Bitcoin

Crypto Products See $321,000,000 in Institutional Capital During Second Consecutive Week of Inflows: CoinShares

Credit : dailyhodl.com

Digital asset supervisor CoinShares says institutional crypto buyers poured lots of of hundreds of thousands in capital into digital asset merchandise final week following the Fed’s introduced charge minimize.

In his newest Digital Asset Fund Flows reportCoinShares says inflows into institutional crypto funding merchandise noticed a $321 million enhance following Fed Chairman Jerome Powell’s announcement that the Federal Open Markets Committee (FOMC) had determined to chop rates of interest by 50 foundation factors (bps).

“Digital asset funding merchandise noticed inflows totaling $321 million for the second consecutive week. This enhance was doubtless pushed by feedback from the Federal Open Market Committee (FOMC) final Wednesday, which took a extra dovish stance than anticipated, together with a 50 foundation level charge minimize. Consequently, whole property below administration (AuM) grew by 9%. Whole quantity of funding merchandise amounted to $9.5 billion, a rise of 9% in comparison with the earlier week.”

The US leads the influx regionally with $277 million. Switzerland adopted with $63 million, whereas Germany, Sweden and Canada accounted for $9.5 million, $7.8 million and $2.3 million in inflows every.

As traditional, Bitcoin (BTC) offered the lion’s share of the influx, specifically $284 million. Ethereum (ETH), then again, suffered an outflow of $29 million final week, its fifth straight week of losses.

“This is because of continued outflows from the established Grayscale Belief and low inflows from the newly issued ETFs. In the meantime, Solana’s funding merchandise proceed to see small however constant weekly inflows, with inflows totaling $3.2 million final week.”

Do not miss a beat – Subscribe to obtain electronic mail alerts straight to your inbox

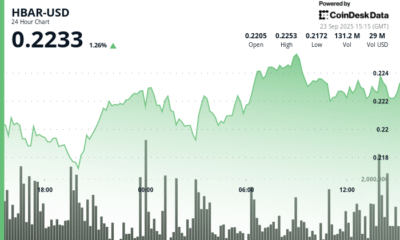

Examine worth motion

Observe us additional X, Facebook And Telegram

Surf to the Each day Hodl combine

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024