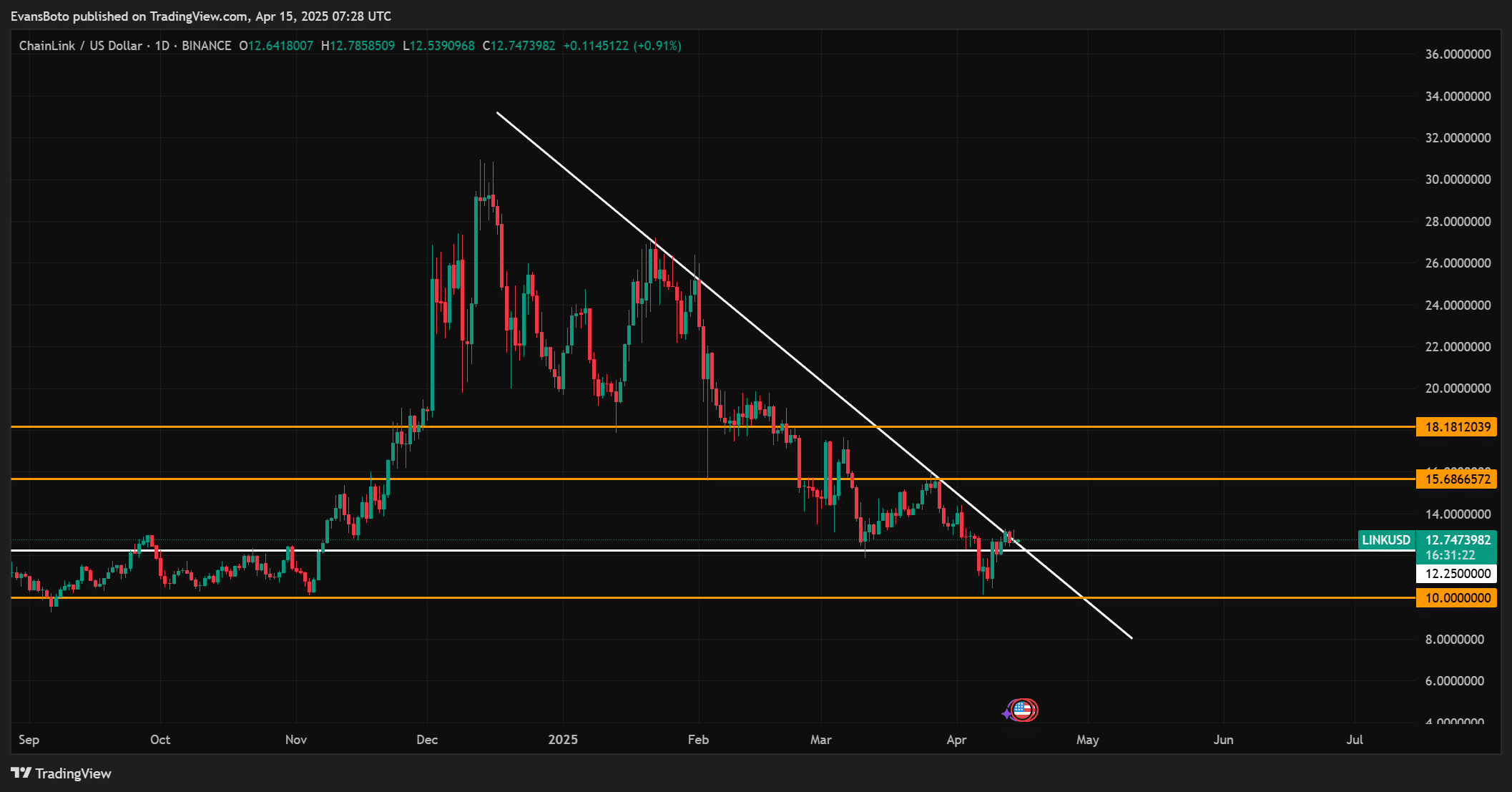

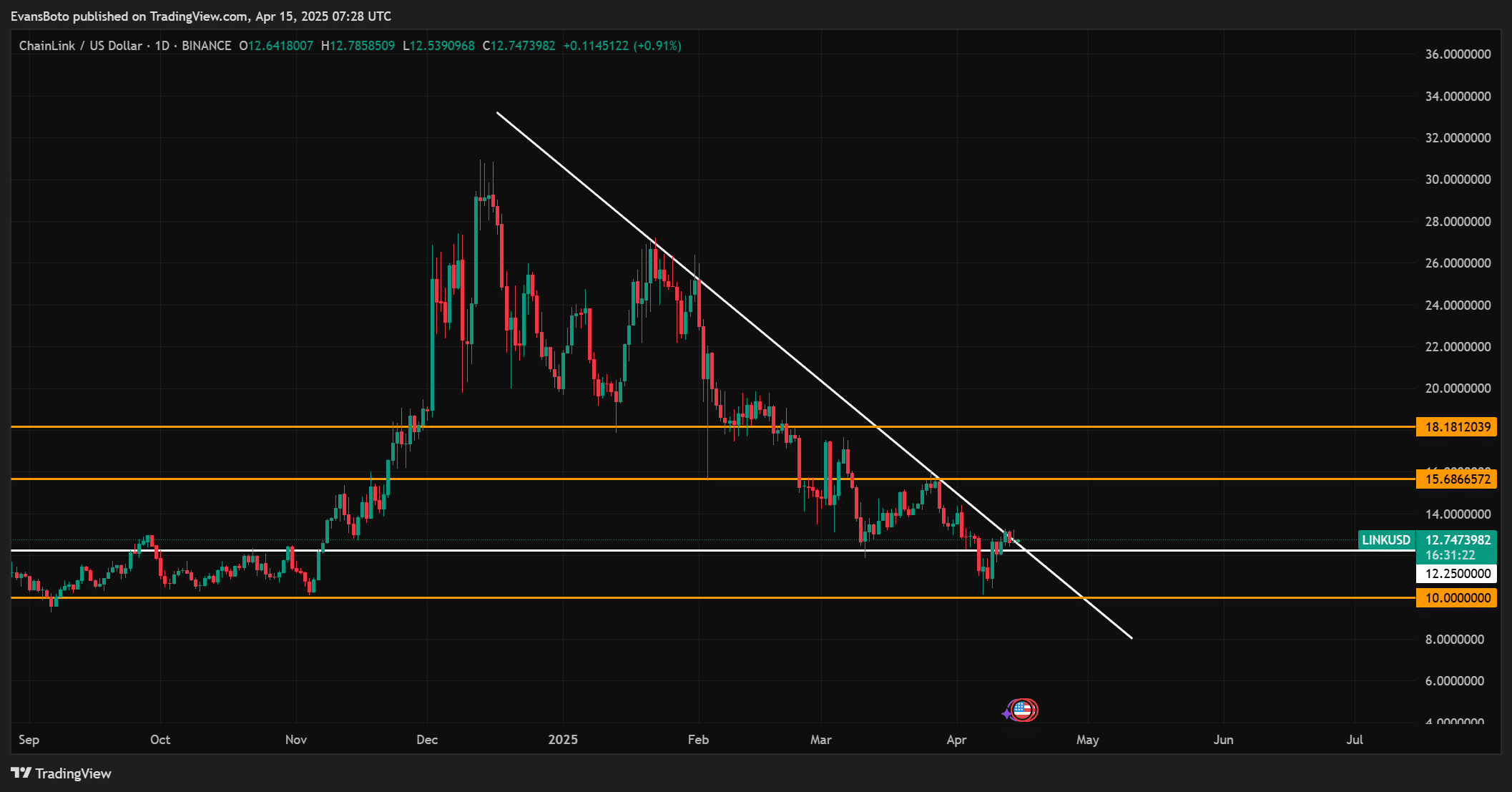

Chain hyperlink [LINK]on the time of writing was Re -test an important demolition zone after breaking an annual rising trendline. This appeared to confer with a decisive second for the brief -term route of the Altcoin.

Regardless of a brief rebound, it even has $ 12.25 degree come forward As an essential battlefield for bulls which are aimed toward regaining dominance. If this help doesn’t maintain, the objectives of the draw back can come to $ 10 and $ 7.50.

