Bitcoin

Crypto market rebounds on Yellen’s positive macro outlook – Gains ahead?

Credit : ambcrypto.com

- US Treasury Secretary Janet Yellen has stated the US financial system is wholesome and there are not any indicators of a recession.

- The crypto market has recovered considerably, with Bitcoin recovering $54,000.

The crypto market has made slight positive aspects, with all prime ten cryptos buying and selling within the inexperienced on the time of writing, though not reaching their weekly highs.

Bitcoin [BTC] has risen above $54,000 once more after a slight achieve of 0.6% in 24 hours. Ethereum [ETH] has adopted swimsuit, gaining 1.3% to commerce at $2,290 on the time of writing.

The largest winner within the prime ten largest cryptos by market capitalization is Dogecoin [DOGE] with a achieve of two.6%.

The current restoration comes after US Treasury Secretary Janet Yellen said the US financial system was wholesome and ‘deeply in restoration’.

Yellen spoke on the Texas Tribune Pageant on Saturday, the place she expressed considerations concerning the susceptible jobs report was launched final week after nonfarm payrolls got here in beneath expectations.

Yellen stated she noticed no “pink lights flashing” and that the roles numbers had been an indication of a tender touchdown, not a recession.

Her feedback have sparked reactions from the crypto group. Based on BitMEX co-founder Arthur Hayes, Yellen will probably resort to printing cash to stimulate the financial system.

“Unhealthy Gurl Yellen is watching: If the markets fall additional, she is going to absolutely add to the issues by printing extra money,” says Hayes. declared.

Such actions could lead on individuals to show to dangerous belongings like crypto, as cash printing will increase inflation threat.

