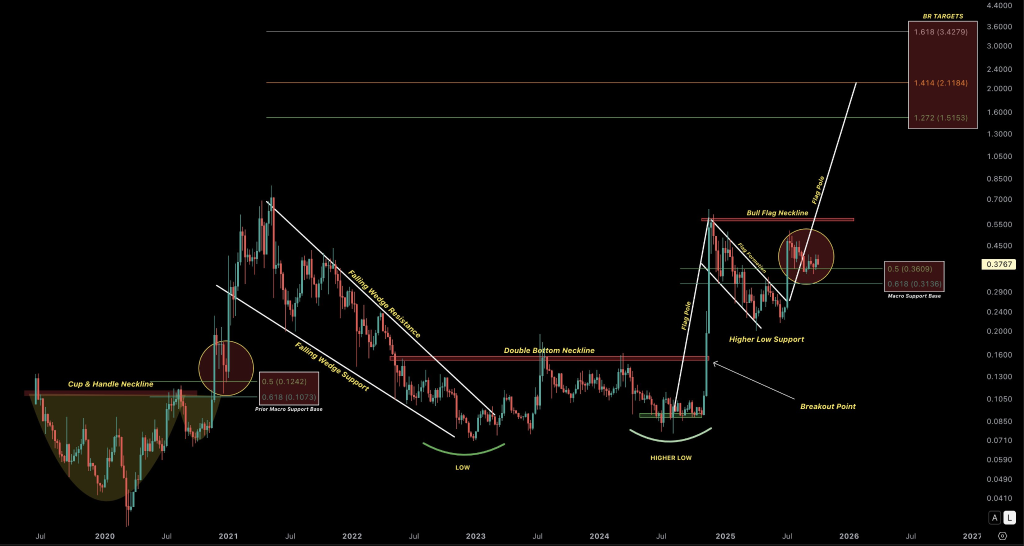

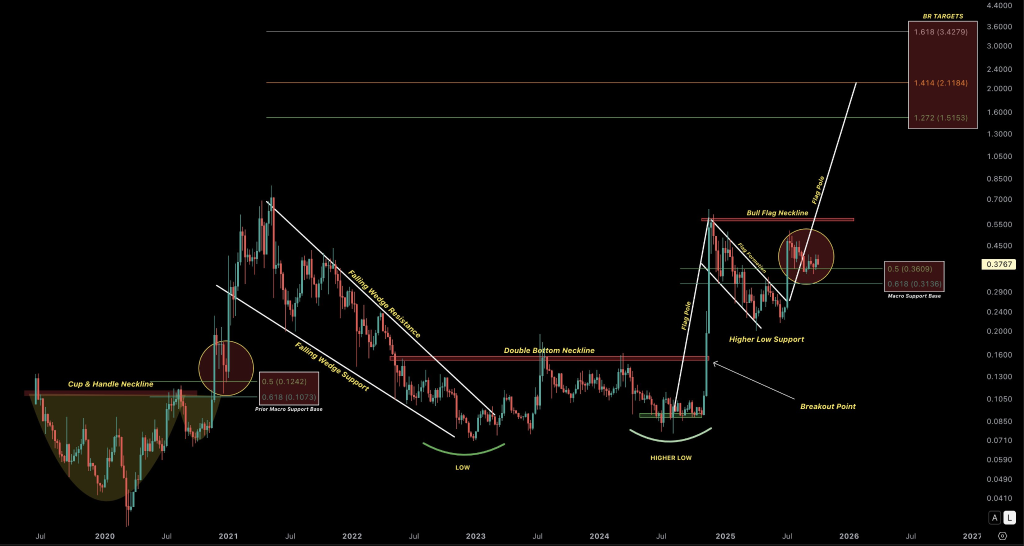

Stellar value is at present nonetheless in a good consolidation section between $0.38 and $0.40 because the market enters the primary days of the fourth quarter with cautious optimism. At the moment buying and selling round $0.38 with a market cap of $12.17 billion, XLM continues to point out resilience after breaking out of a bearish wedge sample within the second half of the 12 months. This consolidation close to a key resistance space displays the market’s robust perception that XLM value USD may very well be making ready for its subsequent upward transfer.

Institutional exercise strengthens market confidence

The most recent Stellar value chart construction signifies that institutional involvement, particularly within the RWA class, may play an important position in sustaining the asset’s stability at increased ranges.

Main shopping for patterns have emerged because the outbreak within the third quarter, indicating continued accumulation. Many merchants view this as a optimistic signal that main gamers are profiting from short-term pullbacks to strengthen long-term positions in XLM crypto.

Moreover, rising buying and selling volumes point out renewed enthusiasm round Stellar’s cross-border fee community. As extra monetary entities discover blockchain-based settlement techniques, Stellar’s know-how stays well-positioned to profit from institutional adoption developments.

Sustained accumulation or pause earlier than the rally?

Whereas the Stellar Whereas value forecasts seem constructive, the continued consolidation may additionally imply a pause earlier than the rally, a interval of accumulation earlier than a breakout.

The tight value vary between $0.38 and $0.40 implies that market contributors are constructing positions in anticipation of a much bigger upward transfer.

Such phases typically result in sharp directional extensions as soon as resistance ranges are damaged, making this zone a important space of statement for merchants.

Potential retracement earlier than the subsequent leg up

Market discussions to suggest that XLM may briefly return to the $0.31 stage earlier than resuming its climb. This potential dip may act as an incentive zone, shaking out weak palms and offering liquidity for stronger patrons to re-enter.

If such a state of affairs unfolds, analysts imagine XLM may goal increased milestones, with long-term projections pointing in direction of $3, and longer-term projections doubtlessly reaching $8.

Whereas these targets could appear bold, they’re in step with the broader sentiment that the Stellar value restoration is structural slightly than speculative. The mixture of technical power, institutional exercise and growing ecosystem adoption creates a supportive basis for long-term sustainable progress.