Ethereum

Charting Ethereum’s path to ATH: Will Bitcoin’s record rally pave the way?

Credit : ambcrypto.com

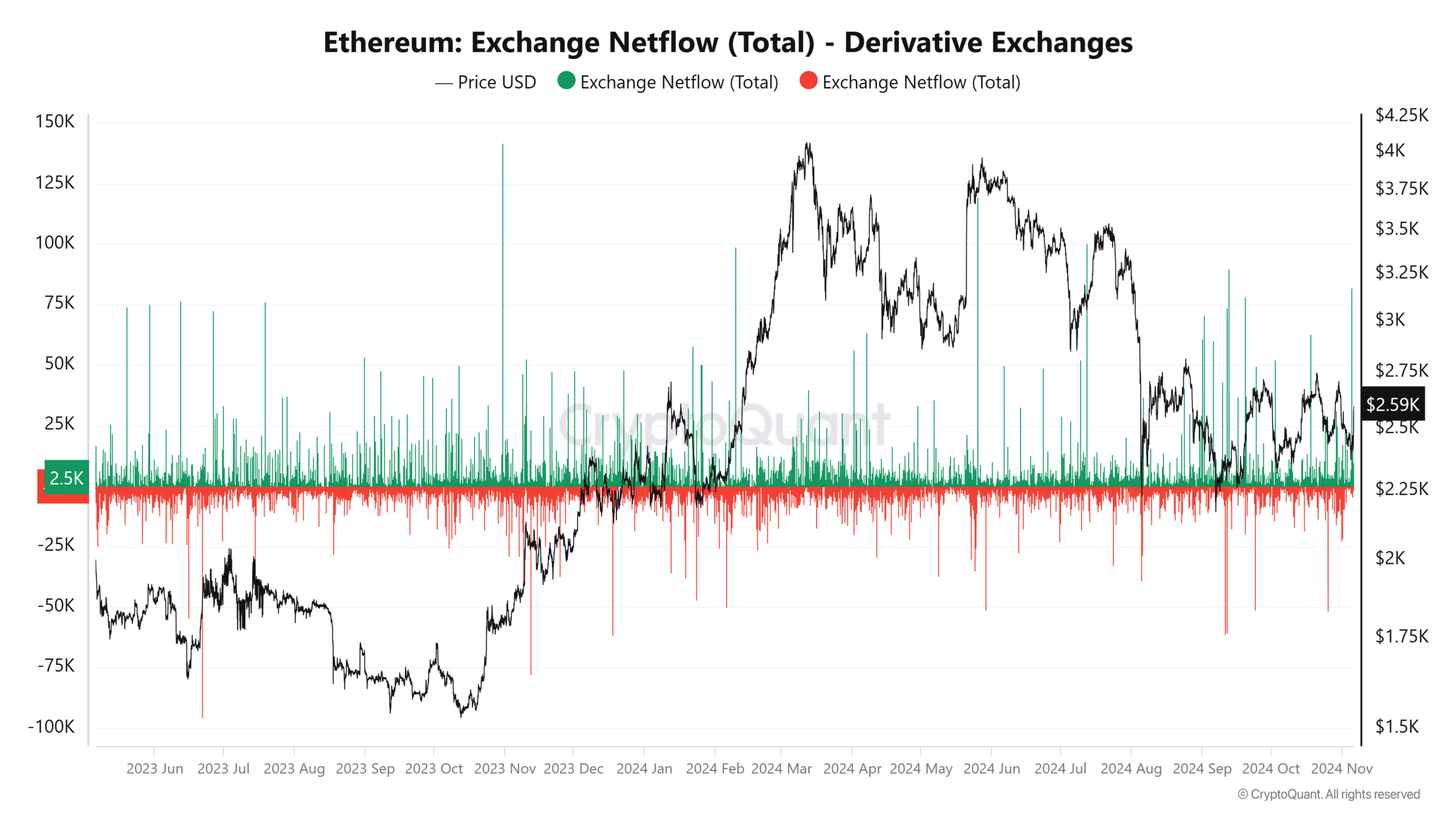

