Ethereum

Crypto stocks rally on ceasefire optimism – But will it last?

Credit : ambcrypto.com

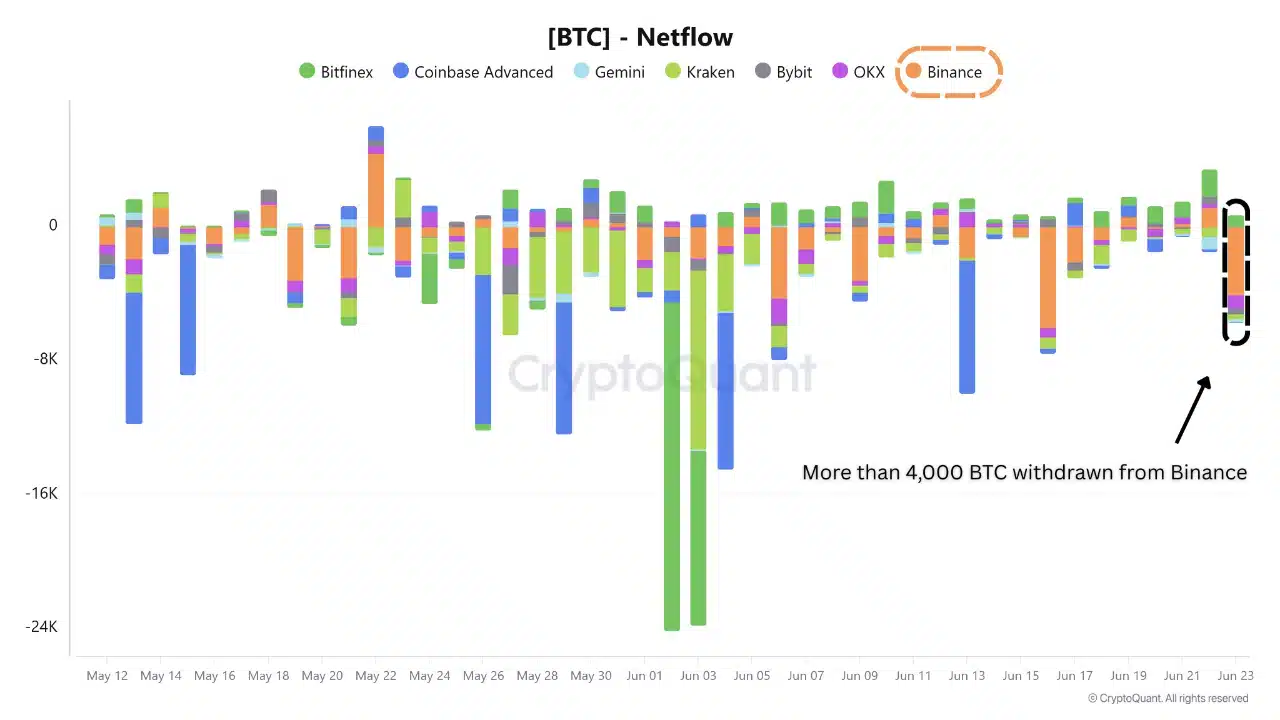

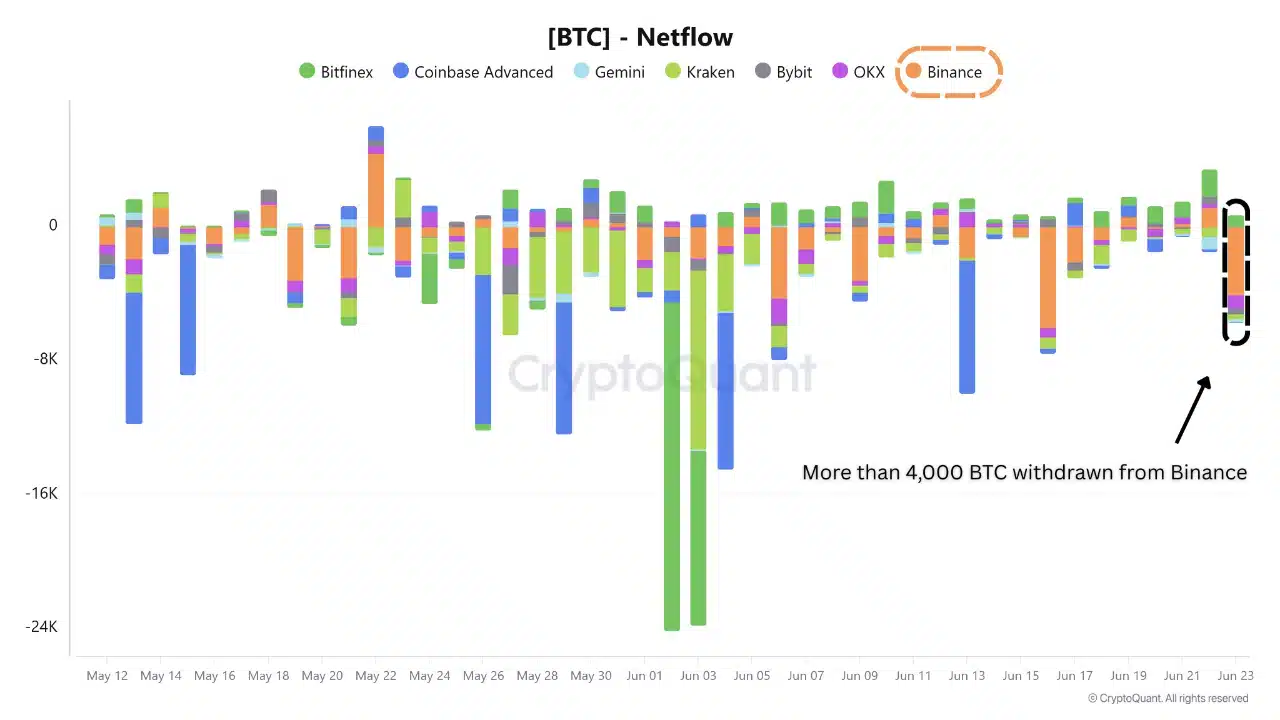

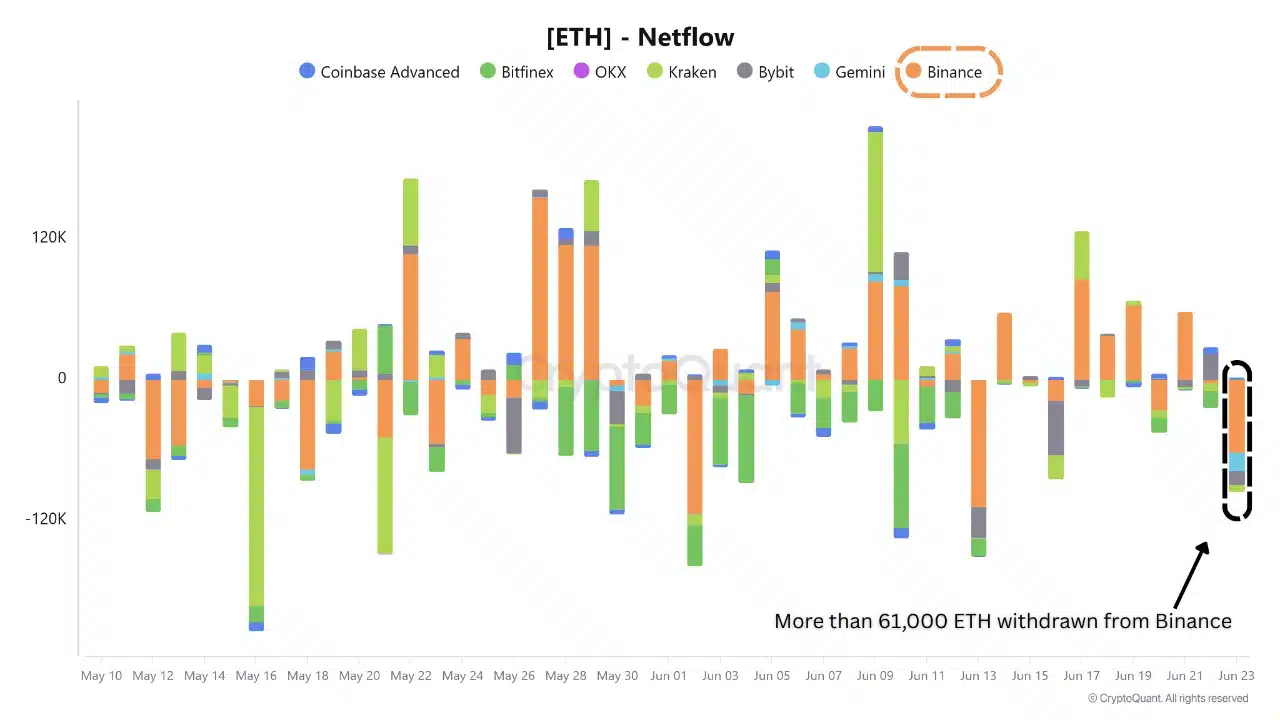

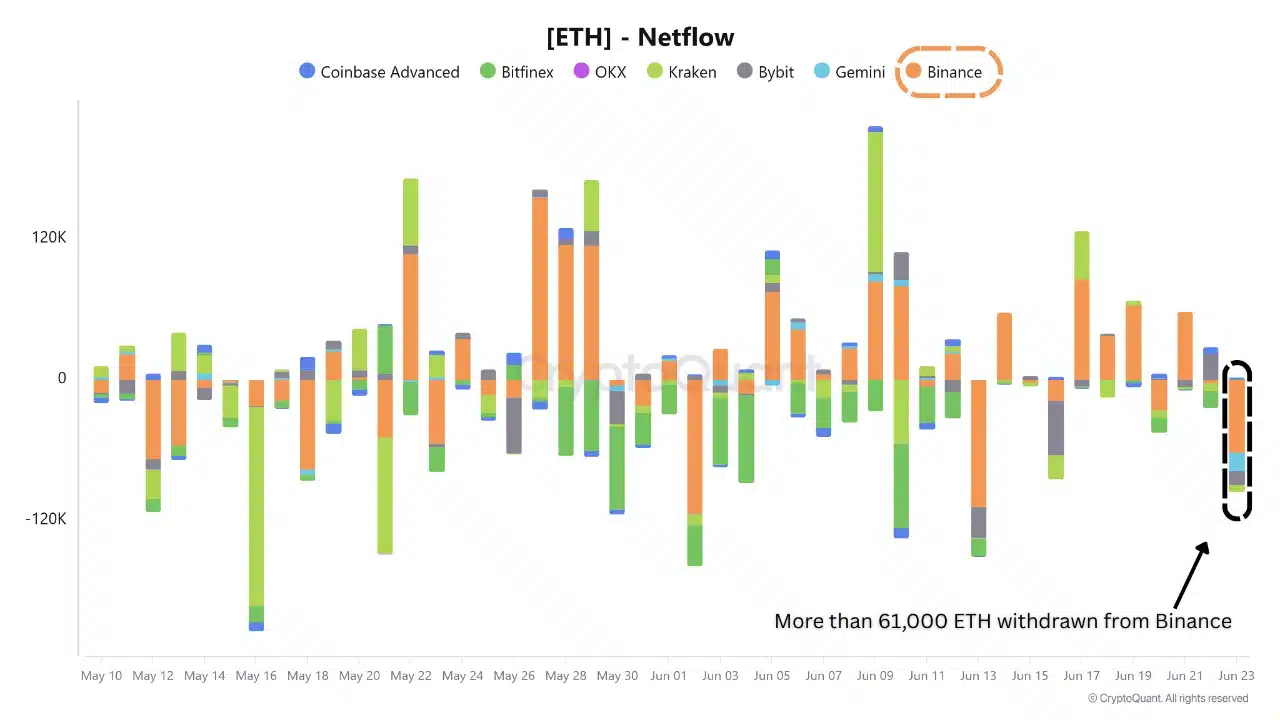

- Greater than 4,000 BTC and 61,000 ETH have been withdrawn from Binance within the midst of illuminating geopolitical tensions.

- S&P 500 Surge and Oil Value Drop Toon Macro assist for crypto -accumulation and dangerous urge for food.

Bitcoin [BTC] and Ethereum [ETH] Registered essential strikes of Binance on 23 June, a shift to lengthy -term investor confidence because the worldwide tensions turn into simpler.

The exodus got here on the heels of the ceasefires of President Donald Trump between Iran and Israel, who prompted a wider risk-rally-rally decreased, the US shares and crypto markets caught the Bullish Bug.

Strong Bitcoin and Ethereum outflows

Supply: Cryptuquant

On June 23, Binance Sharp outflows-more than 4,000 BTC and greater than 61,000 ETH that marked one of many largest recordings in in the future in current reminiscence.

Supply: Cryptuquant

