Altcoin

Coinbase Premium Shows Warning Signs for Ethereum Price – Explained

Credit : ambcrypto.com

- The decline in new addresses was indicative of the broader lack of ETH demand

- Value motion and Coinbase Premium indicated sturdy promoting strain in latest weeks

Ethereum [ETH] has misplaced 12.44% of its worth within the final 30 days, in comparison with that of Bitcoin [BTC] losses of 4.74% on the time of writing. In reality, ETH has struggled to defend key help ranges over the previous six weeks. The affinity with the $3k degree and thereabouts has given rise to lots of jokes made on the expense of ETH holders and bulls.

Regardless of the bearish sentiment, accumulation of whales has been continued. The $30 million withdrawal from Binance was not consultant of market sentiment. In reality, the value motion and different metrics supplied extra bearish than bullish indicators.

Supply: Ali Martinez on X

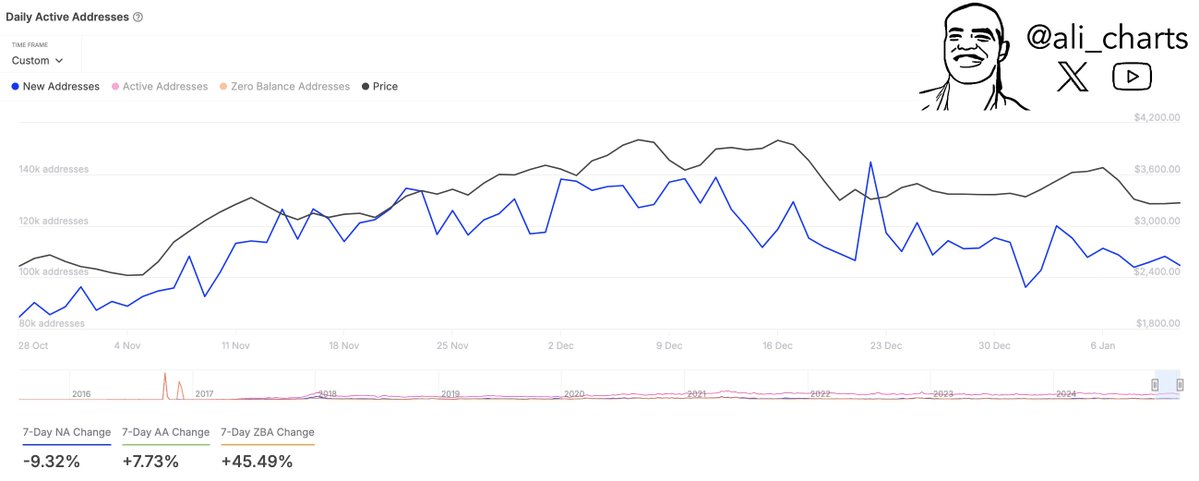

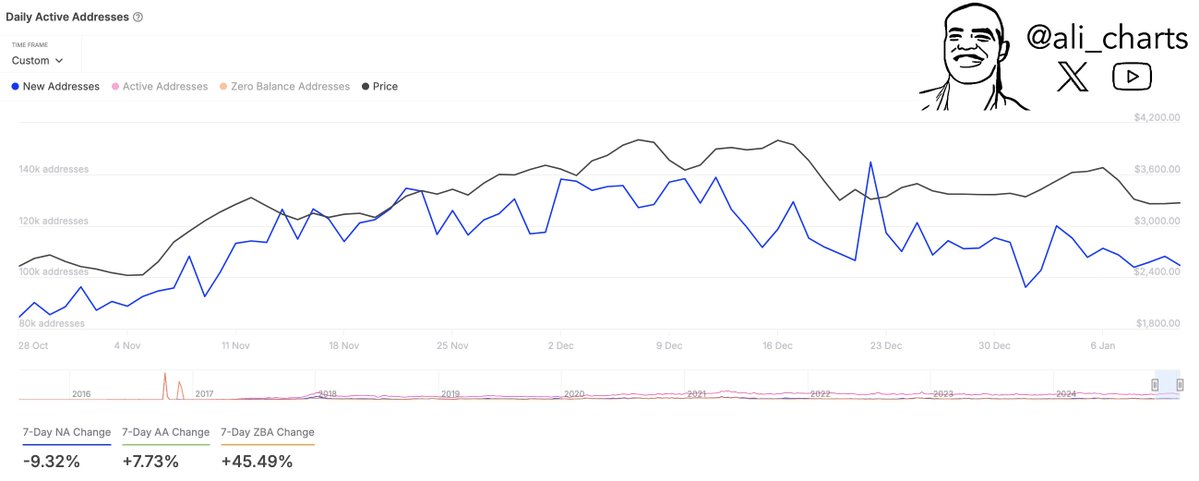

In a single message on X (previously Twitter) crypto analyst Ali Martinez famous that community progress is slowing. The variety of new addresses up to now week (7 days AFTER) was -9.32%. This indicated diminished adoption and demand from newcomers to the chain.

