Altcoin

Crypto Market Sees $1.7 Billion Destruction, Largest Since 2021

Credit : www.newsbtc.com

This text is obtainable in Spanish.

The broader crypto market skilled a significant crash on December 9. Whereas the Bitcoin value fell from $101,109 to $94,150, marking a decline of -7%, the altcoin market suffered considerably heavier losses. Ethereum was down as a lot as -12% at one level, XRP was down -22%, Solana was down -15%, Cardano was down -23%, Dogecoin was down -19%, and Shiba Inu was down -25%.

In keeping with Coinglass factsGreater than 562,000 merchants had been liquidated up to now 24 hours, with the overall variety of liquidations reaching $1.7 billion. The most important single liquidation order occurred on Binance within the ETHUSDT pair, price $19.69 million. Of the overall liquidations of $1.7 billion, $1.55 billion associated to lengthy positions.

Notably, Bitcoin’s leverage flush was comparatively modest in comparison with that of altcoins, with $143 million of BTC longs liquidated. In distinction, ETH noticed $219 million in liquidations, SOL $57 million, DOGE $86 million, XRP $53 million, and ADA $22 million.

Throughout the crypto market, this represented the biggest debt wave since April 2021, when a file $10 billion in crypto futures liquidations occurred in a single day. This surpassed the earlier file of $5.77 billion.

Associated studying

After the flushout, Bitcoin and most altcoins have staged a pointy upward restoration, though they’ve but to return to pre-crash ranges. Over the previous 24 hours, BTC continued to fall -2.4%, ETH -4.8%, XRP -9.6%, SOL -6.4%, and DOGE -8.4%.

What precipitated the crypto market crash?

In keeping with crypto analyst ltrd (@ltrd_), the underlying dynamic is started with the elevated promoting strain on Coinbase, the place merchants began promoting aggressively nearly an hour earlier than the massive cascade. Though the eventual plunge was attributable to a sequence response of liquidations, this extended promoting within the spot markets was crucial in pushing costs into zones the place over-indebted merchants had little alternative however to retreat.

Overheated funding prices and rising open curiosity ranges meant that after the primary cracks appeared, extremely leveraged positions had no likelihood of escape. “How can we inform that the market was overheated? It is easy: the financing prices plus the rise in open curiosity. These two elements are driving the present market and point out that persons are over-indebted,” ltrd explains.

When the market lastly collapsed, the consequences had been uneven. Bitcoin confirmed traits that had been completely different from different devices, and Ethereum confirmed encouraging indicators of accumulation on the way in which down, indicating that a big purchaser may have taken benefit of this chance.

But the actually astonishing developments occurred with XRP on Coinbase, the place, as ltrd put it: “You’ll be able to see one thing loopy: the market results for XRP on Coinbase are mind-boggling. One thing completely unusual occurred. In a big, comparatively mature market, we witnessed a cascade of enormous promote orders that precipitated the market to fall by greater than 5%. We do not know precisely what occurred, however it’s actually uncommon.” Ltd speculated that these enormous and irregular promote orders may have come from a significant participant that was pressured to liquidate at any value.

Associated studying

“It might be price monitoring this case within the coming days. Possibly an enormous participant was pressured to promote like there was no tomorrow,” he mused. The consequence of such an occasion, even in supposedly deeper markets, was a speedy crash that spilled over into perpetual swaps traded elsewhere, triggering additional liquidations.

In keeping with ltrd: “When one thing like this occurs, it is normally a cascade of unintentional instructions. Market makers take up this promoting strain and hedge it, creating sign propagation throughout the exchanges.” Even large-cap altcoins like XRP, which have market caps akin to these of enormous US firms, nonetheless face liquidity constraints that change into obvious beneath stress. “Relative to those market capitalizations, market liquidity remains to be poor,” he famous, explaining how this contributes to the perceived volatility and dramatic nature of such occasions.

When costs lastly stabilized and began bouncing off their lows, ltrd highlighted how this sample is frequent in overheated markets: “The following factor you at all times see in a sizzling market is a fast value turnaround from the low. There are a lot of liquidations, restricted liquidity and there are nonetheless many gamers with earnings seeking to purchase the dip. Let’s have a look at who comes out on high.”

Macro analyst Alex Krüger placed all the occasion in a broader perspective. ‘Nothing has modified. Anticipate costs to proceed to rise,” he stated, noting that future circumstances, similar to a pro-crypto US administration beneath Donald Trump, may create a extra constructive backdrop for digital belongings.