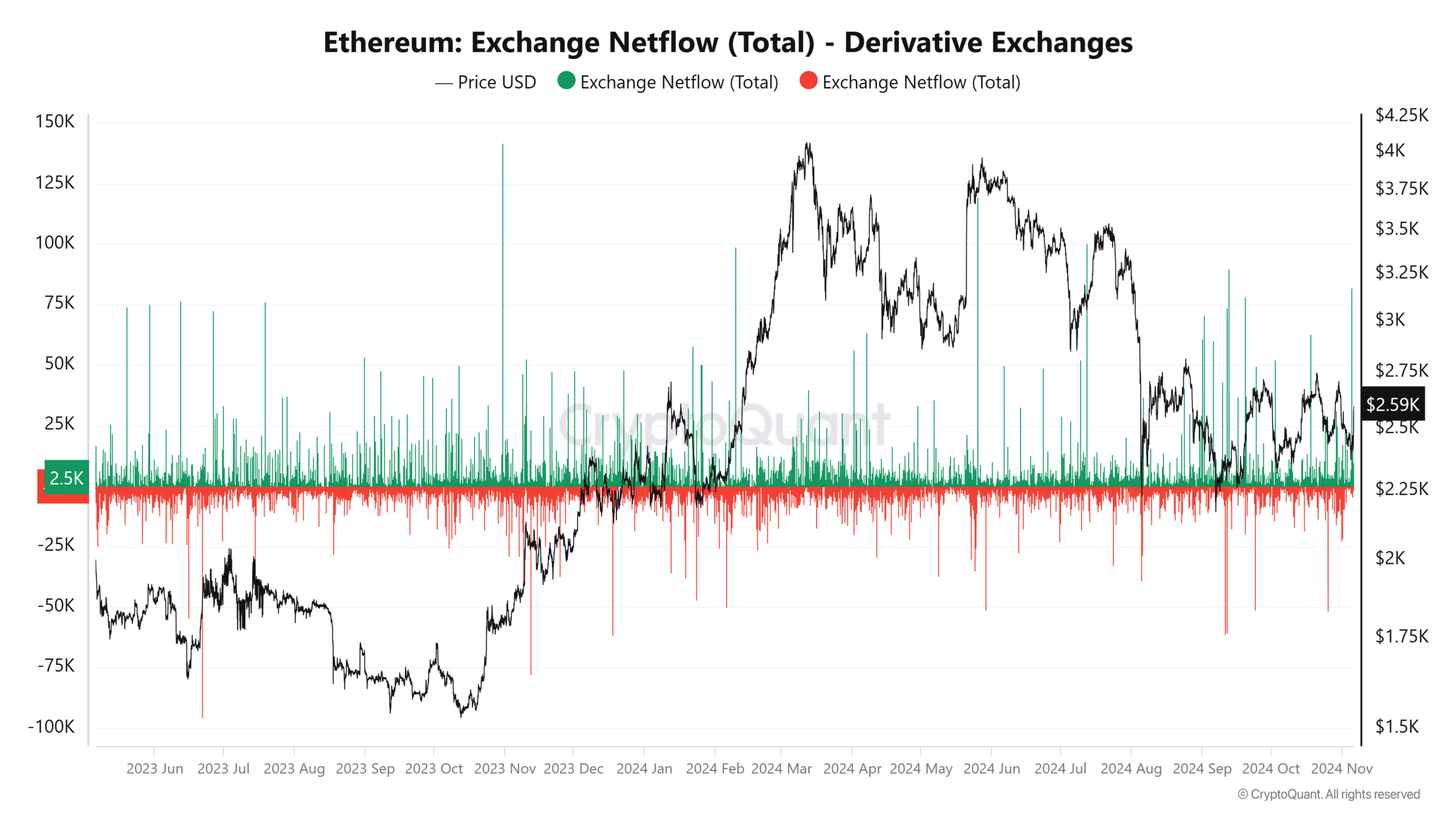

- Ethereum not too long ago noticed a spike in constructive web flows, with roughly 82,000 web flows to derivatives exchanges.

