Ethereum

Crypto inflows surge as Bitcoin ETFs lead the way – Trump effect?

Credit : ambcrypto.com

- Spot Bitcoin ETFs recorded historic inflows of $3.13 billion per week, demonstrating rising investor confidence.

- Altcoins comparable to Solana, XRP and Litecoin witnessed important institutional inflows amid Bitcoin’s dominance.

The ripple results of Donald Trump’s victory within the presidential election proceed to make waves within the cryptocurrency market, fueling a sustained interval of development and exercise.

Final week, the market reached an important milestone when international funding merchandise noticed web inflows of roughly $3.13 billion.

This enhance was largely attributed to elevated curiosity in US spot Bitcoin [BTC] Change-Traded Funds (ETFs), which underline the evolving dynamics of the market.

Crypto influx breaks report

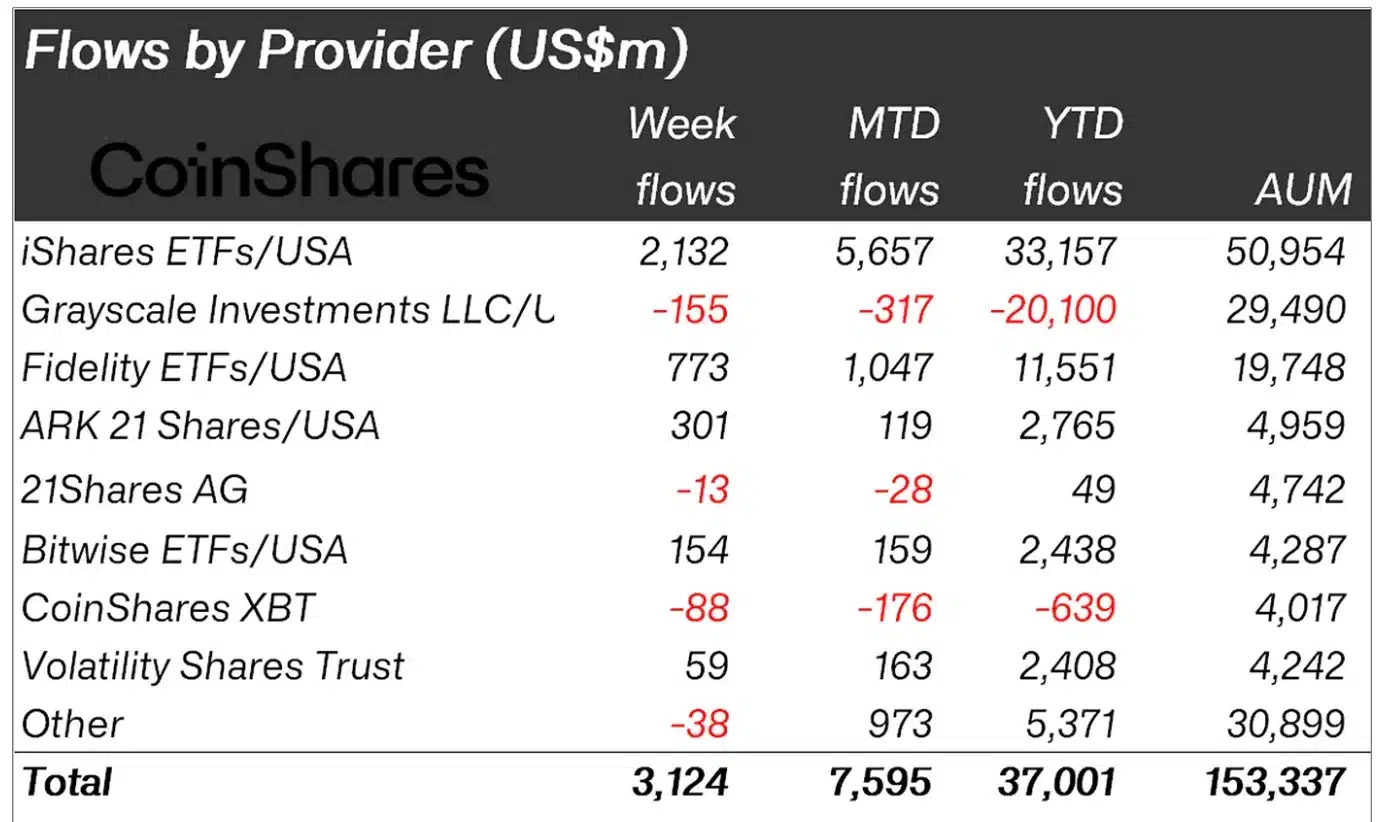

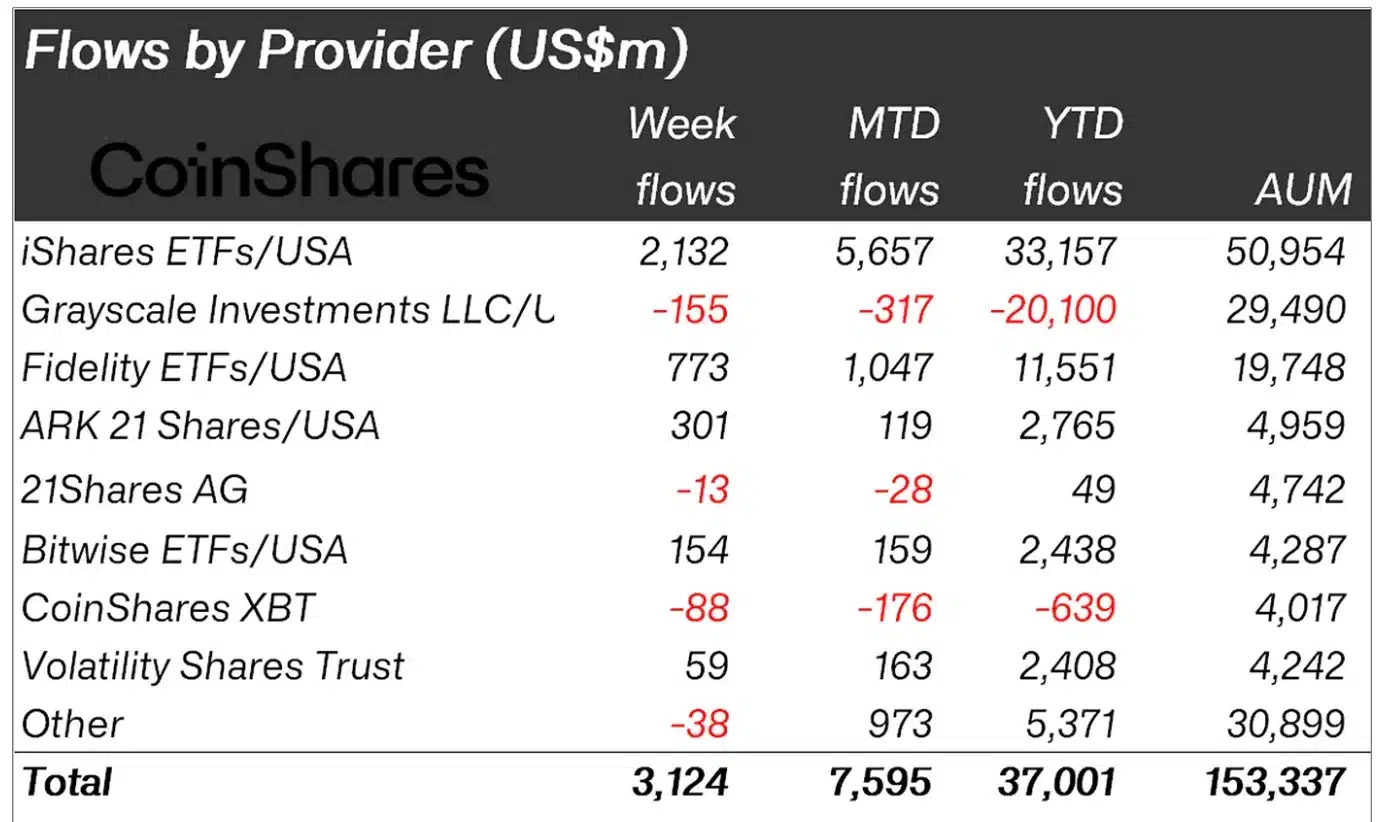

In accordance with CoinShares knowledge, this improvement highlighted rising investor confidence and the transformative influence of political and financial shifts on the crypto house.

In accordance with the report,

“Digital asset funding merchandise noticed their largest weekly inflows ever, reaching a complete of $3.13 billion, bringing whole inflows this yr to a report $37 billion.”

This was for the week of November 18 to 22, the place spot Bitcoin ETFs delivered a powerful 102% enhance from the earlier week’s $1.67 billion, as reported by SoSoValue.

These beneficial properties additionally marked the seventh consecutive week of optimistic inflows, demonstrating continued momentum and rising enthusiasm amongst traders. As well as, whole property underneath administration (AUM) rose to a report excessive of $153 billion.

Amid this surge, BlackRock’s IBIT continued to dominate the market, with web property of $48.95 billion as of Nov. 22, with cumulative inflows of $31.33 billion.

In distinction, Grayscale’s GBTC had $21.61 billion in web property, however has skilled outflows of greater than $20 billion since inception.

