Policy & Regulation

Crypto, Fintech push back against banks’ war on open banking

Credit : cryptonews.net

A coalition of commerce teams from the fintech, crypto and retail industries is urging the U.S. Shopper Monetary Safety Bureau (CFPB) to undertake a strong open banking rule that ensures customers’ management over their monetary knowledge.

The letter shared with Cointelegraph was signed by main crypto advocacy teams – together with the Blockchain Affiliation and the Crypto Council for Innovation – along with fintech and business organizations such because the Monetary Know-how Affiliation, American Fintech Council and others representing retailers and small companies.

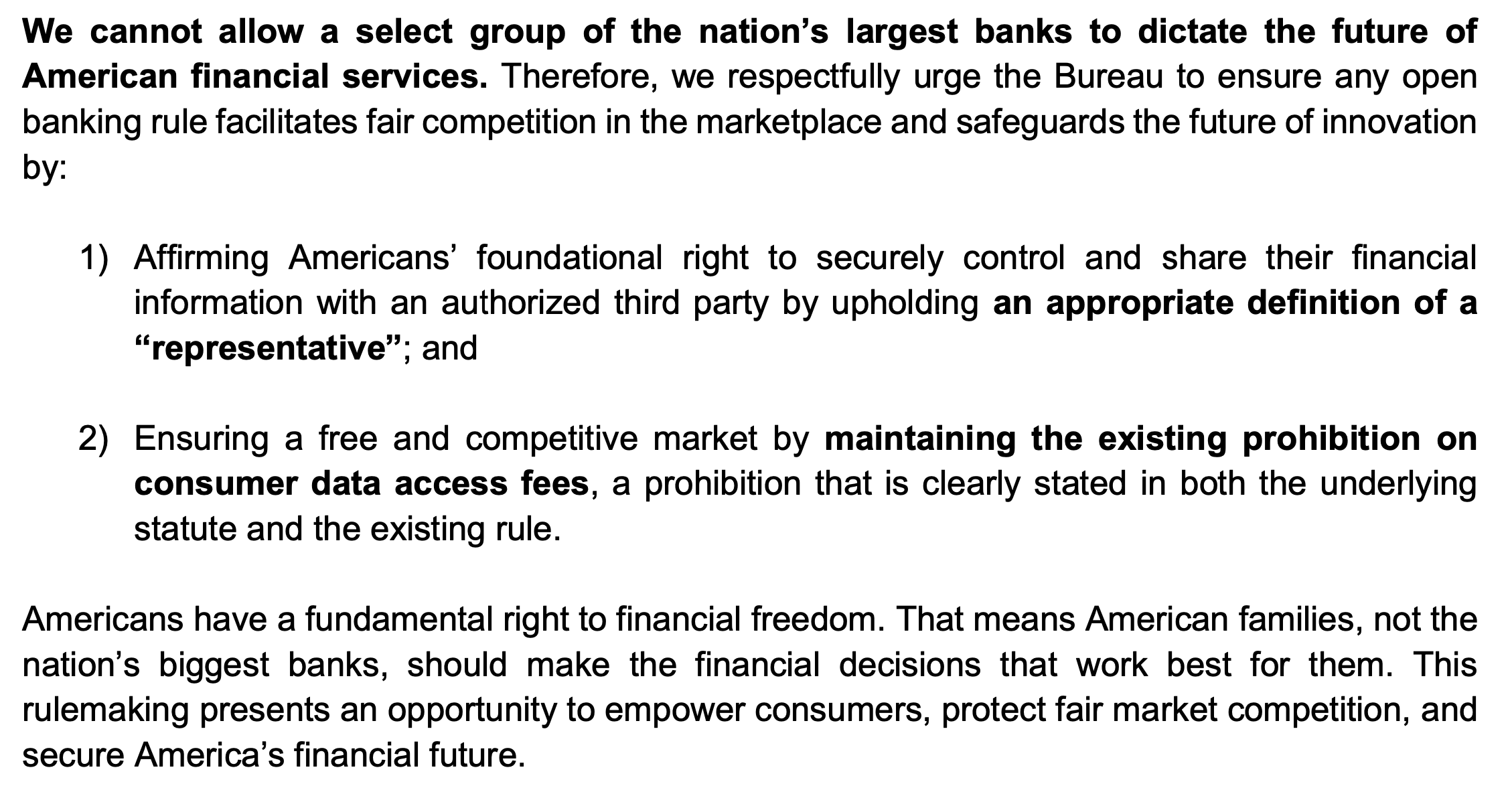

The letter is in response to the CFPB’s revision of the Private Monetary Information Rights Rule below Part 1033 of the Dodd-Frank Act, which can govern how customers share their monetary knowledge with third-party companies.

Remark letter for joint transactions. Supply: Affiliation for Monetary Know-how

The coalition mentioned it helps clear client knowledge rights and urged the CFPB to finalize an open banking rule that affirms that Individuals personal their monetary knowledge, not huge banks. The teams mentioned customers ought to have the liberty to share that knowledge with any licensed third social gathering, not simply fiduciaries.

The group additionally urged the CFPB to take care of the present ban on knowledge entry charges, saying the rule is meant to take care of a free and aggressive market and that the ban is already clearly written into legislation.

Open banking was first proposed within the US throughout former President Joe Biden’s administration in 2022 and was finalized on October 22, 2024.

The framework permits customers to securely share monetary knowledge with third-party apps via software programming interfaces (APIs), creating an important bridge between conventional monetary markets and sectors similar to decentralized finance (DeFi) platforms, crypto-on-ramps and digital banking instruments.