- ETH is up over 8% within the final 24 hours.

Ethereum’s current rise [ETH] the trade netflow, along with Bitcoin’s climb to a brand new all-time excessive (ATH), has generated renewed curiosity within the crypto market.

Ethereum has proven a notable enhance in web flows on derivatives exchanges, a shift which will point out altering investor sentiment. In the meantime, Bitcoin’s break above $75,000 has fueled optimism throughout the board.

Let’s take a more in-depth take a look at what these developments imply for ETH and when ETH might observe BTC’s lead.

Ethereum’s web movement spike displays rising curiosity

In current days, Ethereum’s web movement on derivatives exchanges has seen a big spike. Netflow, which measures the steadiness of belongings flowing into and out of exchanges, serves as an vital gauge of investor sentiment.

Constructive web flows usually point out accumulation, which signifies that traders are transferring belongings to exchanges for the aim of buying and selling or leveraging positions.

Alternatively, unfavourable web flows typically point out long-term possession, transferring belongings from the exchanges.

Supply: CryptoQuant

Web flows not too long ago spiked, with roughly 82,000 constructive web flows recorded per information CryptoQuant. The current spike coincides with elevated worth volatility.

Traditionally, such spikes have led to short-term worth adjustments, as bigger forex deposits typically sign that merchants are getting ready for giant strikes.

This habits means that traders are positioning themselves for potential shifts in Ethereum’s worth, and probably bracing for greater swings.

Ethereum’s worth response to earlier netflow will increase

A glance again at Ethereum’s web movement patterns reveals an attention-grabbing development: spikes in forex inflows are sometimes accompanied by vital worth shifts.

For instance, throughout earlier rallies this yr, durations of elevated web flows have been accompanied by sharp worth will increase as merchants positioned themselves to seize earnings or restrict danger.

Nonetheless, netflow spikes don’t at all times point out bullish sentiment; they will additionally create volatility as merchants put together for worth swings in both route.