Alternatively, the seven-day lively tackle change noticed a constructive change of seven.7%. This indicated fewer new arrivals, however greater buying and selling and networking exercise over the previous week.

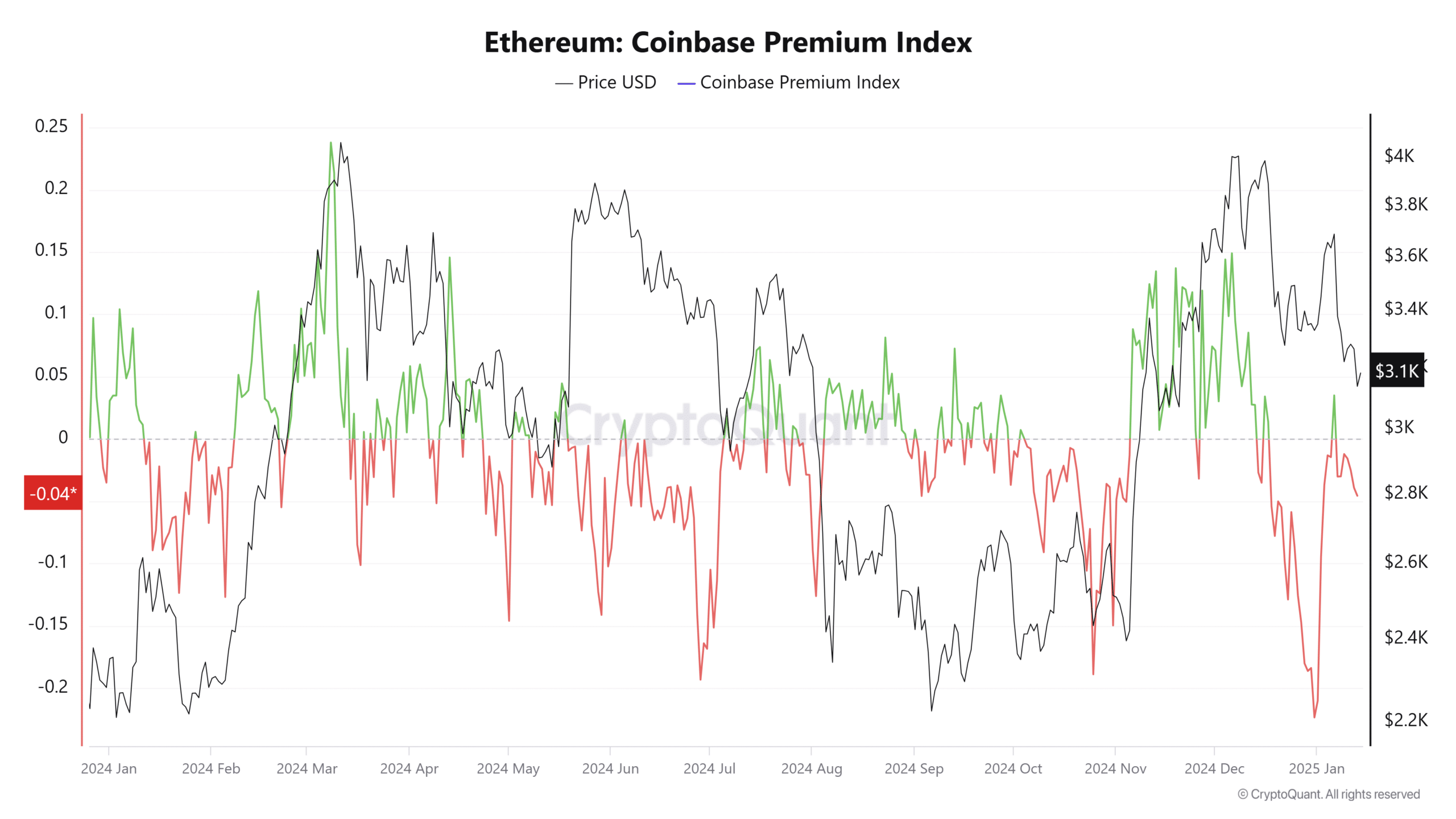

Trying again over an extended time frame, Coinbase Premium has been in detrimental territory for many of the previous month. This metric tracks the proportion distinction between Ethereum costs on Coinbase and Binance, offering some perception into the habits of US-based traders.

