As of October 31, 2025, Chainlink (LINK) is buying and selling round $17.05, down about 2.8% within the final 24 hours. The decline comes because the broader crypto market’s momentum cools, with Bitcoin struggling to remain above $110,000.

Regardless of this decline, LINK stays one of many best-performing altcoins final quarter, with a 30% acquire in Q3 2025 on account of regular development in Chainlink’s oracle adoption and integrations into the DeFi protocols.

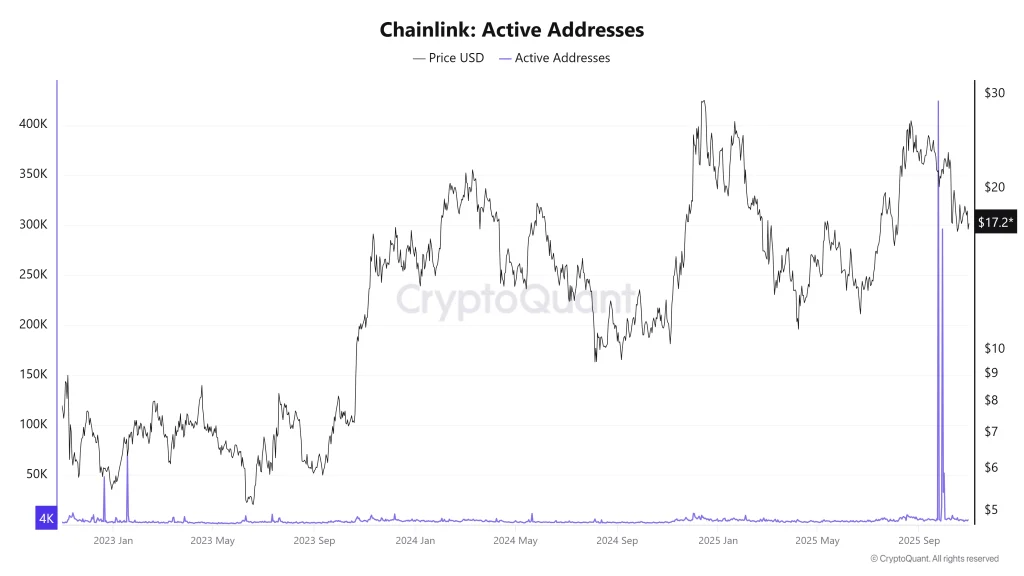

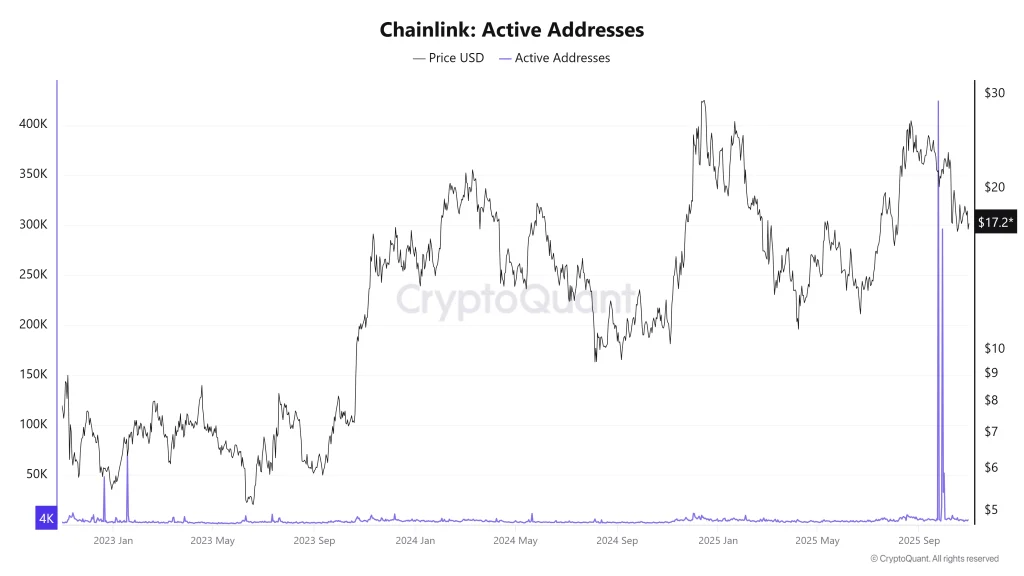

Chainlink lively addresses

In keeping with CryptoQuantCurrent on-chain knowledge reveals that whale transactions have slowed in comparison with final week, indicating lowered accumulation. Nonetheless, the whole variety of lively addresses stays steady, reflecting constant consumer engagement throughout the Chainlink ecosystem.

Moreover, merchants are preserving a detailed eye on Bitcoin’s subsequent transfer as LINK tends to reflect BTC’s short-term worth motion. A BTC rebound above $112,000 may assist LINK stabilize above $17 once more

LINK Worth evaluation

On the day by day chartLINK is damaged beneath ascending assist line close to $17.50turning it into speedy resistance. The subsequent large assist lies round $16.5adopted by $15.8.

- Resistance Ranges: $17.50 and $18.20

- Assist ranges: $16.50 and $15.80

- RSI (14): 43 – indicating delicate bearish strain

- MACD: Exhibits a weak bearish crossover

Chainlink (LINK) November Outlook

Wanting forward, the Assist zone at $16.5 will possible decide LINK’s subsequent course. A profitable protection may entice new consumers and push the value again above $18, whereas failure to carry it may result in a take a look at of $15.5.

With Chainlink’s continued partnerships in real-world knowledge tokenization and oracle enlargement, long-term sentiment continues optimisticeven when the short-term pattern appears considerably bearish.

Ceaselessly requested questions

The Chainlink worth fell on account of heavy institutional promoting, the lack of key technical assist, and the final sense of danger on account of Bitcoin’s correction.

The present assist ranges are at $16.50 and $15.33, whereas the resistance is $17.20.

Spikes in lively addresses point out rising exercise and volatility within the chain, which may precede a restoration or a deeper decline relying on how merchants react to new momentum.