Altcoin

Core rises 33% in 11 hours, but traders have to be careful for …

Credit : ambcrypto.com

- Core handed the resistance of $ 0.4775 earlier.

- It was unlikely that the rally would final, regardless of the rise in commerce quantity.

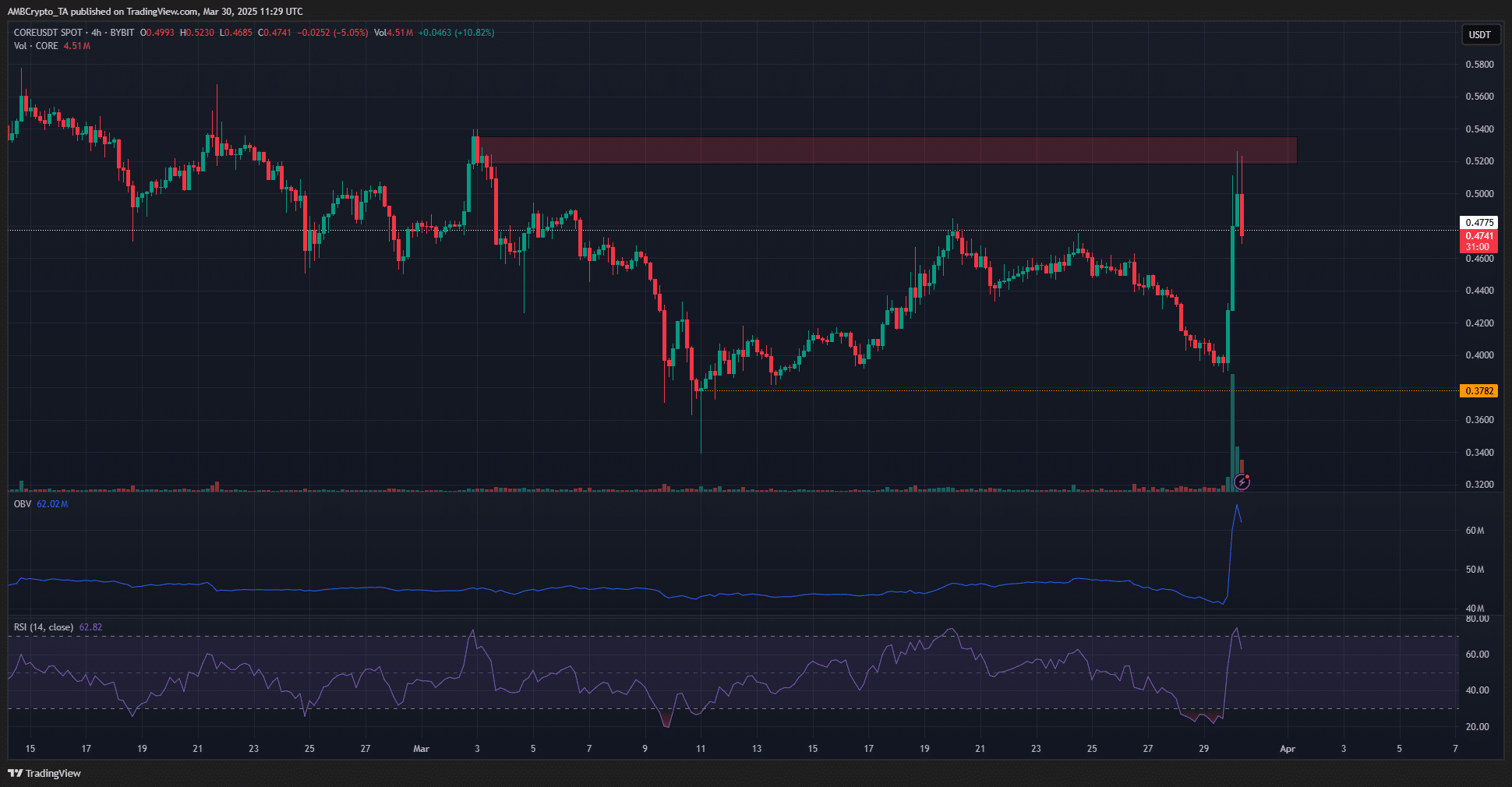

Core [CORE] Rally 33% in 11 hours from the low level on March 29 at $ 0.39 to $ 0.52 on March 30. This introduced many speculative merchants to the core markets.

Information of Coinyze confirmed that the open curiosity behind token has risen 116% within the final 24 hours.

Whether or not this rally can final was unclear. The upper timetables remained robust bearish. Normally such robust conferences indicate a liquidity yacht throughout a weekend.

Why Core Bulls Wrestling

Supply: Core/USDT on TradingView

On the 1-day graph, the core was cussed Bearish. The latest rally has re -tested the resistance stage of $ 0.4775. This stage served as a help in February, and earlier than that, additionally in February 2024.