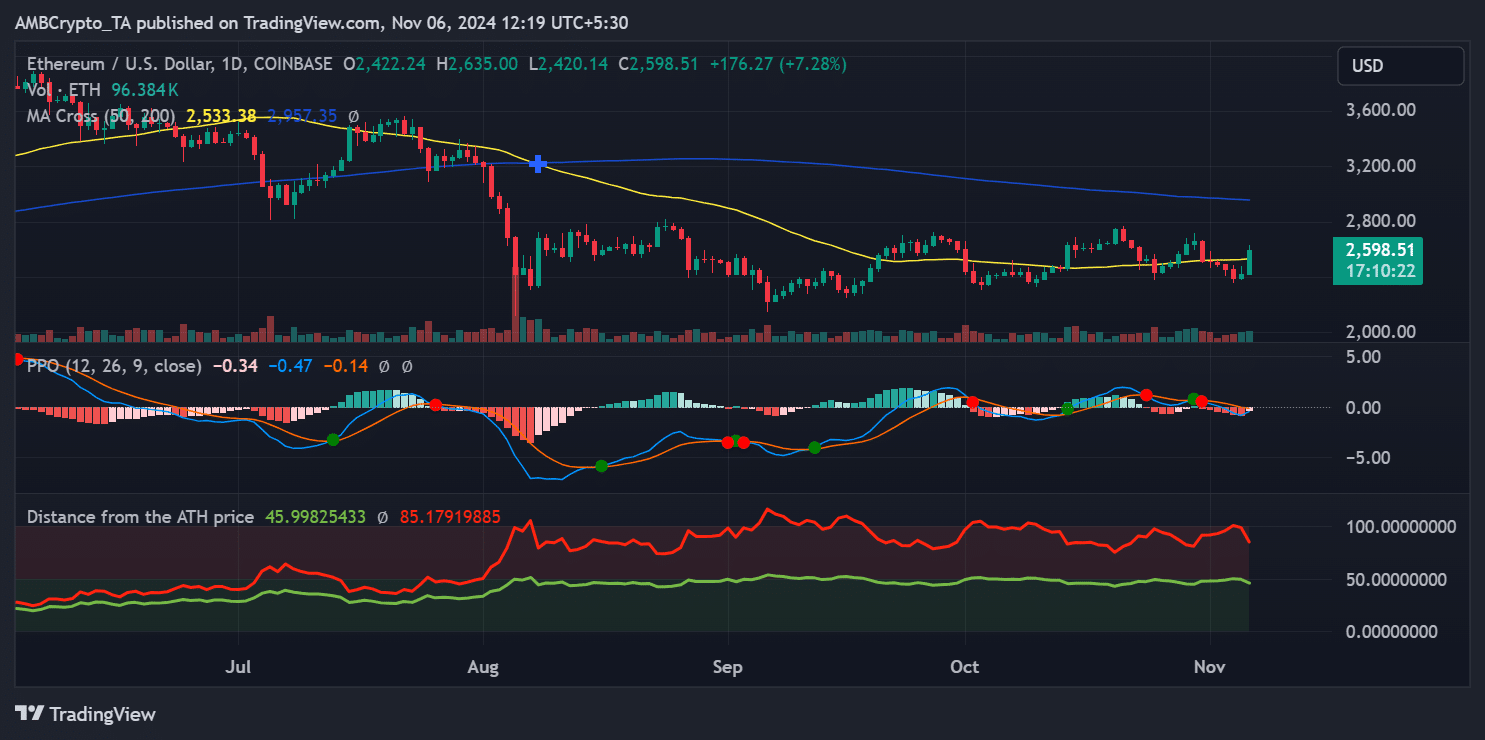

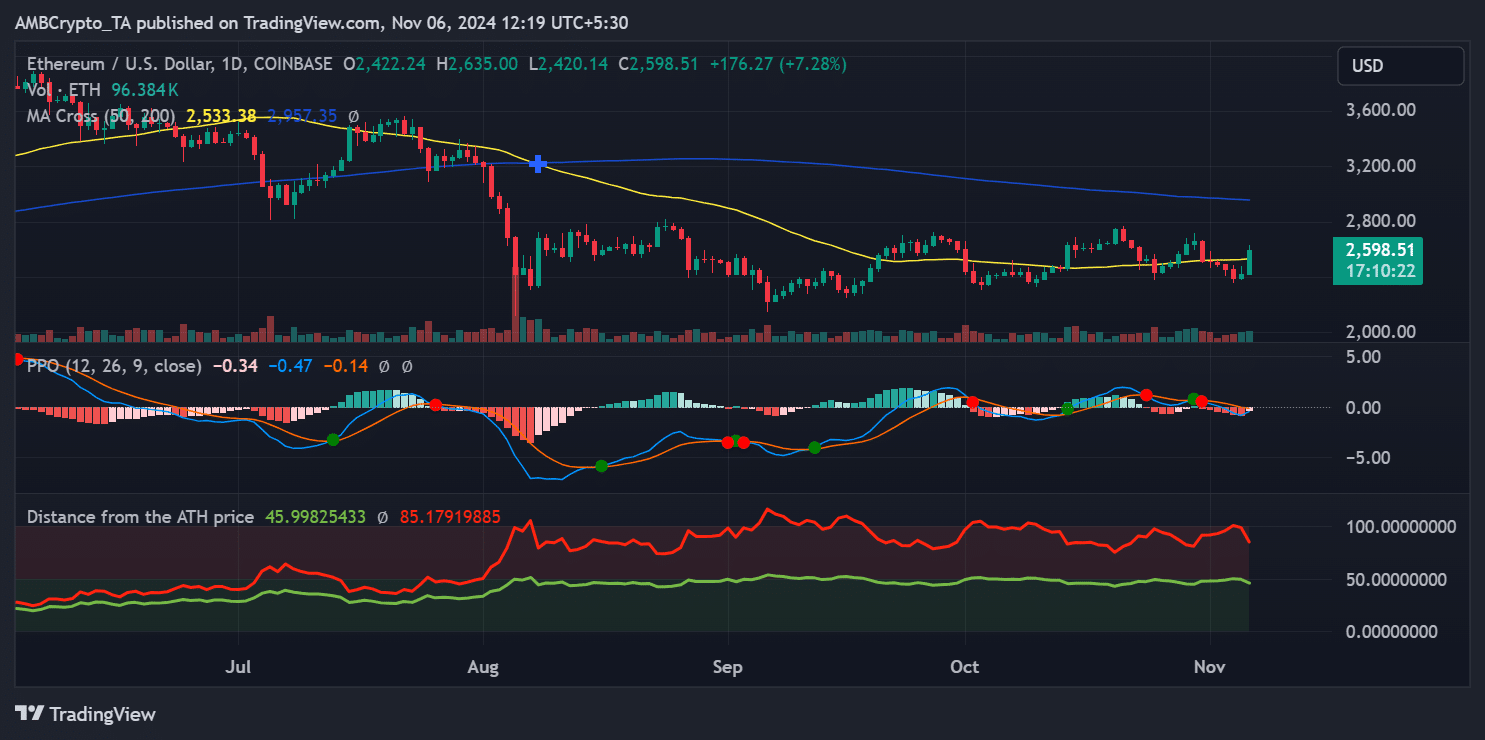

At the moment, Ethereum is buying and selling round $2,600, effectively under its ATH of round $4,800. Regardless of Bitcoin’s current rally, Ethereum has but to succeed in its all-time highs once more.

Nonetheless, the constructive web movement might point out rising optimism amongst traders anticipating a broader market rally. Whether or not ETH can preserve purchaser curiosity in present circumstances will likely be essential to its near-term trajectory.

Bitcoin’s ATH and implications for Ethereum

Bitcoin’s current surge above $75,000 has created a brand new ATH, fueling pleasure throughout the market. This efficiency has led to a ripple impact with potential implications for Ethereum’s worth route.

Whereas ETH stays at $2,600, effectively under its ATH, technical indicators level to paths that would help an uptrend.

To higher perceive ETH’s place, the Distance from ATH indicator reveals that ETH continues to be about 45% under its peak. This vital hole means that ETH has room for development if market sentiment stays constructive.

Traditionally, BTC’s ATH has typically paved the way in which for altcoin rallies as traders look to diversify their features from BTC into different key belongings similar to ETH. Given ETH’s tendency to observe Bitcoin’s lead, it might shut this hole if favorable circumstances persist.