On a technical degree, Hyperlink not too long ago broke over a falling trendline on the Day by day Chart – factors to a attainable pattern shift. Momentum, nevertheless, was weak and the worth might nonetheless flirt with crucial help space.

On the time of the press, the hyperlink was traded at $ 12.67 after a win of 0.41% within the final 24 hours. Bulls should keep stress above $ 12.25 to substantiate a sustainable reversal.

Supply: TradingView

New partnerships and falling reserves – will the Fundamentals trigger a restoration?

Chainlink not too long ago introduced a strategic cooperation with PI community, with the goal of enhancing decentralized purposes by real-time information integration. This motion reinforces the good contract choices of Chainlink and will function a long-term bullish driver.

Nonetheless, the market response has up to now been stuffed in, indicating that merchants may be extra targeted on technical construction within the brief time period than on Fundamentals.

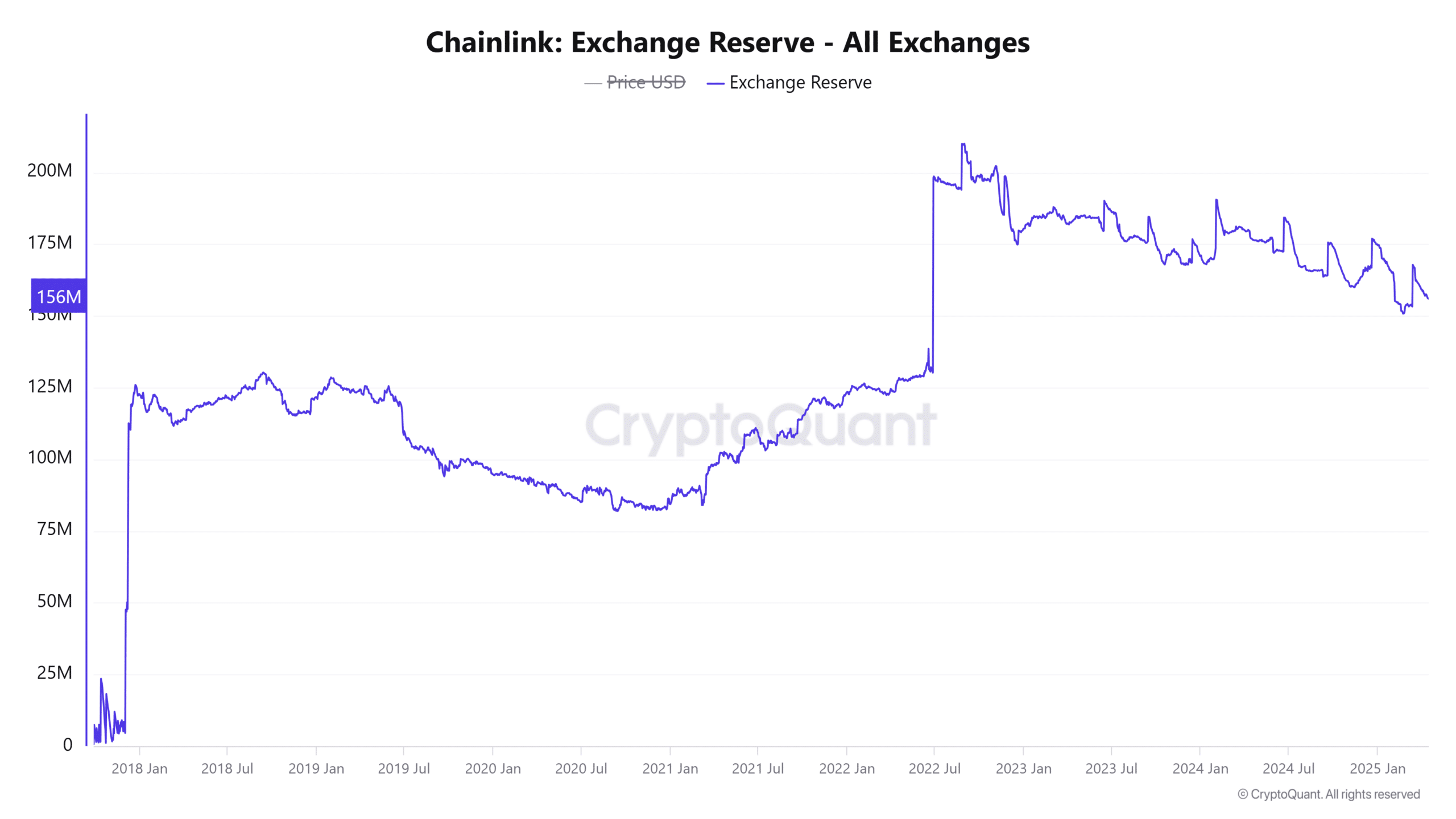

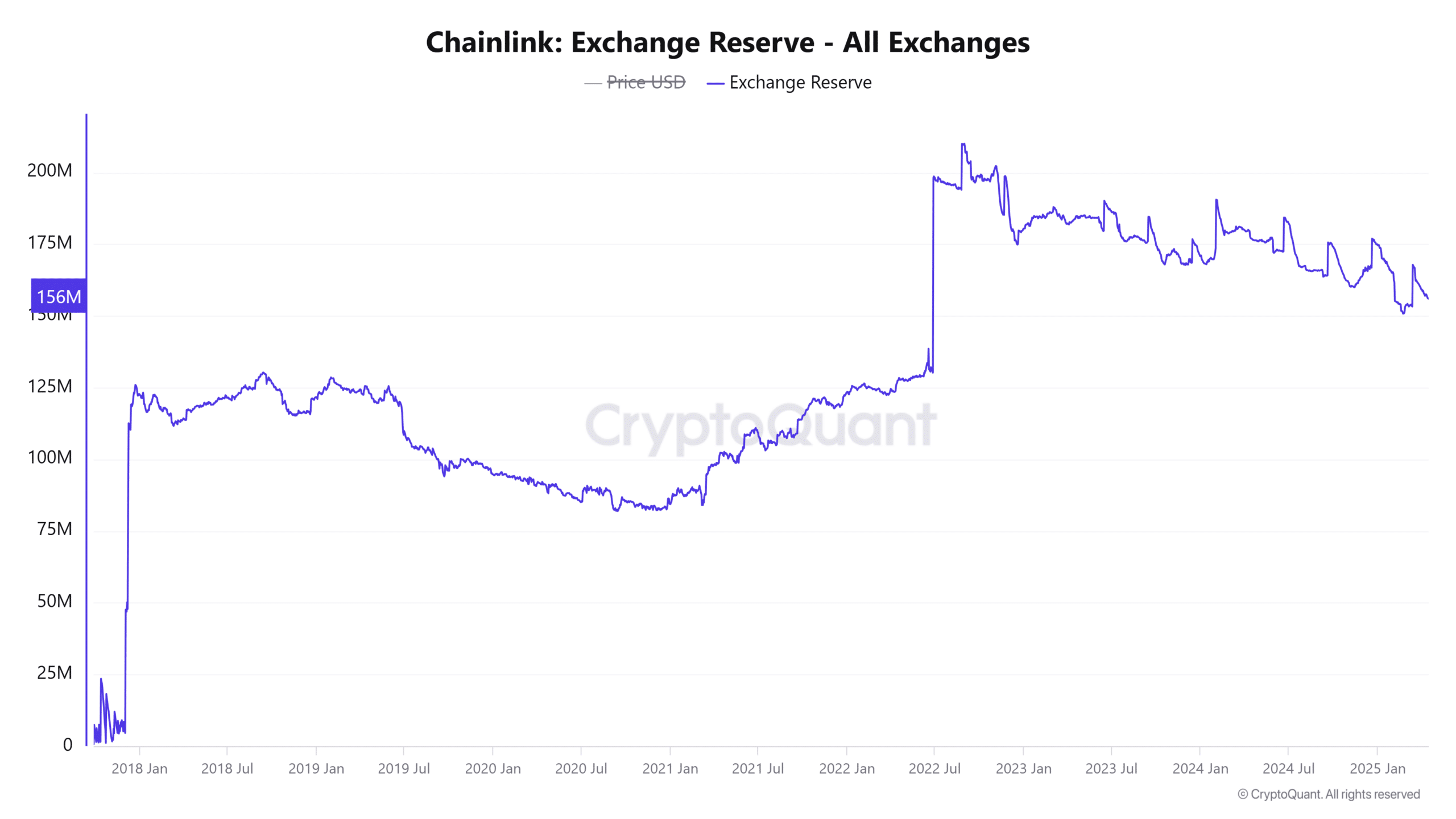

Within the meantime, trade reserve information revealed a lower of 0.2% over the last 24 hours, with a complete hyperlink at gala’s now at 156 million. This fall within the trade workplace levy hinted with falling sales-side version, usually seen throughout accumulative phases. If maintained, this pattern can help larger costs, particularly if demand begins to rise.

Supply: Cryptuquant

What suggests investor habits?

