Ethereum

Crypto liquidation sees $2B wiped out – Is it time to ‘buy the dip’?

Credit : ambcrypto.com

- Bitcoin and Ether fall in the midst of the US commerce charge announcement, which causes appreciable market volatility.

- Regardless of the recession, Bitcoin stored itself above $ 90k, with many buyers taking up to ‘purchase the dip’.

Within the midst of escalating concern a few doable international commerce struggle, Asian inventory markets skilled appreciable decreases.

This adopted the announcement of US President Donald Trump of main charges at Canada, China and Mexico. The financial uncertainty despatched shock waves by way of the markets and in addition influenced cryptocurrencies.

Giant digital belongings, together with Bitcoin [BTC] and Ethereum [ETH]Witness of steep drops. BTC fell briefly to a low three weeks of $ 91,441.89, whereas ETH fell by 24percentand achieved the bottom worth since September.

The recession continued till the weekend, with Bitcoin on with 7%. The Coindesk 20 -Index, which follows the highest 20 cryptocurrencies, noticed a pointy drop of 19%.

Because the sentiment of buyers weakened, concern about future stability has elevated.

Price struggle sends shock waves in crypto

The Cryptomarkt has even skilled its biggest liquidation up to now.

A commentary on this, a crypto investor referred to as ‘The Wolf of All Streets’ pointed out,

“$ 2B liquidated in 24 hours. That is a report. Greater than the Covid -Dump. Greater than the FTX -Inenenteing. Epic.”

Including the battle was one other X (formerly Twitter) user Who stated,

“Be afraid when others are grasping, be grasping when others are scared.”

Regardless of the latest decline, Bitcoin has succeeded in maintaining above $ 90k. Based on Coinmarketcap, BTC traded at $ 95,375, on the time of press, after a lower of 4.36% within the final 24 hours.

Whereas some buyers, corresponding to ‘The Wolf of All Streets’, expressed cautious optimism over additional value dips, with the emphasis on a reluctance to promote in such a offered -over market, the broader crypto group stays hopeful.

Group stays constructive within the midst of huge crypto -reading

Many urge others to ‘purchase the dip’, which suggests a constructive view for the lengthy -term potential of Bitcoin, even within the midst of present volatility.

Supply: Kiwi/X

It was one other to resume related sentiments X user Who has added,

“I’ve not misplaced hope available in the market but, I might say that this was solely an enormous liquidity swing, BTC has bounced in the long run. Your complete market has been offered over.”

He went on

“It will not shock me if the market stays down, however we are going to see a restoration within the coming week.”

Supply: Thread

Robert Kiyosaki, famend creator of Wealthy Dad, poor father, just lately described the latest Bitcoin dip after Trump’s charges as a ‘shopping for possibility’.

He sees this market correction as a sexy alternative for buyers.

Nonetheless, Kiyosaki additionally emphasizes that the American tax debt stays a way more pressing concern, one that may proceed to stimulate curiosity in belongings corresponding to Bitcoin, Gold and Silver as secure ports in occasions of monetary uncertainty.

He stated,

“Trump charges begin: gold, silver, bitcoin can crash. Good. Will purchase extra after the costs crash. Actual downside is money owed … which solely will get worse. Crashes common belongings are on the market. Time to get richer. “

What lies for Bitcoin?

