Bitcoin

Crypto traders in ‘wait-and-see’ mode ahead of ‘Liberation Day’ tariffs

Credit : ambcrypto.com

- Crypto merchants are cautious previous to Trump’s charge announcement, unsure concerning the impression of the market.

- Regardless of the V1 -then, consultants predict that Bitcoin may take a look at $ 100,000 as charges and stabilize coverage measures.

Bitcoin [BTC] Is holding above $ 84k whereas merchants undertake a cautious “wait-and-see” perspective previous to the long-awaited Liberation D charge announcement by President Trump.

With world markets which are eradicating for potential turbulence, crypto buyers with uncertainty proceed to battle. Will the brand new charges ignite new volatility, or will they open the door for brand new alternatives?

Crypto merchants within the ‘wait-and-see’ mode

Presto analysis analyst MIN JUNG stated,

“The market is at present in a wait -and -see mode, as a result of the main points of the charges nonetheless need to be introduced.”

The announcement of latest charges on 2 April, known as “Liberation Day”, is anticipated to make important adjustments to American commerce relationships. Nonetheless, the precise impression on the cryptomarket stays unclear.

Merchants weigh the potential penalties of those charges, which might trigger a sequence response in world commerce.

“Some buyers consider that the impression may be much less severe than initially feared, and think about the latest dip as a possible ‘purchase the dip’ alternative …”

Jung went additional,

“Nonetheless, many merchants nonetheless select to remain on the sidelines till there may be extra readability.”

