Blockchain

Coinbase wants to bring the entire startup lifecycle onchain, CEO Armstrong says

Credit : cryptonews.net

Coinbase CEO Brian Armstrong has outlined an formidable plan to maneuver each stage of a startup’s journey, from incorporation to fundraising and public buying and selling, to the blockchain.

Talking on the TBPN podcast, Armstrong described his imaginative and prescient for an onchain lifecycle the place founders may launch their startups, increase seed rounds, obtain capital straight in USDC (USDC), and finally go public through tokenized fairness.

“You possibly can think about this entire lifecycle coming into the chain,” he stated, including that such a shift “may improve the variety of corporations which might be going to lift capital and get going on this planet.”

Armstrong stated startups will now not want banks or attorneys to deal with world transfers as funding could be raised immediately via onchain sensible contracts. As soon as the capital arrives, founders can begin producing income, accepting crypto funds, accessing financing, and even taking their corporations public straight down the chain.

Associated: Coinbase CEO reveals ‘personal transactions’ coming to Base

Fundraising onchain

Coinbase’s CEO famous that the fundraising course of is “fairly difficult” in the intervening time. He proposed onchain fundraising to make capital formation “extra environment friendly, fairer and extra clear,” leveraging Coinbase’s current acquisition of fundraising platform Echo.

Echo, now a part of Coinbase, has helped greater than 200 initiatives increase greater than $200 million. Armstrong stated the corporate will initially function independently however step by step combine with Coinbase’s ecosystem, giving its founders entry to its half-trillion {dollars} in custodial belongings and a worldwide investor base.

“If we will usher in nice builders who need to increase cash and join them with traders who’ve the cash, we’re the right platform to assist speed up this,” he stated.

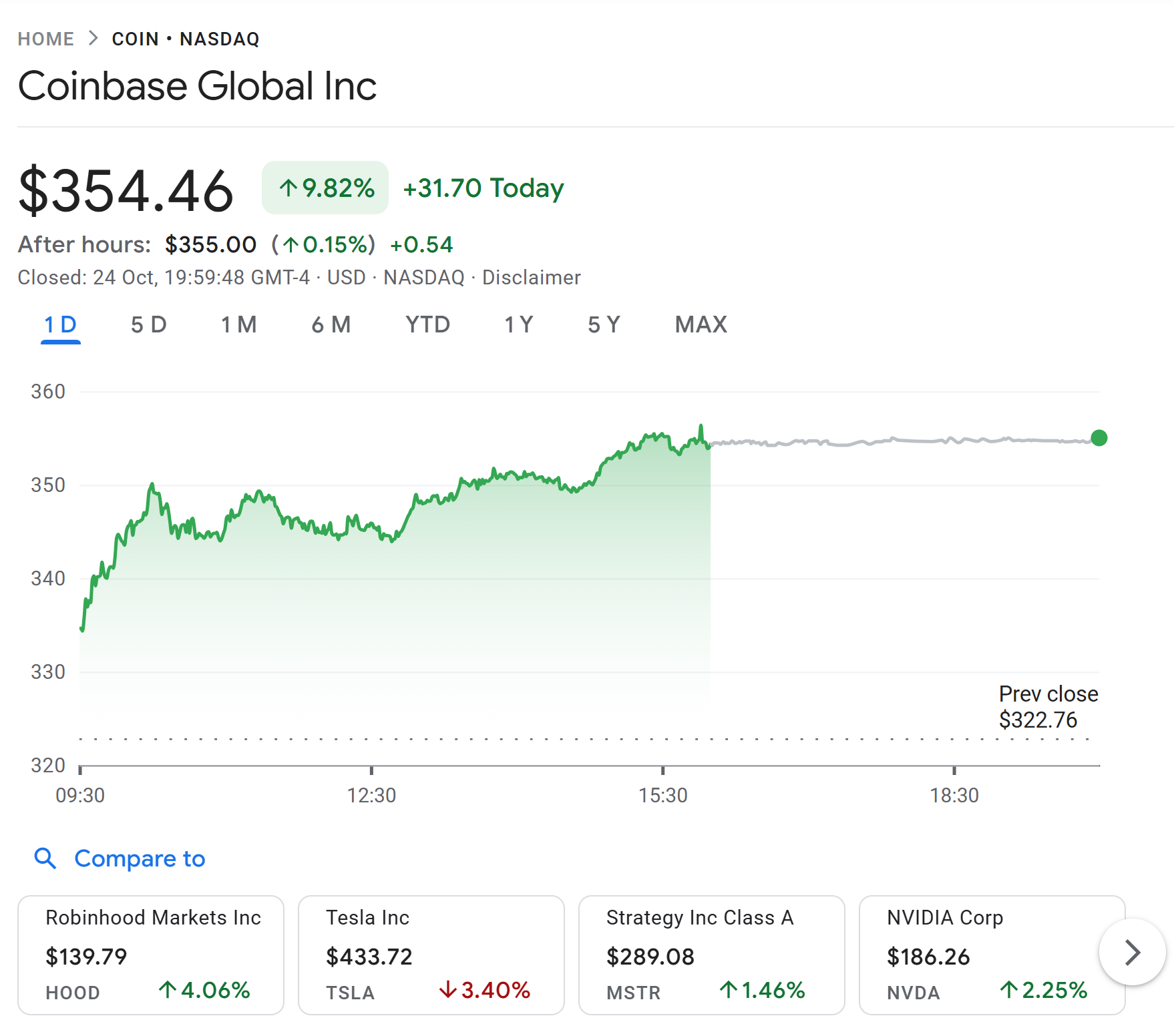

Coinbase shares ended Friday down about 10%. Supply: Google Finance

Coinbase can be working with US regulators to allow broader entry to onchain fundraising. Armstrong claimed that present guidelines for accredited traders exclude many people from early-stage alternatives.

“In some ways, the principles for accredited traders are fairly unfair,” he stated. “We hope we will discover the best steadiness between client safety and making it obtainable to retailers.”

Associated: Coinbase is investing $25 million to revive a podcast from the newest bull run

JPMorgan sees a $34 billion stake in Coinbase’s base

Final week, JPMorgan Chase upgraded Coinbase to ‘Chubby’, citing the excessive development potential of its Base community and revised USDC rewards technique.

Analysts stated Coinbase is “leaning into” its Base layer-2 blockchain to extract extra worth from the platform’s growth. They estimate {that a} potential Base token launch may create a $12 billion to $34 billion market alternative, valuing Coinbase’s inventory between $4 billion and $12 billion.

Journal: Sharplink Supervisor Shocked by Ranges of BTC and ETH ETF Hodling – Joseph Chalom

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024