Bitcoin just isn’t out of the woods but

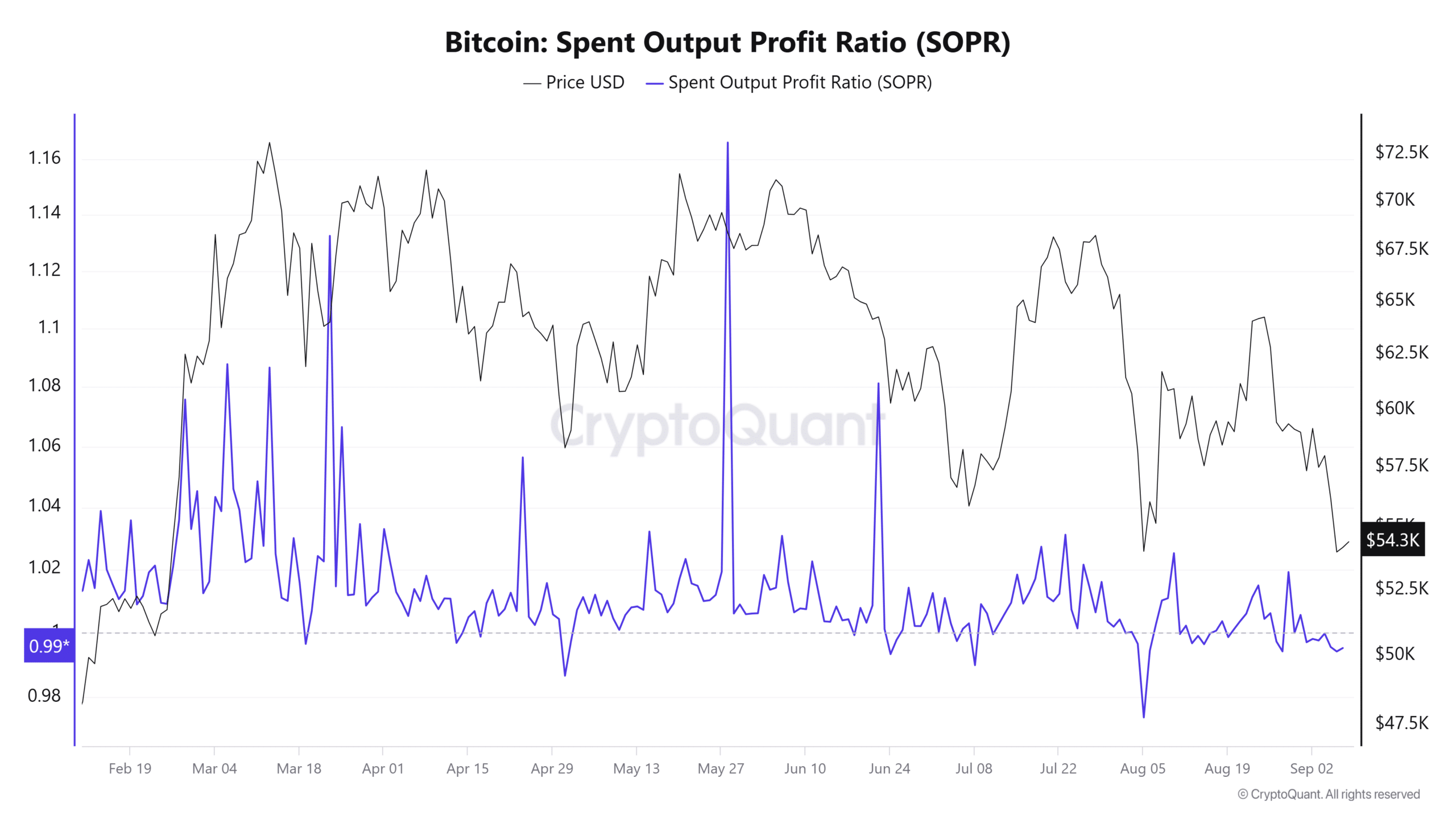

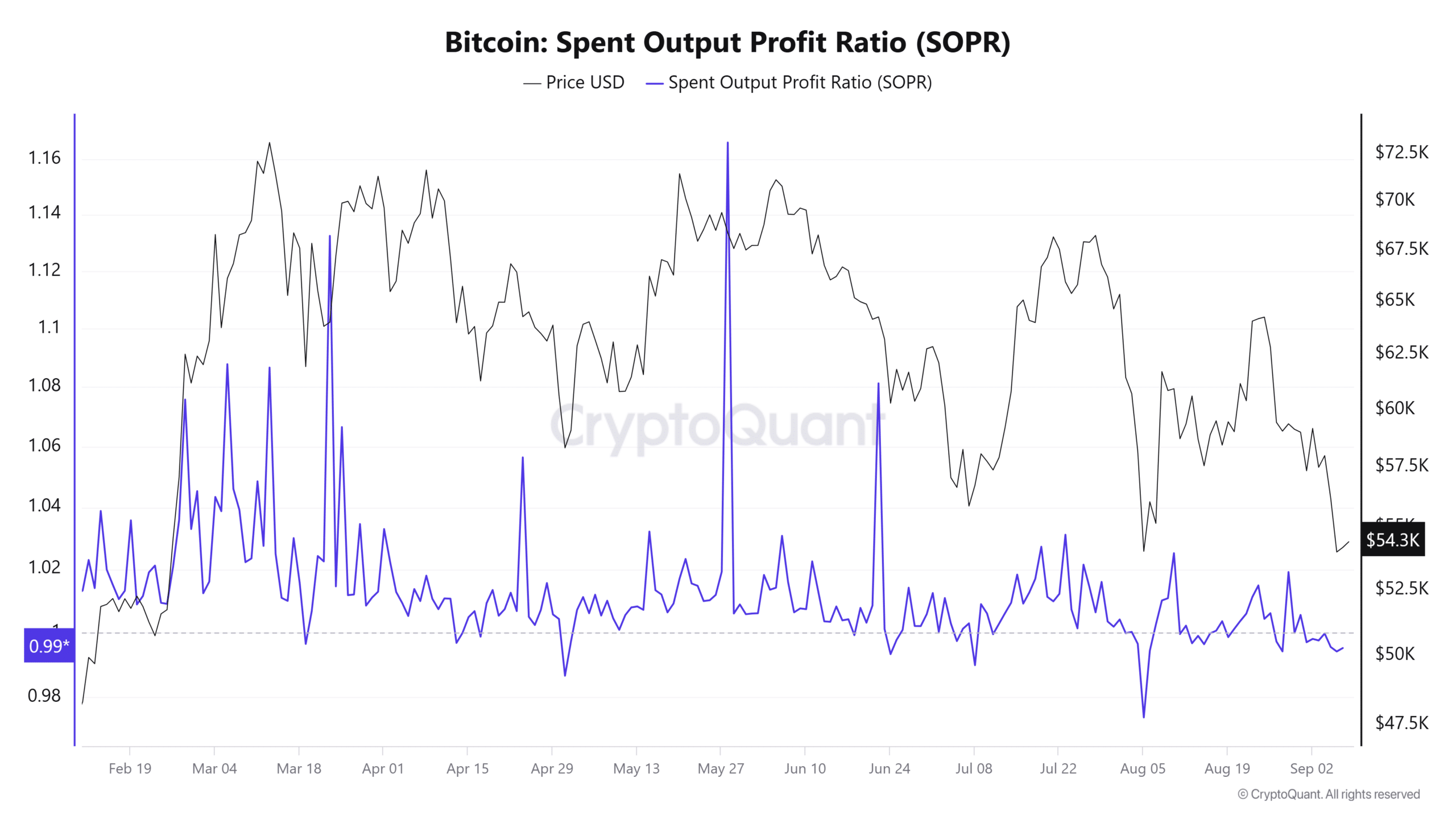

Regardless of the current positive aspects, the BTC value remains to be exhibiting indicators of hassle. For the reason that starting of the month, the Bitcoin Spent Output Revenue Ratio (SOPR) has did not rise above 1.

