Bitcoin

Coinbase Premium Index rebounds, pushes Bitcoin to $98K – Recovery odds?

Credit : ambcrypto.com

- Coinbase Premium Index rallied, indicating larger US demand for BTC

- Nevertheless, there appeared to be huge decrease liquidity that would restrict BTC to a sure value vary

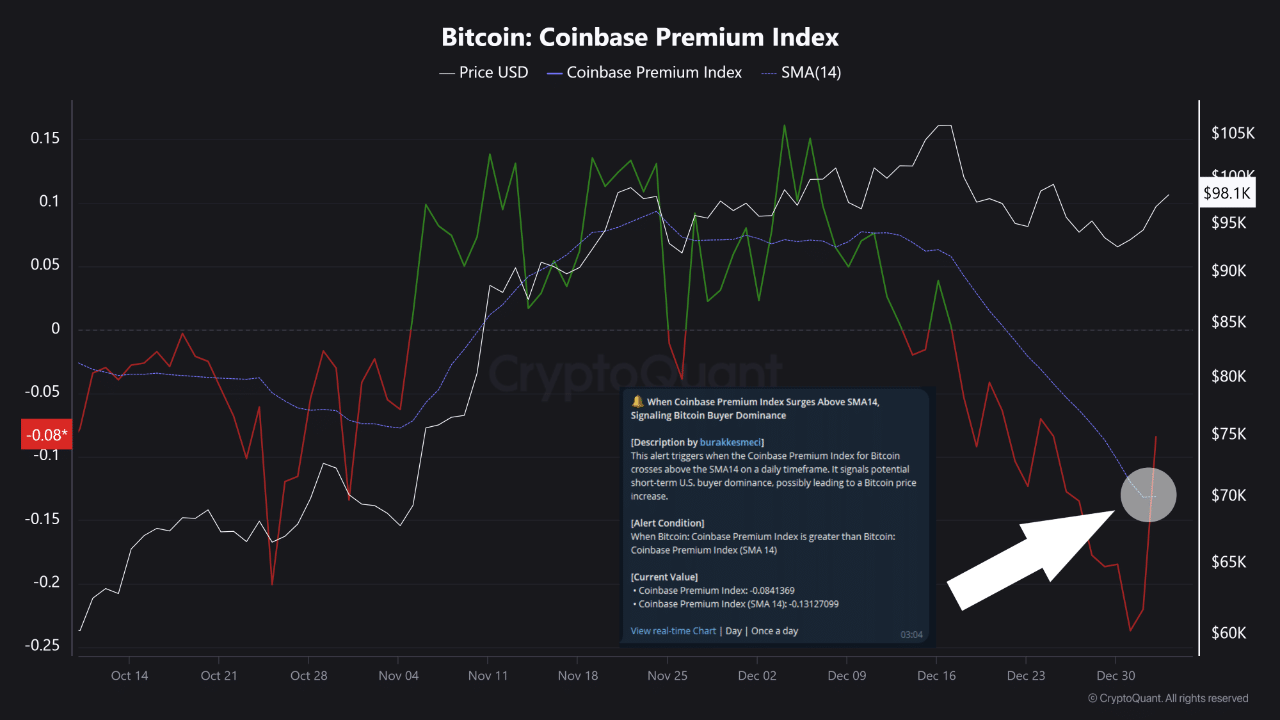

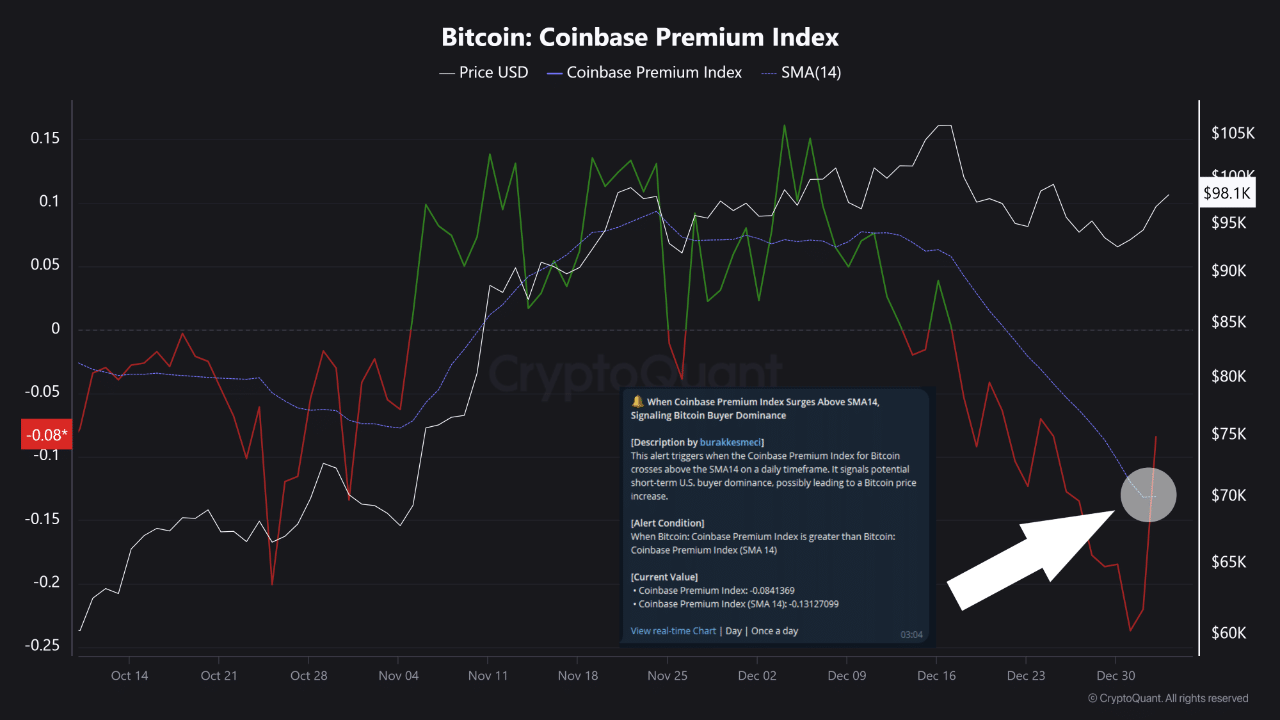

On Friday January 3, Bitcoin [BTC] rose to nearly $99,000 after a restoration in US demand, as mirrored within the Coinbase Premium Index. In reality, tHe lately listed decreased to a 12-month low after a risk-off strategy by US retail and institutional buyers through the vacation season.

The index additionally lately regained the important thing 14-day Easy Shifting Common (SMA) for the primary time in nearly a month. In response to CryptoQuant analyst Burak KesmeciThis highlighted larger dominance of American patrons available in the market.

“When the Coinbase Premium Index rises above the SMA14, indicating the dominance of Bitcoin patrons, this occasion is an early indicator that US-based patrons are regaining market dominance.”