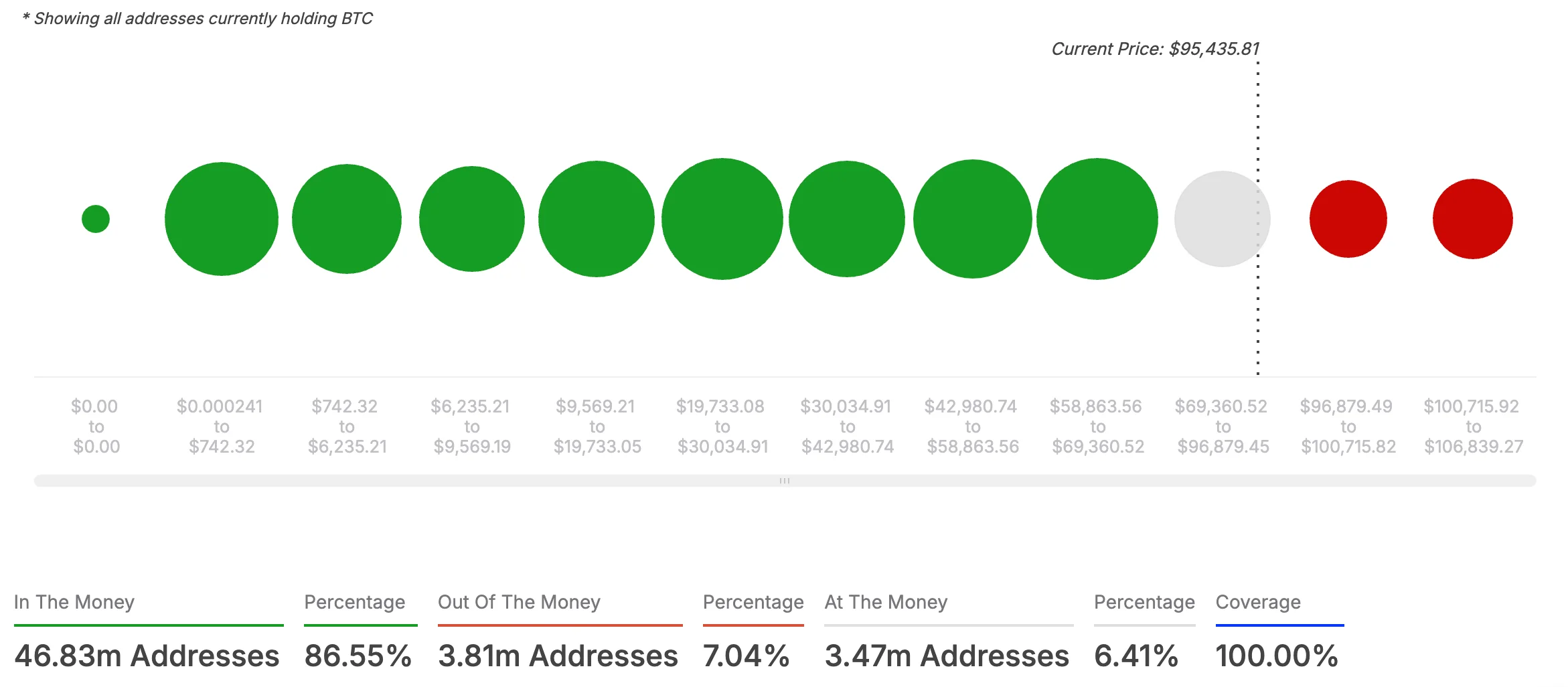

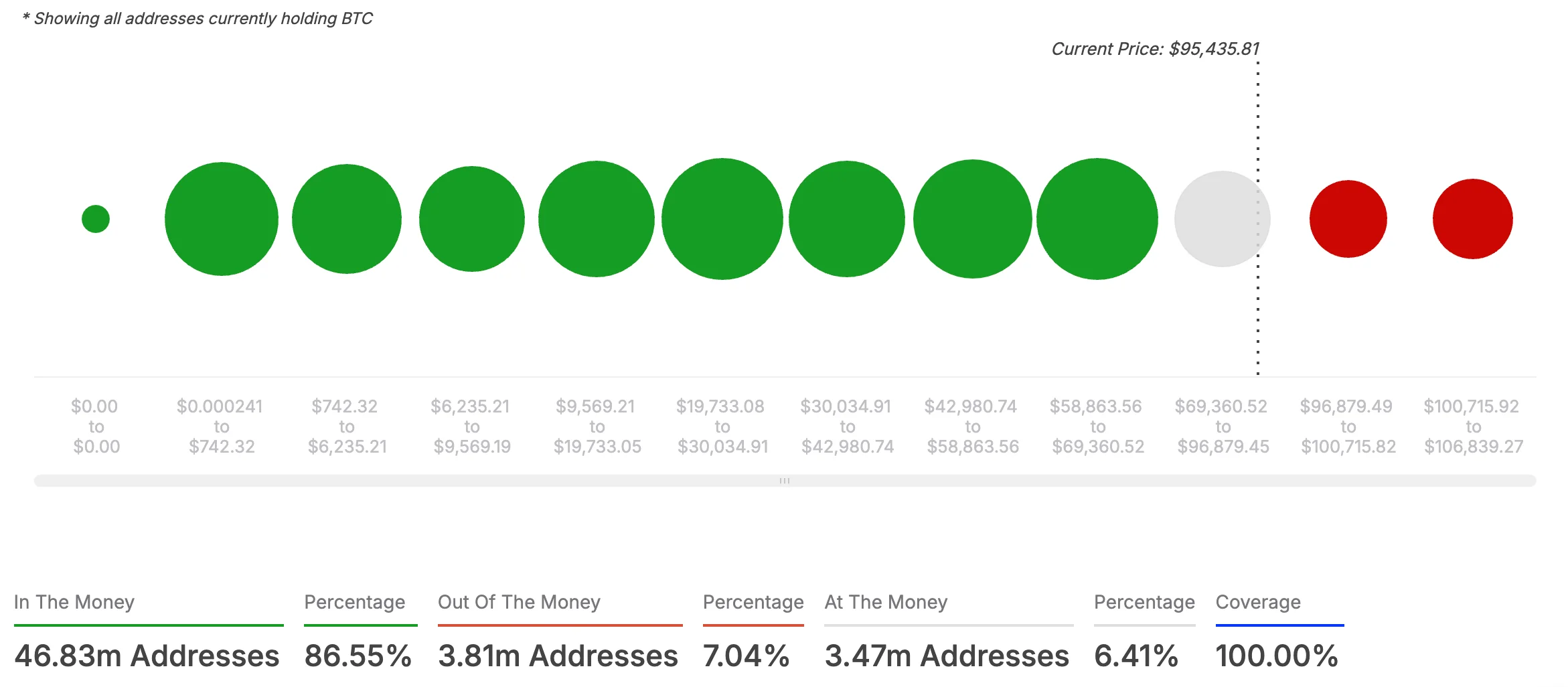

As well as, latest knowledge from Ambcrypto, primarily based on the insights of Intotheblock, reveals a largely constructive sentiment within the Bitcoin market.

A big 86.55% of Bitcoin holders is at present ‘within the cash’, maintaining tokens with a worth of their buy value, which signifies optimism and potential for a value enhance.

Solely 7.04% of holders are ‘exterior of cash’, with their tokens which can be valued decrease than their authentic buy value.

Supply: Intotheblock

This inequality displays the rising bullish sentiment within the cryptocurrency group, regardless of exterior strain corresponding to rising commerce tensions and market volatility.

When evaluating latest occasions with giant market crashes within the historical past of cryptocurrency, the liquidation figures through the FTX collapse in November 2022 are significantly exceptional.

In that case, the market noticed greater than $ 2.8 billion in liquidations inside 24 hours, in order that even the $ 1 billion liquidations through the decline of COVID-19 in March 2020 surpassed. This emphasizes the severity of the market reactions on necessary occasions.

It additionally serves to underline the resilience of the cryptomarket, the place many buyers proceed to see Bitcoin and different digital belongings as lengthy -term alternatives regardless of the fixed volatility.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024