Worst Q1 for Bitcoin since 2018

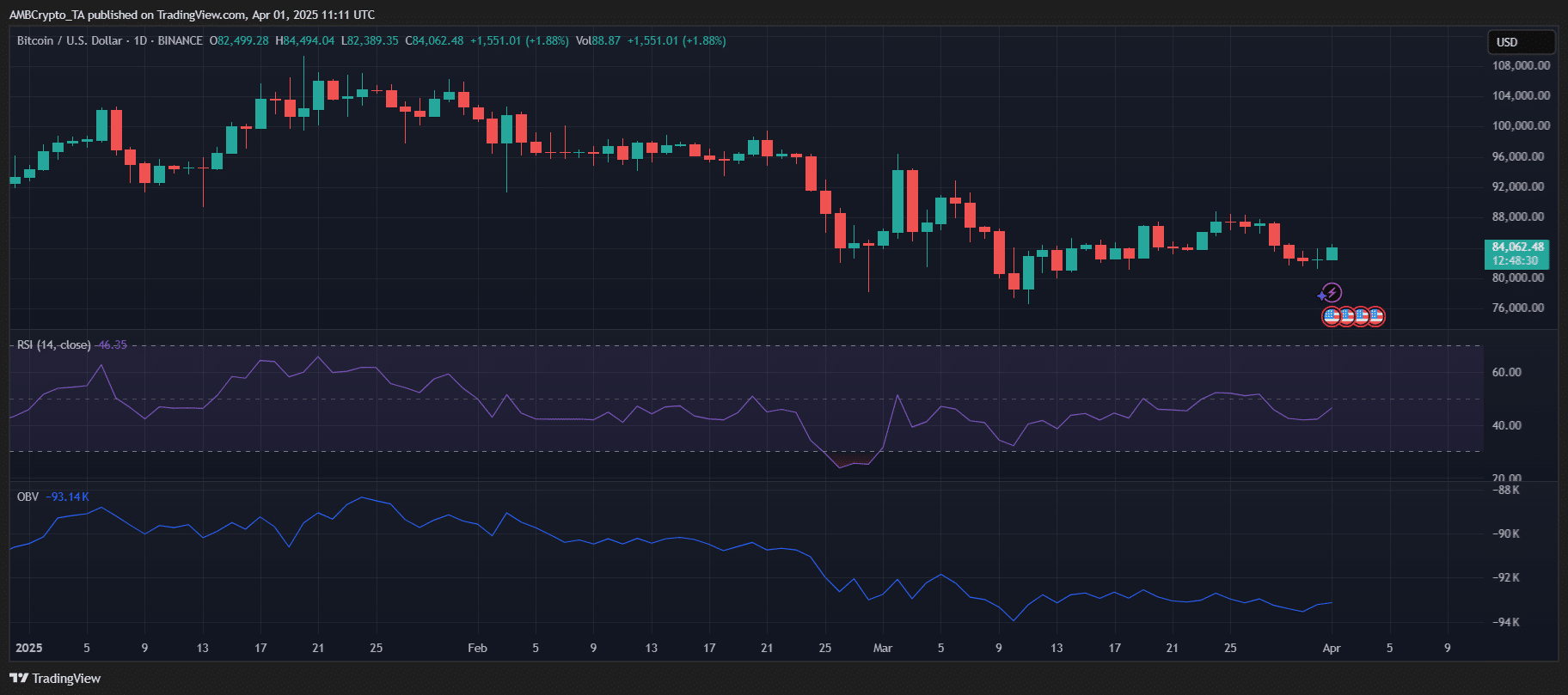

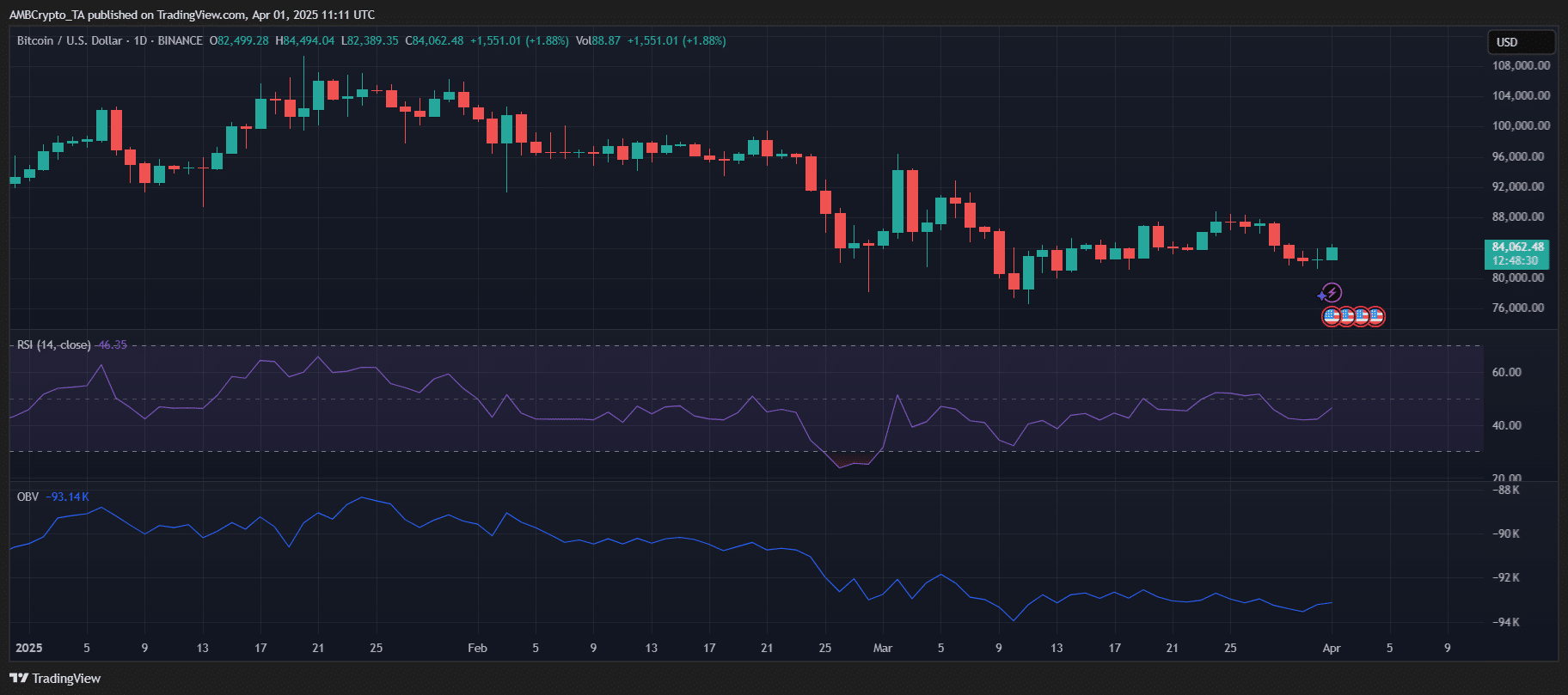

The primary quarter of 2025 was a turbulent for Bitcoin. After peaking over $ 108,000 in January, BTC had a pointy lower as much as lower than $ 80,000 final month.

This lower was consistent with the response from the broader market to Trump’s charge bulletins and world financial uncertainty.

Supply: TradingView

After November the market adopted a traditional “Purchase the rumor, promote the information” sample. Traders initially anticipated Trump’s pro-Crypto perspective at the start of 2025 to handle a bull market.

Nonetheless, the implementation of charges has launched sudden volatility, which shifts the trajectory of the market and the anticipated bullish momentum is crammed in.

The efficiency of Bitcoin Q1 2025 marked the worst since 2018, with a lower of 11.82%.

Look ahead

Regardless of the latest decline, consultants stay optimistic about Bitcoin’s lengthy -term provision.

Though coverage adjustments Time prices to completely unfold, the anticipated momentum of institutional adoption is seen as an vital engine, with pro-Crypto coverage of the present administration that performs a vital function.

Nonetheless, the results of this coverage are most likely gradual.

The Bitcoin prize is anticipated to check the $ 100,000 within the coming months, with a possible restoration within the second quarter of the yr.

If the Federal Reserve lowers the charges and the administration gives readability about its tariff place, Bitcoin may see one other rally, presumably by breaking by resistance to $ 88k.

That stated, dangers live on and the market response will rely upon the main points of the announcement of the speed, in order that buyers are ready for additional readability concerning the financial panorama.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024