Though Krüger raised the opportunity of extra leverage flushes within the coming months, he seen these occasions as a normalizing pressure. “At the moment was an vital flush-out. Particularly for altcoins. Very regular in heat markets with a number of debt. That is how crypto baptizes newcomers and retains crypto natives disciplined,” Krüger stated, including: “By no means enjoyable to get caught in a leverage flush for lengthy. However that is what that is. Funding again to baseline throughout the board. This time additionally alts. Anticipate just a few extra within the coming months.”

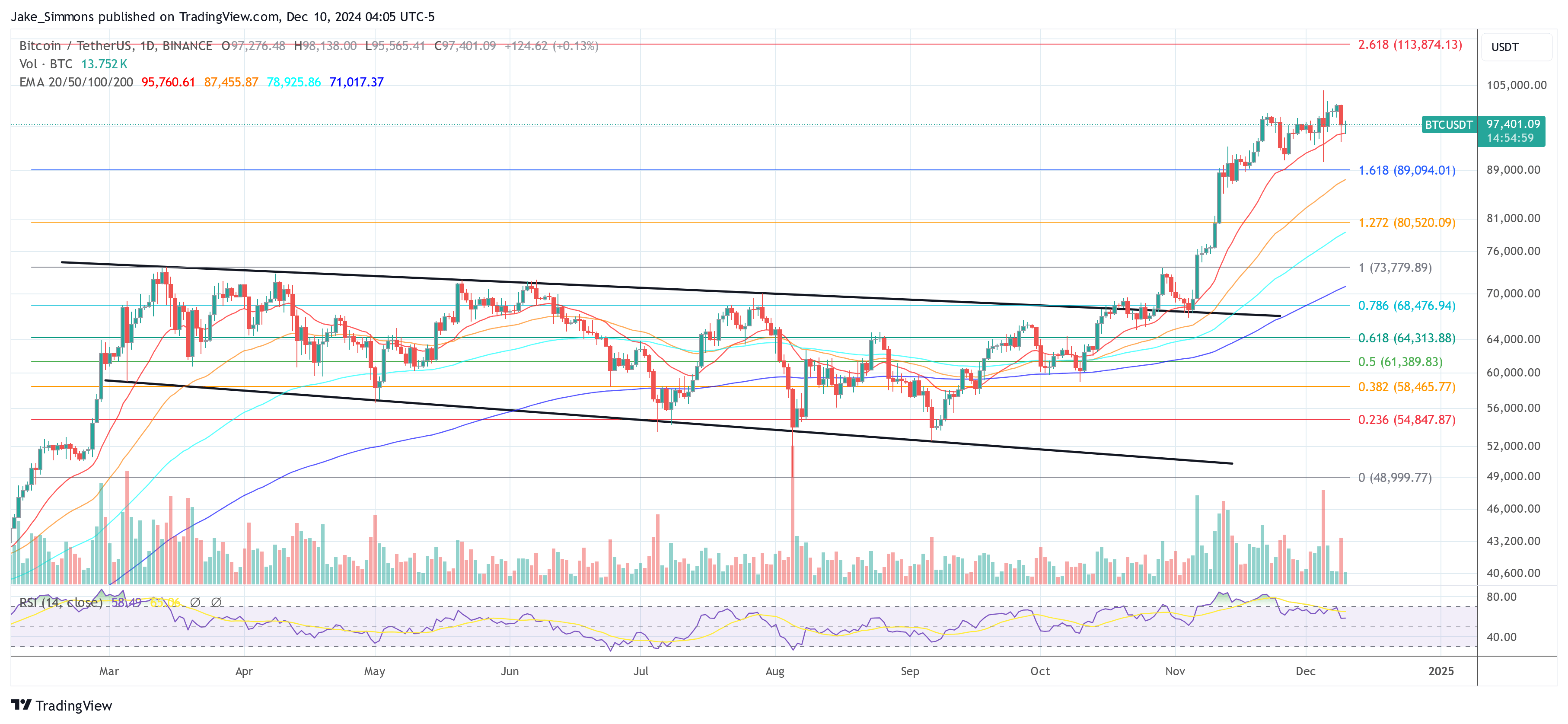

On the time of writing, Bitcoin was buying and selling at $97,401.

Featured picture from Shutterstock, chart from TradingView.com

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now