Supply: CryptoQuant

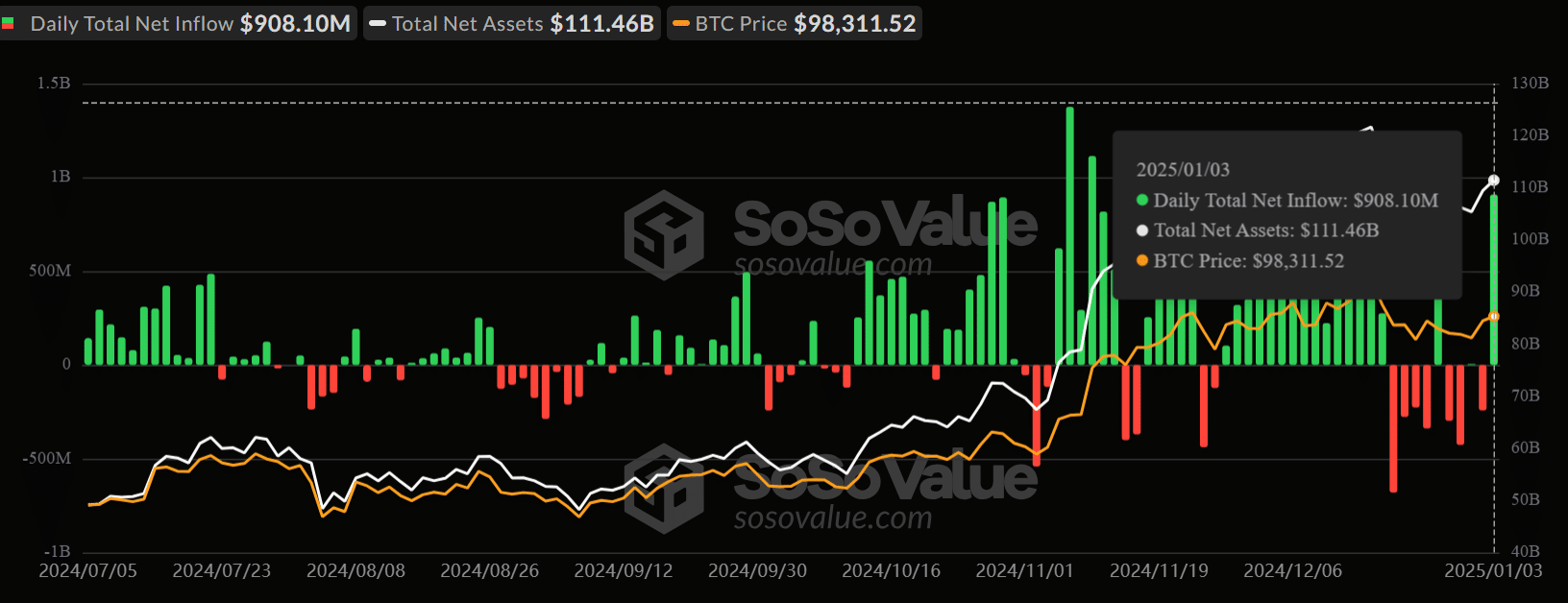

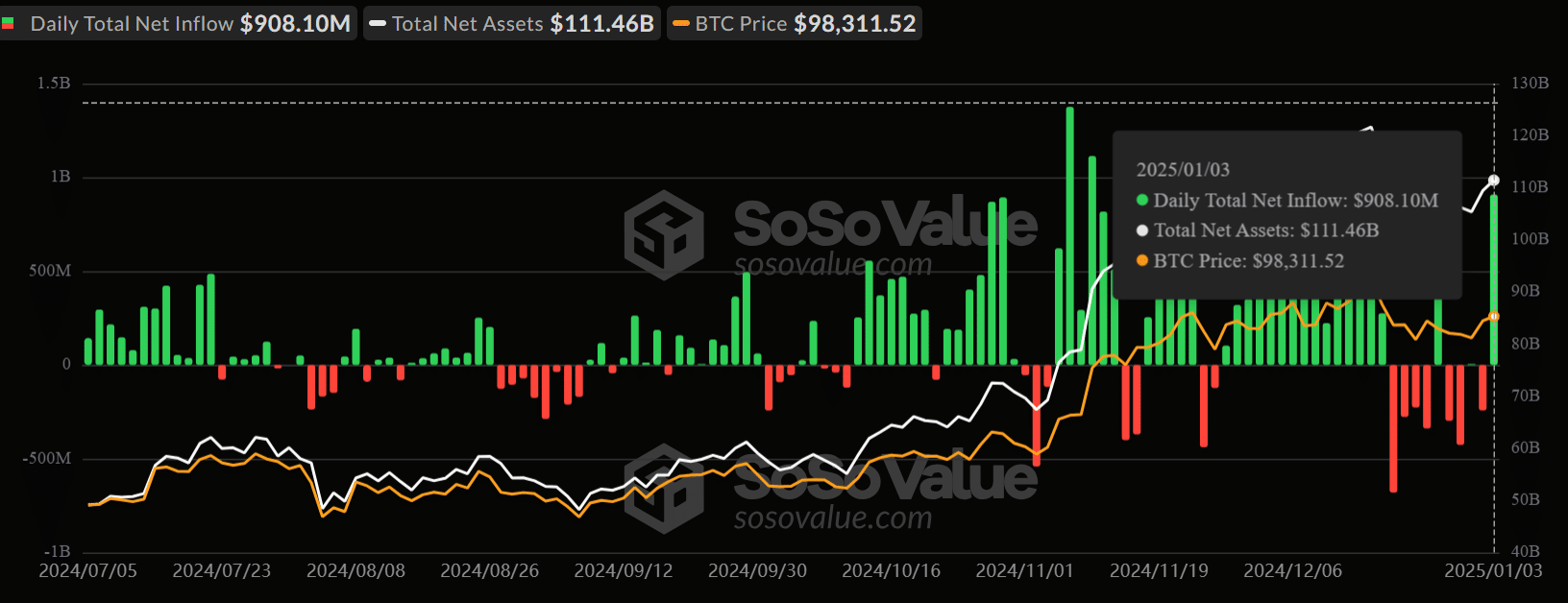

Bitcoin ETFs report day by day inflows of $908 million

The development was additionally clearly seen within the US BTC ETF advanced. They raked in $908 million in day by day internet inflows on Friday, marking a month-to-month excessive.

