Analysis

Chainlink (LINK) Price Crashes 7.5%, Another 15% Drop Ahead?

Credit : coinpedia.org

The overall cryptocurrency market appears toarish. Within the midst of this, some traders noticed an opportunity and picked up them tokens, whereas others panicked and bought their firms.

610,000 hyperlink despatched to exchanges

A outstanding crypto skilled just lately shared a message on X (previously Twitter), which confirmed that Crypto -Walvissen have moved practically 610,000 chain hyperlink (hyperlink) to exchanges within the final 24 hours, which was signaling an elevated gross sales stress.

https://twitter.com/ali_charts/standing/189448777777664369086

Present worth momentum

This substantial switch of hyperlink tokens led to a outstanding worth lower. On the time of the press, the hyperlink close to $ 15 is traded, with greater than 7.50% within the final 24 hours. In the identical interval, nevertheless, commerce quantity elevated by 160%, which signifies an elevated participation of merchants and traders in comparison with the day prior to this.

The rise in commerce quantity might be because of the demolition of an extended -term consolidation zone and a shift in worth motion.

Chainlink (hyperlink) Technical evaluation and upcoming ranges

In accordance with the technical evaluation of specialists, Hyperlink Beararish appears and it’s prepared for additional decline. On the each day time frame, Hyperlink had consolidated inside a good attain for an extended interval. Because the market sentiment shifted, nevertheless, the energetic zone couldn’t maintain, breaking below consolidation and experiencing a big fall.

Trying on the worth motion and the historic momentum, Hyperlink appears to have discovered some assist close to $ 15. If this sentiment stays unchanged and hyperlink a each day candle beneath the extent of $ 15, there’s a robust risk that it’s once more 15percentcan lower, reaching the subsequent assist at $ 12.60.

This consolidation outage has pushed hyperlink right into a downtrend. Throughout the consolidation section, it not solely acted inside a good attain, but in addition moved above the 200 exponential advancing common (EMA) on the each day interval. This breakdown beneath 200 EMA can clarify the bearish pattern of the particular.

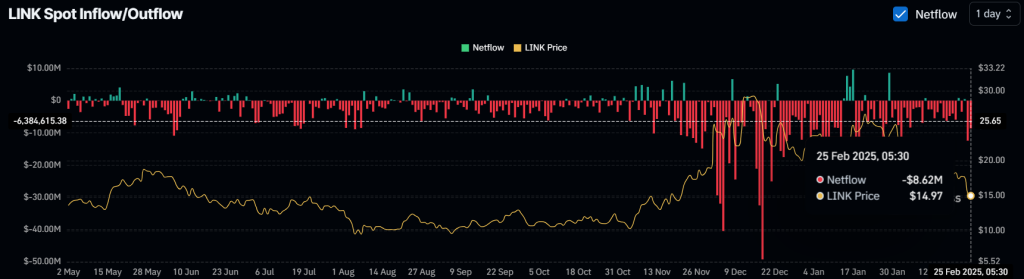

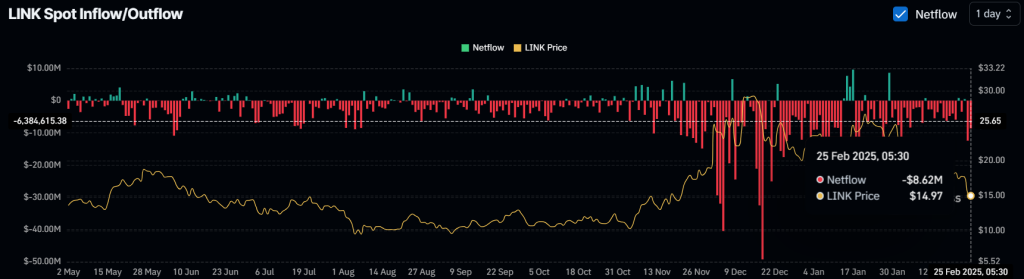

$ 8.65 million in hyperlink present

These Bearish prospects are maybe the rationale why whales have moved their hyperlink holdings to exchanges. Nonetheless, some long-term traders and holders have collected the tokens, as reported by the on-chain Analytics firm Coinglass.

Information from Spot -entry/outflow reveals that exchanges have witnessed within the final 24 hours of an outflow of greater than $ 8.65 million in hyperlink tokens, which signifies potential accumulation.

The numerous dumping and accumulation of hyperlink by traders, lengthy -term holders and whales replicate particular person sentiments within the midst of market uncertainty.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024