Policy & Regulation

Crypto, fintech execs want Trump to ban bank fees for customer data

Credit : cryptonews.net

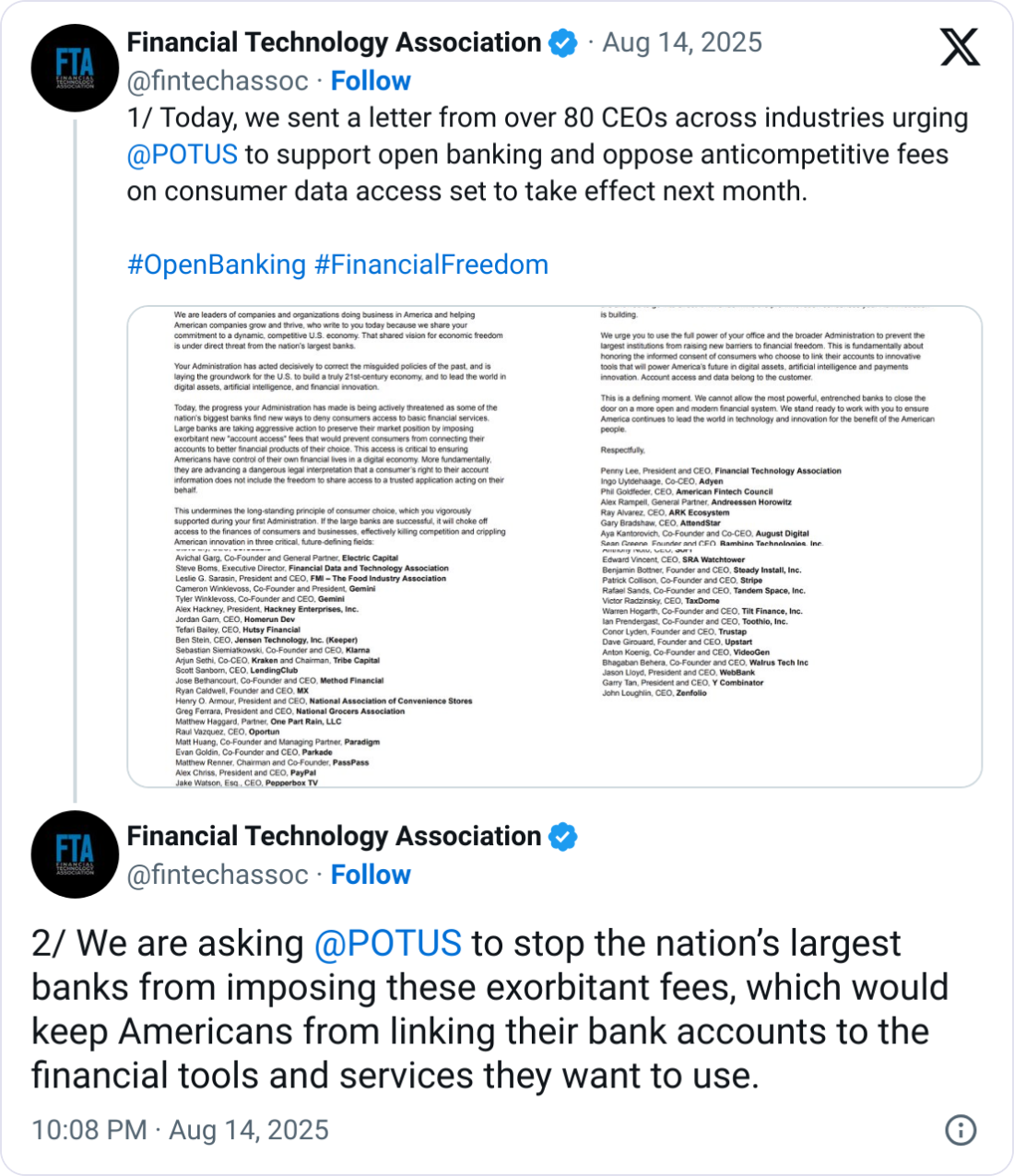

A bunch of crypto and fintech -executives has inspired US President Donald Trump to dam banks to cost prices for entry to their buyer knowledge, with the argument that it suffers the selection of shoppers.

The letter despatched to Trump on Wednesday accused massive banks to look “to take care of their market place by imposing exorbitant new ‘account entry prices’ prices that may forestall shoppers from connecting their accounts with higher monetary merchandise of their alternative.”

Crypto change Gemini, Robinhood buying and selling platform, along with Crypto -Foyer, the Crypto Council for Innovation and the Blockchain Affiliation grows, the letter, who claimed that the reimbursements would paralyze the American cryptigence and digital funds industries.

Crypto swings Trump on an open financial institution rule

The “Open Banking Rule” of former President Joe Biden of the Bureau for Monetary Safety of Shopper Monetary, accomplished final 12 months, allowed clients to share financial institution particulars free of charge with Fintechs.

The rule was welcomed by the Crypto group, however was strongly opposed by main banking business teams, who sued the regulator. Trump initially selected the aspect of the banks to kill the rule, however was thrown again on the finish of July after strain from the crypto foyer to maintain the rule.

The Trump authorities instructed a decide that it could depart the rule in place whereas creating a brand new one.

Prices to refuel our crypto clout claims from group claims

Crypto corporations, equivalent to inventory markets, depend on financial institution particulars to attach the financial institution accounts of their customers on the platform to make it simpler to alter financial institution change switch.

Of their letter on Wednesday, the crypto and fintech managers mentioned that the information prices of the financial institution “may paralyze progressive merchandise” or they may fully shut them, which they suppose may hurt Trump’s crypto-related coverage targets.

Supply: Monetary know-how affiliation

“The flexibility of America to transmit within the accountable improvement of digital property is dependent upon protected, dependable rows that join our banking system with the brand new ecosystem,” the letter mentioned. “Breaking this connection will stimulate innovation offshore and scale back the affect of the US.”

Trump campaigned to show the US a protected haven for crypto, and the crypto business supported its presidential run for a whole lot of hundreds of thousands of {dollars} final 12 months.

“We advocate that you simply use the total energy of your workplace and the broader administration to forestall the most important establishments from being growing new limitations for monetary freedom.”

Financial institution teams say that crypto “Property of the Authorities Award” needs

Financial institution teams led by the American Bankers Affiliation, nevertheless, had been hit by the letter on Wednesday, and mentioned that the group needed to “undermine free markets and decide the federal government prize”.

“The double normal that these corporations need to perpetuate, the place they’ll cost reimbursements for service, whereas banks are anticipated to supply the identical service to those personal corporations free of charge, is absurd.”

The banks mentioned that the letter was written by “intermediaries attempting to mislead Trump” to assist the coverage of Biden period “for private revenue and the best to have a very powerful funding banks experience in defending shoppers’ knowledge.”

The banking and crypto sectors have additionally been at odds this week on Stablecoins, wherein financial institution teams inspired the congress on Tuesday to conclude what they claimed is a Maas within the regulation with which Stablecoin -Emitents will pay revenues on their tokens by way of affiliated corporations.

Authorized panel: Crypto Wilde Banks, now will probably be in Stablecoin Combat

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024