Supply: weblog.coinshares.com

Blackrock’s IBIT exceeds

In truth, a deeper evaluation revealed that a good portion of final week’s inflows, round $2.05 billion, got here from IBIT.

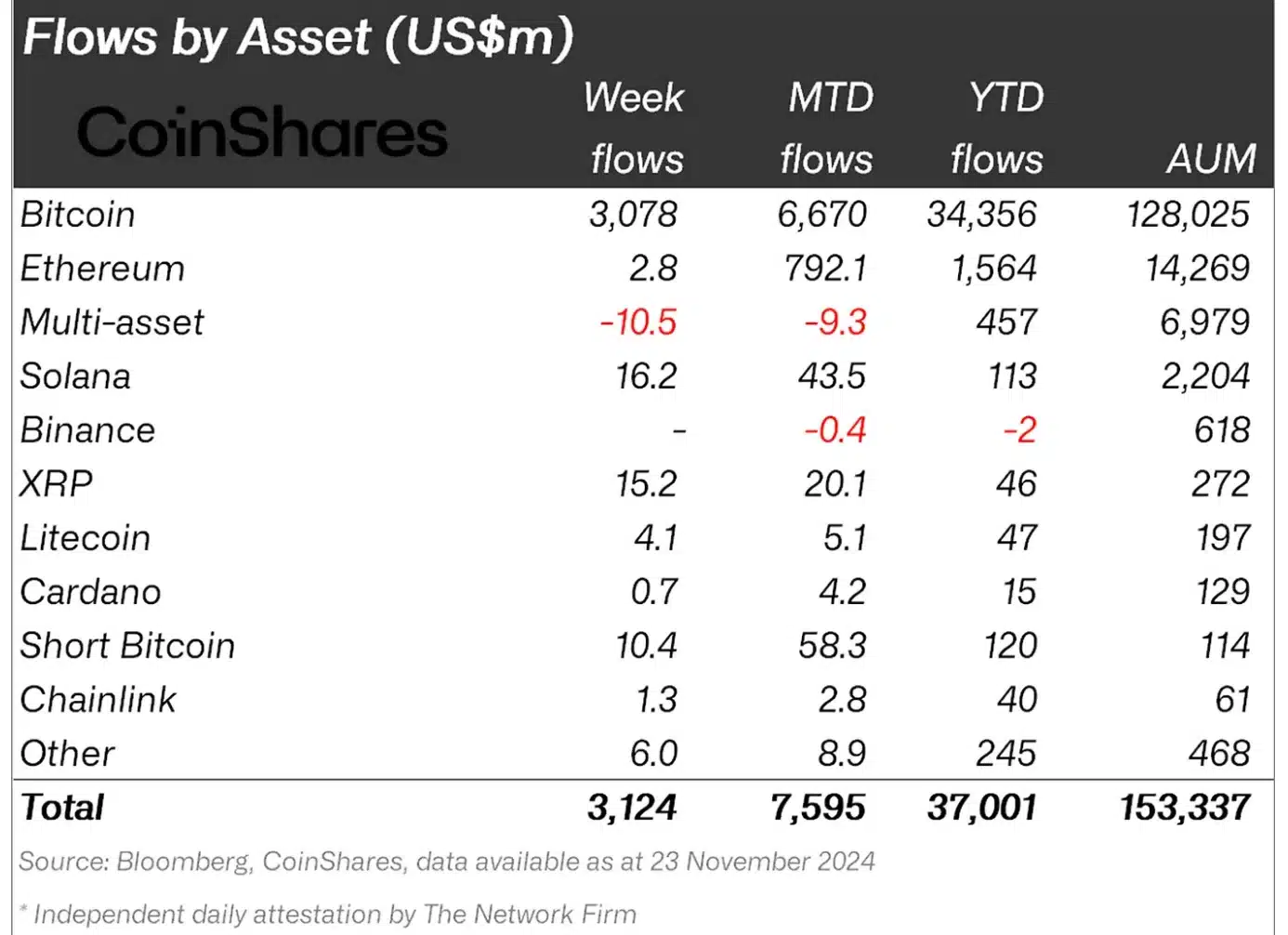

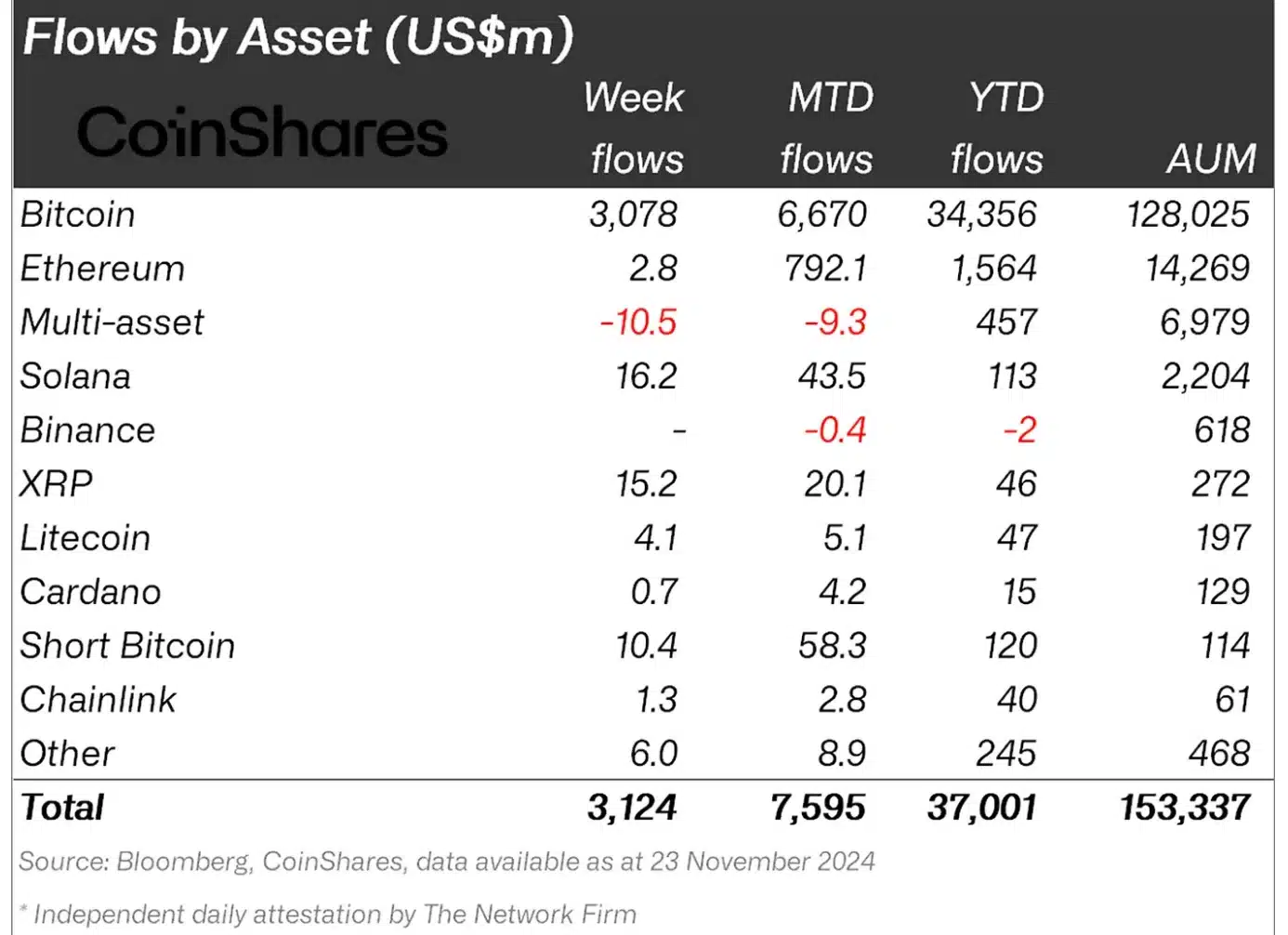

These Bitcoin funds led the best way, contributing $3 billion to the weekly whole – a stark distinction to the modest first-year inflows of $309 million for US gold ETFs.

Thus, whereas Bitcoin’s value rise has continued to draw curiosity from each institutional and retail traders, it has additionally led to an influx of $10 million into quick Bitcoin merchandise.

This pushed the month-to-month fee for these merchandise to $58 million – the very best degree since August 2022.

Bitcoin just isn’t alone

That mentioned, whereas Bitcoin dominated the influx charts, altcoins additionally demonstrated their rising attraction amongst institutional traders.

Solana for instance [SOL] led the altcoin pack with a powerful web weekly influx of $16 million, higher than Ethereum [ETH]which registered $2.8 million.

Different notable artists included Ripple [XRP]Litecoin [LTC]and Chainlink [LINK]which grossed $15 million, $4.1 million and $1.3 million respectively.

Supply: weblog.coinshares.com

These numbers replicate rising confidence within the altcoin sector, fueled by sturdy value momentum and rising adoption of those digital property throughout totally different use circumstances.

Evidently, these developments clearly underlined the profound influence of the election on the crypto market.

Nevertheless, it’s essential to know that different components also can have this impact has influenced the developments. James Butterfill, head of analysis at CoinShares commented:

“This current surge in exercise seems to be pushed by a mix of looser financial coverage and the Republican Occasion’s cleanliness within the current US elections.”

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now