Even BlackRock’s IBIT, which began the 12 months with outflows, noticed $253 million in inflows on Friday.

Supply: Sosowaarde

Constancy’s FBTC led demand with $357 million and Ark Make investments’s ARKB got here third with inflows of $222 million. All advised, this indicated that institutional demand was again and helped BTC’s regular rise to $98.9k.

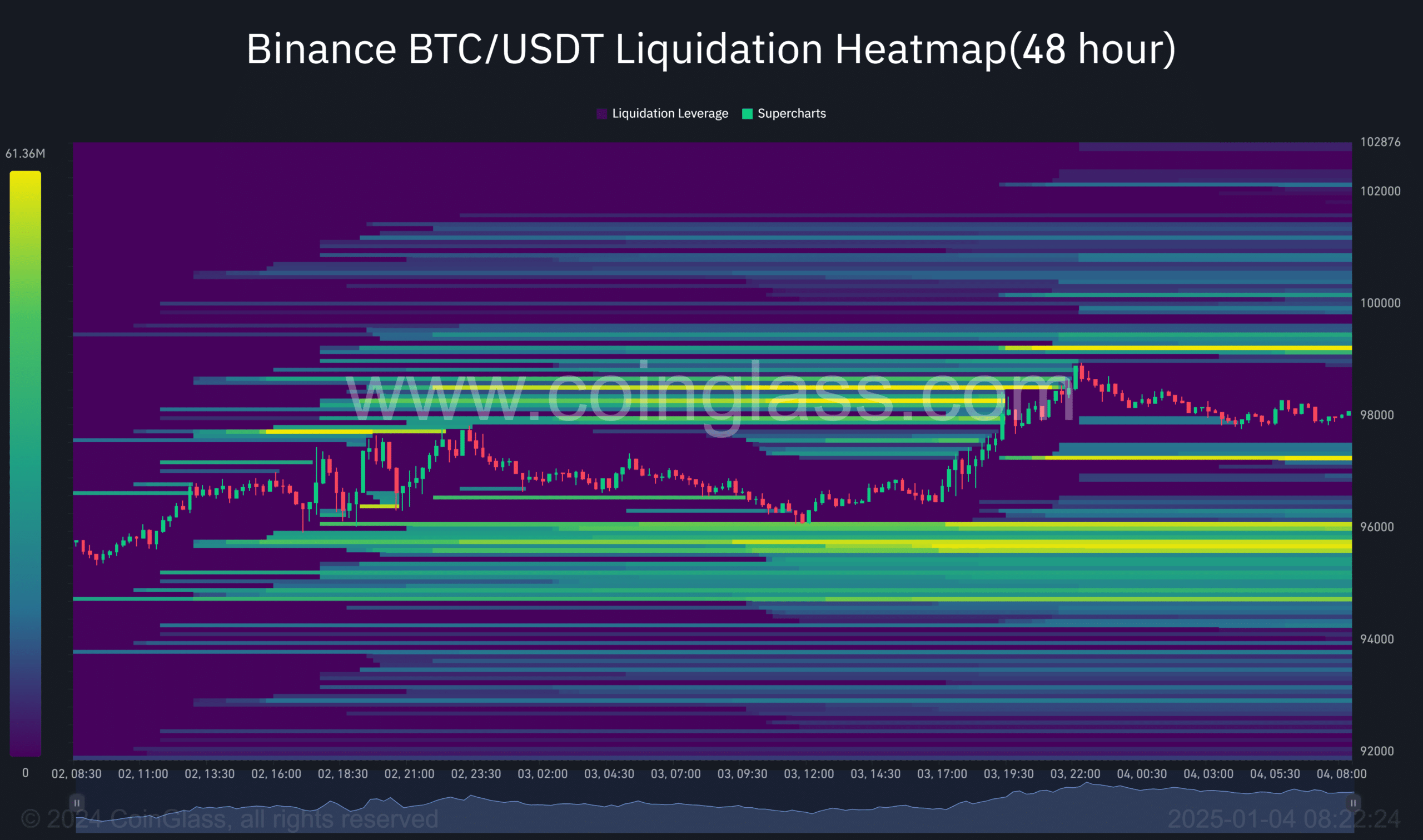

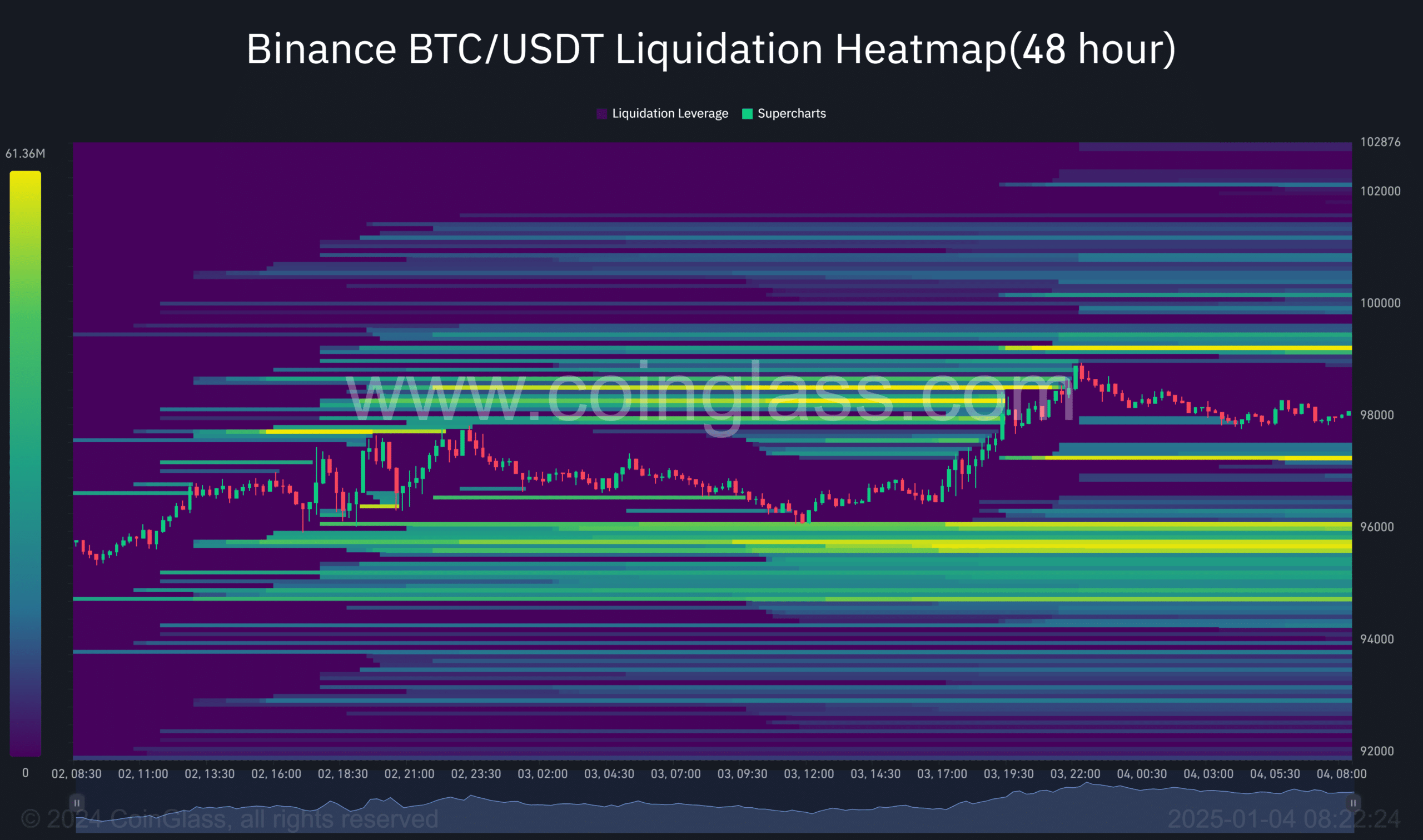

Moreover, the extended restoration has been pushed by a liquidity chase, as there was an enormous pile of quick positions on the $98k degree earlier this week. Now upside liquidity is between $99,000 and $100,000.

Likewise, the decrease liquidity ranges (shiny yellow zones) seemed to be at $97.2k, $96k and $95k.

Supply: Coinglass

Contemplating that on the time of writing extra liquidity seemed to be concentrated on the backside of the worth motion, a drop to $97,000-$95,000 can’t be overruled.

Learn Bitcoin [BTC] Worth prediction 2025-2026

Put one other means, the liquidation heatmap recommended that BTC might attain a value vary between $96,000 and $100,000 within the close to time period.

Nevertheless, it stays to be seen whether or not sturdy demand for BTC ETFs will set off a bullish breakout above $100,000.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now