As proven in Cryptoquant’s Netflow -Hitlijsten, Binance was the first reason for adverse present, whereas different exchanges remained largely impartial. This emphasizes an trade -specific motion that’s in all probability linked to accumulation methods.

The size of those retailers suggests Institutional or HNIS (Excessive neat-worthy people) Repositioning of hypothesis within the quick time period.

This habits is in keeping with rising belief in market stability and a desire for self -coasts; Usually seen bull cyclus positioning at an early stage.

It ceases -furen applies regardless of early tensions

It ceases -the fires between Israel and Iran began on shaky land, whereby each events rapidly accused one another of violations.

The Israeli Minister of Protection Israel Katz claimed that Iran launched missiles to Israeli territory, which referred to as on a navy response. Iran denied the accusations and in flip accused Israel of aggression.

President Trump insisted on each international locations to indicate restraint and repeated our assist for ceases -the hearth.

Regardless of the tense begin, the ceasefire stays in pressure, calming market nerves and probably stimulating the chance of the worldwide and crypto markets.

Supply: TradingView

Main crypto belongings responded to the enhancing sentiment, with Bitcoin and Solana [SOL] withdraw into constructive territory.

Ethereum and Binance Chain, however [BNB] Remained comparatively flat, which signifies a selective market restoration and a provisional return of investor confidence.

Macro -reinforce

Supply: Cryptuquant

For the primary time since February 2025, the S&P 500 rose previous 6000 Mark, with the belief of buyers and a transparent shift to danger swimming pools.

On the similar time, the oil costs of West -Texas fell greater than 14%, a motion that strengthens the worldwide disinflation story.

Supply: Cryptuquant

These indicators counsel a background of relieving geopolitical tensions, falling price strain and powerful progress eagle.

For crypto, this macroom atmosphere creates a positive association for accumulation, particularly as a result of digital belongings more and more mirror a risk-to-sentiment in conventional monetary (tradfi) markets.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024