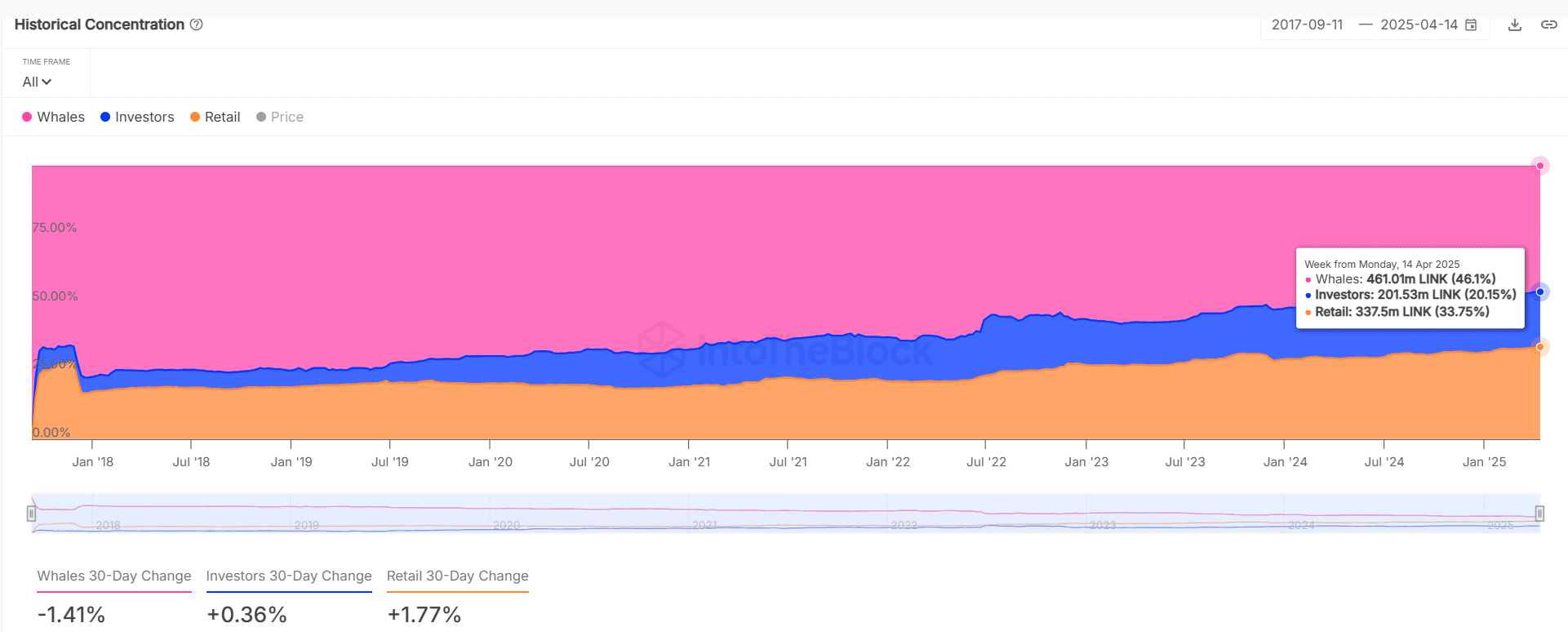

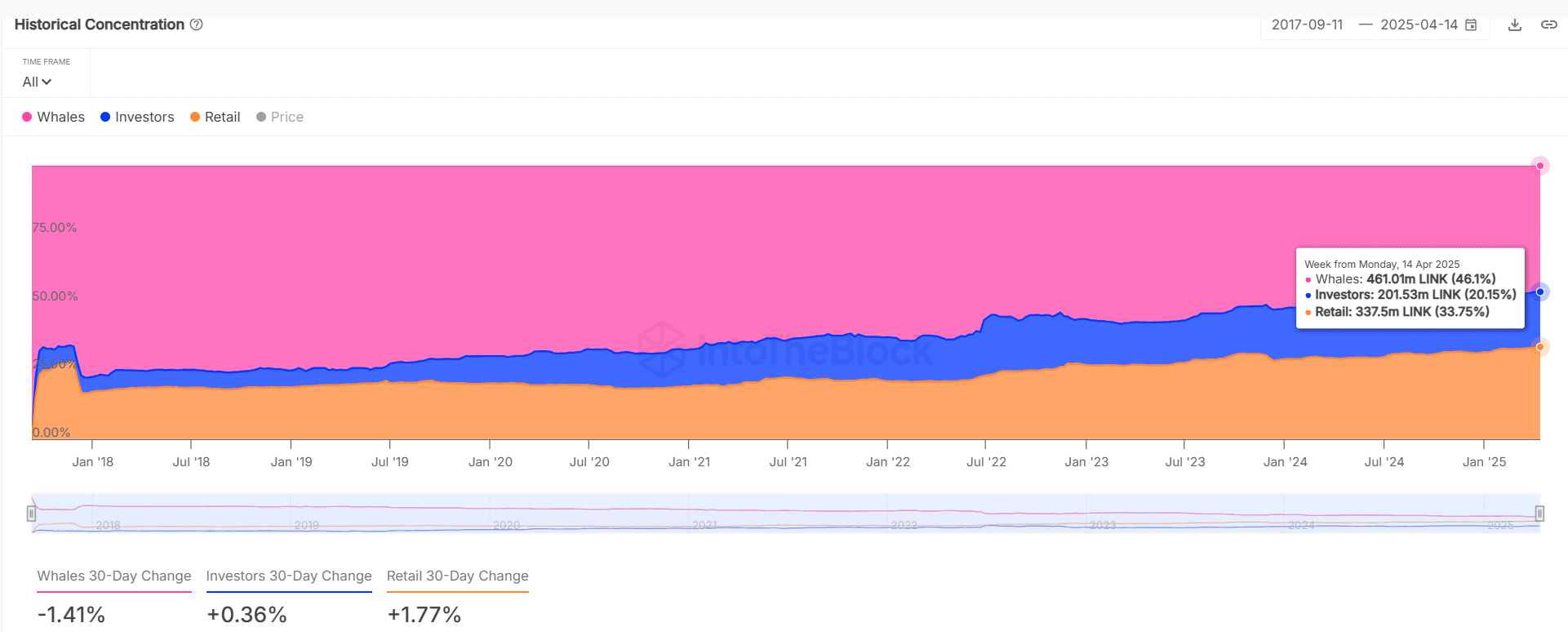

In the meanwhile, whales management 46.1% of Hyperlink. Nonetheless, their corporations fell by 1.41percentpreviously month.

Retail participation, then again, climbed by 1.77% and their investor pursuits rose marginal by 0.36%. This redistribution could point out rising curiosity from smaller market members, regardless of gentle whale outflow.

Supply: Intotheblock

Quite the opposite, tackle exercise advised that merchants are nonetheless on the sidelines. New addresses fell by 44.25%, energetic addresses with 49.5percentand zero-balance addresses with 56.62percentpreviously week.

This delay in community exercise can restrict the upward potential of hyperlink within the brief time period. Except quantity and participation return to the market.

Conclusion

The present association of Chainlink displays a market within the limo-prisoners between promising structural shifts and declining involvement of the chain. The $ 12.25 degree stays probably the most direct line of protection for bulls, supported by decrease trade reserves and constructive developments such because the PI Community Partnership.

Nonetheless, the blur of consumer exercise and a lower in whaling involvement introduce warning. A decisive bouncing above the time ranges may cause a momentum, however the failure to carry can hyperlink to a deeper correction space.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024