Analysis

Chainlink Price Poised for a Major Upswing as CCIP and RWA Collaborations Accelerate Adoption

Credit : coinpedia.org

The value of the Chainlink token displays the rising popularity of the community, because it proved to be an important infrastructure layer within the decentralized ecosystem that resembles a “digital spine”. As a decentralized oracle community, Chainlink offers dependable information feeds to numerous blockchain purposes, making it an indispensable a part of the Web3 panorama.

Just lately, its affect has elevated dramatically as a consequence of steady technological developments and large-scale integrations. Even the onchain information speaks optimistically about it, particularly the Chainlink Reserve metric. This implies an impending upside alternative within the token value given its progress, which might break the present consolidating value motion it’s displaying on value charts.

CCIP is gaining momentum with new collaborations

One of many key catalysts behind the rally within the LINK value in USD is Chainlink’s Cross-Chain Interoperability Protocol (CCIP). This know-how is shortly turning into the trade commonplace for cross-chain connectivity.

The most recent announcement revealed that JovayNetwork will just do that integrate Chainlink CCIP as canonical cross-chain infrastructure from day one. Bulletins like this vastly reinforce Chainlink’s dominance in interoperability.

Moreover, the mission’s seek for real-world property (RWAs) continues to achieve momentum. A recent collaboration with OpenEden and Plume network goals to tokenize compliant RWAs utilizing Chainlink’s CCIP. The partnership will permit USDO to change into the primary bridged asset on Plume’s blockchain.

These are the most recent additions to Chainlink, however the mission has reached important milestones, with quite a few partnerships and collaborations introduced since early 2025.

Strengthening ties with conventional finance

Including to the thrill, Chainlink’s rising connection to conventional monetary infrastructure seems stronger than ever. On the finish of the third quarter they confirmed their partnerships. Now they’ve began sharing what they need to do subsequent, asserting it adopt blockchains and oracle networks as an essential subsequent step for his or her new blockchain-based ledger.

Now, alongside these traces, they shared a workflow diagram shared by Chainlink showcases its Cross-Chain Reference (CRE) framework built-in with SWIFT’s fee processor, labeled as a ‘successful entry’.

This improvement strongly suggests deeper institutional involvement that would take the Chainlink value prediction story to the subsequent stage within the coming months.

Unprecedented exercise and adoption within the chain

In response to ChainLink Statisticsthe ecosystem now secures a staggering $25.84 trillion price of transactions facilitated by its oracles. This determine underlines the big confidence and scale that Chainlink has achieved throughout a number of chains and industries. The rising adoption fee not solely will increase utility but additionally fuels bullish sentiment on the earth Chain link value chart.

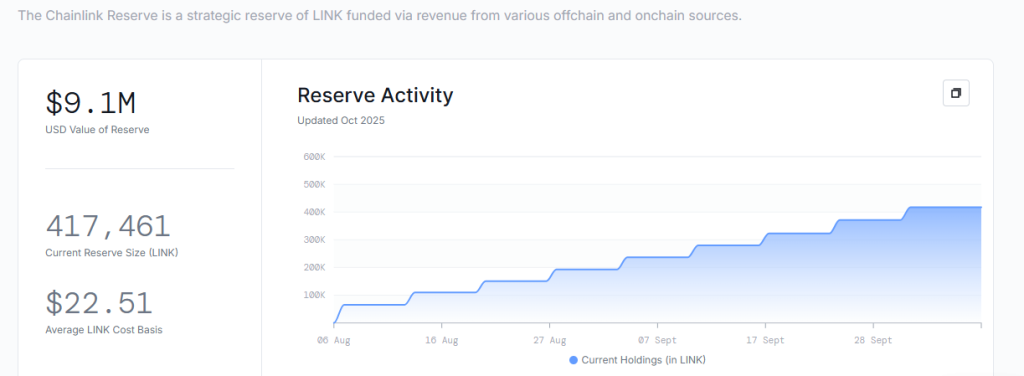

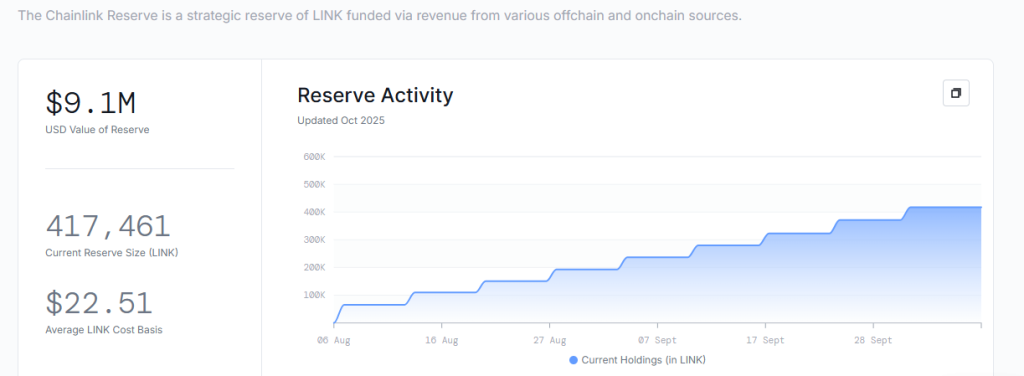

Market optimism is additional strengthened by the Chainlink Reserve, established has skilled explosive progress as a strategic fund, supported by each on-chain and off-chain revenue. From proudly owning only one LINK in August, it now owns greater than 417,000 LINK tokens, price roughly $9.1 million.

This fast accumulation displays buyers’ and establishments’ confidence within the long-term sustainability of Chainlink crypto.

Chainlink Worth Prediction: Is a Three-Digit LINK Inside Your Attain?

With constant ecosystem progress, strategic integrations, and unparalleled oracle dominance, Chainlink value might shortly break previous its double-digit section. Analysts within the crypto area anticipate that sustained adoption and institutional involvement might push LINK into triple-digit territory, particularly above $100, prior to anticipated.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial tips primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our overview coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We goal to offer well timed updates on every little thing crypto and blockchain, from startups to trade majors.

Funding disclaimer:

All opinions and insights shared signify the writer’s personal views on present market circumstances. Please do your personal analysis earlier than making any funding choices. Neither the author nor the publication accepts duty to your monetary decisions.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks could seem on our web site. Adverts are clearly marked and our editorial content material stays fully unbiased from our promoting companions.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now