The detrimental premium on Coinbase implied better promoting strain and weak shopping for from US contributors. It additionally underlined the cautious strategy to ETH by these merchants.

Supply: ETH/USDT on TradingView

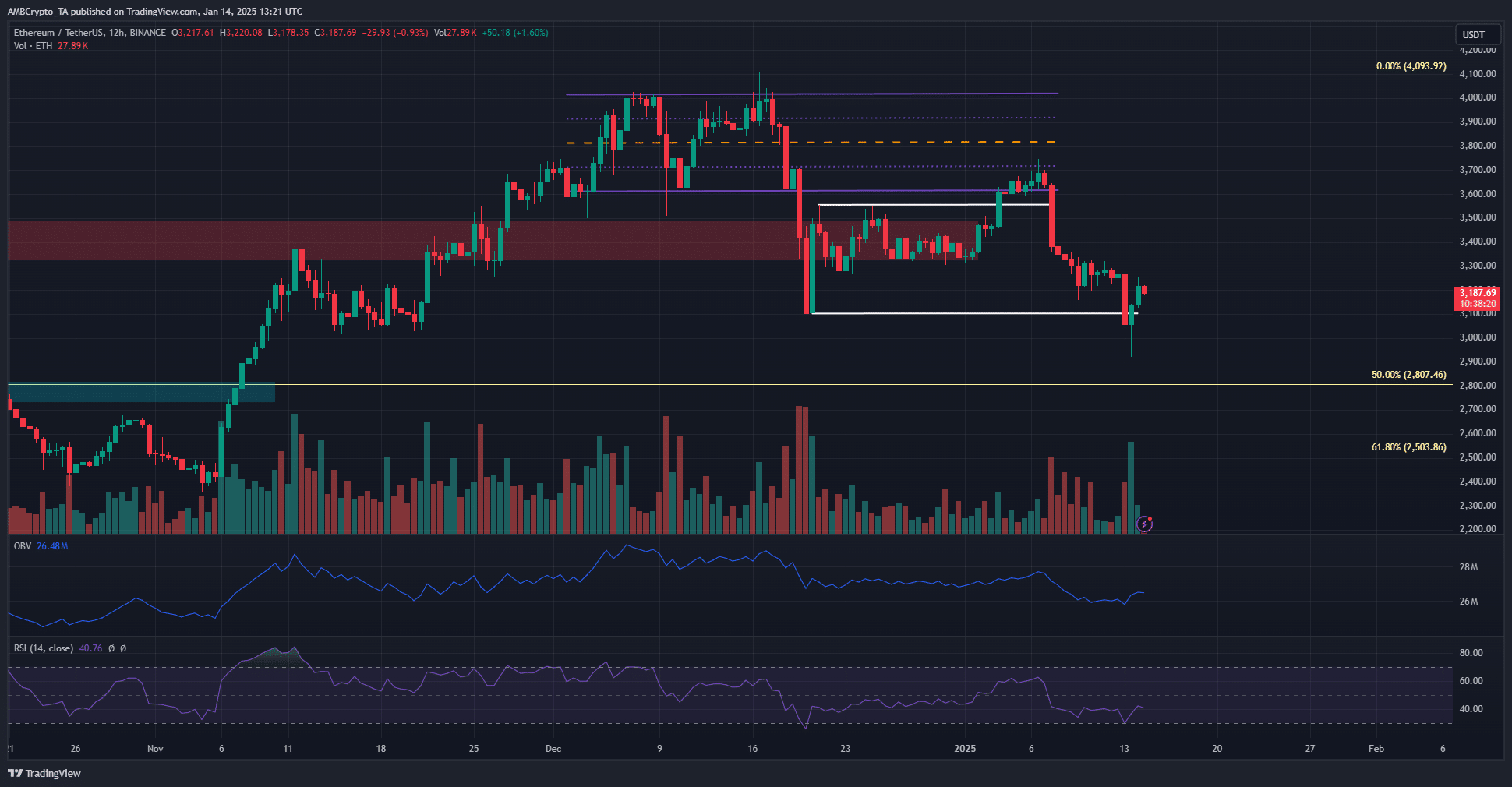

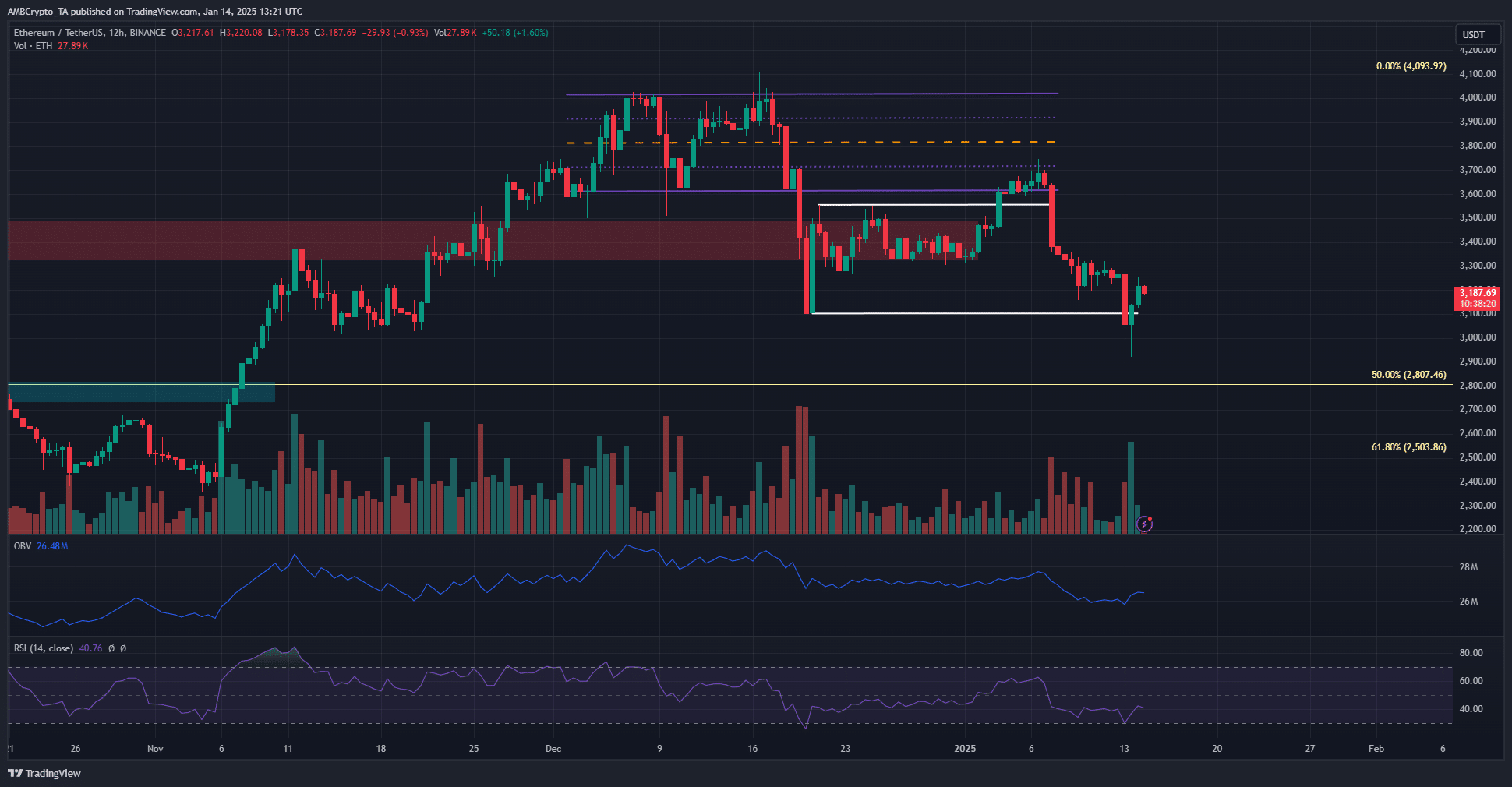

The value motion of the previous two months additionally highlighted the warning and eagerness to promote ETH. The bandwidth formation within the first half of December gave means as BTC crashed from $108,000 to $92,000. Whereas BTC was buying and selling at $96.5k on the time of writing, ETH hit decrease lows and was valued just below $3.2k.

Is your portfolio inexperienced? Examine the Ethereum revenue calculator

Lastly, the OBV highlighted the regular promoting strain since December by marking a collection of decrease highs. The RSI additionally famous the prevailing bearish momentum.

As issues stand now, the $3.4k resistance zone must be reclaimed earlier than swing merchants can undertake a bullish bias.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now