Supply: TradingView

Moreover, the Proportion Value Oscillator (PPO) additionally offers perception into Ethereum’s momentum relative to its historic worth.

The PPO is presently just under zero, indicating a decline in bearish momentum. Ought to the PPO enter constructive territory, it might strengthen the case for a bullish development, suggesting that ETH might regain energy and face upward worth stress.

Ethereum/BTC pair stability and impartial energy

The Ethereum/Bitcoin (ETH/BTC) pair is one other priceless benchmark for assessing ETH’s efficiency. At the moment, the ETH/BTC ratio stays steady, implying that ETH retains its worth towards BTC at the same time as BTC reaches new highs.

If the ETH/BTC pair strengthens, it might point out that ETH is attracting traders independently of BTC’s strikes, doubtlessly paving the way in which for a extra continued rally.

Reasonable or not, right here is the ETH market cap by way of BTC

A broader revival of curiosity in Altcoin?

The mixture of accelerating Ethereum netflow on derivatives exchanges and Bitcoin’s ATH suggests a renewed curiosity in altcoins. Given the historic correlation between BTC and ETH, ETH might observe BTC’s upward momentum if BTC’s rally continues.

Whereas Ethereum continues to be far from its ATH, current web movement information signifies rising market curiosity and potential volatility forward.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now