The bearish retest of this long-term-s/R stage meant that it was probably that the core dao token worth would fall decrease within the coming days. Nevertheless, the commerce quantity was extraordinarily excessive on the weekend.

This ensured that the OBV elevated to the highlights of December.

Within the meantime, the RSI was about to shut a each day session above impartial 50. This is able to be one other sign of a shift in Momentum, however it won’t imply that an upward development was on the fingers.

The upper development in time should be revered, and buyers would in all probability be higher suspicious for this rally than admit to Fomo.

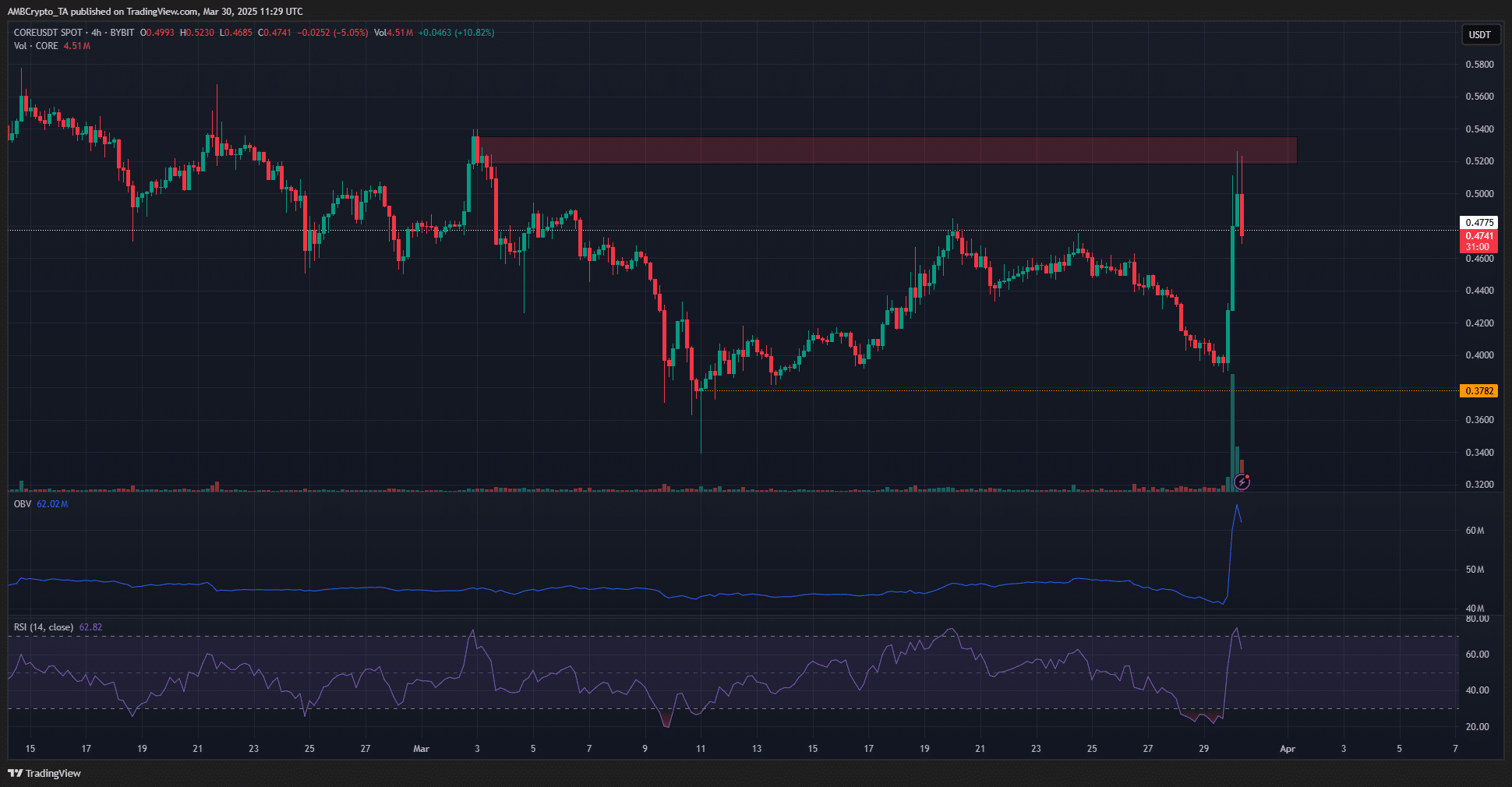

Supply: Core/USDT on TradingView

On the H4 graph a clear rejection of the Bearish Order block from earlier in March was seen at $ 0.52. The worth was re -testing the extent of $ 0.4775 as help, however it won’t final.