The letter claims that “greater than 100 million Individuals” depend on open banking to entry instruments similar to funding platforms, crypto wallets and digital cost apps to handle their funds and run companies.

“But these rights are below assault,” the letter says. “The nation’s largest banks wish to roll again open banking, weaken the sharing of client monetary knowledge and crush competitors to guard their place within the market.

Associated: The US shutdown is getting into its third week as Senate Democrats plan a crypto roundtable

Banks are pushing again on open banking

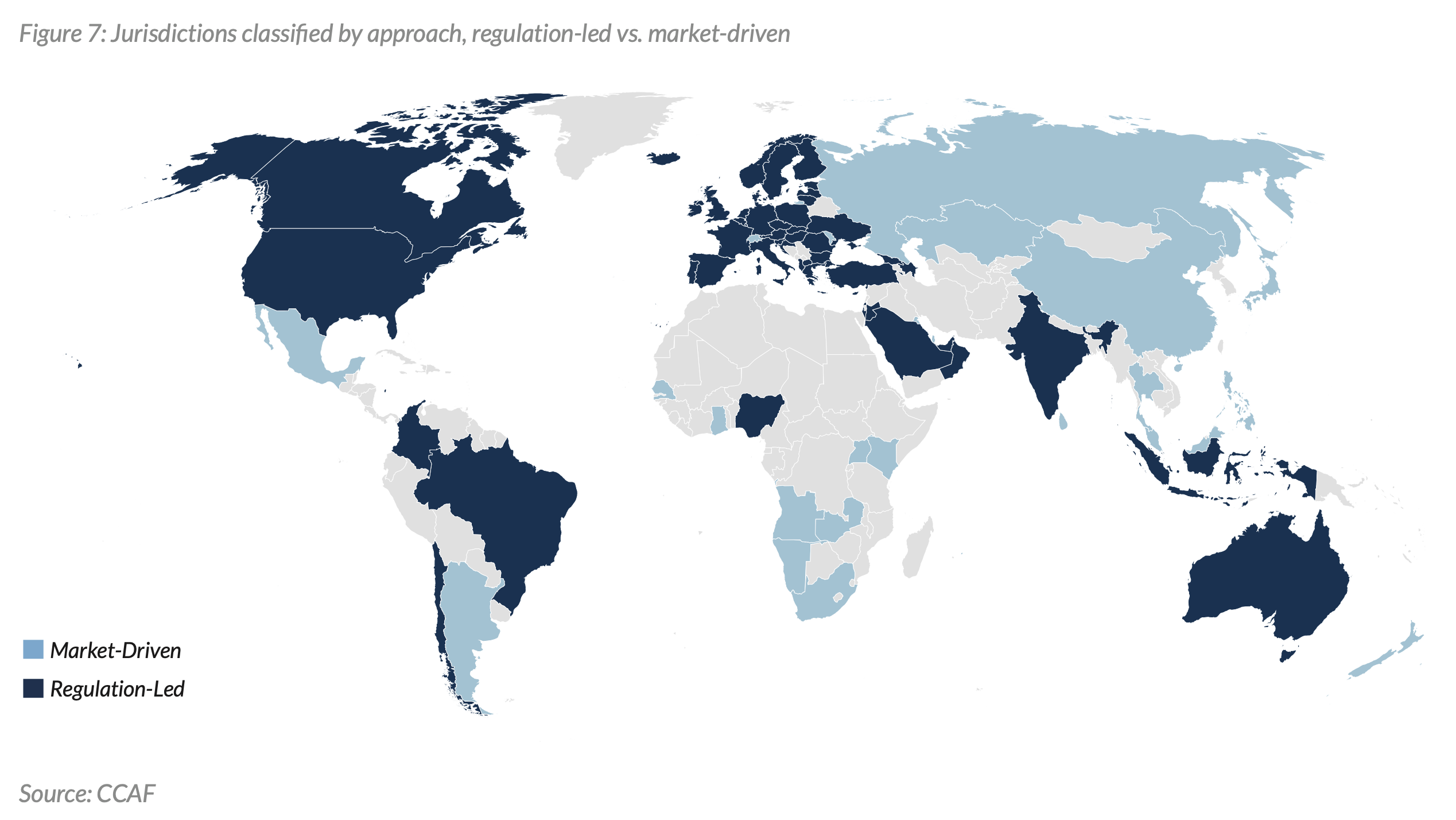

Though open banking already exists within the European Union, Britain, Brazil and several other different nations, there’s resistance to the rule within the US from huge banks.

International adoption of open banking. Supply: “The worldwide state of open banking and open finance report”, 2024.

On the identical day the rule was finalized in October 2024, the Financial institution Coverage Institute, a commerce group representing main banks like Wells Fargo, Financial institution of America and JPMorgan Chase, filed a lawsuit to dam the rule, arguing it posed safety dangers and unfairly burdened incumbents.

On July 11, a Bloomberg report revealed that JPMorgan deliberate to cost fintech corporations for entry to their prospects’ banking data.

The crypto business is growing the stress on Washington

Tuesday’s letter builds on an earlier attraction the coalition despatched to US President Donald Trump on July 23, accusing US banks of stifling innovation by submitting a lawsuit to delay open banking reforms and introducing 80 executives from the crypto and fintech sectors to signal a letter calling on the president to forestall banks from imposing charges on corporations that entry entry buyer monetary knowledge.

On Monday, Gemini co-founder Tyler Winklevoss wrote on

Tomorrow is the final day to file a remark letter with the CFPB concerning the proposed open banking rule.

Supply: Tyler Winklevoss

Journal: The EU’s privacy-killing Chat Management invoice has been delayed, however the struggle isn’t over

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024