Ethereum

Coinbase Premium Signals Aggressive Ethereum Accumulation: Institutional Demand Accelerates

Credit : www.newsbtc.com

Ethereum has risen greater than 70% since mid -June and marks probably the most spectacular conferences of the 12 months. The transfer is pushed by a powerful momentum, with bulls firmly beneath management as a result of ETH not too long ago not too long ago recovered the crucial stage of $ 3,500. Specifically, the uptrend has proven little to no retracement because the preliminary outbreak, which signifies that persistent pursuits and belief with buyers is signaling.

Associated lecture

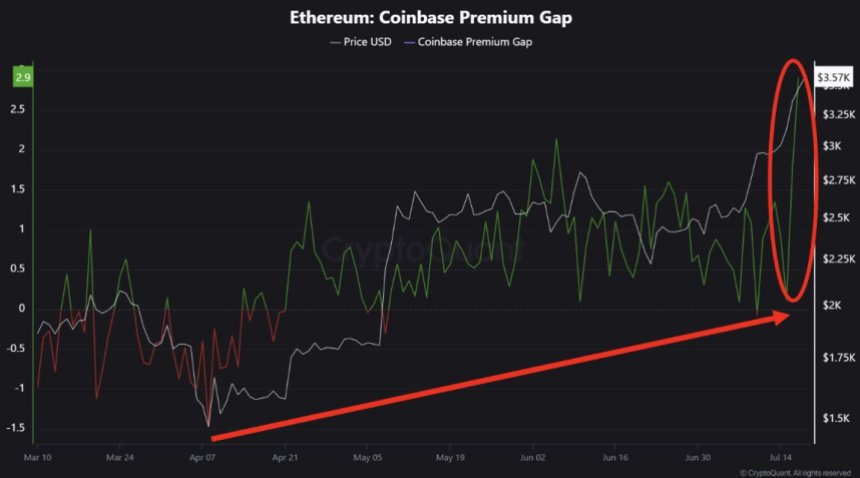

One of the vital placing developments to help this step comes from cryptoquant, which emphasizes the rise of an vital premium on Ethereum that’s traded by way of Coinbase. That is notably exceptional as a result of Coinbase is a platform that’s primarily utilized by American establishments and Hoognet-worthy people. The premium suggests aggressive spot buy via whales, indicating renewed institutional significance in Ethereum.

This renewed query comes when the broader cryptomarkt sees clearer regulatory indicators and the ETF flows in ETH-related merchandise improve. Whereas Ethereum continues to surpass and entice capital, merchants are intently monitoring to see if this momentum will put on a wider Altcoin rally and even the start of a long-awaited altiation season.

American whales lead the lead whereas shopping for Ethereum -activity accelerates

In line with a current report Resulting from cryptoquant analyst Crypto Dan, Ethereum sees a exceptional improve in shopping for exercise, particularly of whales established within the US. The regular improve in accumulation, mixed with a transparent premium on Coinbase, means that gamers with a excessive web worth place themselves additional on the highest.

To help this development, day by day influx into Ethereum Spot ETFs have risen to new all-time highlights. This sharp peak displays the rising institutional confidence in ETH as a core digital energetic, particularly after current readability of the rules within the US. Now that Ethereum is now being traded above $ 3,600, the demand continues to exceed the availability over a number of channels.

What makes this rally notably attention-grabbing is the present market atmosphere. Statistics on the chain present that Ethereum just isn’t but considerably overheated. Indicators similar to NUPL (Internet non -realized revenue/loss) recommend room for additional enlargement earlier than extreme euphoria begins. This creates favorable situations for ETH to consolidate at increased ranges earlier than they could escape once more.

Nonetheless, within the coming weeks will probably be essential. If sturdy consumption and bullish momentum persist in the long run of Q3 2025, analysts warn that signing overheating may trigger. Though we aren’t there but, repeated vertical actions with out retracement should be cautious. Traders could must reassess the danger stage if the sample continues.

Associated lecture

Ethereum breaks key resistance with a powerful weekly candle

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024