Ethereum

Corporate Ethereum Treasuries Could Hit 10% of Supply, Says Standard Chartered

Credit : coinpedia.org

Ethereum is introducing a brand new section of institutional adoption. From treasury methods to bullish value goals, it will get severe consideration from enterprise and monetary gamers.

By one Recent report Normal Chartered now incorporates institutional treasure chests about 1% of the entire circulating vary of ETH. However that’s only the start.

The financial institution believes that this might develop ten instances, with firms in the end have as much as 10% of the entire provide of ETH.

Ethereum will get a lead over Bitcoin

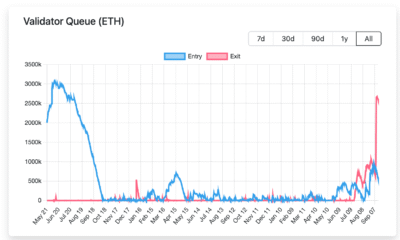

Shopping for firm eth and spot ether ETF entry each are rising. In line with knowledge from SosovalueThe cumulative complete internet entry for spot -ether ETFs has reached $ 9.40 billion.

The rise in curiosity has most likely performed a serious position in ETH that not too long ago performs higher than Bitcoin. The ETH/BTC ratio has risen from 0.018 in April to 0.032 in July. Geoff Kendrick, analyst at Normal Chartered, notes that this might trigger the beginning of a bigger shift, the place establishments Ethereum start to advertise heavier of their digital activa portfolios, even above Bitcoin.

Is ETH extra enticing than BTC?

Ethereum is on the rise as a extra helpful treasury activa than Bitcoin. Though Bitcoin is commonly held due to its shortage, Ethereum gives the additional advantages of hanging rewards, at the moment round 3%, along with entry to Defi instruments that may enhance the effectivity.

Ethereum additionally stands out in areas with strict crypto directions. The report means that ETH can function a wise resolution for firms that need crypto publicity to their steadiness sheets, however are confronted with regulatory restrictions.

That makes ETH a extra versatile choice for publicly talked about firms.

Strike entails rewards and dangers

Nonetheless, a Bernstein report emphasizes how Ethereum Treasuries observe a distinct strategy than Bitcoin-oriented. As a substitute of simply protecting ETH, firms encourage returns to earn returns and enhance the earnings.

However this technique is just not with out dangers. There are liquidity delays within the occasion of non -failure, and instruments comparable to repairing or Defi protocols introduce sensible contract dangers with which conventional belongings usually are not confronted.

Corporations comparable to Bitmine, Sharplink and Bit Digital collected greater than 876,000 ETH in July, with Bitmine simply exceeding $ 2 billion in ETH and strives for five% the entire provide. Bernstein sees Ethereum attaining lengthy -term worth from the rising ecosystem.

Will Ethereum cross $ 4,000? Analysts debating

Ethereum briefly crossed $ 3,900 on Monday, the best since December 2024, earlier than he withdrew. It has risen greater than 50% up to now month.

Normal Chartered has maintained his $ 4,000 aim for Ethereum, whereas analysts count on it to interrupt his earlier highest excessive level of $ 4,800 this 12 months. Bitmex founder Arthur Hayes even sees $ 10,000 contact. In the meantime, Tom Lee’s Bitmine Projected a hanging aim of $ 60,000.

Chris Burnish Be it that Ethereum went to the favourite in simply 5 weeks from essentially the most hated coin.

Crypto analyst Wolf predicts that ETH might attain greater than $ 8,000 in a conservative situation, whereas the extra optimistic view focuses on $ 13,000. Wolf additionally warned that after Ethereum has reached a brand new of all time, a typical market correction of 20-25% is probably going earlier than the following rally begins.

Ethereum shortly turns into greater than a digital lively and is now an extended -term strategic recreation. Token is at the moment traded at $ 3,853, a lower of 0.7% within the final 24 hours.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024