Fast revenue within the weekend, when commerce volumes are often low, meant that the worth promotion was extra delicate to the actions of bigger market contributors.

The $ 0.378 was the following help stage to have a look at. Core Bulls would have a motion of greater than $ 0.52 in thoughts.

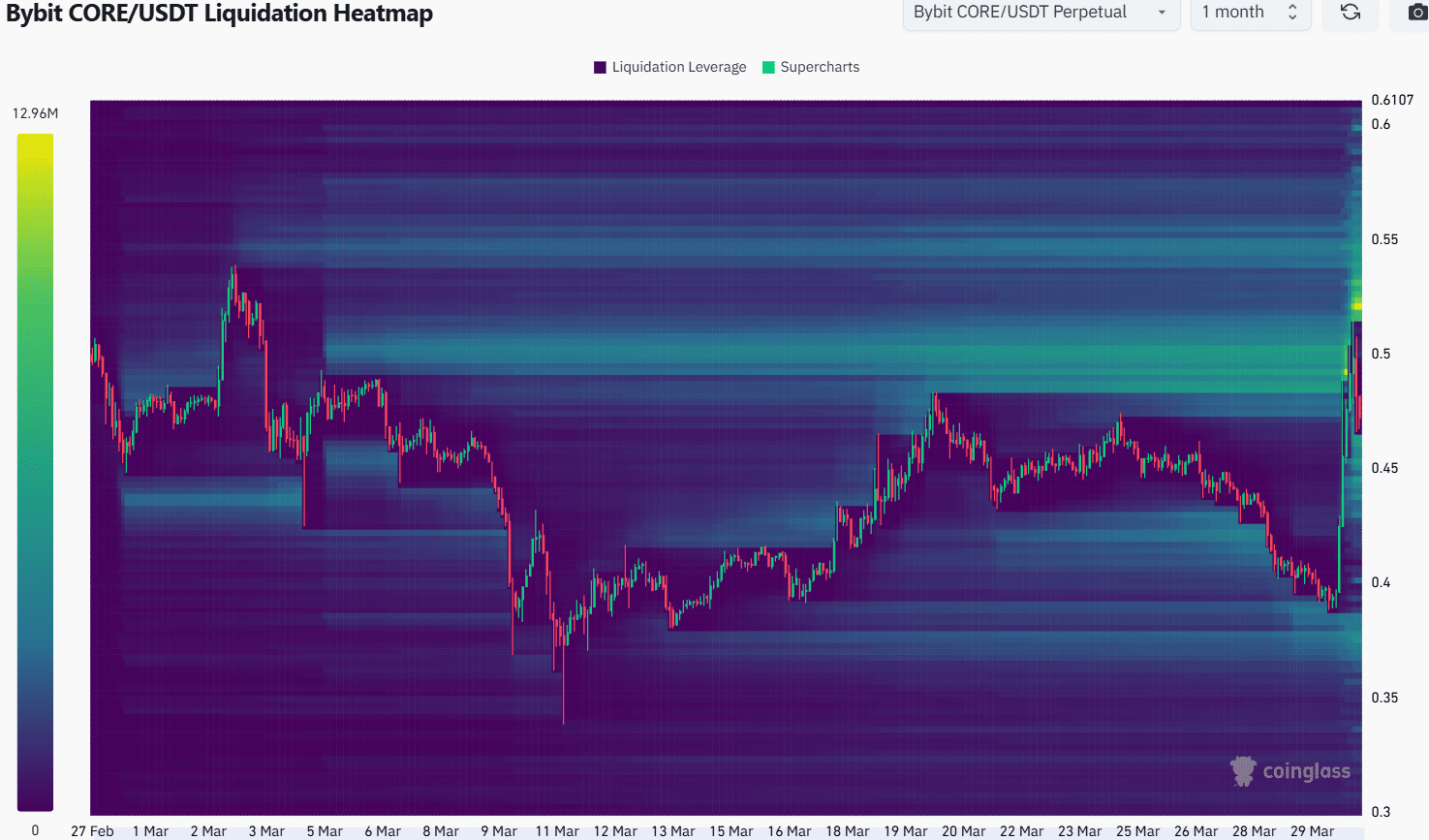

The liquidation Heatmap emphasised the $ 0.5 space as a magnetic zone prior to now month. The latest worth promotion noticed this liquidity pocket swept.

Within the course of, a stronger magnetic zone crammed with quick liquidations at $ 0.52.

That’s the reason it was probably that the core would see extra volatility within the coming days. One other check of the $ 0.52- $ 0.53 space would in all probability supply a chance to promote the core of the quick sale.

Disclaimer: The introduced data doesn’t kind monetary, investments, commerce or different sorts of recommendation and is barely the opinion of the author

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September