Supply: CryptoQuant

This metric exhibits that the typical investor bought BTC at a loss over the previous week. Such loss-making exercise alerts bearish sentiment and market hassle, as traders panic and reduce their losses.

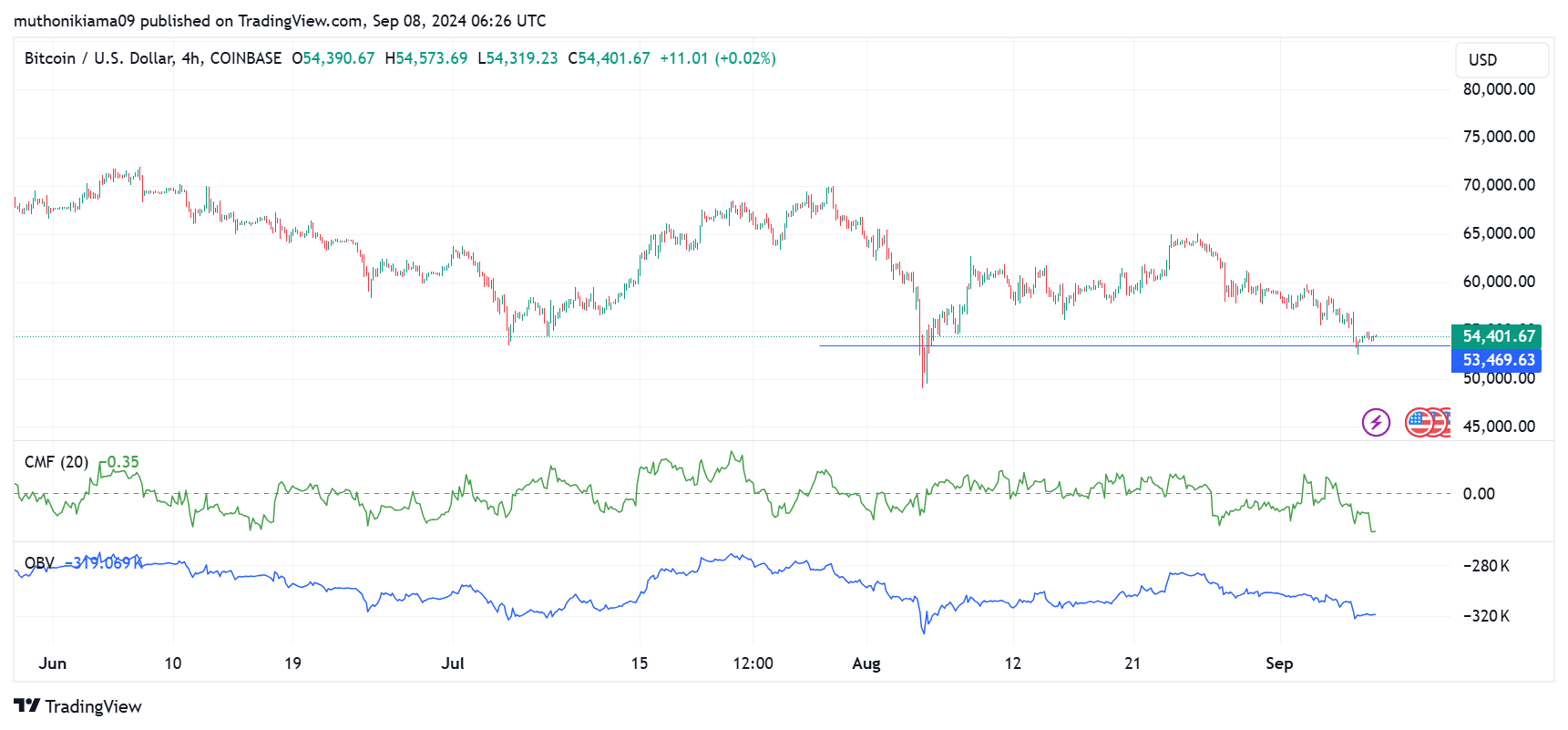

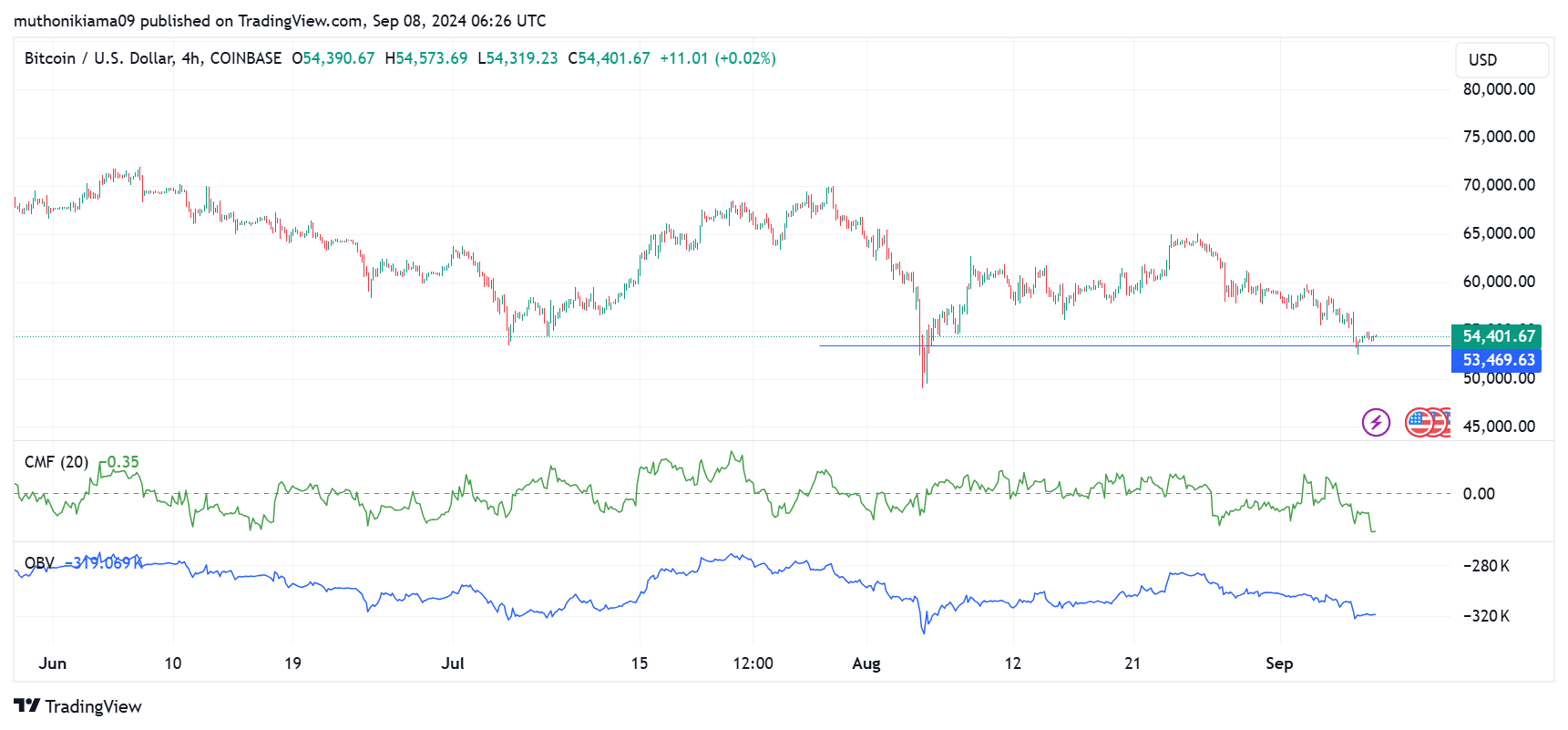

Shopping for strain additionally stays low, as evidenced by the Chaikin Cash Circulate (CMF) indicator, which was detrimental on the time of writing. This index continues to create decrease lows and is presently at its lowest stage since June on the four-hour chart.

Supply: Tradingview

The prevailing bearish sentiment was additionally seen in On Stability Quantity (OBV), which stays predominantly detrimental. This pattern exhibits market weak spot as gross sales volumes dominate and put downward strain on BTC costs.

However, BTC may have been a great entry level after testing the help at $53,469. The final time BTC examined this help, it registered an 8% achieve.

It’s essential to notice that patrons could stay cautious forward of the discharge of the US Client Worth Index (CPI) on September 11.

The market prediction for August inflation is 2.6%. If the CPI falls inside or beneath expectations, the crypto market may get better. Conversely, if information continues to point out a weakening US financial system, crypto costs may fall additional.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024