Policy & Regulation

Convictions for crime related to crypto total 272 years in jail over past decade

Credit : cryptonews.net

Crypto leaders have confronted continued authorized scrutiny in recent times, with a number of high-profile figures receiving prolonged jail sentences. In a current investigation into jail sentences in crypto, Social Capital Markets attracts parallels with the prosecution of bankers after the 2008 monetary disaster.

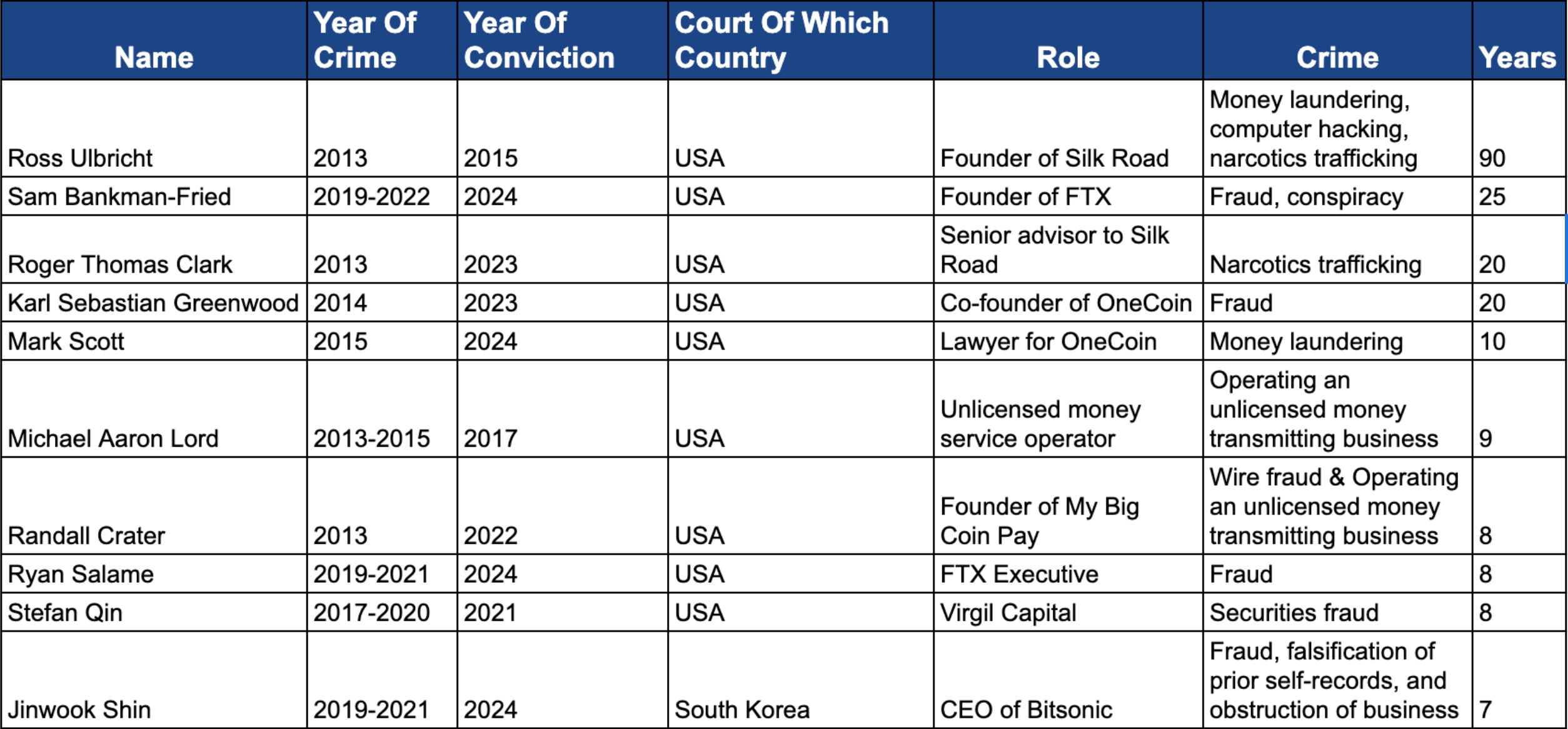

Social Capital Markets reported that main crypto gamers have been sentenced to 272 years mixed in jail. Between 2019 and 2023, the variety of crypto-related convictions has skyrocketed, reflecting rising enforcement actions. The conviction price elevated by 267%, indicating a pointy enhance within the success of prosecutions towards crypto-related offenses.

Ross Ulbricht, founding father of the darknet market Silk Highway, obtained the harshest sentence so far in 2015: double life imprisonment plus 40 years. His case illustrates the tough authorized penalties imposed on these concerned in unlawful actions utilizing cryptocurrencies. Greater than 10% of convicted crypto criminals within the US have been sentenced to greater than 20 years in jail.

The common jail sentence within the prime 10 crypto circumstances is over twenty years. Cash laundering and fraud account for practically 60% of the longest sentences in crypto crimes. 63% of convictions (26) occurred within the final three years.

Figures like Karl Sebastian Greenwood, co-founder of OneCoin, have been given important jail sentences for orchestrating fraudulent schemes. Greenwood was sentenced to twenty years for his position in one of many largest Ponzi schemes in crypto historical past.

The USA has imposed strict penalties, impacting international requirements in its crackdown on monetary crimes throughout the crypto business. This view might point out that the business is maturing and being held to increased requirements, much like conventional monetary programs. Nevertheless, there’s additionally controversy, injustice and discontent throughout the business, with many rallying behind the likes of Ulbricht, Twister Money developer Alexey Pertsev and Binance director Tigran Gambaryan.

Moreover, there’s a distinction between the way in which crypto criminals and conventional monetary offenders are handled. Excessive-profile figures within the crypto world have obtained harsh sentences, whereas executives accountable for conventional monetary crises have typically averted jail and as a substitute opted for settlements and fines. This raises questions in regards to the equity of the punishment and whether or not crypto criminals are handled extra harshly.

Knowledge exhibits that crypto-related crimes and convictions have elevated over the previous decade. The best variety of crimes occurred in 2013 and 2014, whereas the variety of convictions steadily elevated. This development signifies each delayed authorized motion and rising enforcement efforts.

The US-led crackdown could be seen as a dedication to manage crypto and discourage unlawful actions. Nevertheless, some view it as regulation by enforcement that overlooks the nuances of the sides concerned. For instance, Sam Bankman-Fried obtained harsh sentences for his crimes associated to the failed FTX trade. Nevertheless, most, if not all, of Bankman-Fried’s crimes have been crypto-related, versus on-chain crimes. In actuality, his fraudulent actions resembled these of Wall Avenue, utilizing consumer cash for private achieve.

In line with Social Capital Markets, the sector faces an important query: are these harsh penalties a step to set an instance or an indication that the crypto sector is being built-in into the broader regulatory framework for conventional finance?

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024