Altcoin

Chartist predicts a sharp drop forward

Credit : www.newsbtc.com

Cause to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by specialists from the trade and thoroughly assessed

The very best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

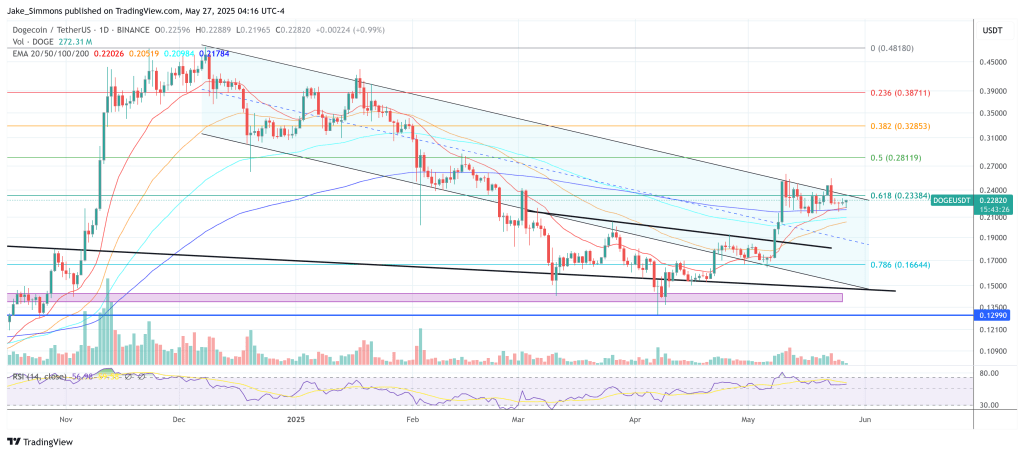

Dogecoin slid on Tuesday to the decrease finish of his month-to-month vary when the Impartial Chartist Quantum Ascent provided an in depth breakdown of why he believes that the meme-guy is partially resulting from a corrective cascade that would finish within the zone with excessive teenager. Midway by the afternoon in Europe, the token fluctuated at $ 0.228, nearly 12% below the height of 11 Could and nursing modest intraday losses.

Dogecoin enters the hazard zone

Assessing the every day graph, the analyst reheat To the explosive motion that began on 8 Could and produced a rise of fifty% three periods: “The final time we checked in right here on 8 Could, once we acquired this huge inexperienced candle, we stated, boys, plainly we kicked our fifth microwave right here,” he reminded viewers. His first upward projection was a modest 2.36 Fibonacci extension, however Dogecoin “truly went a lot increased”, an indication, he added, from a robust retail momentum, but in addition from a sample that now appears to be like.

Quantum Ascent has since migrated its golf counts to point out that the thrust was solely the fifth subgolf in a bigger First-Wave-Opmars. “We’re in the course of an ABC whereas we converse … These blue waves will go right here,” he stated, once more drawing the labels to mark the continual racement. In Elliott-Wave Parlance, the C-Leg should at the very least be the A-Been, and the presenter has transformed that rule into arithmetic: “Eighteen factors eight p.c from there … that is certainly one of our targets, about 20.5 cents.”

Associated lecture

Deeper penetration is just not solely doable, however statistically frequent, he argued, as a result of “usually it comes down on this third or fourth wave.” With the sizes of the early Could low to the highest of the mid-Could, he set the 0.500, 0.618 and 0.702 racements off-a band that prolonged roughly 19.5 cents to 17 cents and known as it “the logical zone for a first-and-second golf reset.” A shallower cease at 0.382, about 21.8 cents, could be ‘a reasonably shallow correction’.

One try to interrupt increased is already caught in what he has labeled the “Hazard Zone” between the rehabilities of 0.618 and 0.786: “We now have taken a stab for breaking, however we weren’t closed … We had been unhealthy, ended there on the 702, the rejection, and now it’s a little bit of overwhelming.” That failure leaves a close-by set off stage: “We break right here so low with 21 cents, then we see at the very least 20.5 cents.”

The tape promotion, he added, appears to be like like a Wyckoff-Heraccumulation construction: “Seems to be truthfully a type of Wyckoff and we construct the signal of energy right here earlier than we go away.” But the Bullish Pay-Off, when it comes, might be a couple of weeks forward. The correction alongside the way in which is “a macro that we’re engaged on now,” he stated, and emphasised that the following third wave could be decisive: “Macro Golf three – these are the fathers. These are the massive ones. These are the place we actually get some juice.”

Associated lecture

Macro context temperes any enthusiasm within the quick time period. Bitcoin-Wiens personal fifth golf prime beforehand arrived and his earlier cycle has already been extremely overrun in its personal ABC, and Quantum Ascent expects that Altcoins will “settle” alongside the Bellwether. “Whether or not it goes rapidly in a C-Wave or we simply maintain meandering, we must wait,” he concluded, and for followers to have a look at quantity profiles and shutting ranges as an alternative of intraday licking.

As all the time, Elliott-Wave counts stay interpretative as an alternative of predictive, and merchants should modify any positioning to their private threat limits. Dogecoin retains the eighth largest market capitalization in crypto, however elevated volatility implies that even small worth slats can translate into proportion of double -digit fluctuations.

On the time of the press, Doge traded at $ 0.228.

Featured picture made with dall.e, graph of tradingview.com

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024